What is Living Trust?

Living Trusts are legal arrangements that hold your assets for your benefit during your lifetime, and for your beneficiaries after your death. Explore state-specific templates for your needs.

Living Trusts help manage assets during your lifetime and after. Attorney-drafted templates are quick and simple to complete.

Create a living trust tailored for a couple with children to ensure smooth asset management and inheritance distribution.

Secure your children's inheritance and manage your estate with this versatile trust, perfect for individuals who are single, divorced, or widowed.

Make changes to your existing living trust with this amendment, ensuring it reflects your current wishes for asset distribution.

Establishing a living trust can help safeguard and manage your assets effectively, especially for single, divorced, or widowed individuals without children.

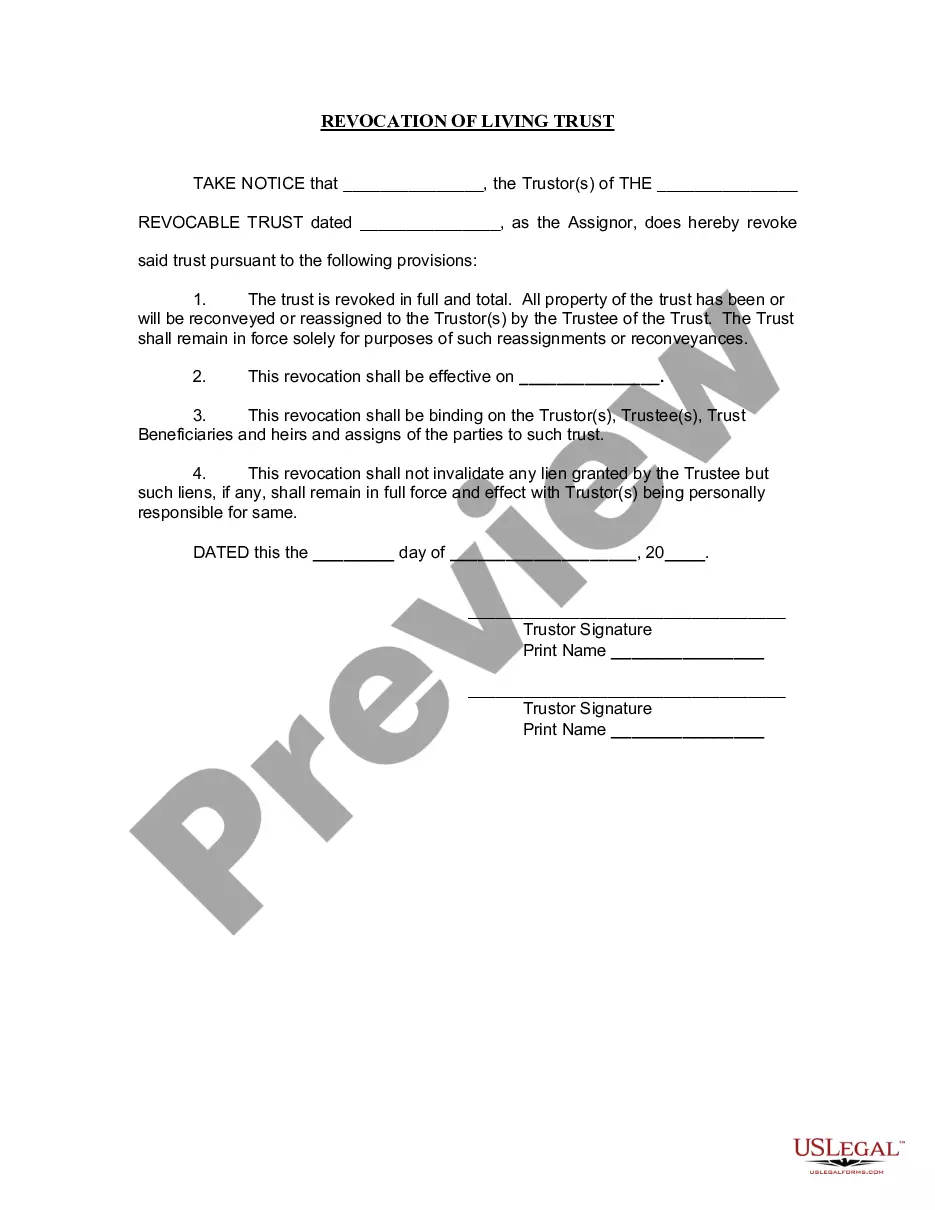

Easily revoke a living trust to ensure your assets are returned to you, maintaining control over your estate planning.

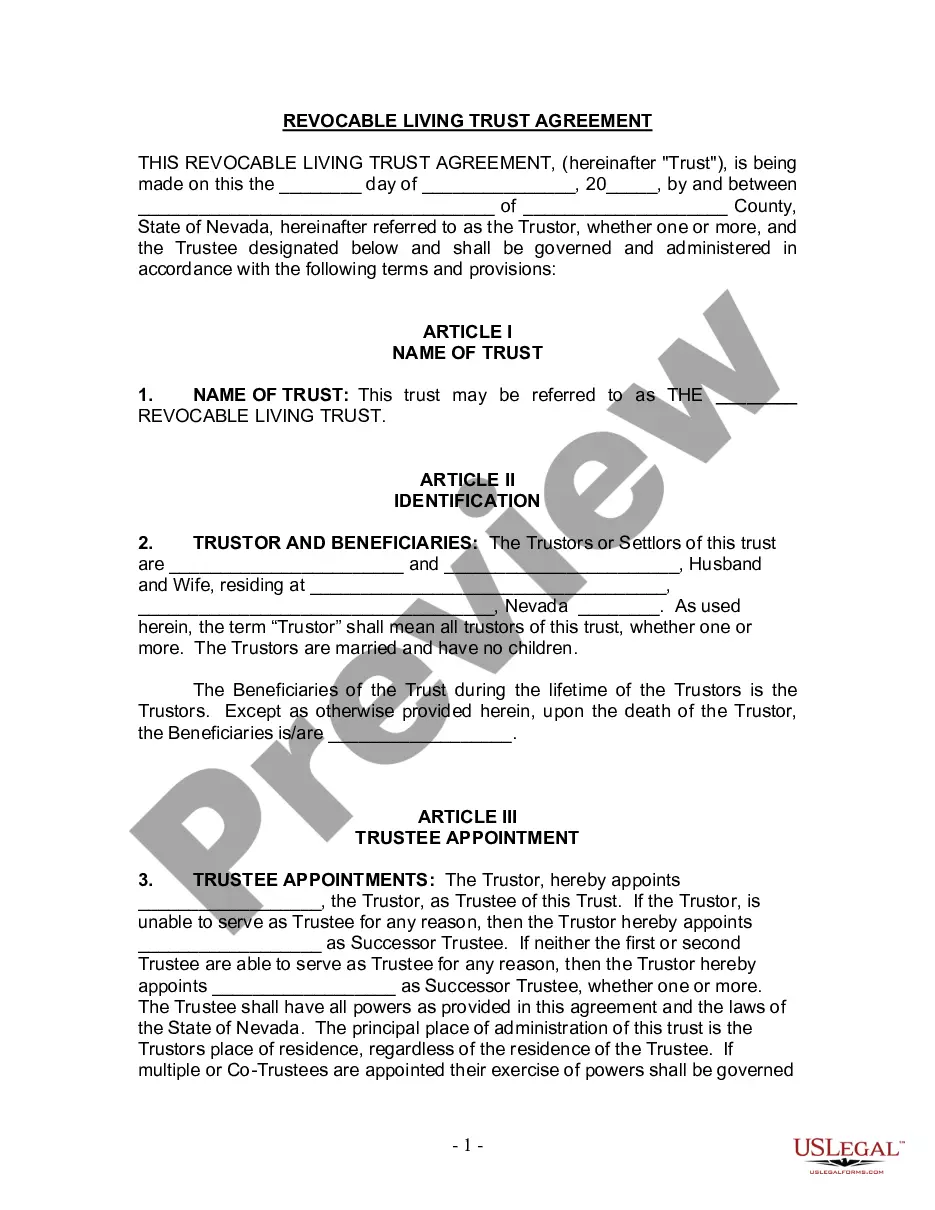

Create a living trust for a married couple without children to manage assets during their lives and simplify estate planning.

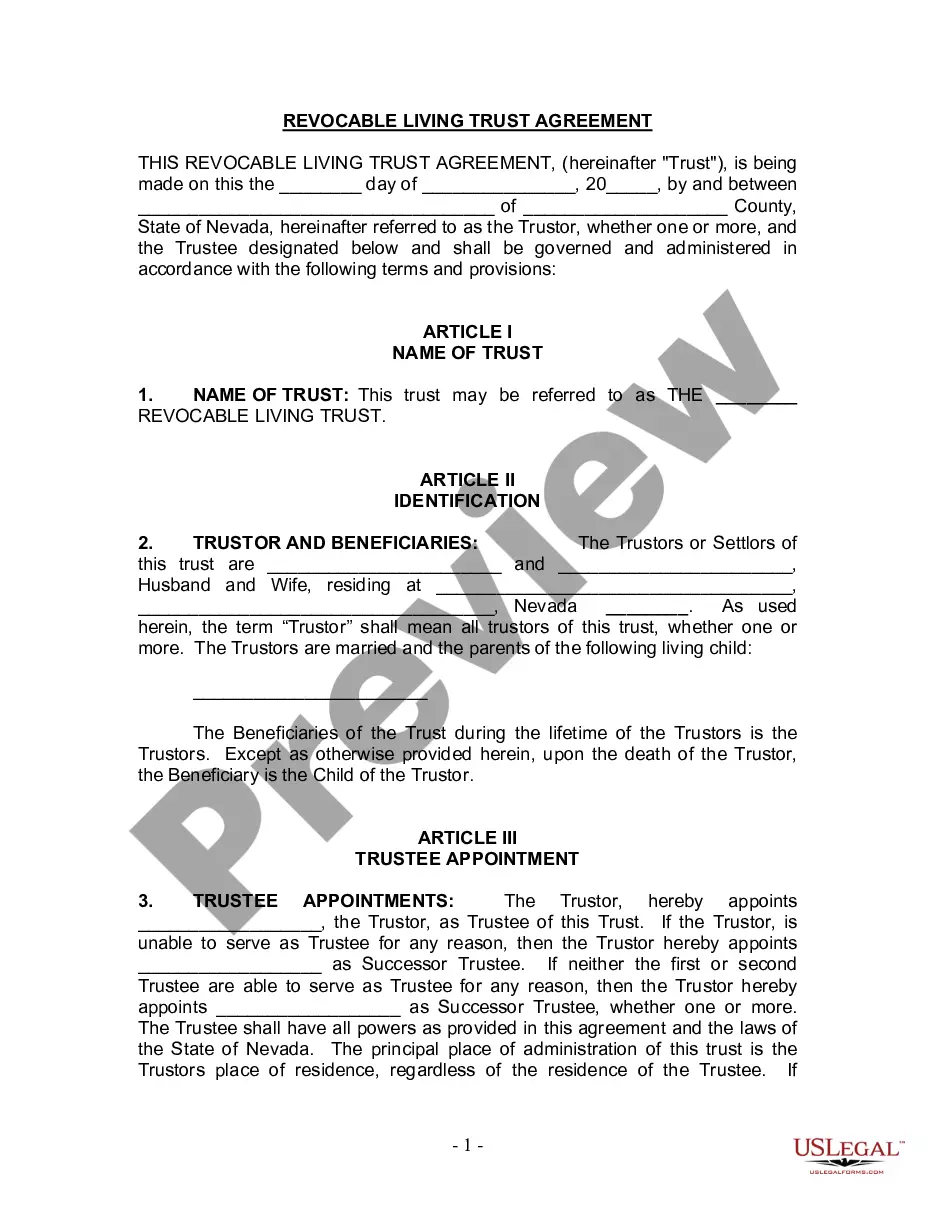

Use this agreement to establish a revocable living trust for a couple with a child, ensuring asset protection and smooth estate transfer.

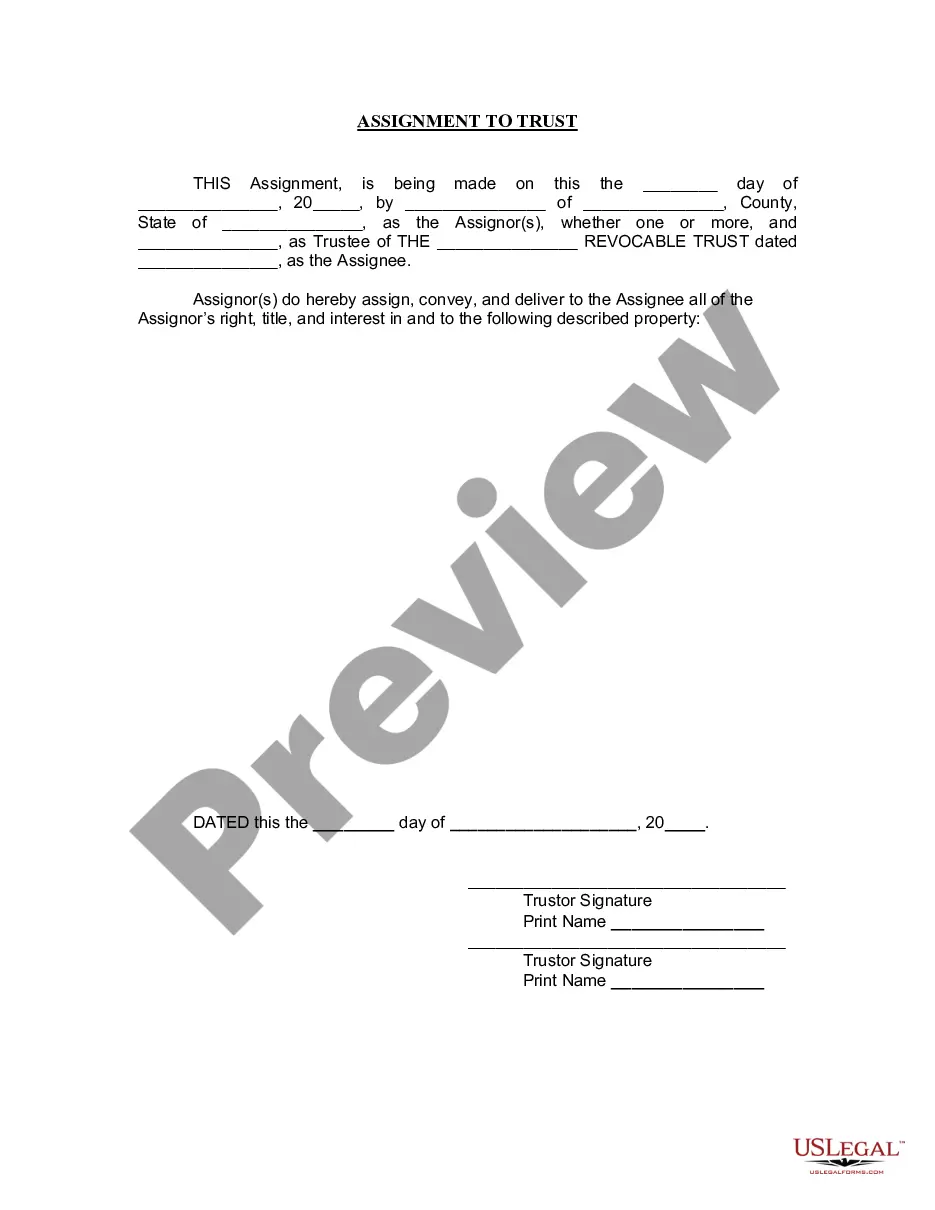

Easily transfer ownership of assets into a living trust to avoid probate and ensure smooth asset management.

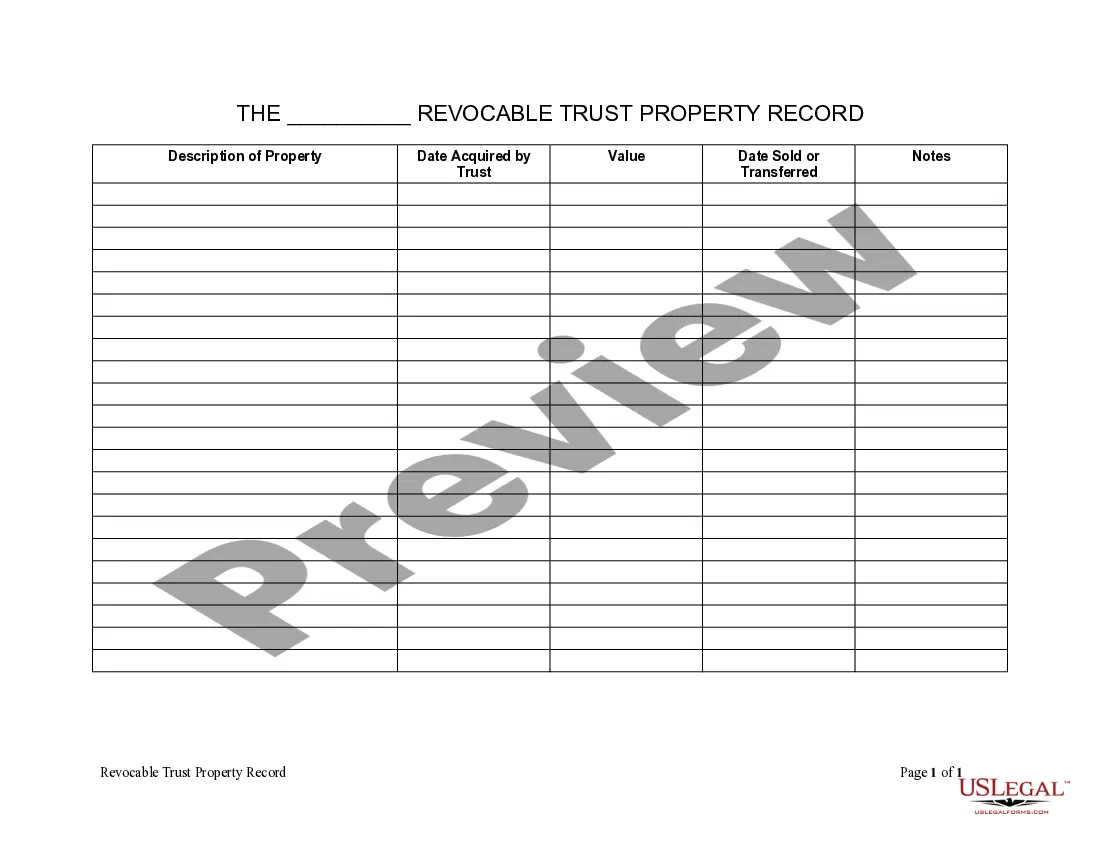

Track and manage property owned by a living trust. Essential for ensuring accurate asset documentation.

Facilitate the transfer of financial accounts into a living trust for better estate management and asset protection.

A Living Trust bypasses probate, allowing for quicker asset distribution.

Trusts can reduce estate taxes under certain conditions.

You can modify a revocable trust as long as you are alive.

Trusts can protect assets from creditors in some situations.

Naming a trustee is crucial for managing the trust effectively.

Begin the process easily with these steps.

A trust can provide benefits during your lifetime, while a will only takes effect after your death.

Your assets may go through probate, which can be lengthy and costly.

Review your plan every few years or after significant life changes.

Beneficiary designations can override terms in your trust or will.

Yes, you can designate separate individuals for financial and health care decisions.