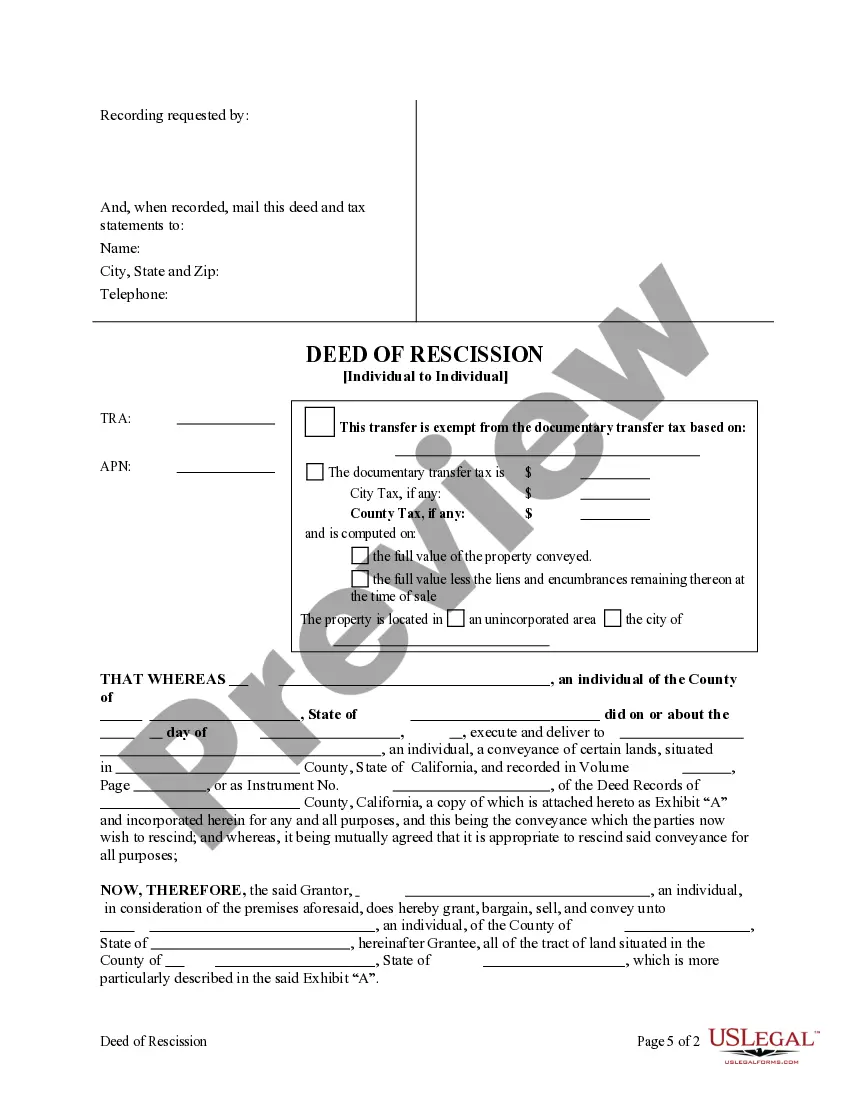

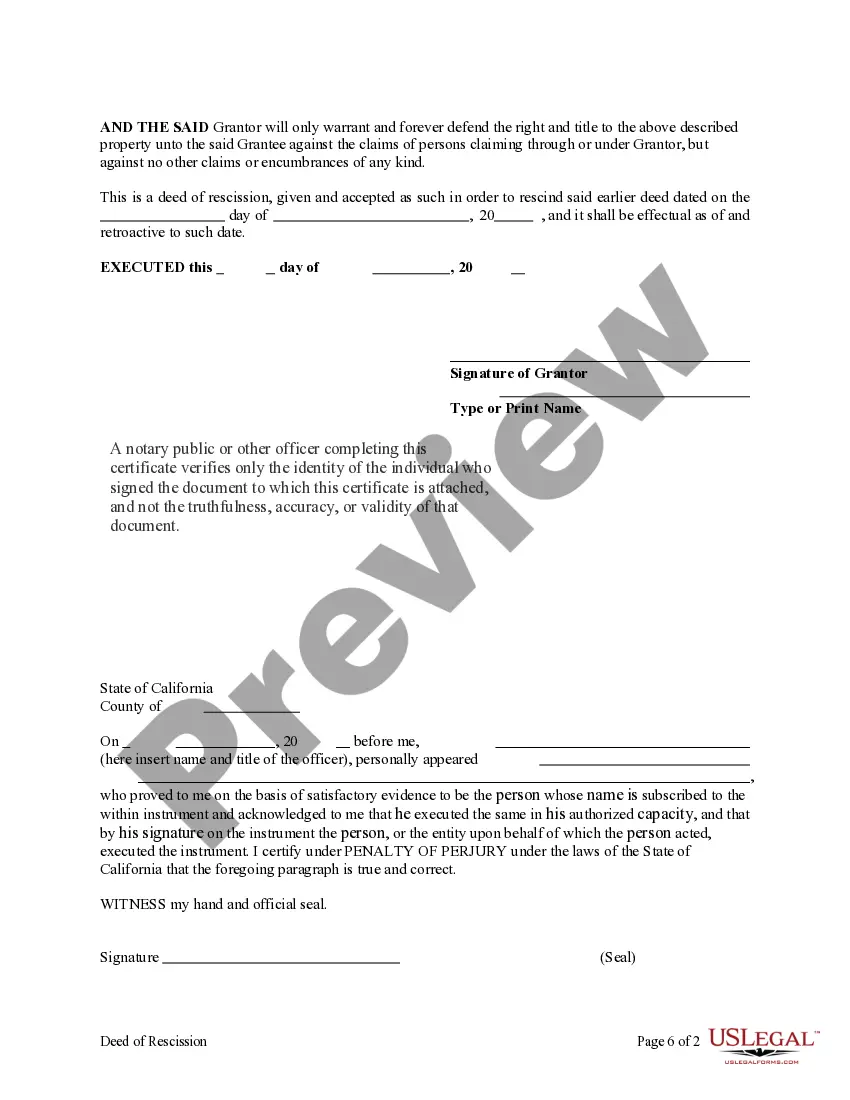

This form is a Deed of Rescission where the Grantor is an individual and the Grantee is an individual. The parties are rescinding or unwinding a prior transfer of the subject property. Grantor conveys and grants the described property to the Grantee. Grantor will defend and warrant the property only as to those claiming by through and under him and not otherwise. This deed complies with all state statutory laws.

The Santa Clara California Deed of Rescission — Individual to Individual is a legal document that allows individuals to cancel or undo a previously recorded deed. It is commonly used in real estate transactions when both parties agree to rescind or revoke a previously completed deed. A deed of rescission is typically employed when there is a need to correct errors, address misunderstandings, or nullify a property transfer due to various reasons. It effectively restores the parties involved to their original positions before the recorded deed came into effect. There are different types of Santa Clara California Deed of Rescission — Individual to Individual, such as: 1. General Deed of Rescission: This is the most common type, used when both parties mutually agree to cancel the recorded deed. It requires the signatures of all parties involved, including the granter(s) and grantee(s). 2. Corrective Deed of Rescission: This type of deed is utilized when there are errors or mistakes in the original deed that need to be rectified. It is essential to specifically outline the corrections being made and ensure all parties acknowledge and agree to the changes. 3. Rescission Due to Non-Performance: In certain cases, one party may fail to fulfill their obligations as outlined in the original recorded deed. In such instances, the other party may opt for a rescission that revokes the deed and cancels any further obligations. 4. Rescission Due to Fraud or Misrepresentation: If fraudulent activity or misrepresentation is discovered after the execution of a recorded deed, the affected party may pursue a rescission to nullify the transaction and seek legal remedies. 5. Rescission for Boundary Disputes: This type of deed is used when there is a dispute or disagreement over property boundaries. Parties involved in such disputes may agree to rescind the original deed to resolve issues regarding the property lines. When drafting and executing a Santa Clara California Deed of Rescission — Individual to Individual, it is crucial to consult with a qualified attorney specializing in real estate law to ensure all legal requirements are fulfilled and that the document accurately reflects the intentions of all parties involved.