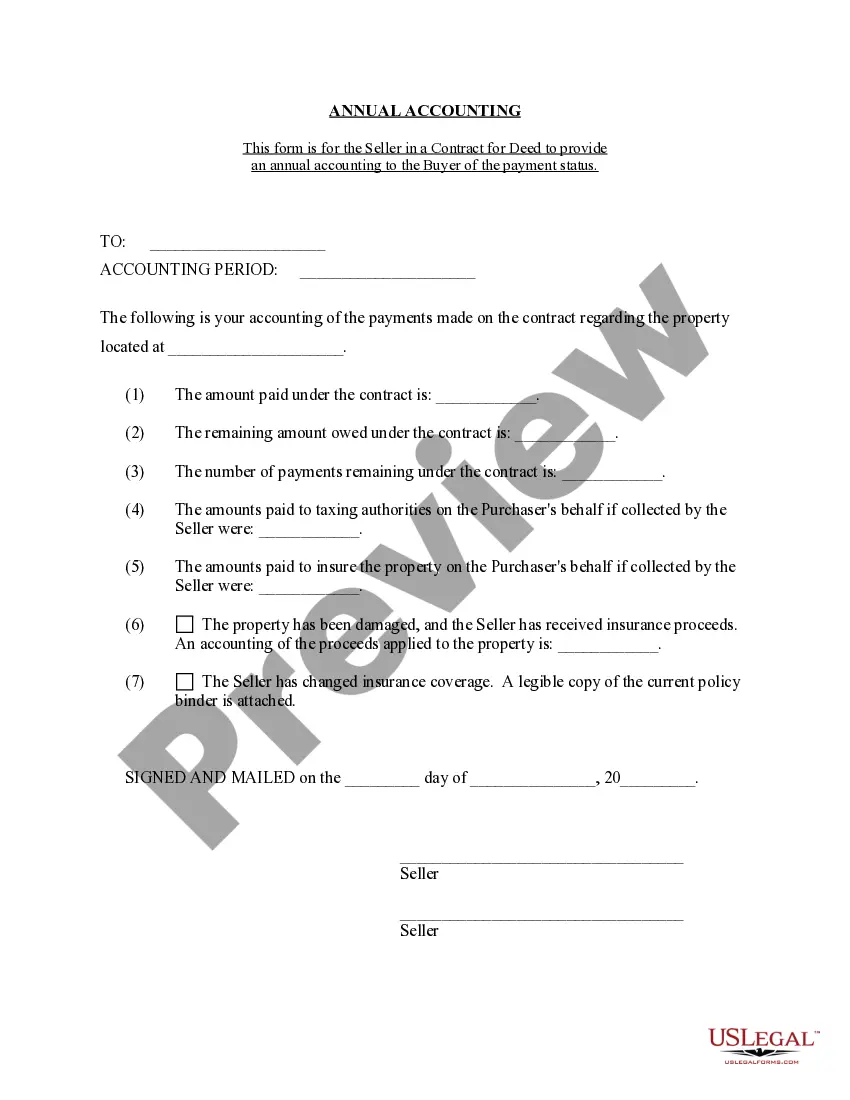

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Anchorage Alaska Contract for Deed Seller's Annual Accounting Statement

Category:

State:

Alaska

City:

Anchorage

Control #:

AK-00470-4

Format:

Word;

Rich Text

Instant download

Description

How to fill out Alaska Contract For Deed Seller's Annual Accounting Statement?

We consistently endeavor to minimize or avert legal harm when engaged in intricate legal or financial matters.

To achieve this, we enroll in attorney services that are typically quite expensive.

Nevertheless, not all legal problems are equally complicated; many can be addressed by ourselves.

US Legal Forms is an online repository of current DIY legal templates that includes everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Just Log In to your account and click the Get button beside it. If you happen to misplace the form, you can always re-download it in the My documents tab.

- Our platform empowers you to manage your matters independently without relying on legal services.

- We provide access to legal document samples that may not always be available to the public.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

- Take advantage of US Legal Forms whenever you need to obtain and download the Anchorage Alaska Contract for Deed Seller's Annual Accounting Statement or any other document swiftly and securely.