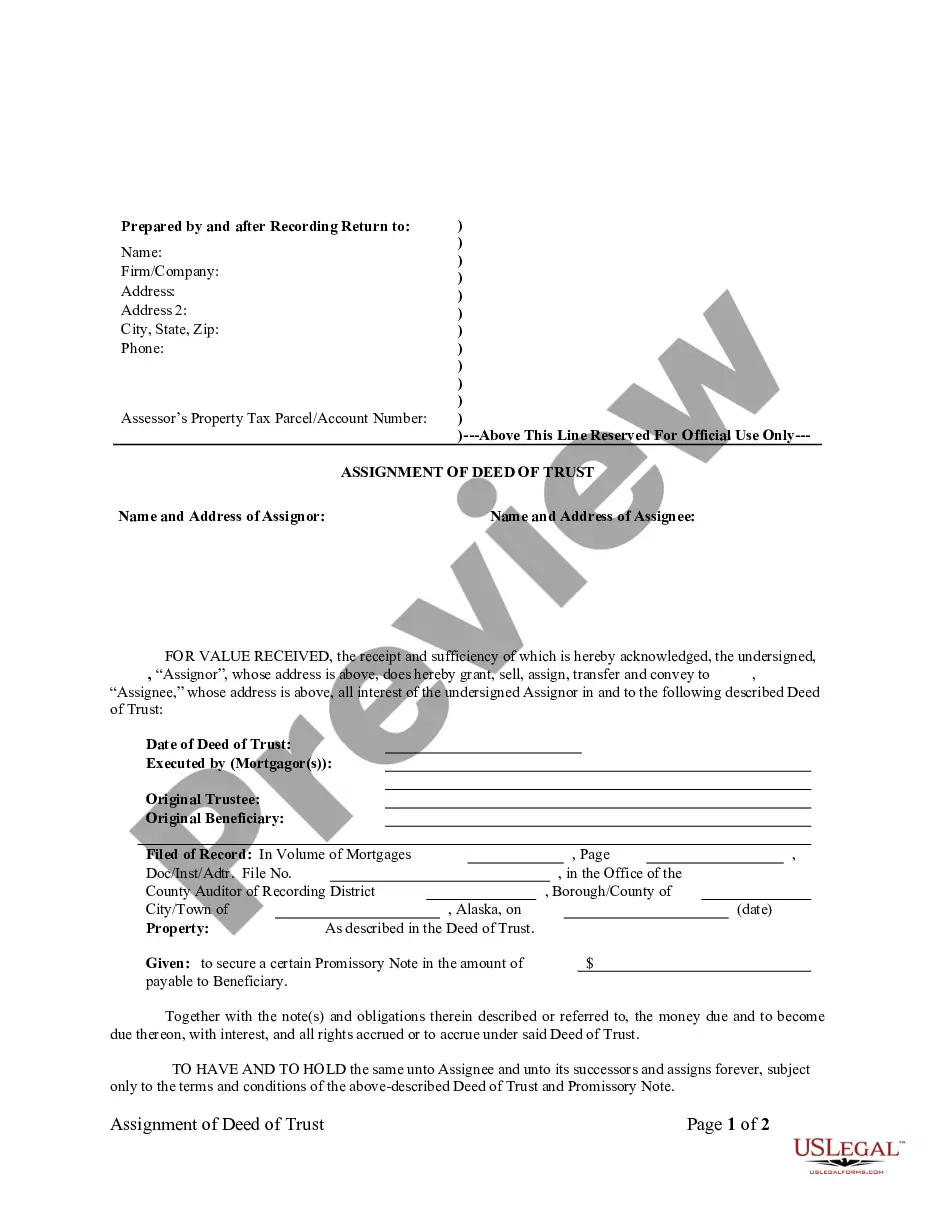

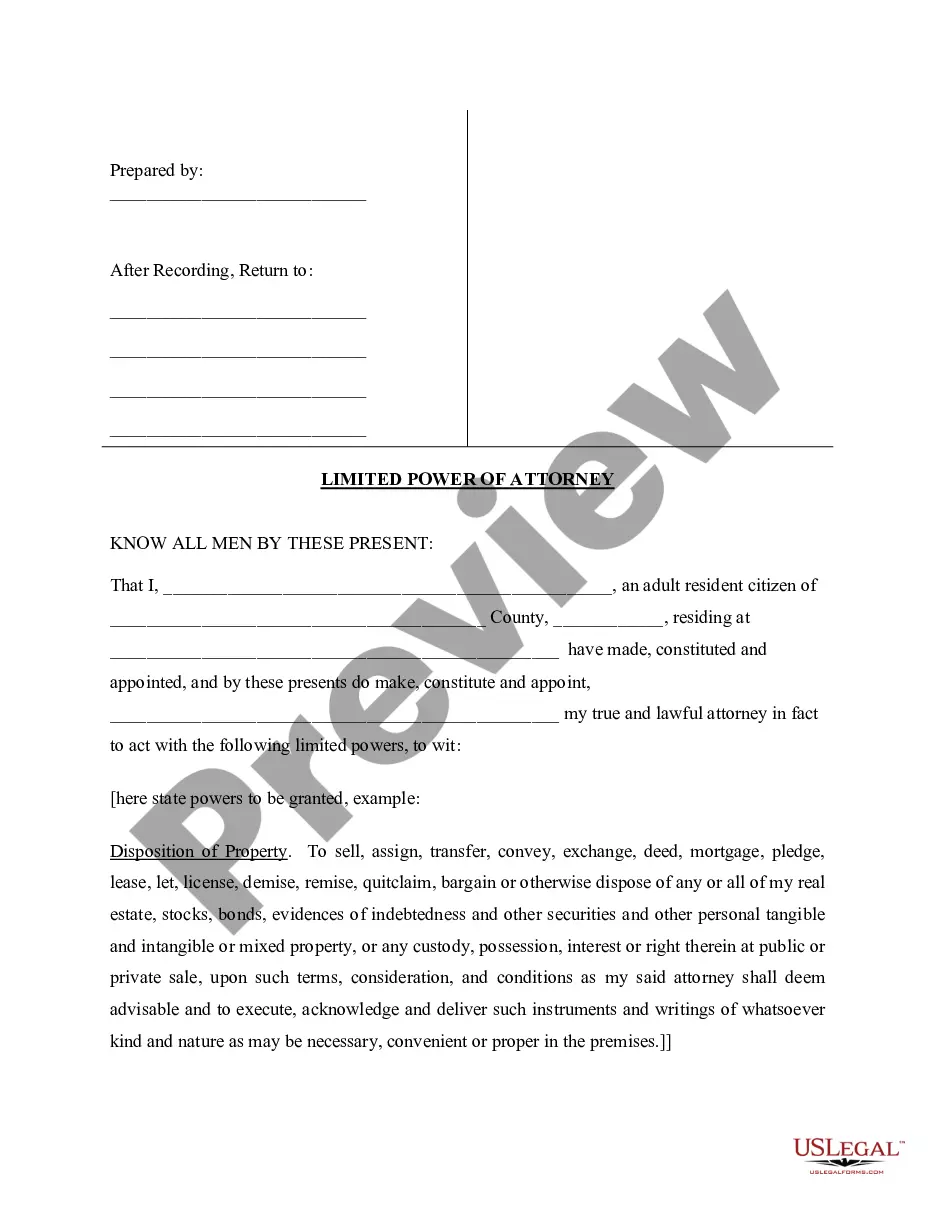

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out Alaska Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Regardless of social or occupational position, completing legal forms is a regrettable obligation in the current workplace.

Typically, it’s nearly unfeasible for an individual lacking a legal background to create such documents from scratch, primarily due to the intricate language and legal subtleties they contain.

This is where US Legal Forms can be a lifesaver.

Confirm that the template you have located is tailored to your region since the regulations of one state or county do not apply to another.

Review the document and read a brief description (if available) regarding the cases the form can be utilized for.

- Our service provides an extensive collection of over 85,000 ready-to-utilize state-specific forms applicable for nearly any legal circumstance.

- US Legal Forms is also an excellent tool for associates or legal advisors who wish to conserve time using our DIY documents.

- Whether you need the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder or any other document suitable for your state or county, with US Legal Forms, everything is easily accessible.

- Here’s how you can obtain the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder within minutes using our trustworthy service.

- If you are already a customer, you can go ahead to Log In to your account to access the required form.

- However, if you are new to our library, make sure to follow these steps prior to downloading the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder.

Form popularity

FAQ

A corporate Assignment involves transferring rights from one corporate entity to another. This can include the rights to assets, contracts, or other financial instruments. When it comes to the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder, understanding how these corporate Assignments work is crucial for ensuring compliance and protecting your investment.

A corporate Assignment of Deed of Trust refers to the process where a corporate entity transfers its rights and responsibilities associated with a mortgage. This type of Assignment provides clarity in ownership and assures the new holder of their legal rights. Engaging with an Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder further emphasizes the importance of these corporate transactions.

Typically, the corporate mortgage holder and the assignor must sign the Assignment of Deed of Trust. This formal signature validates the transfer of the mortgage's benefits and rights, ensuring all parties are in agreement. Properly executing this document is vital for any Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder, as it protects everyone's interests.

Transferring ownership of property in Alaska involves completing the necessary legal documents, such as a warranty deed. After preparing the deed, you must sign it before a notary public and file it with the local recorder's office. This process is crucial when dealing with an Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder, as it safeguards your interests and clarifies ownership.

A deed signifies ownership of a property, establishing who holds legal rights. On the other hand, an Assignment of Deed of Trust transfers the responsibilities and benefits associated with that deed. In the context of Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder, the focus is on the transfer of trust to another party, ensuring clarity in mortgage transactions.

Corporate assignment of deed of trust signifies the transfer of a deed of trust, usually by a corporation, to another holder. This is vital in the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder context, illustrating how companies manage their real estate financing. Awareness of this process can provide peace of mind to borrowers, knowing that their financial agreements remain intact despite ownership changes. It reinforces the stability of their mortgage commitments and the importance of proper documentation.

Corporate assignment of a mortgage refers to the formal process where a corporation assigns its rights and duties under a mortgage to another party. This assignment is significant in the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder landscape, highlighting how corporations handle the transfer of mortgage interests. Understanding this process can ease concerns for homeowners, as it allows mortgage holders to adapt and optimize their asset management strategies. It reassures borrowers that their loans are still being handled responsibly.

A corporate assignment of a mortgage is when a corporation, such as a bank or financial institution, transfers its mortgage rights to another entity. In the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder, this process ensures that the original lender can maintain liquidity and manage their assets effectively. This type of assignment is common in the mortgage industry and maintains the relationship between the borrower and the lending institution. Knowing this can empower borrowers to make informed decisions during the assignment process.

No, an assignment of mortgage does not indicate foreclosure. Foreclosure occurs when the lender takes back the property due to non-payment. Instead, the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder is simply a transfer of the mortgage rights. It can occur for various reasons, such as sale or refinancing, and does not imply that the borrower faces immediate threats regarding their property.

The easiest way to transfer ownership of a house is to execute a quitclaim deed, which requires less formalities than other types of deeds. However, including the Anchorage Alaska Assignment of Deed of Trust by Corporate Mortgage Holder will help manage any existing mortgages effectively. To ensure a smooth transfer, consider using US Legal Forms, which offers resources and templates tailored for your needs. This approach provides peace of mind and legal security during the transfer process.