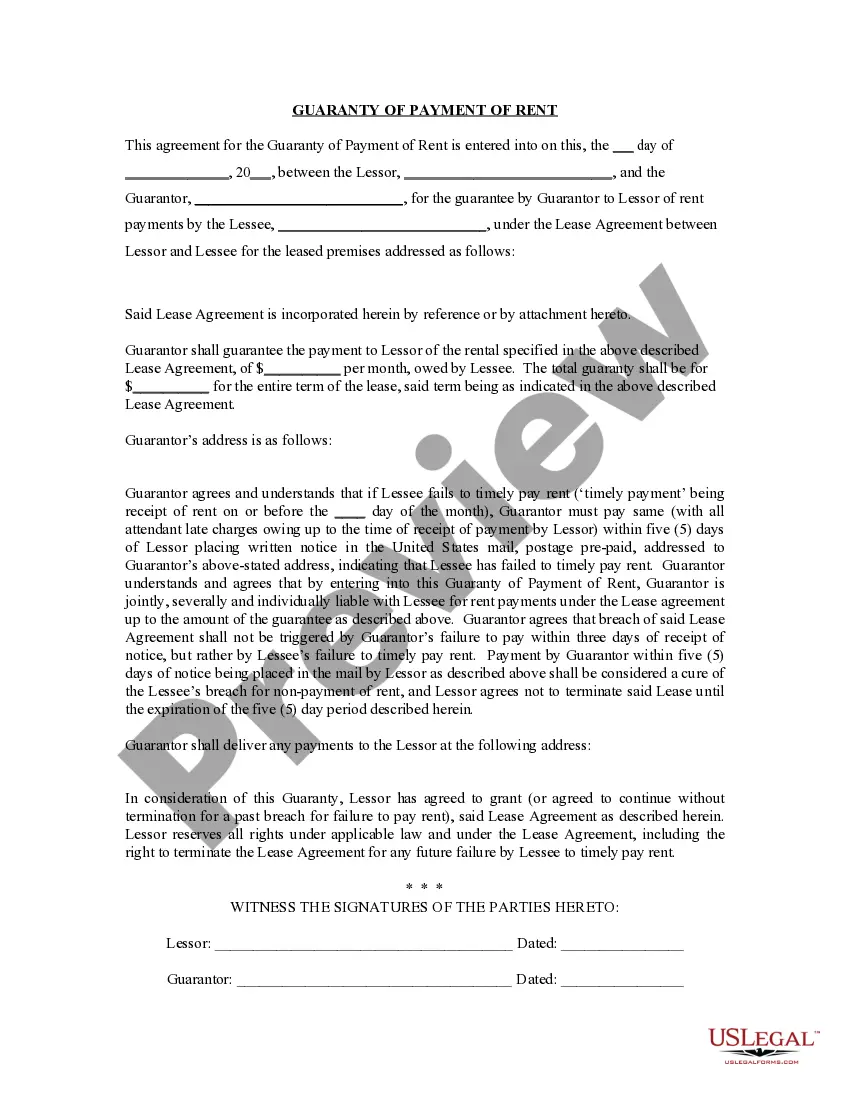

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Anchorage Alaska Guaranty or Guarantee of Payment of Rent is a legally binding agreement entered into by a tenant and a guarantor, which ensures that the rent is paid in a timely manner throughout the duration of a lease in Anchorage, Alaska. This guarantee serves as a safeguard for landlords and property owners, providing them some level of certainty that rent payments will be made even if the tenant defaults on their obligation. There are various types of Guaranty or Guarantee of Payment of Rent in Anchorage, Alaska, tailored to meet different circumstances and preferences. Some common types include: 1. Individual Guarantor: In this type, an individual who acts as a co-signer or guarantor assumes the responsibility of paying the rent if the primary tenant fails to do so. The individual guarantor's income, credit history, and assets are usually assessed before signing the agreement. 2. Corporate Guarantor: A corporate entity, such as a parent company, acts as a guarantor for the lease agreement. This type of guarantee is commonly used when the tenant is a subsidiary, franchise, or a newly established business without a solid financial background. It provides the landlord with added security as the corporate guarantor's resources and stability are considered. 3. Letter of Credit: A letter of credit is a financial document issued by a bank, assuring the landlord that if the tenant is unable to pay rent, the bank will cover the amount stated in the letter. This type of guarantee is useful for tenants with limited credit history, as it provides the landlord with a financial backup and reduces the risk associated with potential non-payment. 4. Security Deposit: While not strictly a guarantee of payment of rent, a security deposit is a sum of money that the tenant pays upfront to the landlord as a form of collateral. The security deposit may be used by the landlord to cover any unpaid rent or damages caused during the tenancy. It is important for both tenants and guarantors to thoroughly understand the terms and conditions of the Anchorage Alaska Guaranty or Guarantee of Payment of Rent before signing. These agreements typically outline the responsibilities, obligations, and potential repercussions for both parties involved. Seeking legal advice or guidance is often recommended ensuring compliance and understanding of the specific terms outlined in the agreement.Anchorage Alaska Guaranty or Guarantee of Payment of Rent is a legally binding agreement entered into by a tenant and a guarantor, which ensures that the rent is paid in a timely manner throughout the duration of a lease in Anchorage, Alaska. This guarantee serves as a safeguard for landlords and property owners, providing them some level of certainty that rent payments will be made even if the tenant defaults on their obligation. There are various types of Guaranty or Guarantee of Payment of Rent in Anchorage, Alaska, tailored to meet different circumstances and preferences. Some common types include: 1. Individual Guarantor: In this type, an individual who acts as a co-signer or guarantor assumes the responsibility of paying the rent if the primary tenant fails to do so. The individual guarantor's income, credit history, and assets are usually assessed before signing the agreement. 2. Corporate Guarantor: A corporate entity, such as a parent company, acts as a guarantor for the lease agreement. This type of guarantee is commonly used when the tenant is a subsidiary, franchise, or a newly established business without a solid financial background. It provides the landlord with added security as the corporate guarantor's resources and stability are considered. 3. Letter of Credit: A letter of credit is a financial document issued by a bank, assuring the landlord that if the tenant is unable to pay rent, the bank will cover the amount stated in the letter. This type of guarantee is useful for tenants with limited credit history, as it provides the landlord with a financial backup and reduces the risk associated with potential non-payment. 4. Security Deposit: While not strictly a guarantee of payment of rent, a security deposit is a sum of money that the tenant pays upfront to the landlord as a form of collateral. The security deposit may be used by the landlord to cover any unpaid rent or damages caused during the tenancy. It is important for both tenants and guarantors to thoroughly understand the terms and conditions of the Anchorage Alaska Guaranty or Guarantee of Payment of Rent before signing. These agreements typically outline the responsibilities, obligations, and potential repercussions for both parties involved. Seeking legal advice or guidance is often recommended ensuring compliance and understanding of the specific terms outlined in the agreement.