Creditors Affidavit, is an official form from the Alaska Court System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Alaska statutes and law.

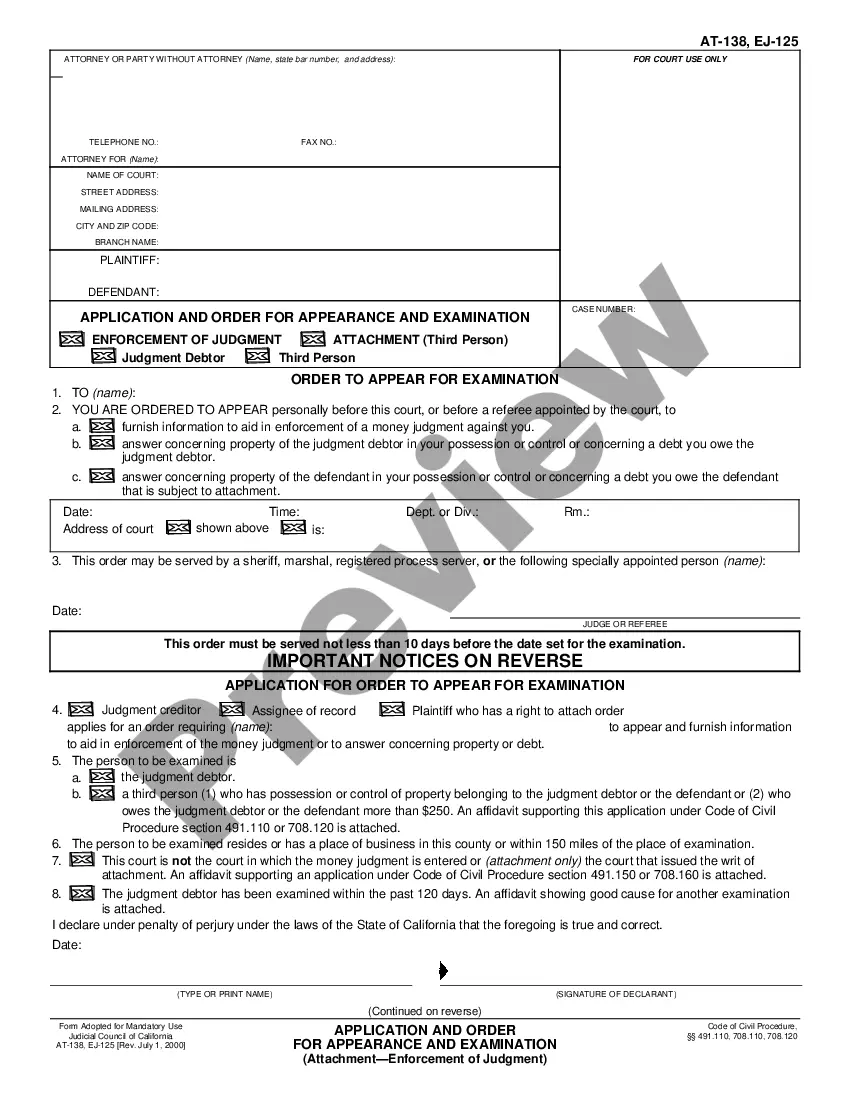

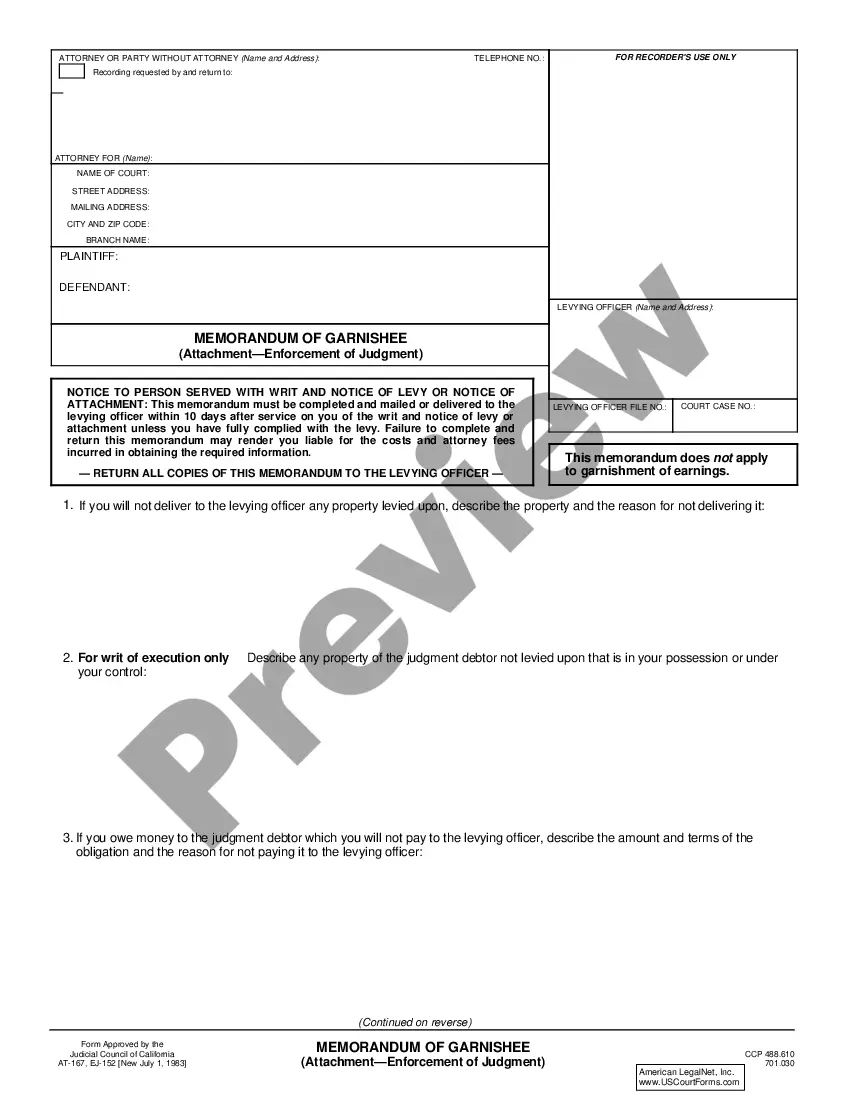

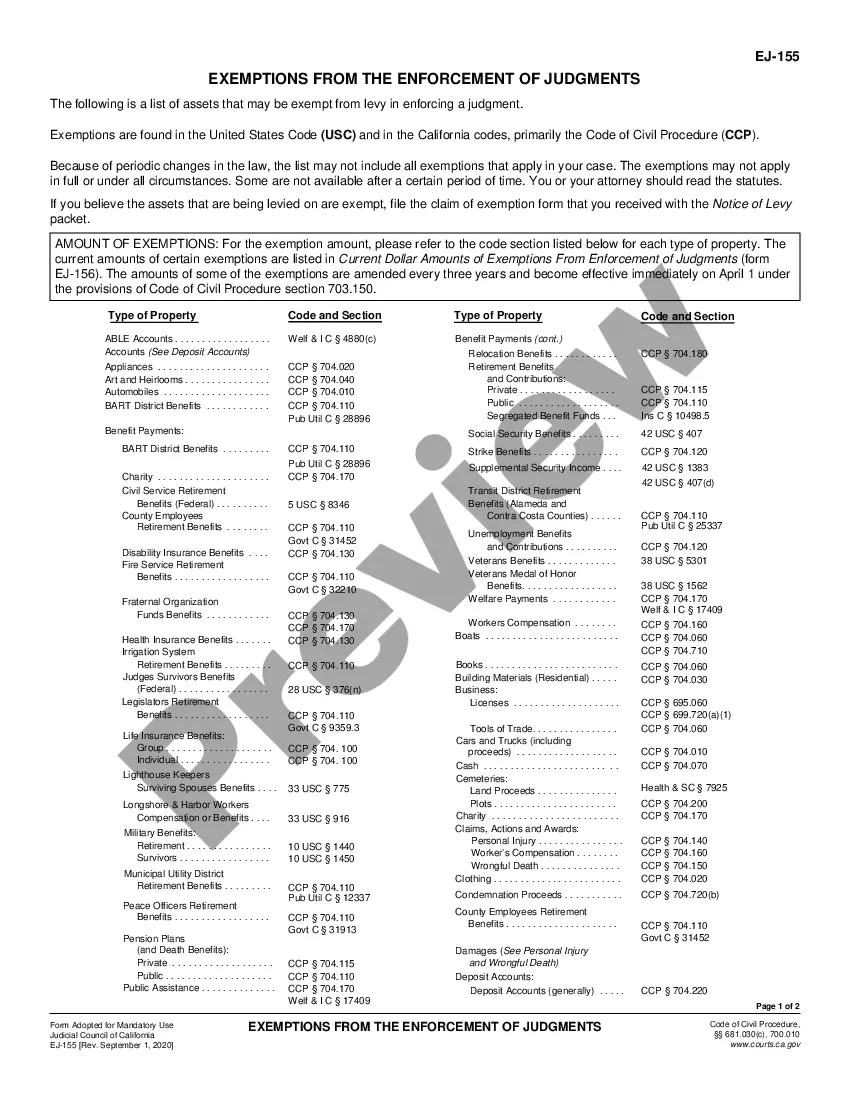

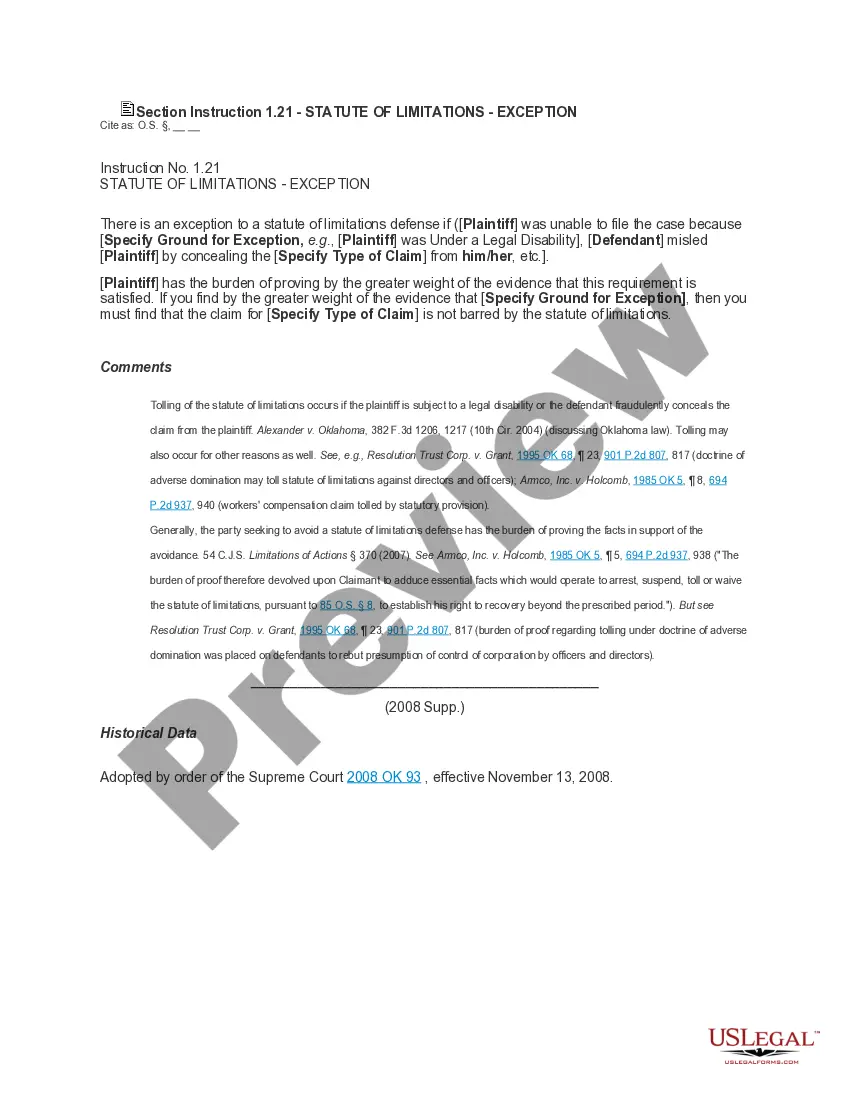

An Anchorage Alaska Creditors Affidavit is a legal document filed in the state of Alaska by a creditor to assert their right to collect a debt owed by a debtor. This affidavit serves as a formal declaration by the creditor, under penalty of perjury, providing detailed information about the debt owed and the attempts made to collect it. Keywords: Anchorage Alaska Creditors Affidavit, legal document, creditor, debt, debtor, filed, state of Alaska, perjury, collect debt. There are two main types of Anchorage Alaska Creditors Affidavits: 1. Anchorage Alaska Creditors Affidavit for Collections: This type of affidavit is filed by a creditor to initiate the debt collection process. It provides essential details about the creditor, debtor, and the amount owed. The affidavit may include information such as the original loan agreement, outstanding balance, payment history, and any communication between the creditor and debtor regarding the debt. Filing this affidavit allows the creditor to seek legal remedies to recover the debt, such as garnishing wages or placing liens on the debtor's assets. 2. Anchorage Alaska Creditors Affidavit for Bankruptcy: In the case of a debtor filing for bankruptcy in Anchorage, Alaska, creditors may be required to file a special affidavit. This affidavit outlines the creditor's claim against the debtor and lists the details of the debt owed. Additionally, it may include information about any previous court judgments obtained by the creditor. Filing this affidavit ensures that the creditor's claim is considered during the bankruptcy proceedings and increases the likelihood of recovering a portion or the full amount owed. Overall, an Anchorage Alaska Creditors Affidavit is a crucial legal document that formalizes a creditor's claim for debt repayment. Properly filing this affidavit helps protect the creditor's rights and allows them to pursue necessary legal actions to resolve the outstanding debt, whether through regular collections or bankruptcy procedures.