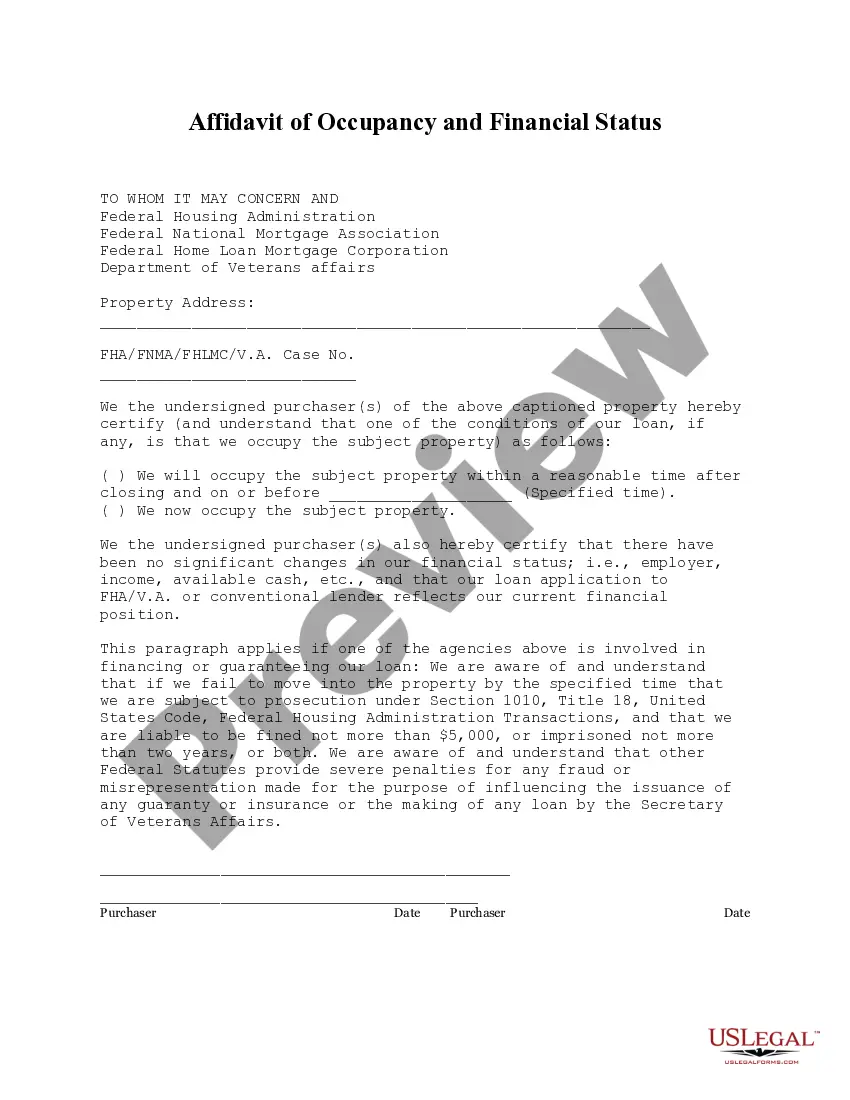

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

The Anchorage Alaska Affidavit of Occupancy and Financial Status is an official document used to establish and verify a person's current residence and financial standing in Anchorage, Alaska. This affidavit is typically required in various legal and administrative processes, such as applying for housing assistance programs, obtaining a mortgage, or supporting residency claims. The affidavit encompasses important details related to both occupancy and financial status. The occupancy section requires the affine (person submitting the affidavit) to provide specific information about their current residential address in Anchorage, including the property's full physical address, the duration of their stay, the primary purpose of residing at the address (e.g., owner, tenant, family member), and any other relevant occupancy details. This section aims to ensure that the individual is genuinely living at the mentioned address. On the other hand, the financial status section seeks to gather information about the affine's financial position. It may involve disclosing details about monthly income, sources of income (e.g., employment, business, investments), monthly expenses (such as rent, utilities, insurance), outstanding debts, assets owned (such as property, vehicles), and any other pertinent financial information. This section is crucial in assessing the affine's ability to meet financial obligations or determine eligibility for certain programs or services. The Anchorage Alaska Affidavit of Occupancy and Financial Status may have distinct variations based on the purpose for which it is being used. Some potential types include: 1. Rental Affidavit of Occupancy and Financial Status: Required by landlords and property management companies to assess prospective tenants' ability to pay rent and evaluate their financial stability. 2. Mortgage Affidavit of Occupancy and Financial Status: Used by lenders during mortgage applications to verify a borrower's residence and financial capacity to repay the loan. 3. Public Assistance Affidavit of Occupancy and Financial Status: Utilized by government agencies offering public assistance programs, such as housing vouchers or rental subsidies, to determine an applicant's eligibility and need. 4. Residency Affidavit of Occupancy and Financial Status: Often required in official processes like establishing residency for tax purposes, voting, or claiming benefits exclusive to Anchorage residents. It is crucial to accurately fill out the Anchorage Alaska Affidavit of Occupancy and Financial Status, as any false information provided may have legal consequences. The affidavit serves as a declaration made under penalty of perjury, affirming that all the information provided is true and accurate to the best of the affine's knowledge.