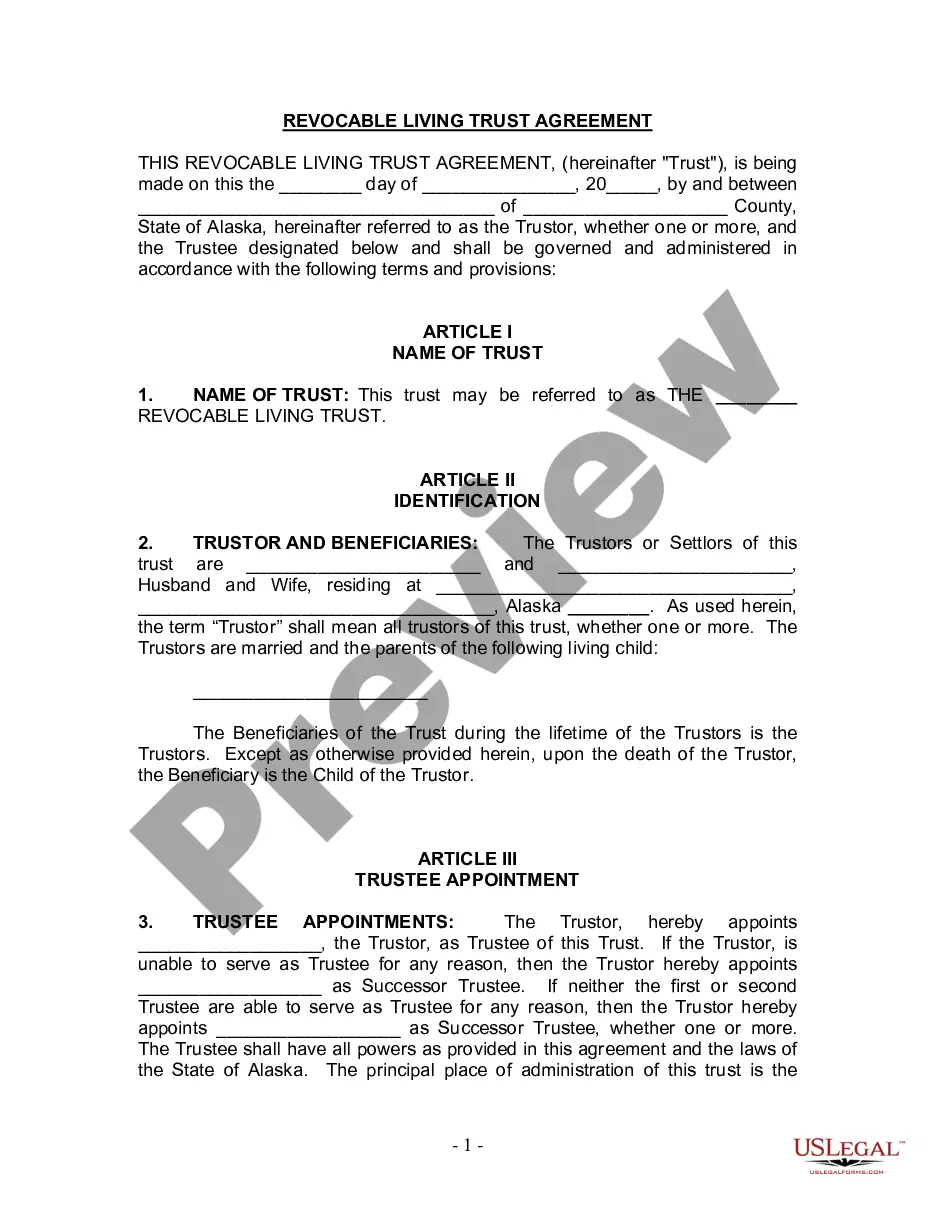

This living trust form was prepared for your State. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Title: Anchorage Alaska Living Trust for Husband and Wife with One Child: Explained Introduction: When it comes to estate planning in Anchorage, Alaska, one effective option for couples with a single child is establishing a Living Trust. A Living Trust is a legal document that allows individuals to manage their assets, minimize tax implications, and efficiently transfer their properties to beneficiaries. Let's dive into the details of an Anchorage Alaska Living Trust for Husband and Wife with One Child. 1. Definition and Purpose: An Anchorage Alaska Living Trust for Husband and Wife with One Child is a comprehensive estate planning tool that enables couples to protect and distribute their assets during their lifetime and upon their passing. By creating a Living Trust, couples can maintain control over their properties, avoid probate, and ensure a seamless transfer of assets to their child. 2. Types of Anchorage Alaska Living Trust: a) Revocable Living Trust: A revocable Living Trust allows couples to maintain complete control over their assets during their lifetime. They can modify, amend, or revoke the trust as per their wishes, providing flexibility and adaptability. In the event of incapacitation or death, the trust assets are seamlessly transferred to the surviving spouse and subsequently to the child. b) Irrevocable Living Trust: An irrevocable Living Trust offers couples a higher level of asset protection and potential tax savings. Once assets are transferred to the trust, they no longer belong to the couple. Instead, they are protected from creditors, estate taxes, and other financial liabilities. Although the couple cannot make substantial changes to the trust, they can still benefit from the trust's assets during their lifetime. 3. Key Features and Advantages: a) Probate Avoidance: An Anchorage Alaska Living Trust for Husband and Wife with One Child effectively bypasses the probate process, saving time, expenses, and ensuring privacy. Probate can be a lengthy and costly legal procedure, but with a Living Trust, assets are transferred directly to the designated beneficiaries. b) Asset Protection: By establishing an irrevocable Living Trust, couples can protect their assets from legal claims, bankruptcy, or divorce settlements, ensuring the inherited wealth remains intact for their child's benefit. c) Flexibility and Control: With a revocable Living Trust, couples maintain control over their assets until they are unable to manage them. They can add or remove assets, make changes to beneficiaries or terms, and even dissolve the trust if circumstances change. d) Special Provisions: Couples can include special provisions in their Living Trust, such as the appointment of a guardian for their child, instructions for healthcare decisions, and charitable donations. 4. Seek Professional Guidance: Creating an Anchorage Alaska Living Trust for Husband and Wife with One Child requires careful consideration of legal requirements and individual circumstances. It is highly recommended consulting with an experienced estate planning attorney who specializes in Alaska laws to ensure the trust meets all legal requirements and effectively protects the family's assets. Conclusion: An Anchorage Alaska Living Trust for Husband and Wife with One Child provides a comprehensive estate planning solution that allows couples to manage and distribute their assets, protect their child's inheritance, and avoid probate. By selecting the appropriate living trust type and seeking professional guidance, couples can secure their family's future and leave a lasting legacy in Anchorage, Alaska.