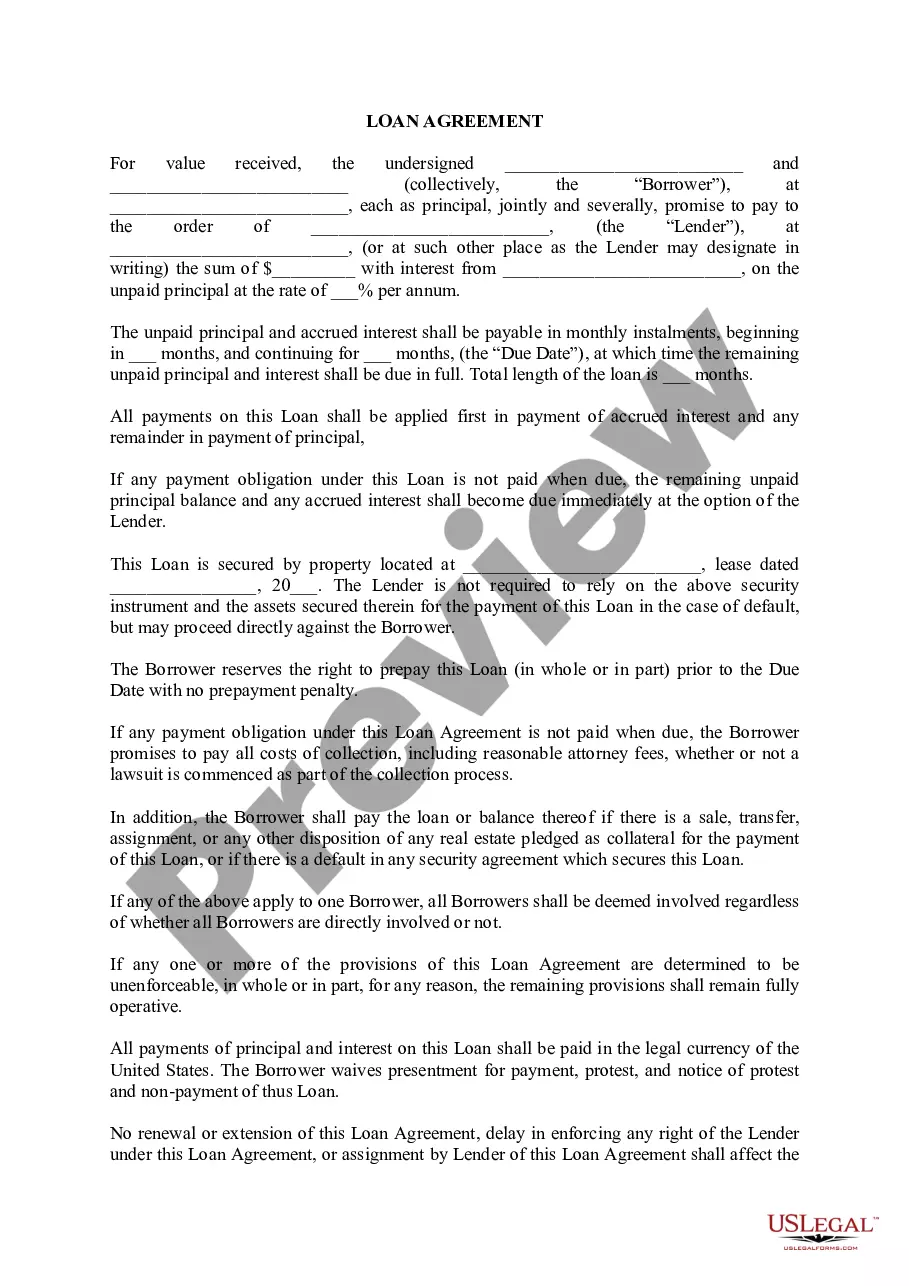

Anchorage Alaska Loan Agreement is a legally binding contract entered into between a lender and a borrower in Anchorage, Alaska. It outlines the terms and conditions under which a loan is provided, including the amount borrowed, interest rates, payment schedules, and other crucial details. In the vast array of loan options available in Anchorage, Alaska, different types of loan agreements serve various financial needs: 1. Personal Loan Agreement: This type of loan agreement serves individuals who require funds for personal expenses such as education, medical bills, vacations, or home improvements. The agreement specifies the loan amount, interest rate, repayment period, and any collateral requirements. 2. Mortgage Loan Agreement: Anchorage residents seeking to finance the purchase of a home may enter into a mortgage loan agreement. This agreement defines the loan amount, interest rate, repayment terms, and specifics about the property serving as collateral. It also includes details about insurance, taxes, and escrow accounts. 3. Auto Loan Agreement: Individuals in Anchorage wishing to purchase a vehicle can acquire funds through an auto loan agreement. This loan agreement states the loan amount, interest rate, repayment duration, and terms related to the vehicle's title and insurance. 4. Business Loan Agreement: Entrepreneurs and business owners in Anchorage may require additional funds for expansion, capital investments, or operational needs. A business loan agreement specifies the loan amount, interest rate, repayment structure, and may include additional terms such as personal guarantees or collateral requirements. 5. Student Loan Agreement: Students pursuing higher education in Anchorage may require financial assistance to cover tuition fees, books, and living expenses. A student loan agreement outlines the loan amount, interest rate, repayment options, and any deferment or forgiveness provisions. 6. Payday Loan Agreement: Payday loans are short-term loans usually taken to cover unexpected expenses or bridge financial gaps until the borrower's next paycheck. A payday loan agreement in Anchorage defines the loan amount, finance charges, repayment terms, and the borrower's repayment obligations. Regardless of the type of loan agreement, it is crucial for both lenders and borrowers in Anchorage, Alaska, to thoroughly read and understand the terms before signing. Legal counsel is often recommended ensuring compliance with Alaskan laws and protect the interests of both parties involved in the loan agreement.

Payday Loans Anchorage

Description

How to fill out Anchorage Alaska Loan Agreement?

Take advantage of the US Legal Forms and gain immediate access to any form template you require.

Our practical platform with a vast array of documents enables you to locate and acquire nearly any document sample you need.

You can export, complete, and sign the Anchorage Alaska Loan Agreement in just a few minutes rather than spending hours online searching for the appropriate template.

Utilizing our collection is an excellent method to enhance the security of your form submissions.

If you have not established a profile yet, follow the instructions below.

Access the page with the form you need. Ensure that it is the template you intended to find: verify its title and description, and utilize the Preview feature when available. If not, use the Search field to find the required one.

- Our skilled legal experts consistently evaluate all documents to ensure that the templates are applicable for a specific state and comply with current regulations and statutes.

- How can you access the Anchorage Alaska Loan Agreement.

- If you already possess a subscription, simply Log In to your account. The Download option will appear on all the samples you review.

- Moreover, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

The short answer to can you originate your own loan is: yes.

There are 10 basic provisions that should be in a loan agreement. Identity of the Parties. The names of the lender and borrower need to be stated.Date of the Agreement.Interest Rate.Repayment Terms.Default provisions.Signatures.Choice of Law.Severability.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Does a personal loan agreement need to be notarized? No, a personal loan agreement does not need to be notarized to be legally binding ? it simply needs to be signed by each party to the agreement.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

There are no legal differences between typed and handwritten agreements when it comes to enforceability. When most people think of a contract, a formally typed, the professional contract usually comes to mind. Nonetheless, a handwritten contract can be as valid as one that's typed.

A personal loan contract is a legally binding document regardless of whether the lender is a financial institution or another person. The consequences are the same if you default on the contract. As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

A loan agreement, also referred to as a loan contract, is a binding contract documenting a financial agreement between two or more parties. The party who writes the loan agreement letter is the lender, and the other party is the borrower. Both parties must agree to the terms and sign the letter for it to be binding.