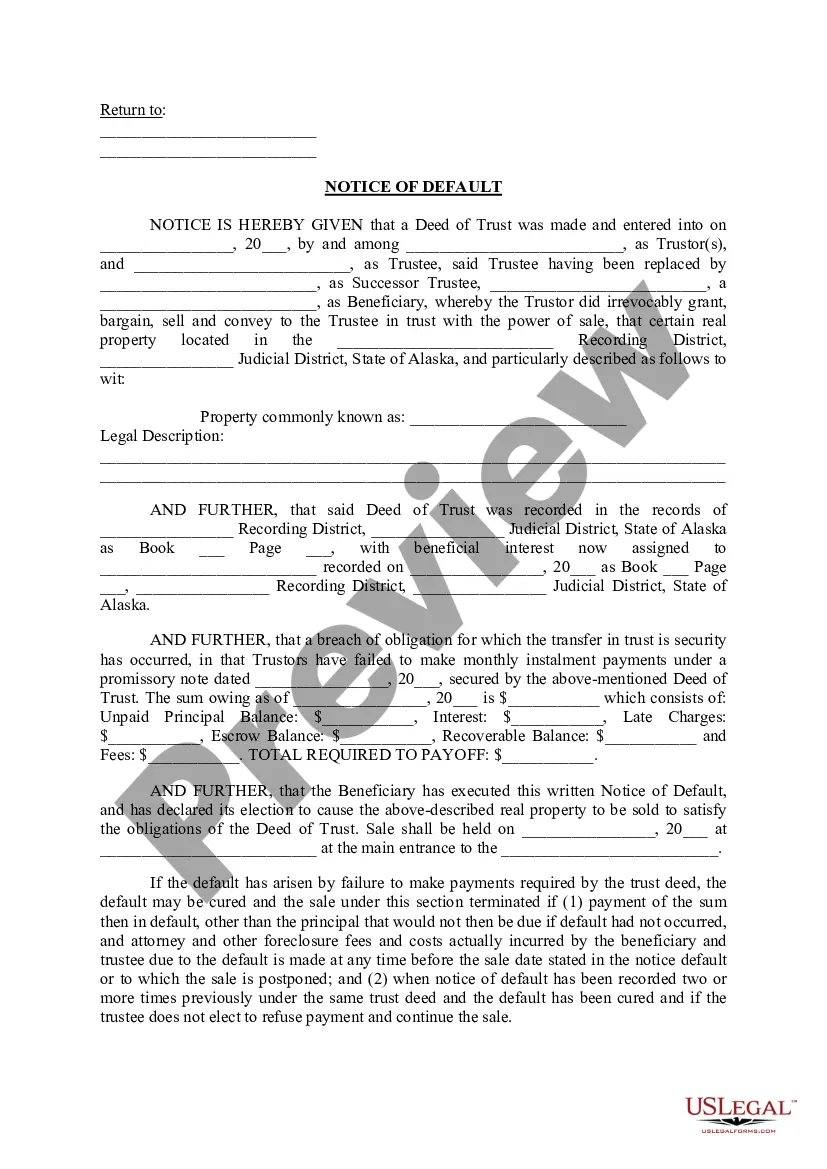

Title: Anchorage Alaska Notice of Default: Explained and Types of Notices Available Description: In the vast realm of real estate, understanding the Anchorage Alaska Notice of Default is crucial for homeowners, property investors, and lenders alike. This detailed description will provide comprehensive insights into what constitutes a Notice of Default, its significance, and highlight various types that may exist in Anchorage, Alaska. Using relevant keywords, we will shed light on this critical aspect of property ownership. Keywords: Anchorage Alaska, Notice of Default, real estate, homeowners, property investors, lenders, foreclosure process, mortgage loan. 1. What is an Anchorage Alaska Notice of Default? An Anchorage Alaska Notice of Default is a legal document important in the foreclosure process. It signifies that the borrower (homeowner or property owner) has defaulted on their mortgage loan agreement, breaching the terms outlined by the lender. 2. Purpose and Significance: The primary purpose of an Anchorage Alaska Notice of Default is to notify the borrower of their delinquency and impending legal actions. This notice also establishes the foundation for initiating the foreclosure process if the borrower fails to rectify their default and bring the loan current. Types of Anchorage Alaska Notice of Default: a. Pre-Foreclosure Notice: This type of Notice of Default is typically issued by lenders or their agents before initiating formal foreclosure proceedings. It serves as an initial warning to the borrower, giving them an opportunity to resolve their default within a specific timeframe. The pre-foreclosure notice outlines the amount owed, the necessary actions to cure the default, and the consequences of non-compliance. b. Li's Pendent Notice: Derived from Latin, "is pendent" means "suit pending." A Li's Pendent Notice of Default serves to inform potential buyers or interested parties that a legal action or lawsuit has been initiated against a particular property. This type of notice is recorded publicly to ensure that anyone interested in the property is aware of the ongoing litigation or foreclosure proceedings. c. Intent to Accelerate Notice: If the borrower fails to correct the default within the stipulated timeframe provided in the initial Notice of Default, the lender may issue an Intent to Accelerate Notice. This notice specifies that the lender intends to accelerate the loan, making the full balance due and payable immediately, unless the borrower takes necessary remedial actions. d. Auction Notice: When the foreclosure process advances to the auction stage, an Auction Notice of Default is typically issued. This notice informs the borrower, potential buyers, and interested parties about the scheduled sale date and details of the auction. Understanding the different types of Anchorage Alaska Notice of Default is vital for borrowers to take appropriate action and explore potential options to prevent foreclosure proceedings. In conclusion, Anchorage Alaska Notice of Default is an integral part of the foreclosure process. By being aware of the relevant notice types, borrowers, lenders, and interested parties can better navigate through the complex foreclosure procedures and make informed decisions about property ownership and investments in Anchorage, Alaska.

Title: Anchorage Alaska Notice of Default: Explained and Types of Notices Available Description: In the vast realm of real estate, understanding the Anchorage Alaska Notice of Default is crucial for homeowners, property investors, and lenders alike. This detailed description will provide comprehensive insights into what constitutes a Notice of Default, its significance, and highlight various types that may exist in Anchorage, Alaska. Using relevant keywords, we will shed light on this critical aspect of property ownership. Keywords: Anchorage Alaska, Notice of Default, real estate, homeowners, property investors, lenders, foreclosure process, mortgage loan. 1. What is an Anchorage Alaska Notice of Default? An Anchorage Alaska Notice of Default is a legal document important in the foreclosure process. It signifies that the borrower (homeowner or property owner) has defaulted on their mortgage loan agreement, breaching the terms outlined by the lender. 2. Purpose and Significance: The primary purpose of an Anchorage Alaska Notice of Default is to notify the borrower of their delinquency and impending legal actions. This notice also establishes the foundation for initiating the foreclosure process if the borrower fails to rectify their default and bring the loan current. Types of Anchorage Alaska Notice of Default: a. Pre-Foreclosure Notice: This type of Notice of Default is typically issued by lenders or their agents before initiating formal foreclosure proceedings. It serves as an initial warning to the borrower, giving them an opportunity to resolve their default within a specific timeframe. The pre-foreclosure notice outlines the amount owed, the necessary actions to cure the default, and the consequences of non-compliance. b. Li's Pendent Notice: Derived from Latin, "is pendent" means "suit pending." A Li's Pendent Notice of Default serves to inform potential buyers or interested parties that a legal action or lawsuit has been initiated against a particular property. This type of notice is recorded publicly to ensure that anyone interested in the property is aware of the ongoing litigation or foreclosure proceedings. c. Intent to Accelerate Notice: If the borrower fails to correct the default within the stipulated timeframe provided in the initial Notice of Default, the lender may issue an Intent to Accelerate Notice. This notice specifies that the lender intends to accelerate the loan, making the full balance due and payable immediately, unless the borrower takes necessary remedial actions. d. Auction Notice: When the foreclosure process advances to the auction stage, an Auction Notice of Default is typically issued. This notice informs the borrower, potential buyers, and interested parties about the scheduled sale date and details of the auction. Understanding the different types of Anchorage Alaska Notice of Default is vital for borrowers to take appropriate action and explore potential options to prevent foreclosure proceedings. In conclusion, Anchorage Alaska Notice of Default is an integral part of the foreclosure process. By being aware of the relevant notice types, borrowers, lenders, and interested parties can better navigate through the complex foreclosure procedures and make informed decisions about property ownership and investments in Anchorage, Alaska.