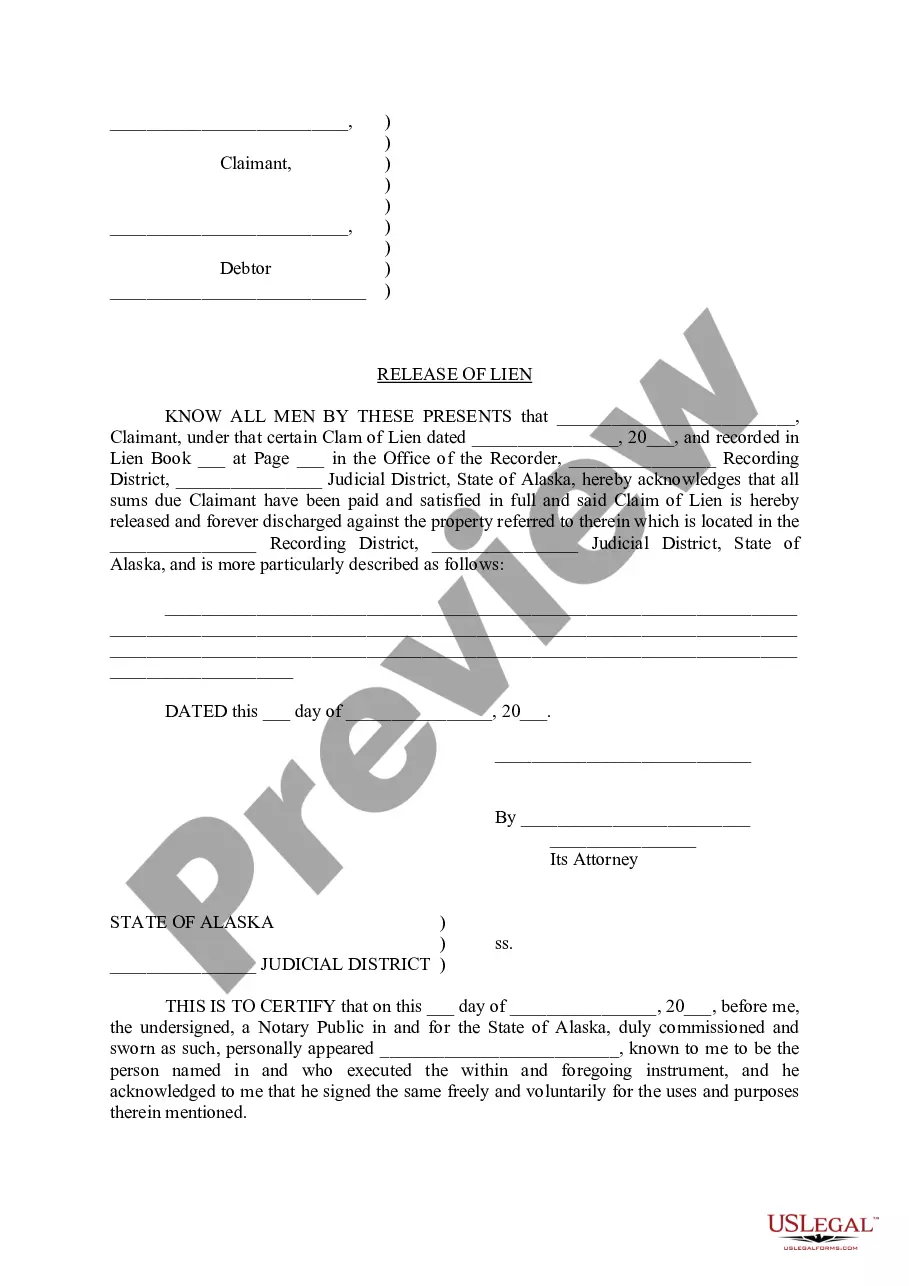

Anchorage Alaska Release of Lien: A Comprehensive Guide What is an Anchorage Alaska Release of Lien? An Anchorage Alaska Release of Lien refers to a legal document that releases a claim or interest in a property. It is typically filed by a lien holder or creditor to formally acknowledge that a debt or obligation has been satisfied, allowing the property owner to obtain a clear title. Types of Anchorage Alaska Release of Lien: 1. Construction or Mechanic's Lien Release: This type of release is commonly used in the construction industry when contractors, subcontractors, or suppliers file a lien against a property to secure payment for work or materials provided. Once the debt has been paid, a Construction or Mechanic's Lien Release is used to release the claim and remove the encumbrance from the property. 2. Property Tax Lien Release: When property taxes are unpaid, the Municipality of Anchorage may place a tax lien on the property. Upon repayment of the delinquent taxes, a Property Tax Lien Release is filed to release the lien and clear the title. 3. Judgment Lien Release: If a creditor obtains a court judgment against a property owner due to unpaid debts, they can file a judgment lien against the property. Upon repayment or satisfaction of the judgment, a Judgment Lien Release is filed to release the lien and free the property from encumbrance. 4. Mortgage or Deed of Trust Lien Release: When a property owner pays off their mortgage or deed of trust, it is crucial to obtain a Mortgage or Deed of Trust Lien Release. This document acknowledges the satisfaction of the loan and releases the lender's claim on the property, ensuring the owner possesses clear and marketable title. 5. IRS Tax Lien Release: In the event of unpaid federal taxes, the Internal Revenue Service (IRS) may place a tax lien on a property. Once the debt has been resolved, an IRS Tax Lien Release is filed to release the lien and remove any legal claim the IRS has on the property. Key Steps and Considerations for Obtaining an Anchorage Alaska Release of Lien: 1. Identify the relevant lien type: Determine the specific type of lien filed against the property. 2. Satisfy the outstanding debt: Make full payment or satisfy the obligation associated with the lien, ensuring all terms are met. 3. Draft the Release of Lien: Prepare a formal document acknowledging the satisfaction of the debt and releasing the lien from the property. 4. Notarize the document: Obtain notarization to validate the authenticity of the Release of Lien. 5. File the Release of Lien: Submit the document to the appropriate Anchorage, Alaska recording office or agency where the original lien was filed. 6. Notify relevant parties: Provide copies of the Release of Lien to all interested parties, including creditors, property owners, and related agencies. In conclusion, an Anchorage Alaska Release of Lien is a crucial document needed to release any type of lien placed on a property. Whether it's a construction lien, property tax lien, judgment lien, mortgage lien, or IRS tax lien, satisfying the debt and obtaining a proper release is essential to ensure a property owner retains a clear title.

Anchorage Alaska Release of Lien

Description

How to fill out Anchorage Alaska Release Of Lien?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no legal education to create such paperwork from scratch, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a huge catalog with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Anchorage Alaska Release of Lien or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Anchorage Alaska Release of Lien in minutes using our trustworthy platform. In case you are presently a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are new to our library, ensure that you follow these steps before downloading the Anchorage Alaska Release of Lien:

- Ensure the template you have found is good for your area because the regulations of one state or area do not work for another state or area.

- Preview the form and read a short description (if provided) of cases the document can be used for.

- If the form you picked doesn’t meet your requirements, you can start again and look for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Anchorage Alaska Release of Lien once the payment is done.

You’re all set! Now you can go ahead and print the form or complete it online. If you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.