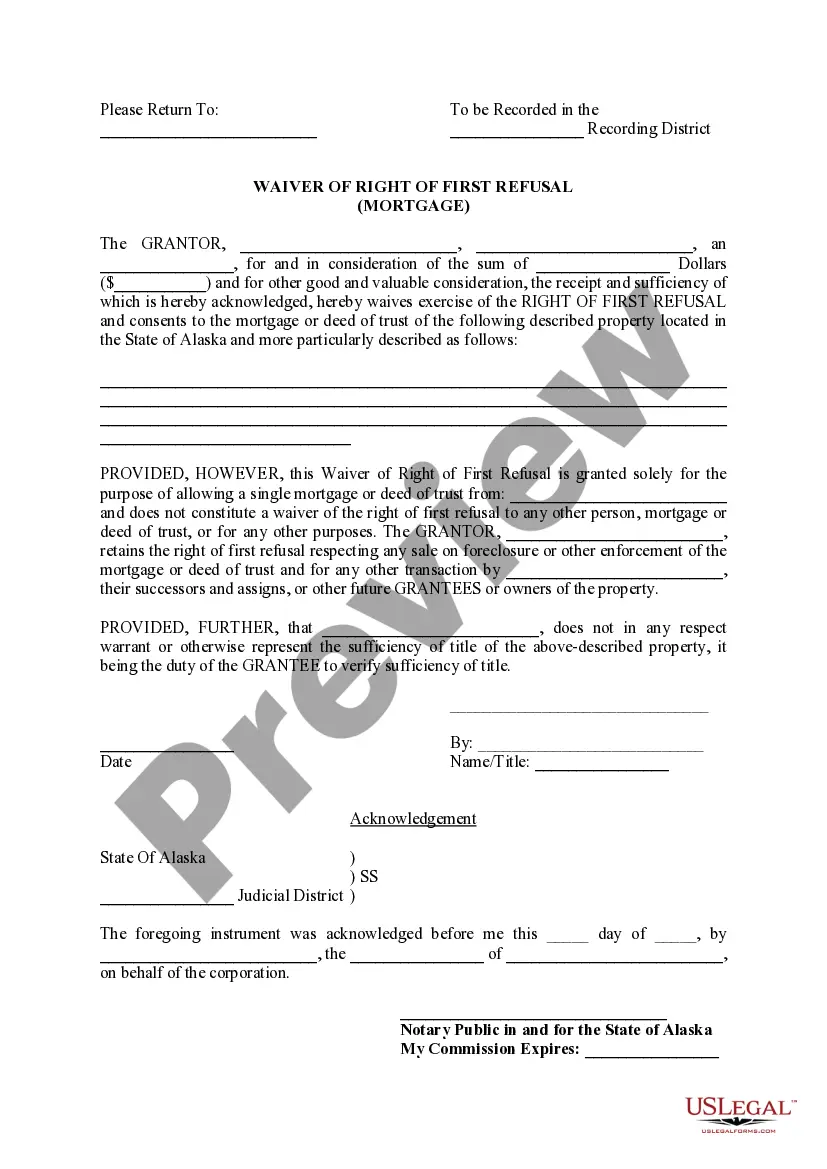

Anchorage Alaska Waiver of Right of First Refusal

Description

How to fill out Anchorage Alaska Waiver Of Right Of First Refusal?

If you have previously utilized our service, Log In/">Log In to your account and download the Anchorage Alaska Waiver of Right of First Refusal onto your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it according to your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have ongoing access to all documents you have purchased: they can be found in your profile under the My documents section whenever you wish to reuse them. Use the US Legal Forms service to quickly locate and save any template for your individual or professional requirements!

- Ensure you’ve located an appropriate document. Browse through the description and utilize the Preview feature, if available, to confirm if it satisfies your requirements. If it doesn’t fit, use the Search tab above to find the suitable one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Anchorage Alaska Waiver of Right of First Refusal. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Duration: The ROFR may expire after a certain amount of time or after an event occurs, such as the expiration of a lease. After the specified time, the property owner may enter into a transaction without notifying the holder of the ROFR.

Before the seller goes under contract to sell the property to someone else they must make the offer to the ROFR holder. The ROFR holder then has to agree to the same terms as the offer and if they do not respond within X days of their receipt of the offer they are deemed to have waived their ROFR.

Of course, for these reasons, a ROFR generally comes with a time limit on it that states how long a buyer has to negotiate with a seller before their window of opportunity and right of first refusal expires.

If they fail to respond the seller may not sell their property to a third party and must hold the property until they can obtain the waiver of ROFR. The owner must wait until the ROFR holder responds to them.

Typically, right of first refusal agreements are bound by time. After the period expires, the seller is free to pursue other buyers.

What Is the Difference Between Right of First Offer and Right of First Refusal? A right of first offer gives the holder the right to submit the first bid on the potential sale of a property. A right of first refusal gives the holder the right to match or refuse to match an offer that has been made to a seller.

A ROFR is considered to favour those shareholders who intend to stay long-term (likely buyers); while a ROFO is seen to favour likely sellers. In a ROFR mechanism, the selling shareholder has to solicit an offer from a third party before offering its shares to the non-selling shareholders.

A right of first offer requires the owners to offer the property, on terms of their choosing, to the person who holds the right (called the ?holder? or ?grantee?) before offering the property to others.

To be enforceable, options and rights of first refusal must usually be in writing, signed, contain an adequate description of the property, and be supported by consideration. They may be included in lease contracts, or they may be drafted as standalone agreements.

In some cases, a right of first refusal may give the holder the right to purchase the property at a specified ?bargain? price. Such provisions may be held unenforceable, especially if it is apparent that the specified price is significantly less than fair market value.