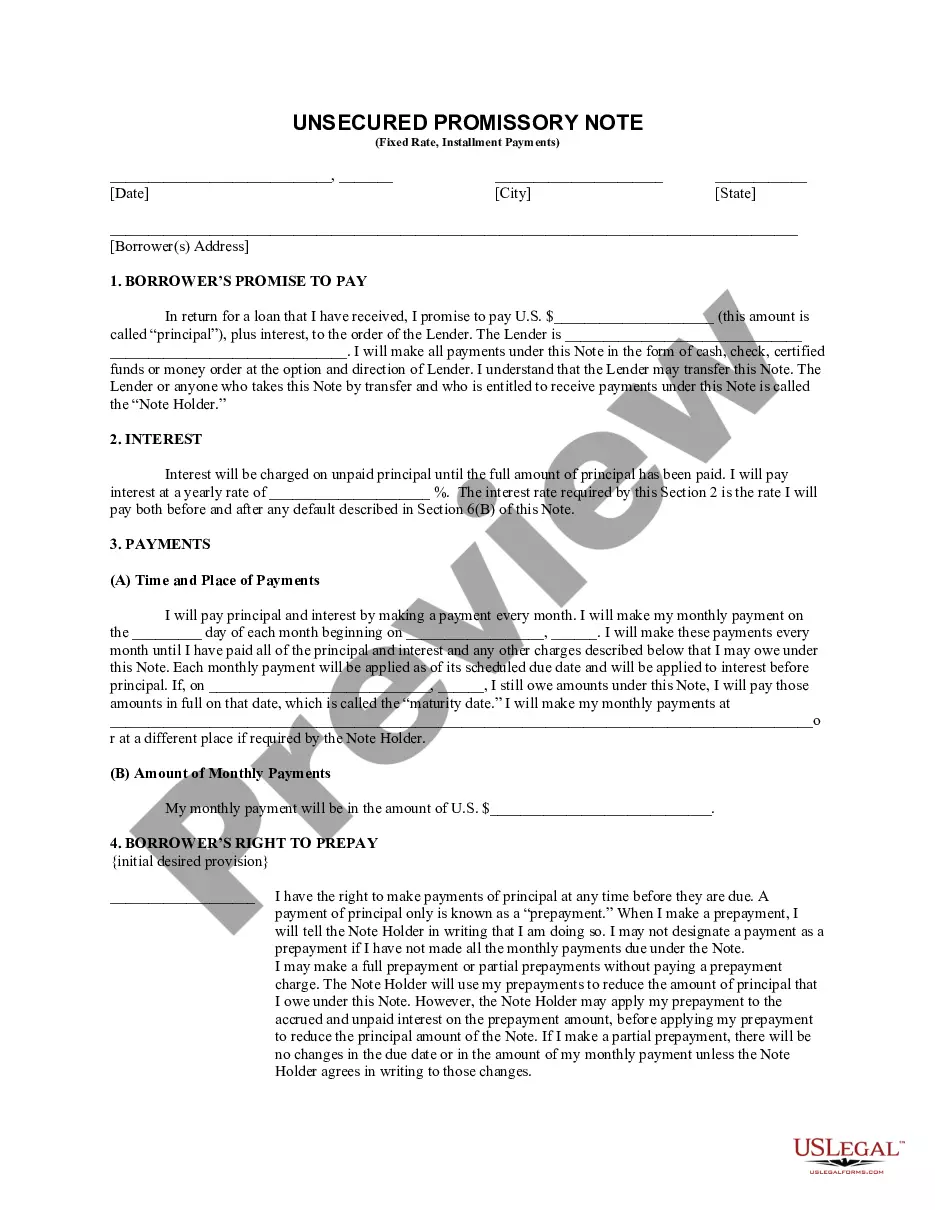

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

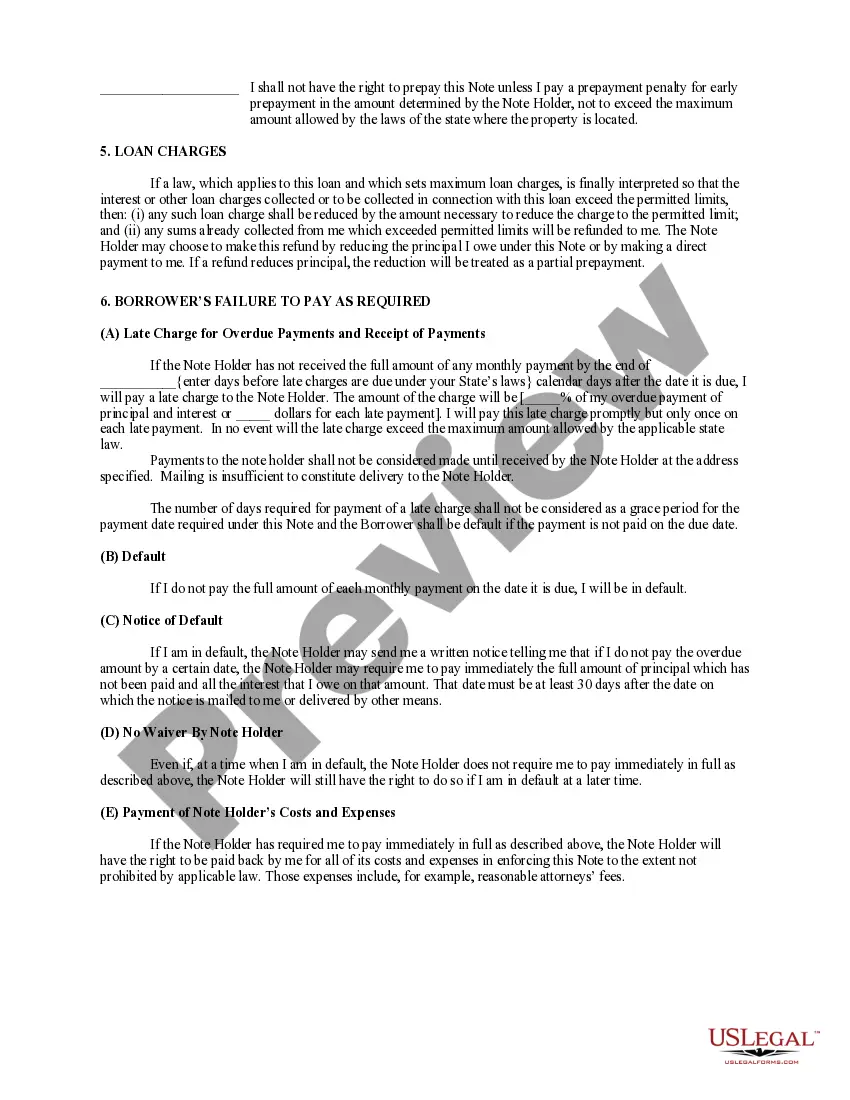

An Anchorage Alaska unsecured installment payment promissory note for a fixed rate is a legally binding agreement between a lender and a borrower in Anchorage, Alaska. This type of promissory note is commonly used when a borrower needs to borrow a specific amount of money and agrees to repay it in regular installments over a set period of time. The unsecured aspect of the promissory note means that there is no collateral attached to the loan. This means that the lender relies solely on the borrower's promise to repay the loan, and if the borrower fails to make payments, the lender may have limited options to recover the loan amount. The promissory note includes detailed information about the terms and conditions of the loan. This includes the principal amount borrowed, the interest rate (which is fixed and does not change over the repayment period), the repayment schedule (usually monthly or quarterly installments), and the due dates for each installment. It is important for both the lender and the borrower to clearly understand the terms of the promissory note before signing it. The borrower should carefully review the repayment schedule and ensure they can afford the monthly payments. The lender, on the other hand, should assess the borrower's creditworthiness and ability to repay the loan. Different types of Anchorage Alaska unsecured installment payment promissory notes for fixed rate may include: 1. Personal installment promissory note: This type of promissory note is used for personal loans between individuals, such as friends or family members. 2. Business installment promissory note: This type of promissory note is used for loans between a business entity and an individual or another business. 3. Student loan promissory note: This type of promissory note is specific to educational loans provided to students for financing their education. 4. Medical expense promissory note: This type of promissory note is used when a borrower needs to finance medical expenses and repay them in regular installments. In conclusion, an Anchorage Alaska unsecured installment payment promissory note for a fixed rate is a legal document outlining the terms and conditions of a loan. It is essential for both parties involved to thoroughly understand the terms and obligations specified in the promissory note before signing it.An Anchorage Alaska unsecured installment payment promissory note for a fixed rate is a legally binding agreement between a lender and a borrower in Anchorage, Alaska. This type of promissory note is commonly used when a borrower needs to borrow a specific amount of money and agrees to repay it in regular installments over a set period of time. The unsecured aspect of the promissory note means that there is no collateral attached to the loan. This means that the lender relies solely on the borrower's promise to repay the loan, and if the borrower fails to make payments, the lender may have limited options to recover the loan amount. The promissory note includes detailed information about the terms and conditions of the loan. This includes the principal amount borrowed, the interest rate (which is fixed and does not change over the repayment period), the repayment schedule (usually monthly or quarterly installments), and the due dates for each installment. It is important for both the lender and the borrower to clearly understand the terms of the promissory note before signing it. The borrower should carefully review the repayment schedule and ensure they can afford the monthly payments. The lender, on the other hand, should assess the borrower's creditworthiness and ability to repay the loan. Different types of Anchorage Alaska unsecured installment payment promissory notes for fixed rate may include: 1. Personal installment promissory note: This type of promissory note is used for personal loans between individuals, such as friends or family members. 2. Business installment promissory note: This type of promissory note is used for loans between a business entity and an individual or another business. 3. Student loan promissory note: This type of promissory note is specific to educational loans provided to students for financing their education. 4. Medical expense promissory note: This type of promissory note is used when a borrower needs to finance medical expenses and repay them in regular installments. In conclusion, an Anchorage Alaska unsecured installment payment promissory note for a fixed rate is a legal document outlining the terms and conditions of a loan. It is essential for both parties involved to thoroughly understand the terms and obligations specified in the promissory note before signing it.