This Small Business Accounting Package contains many of the business forms needed to operate and maintain a small business, including a variety of accounting forms. These forms may be adapted to suit your particular business or situation.

Included in your package are the following forms:

1. Profit and Loss Statement

2. Aging Accounts Payable form

3. Balance Sheet Deposit

4. Cash Disbursements and Receipts form

5. Check Request form

6. Daily Accounts Receivables form

7. Depreciation Schedule

8. Invoice

9. Petty Cash form

10. Purchase Order

11. Purchasing Cost Estimate

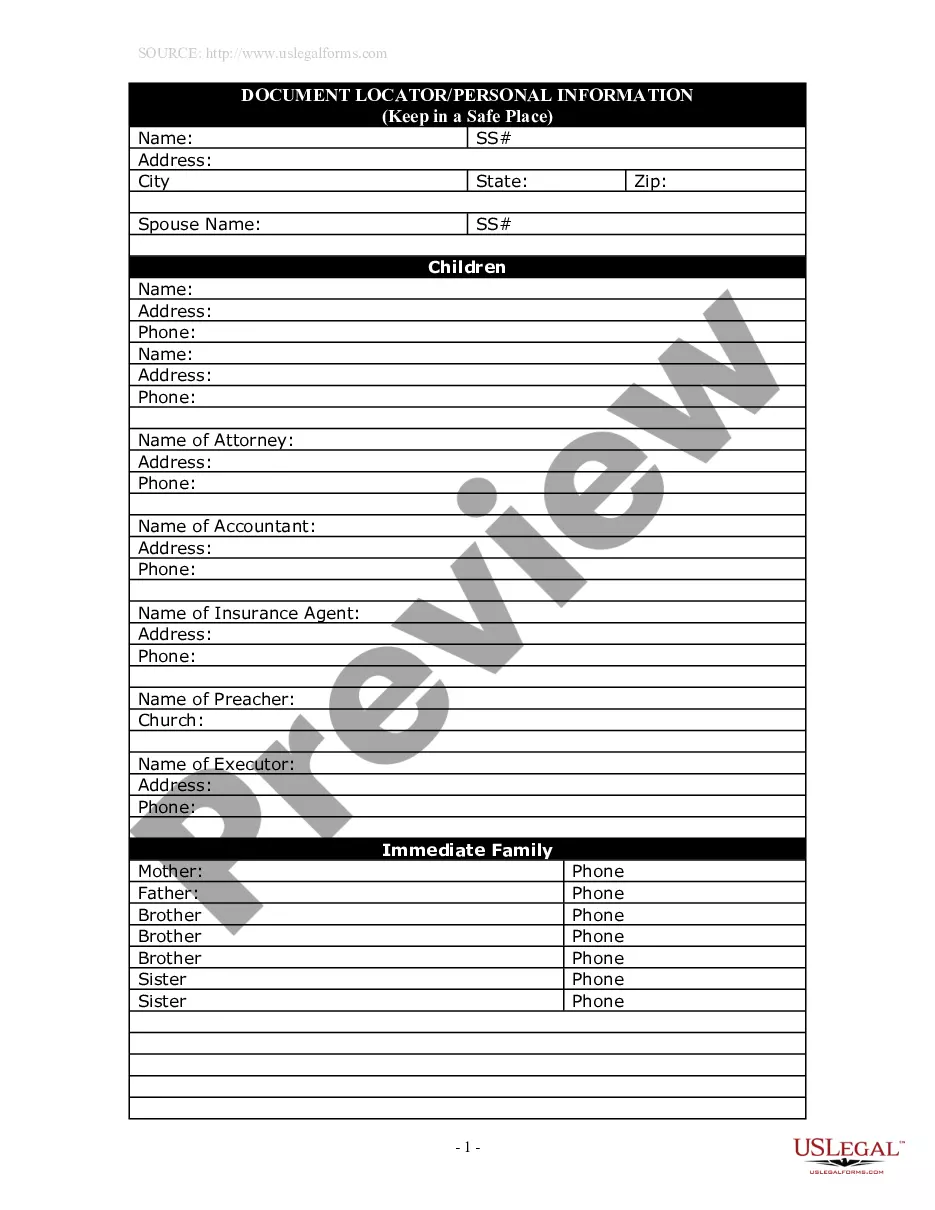

12. Records Management form

13. Yearly Expenses form

14. Yearly Expenses form by Quarter

Purchase this package and save up to 50% over purchasing the forms separately!

Anchorage Alaska Small Business Accounting Package is a comprehensive financial management solution designed specifically for small businesses in Anchorage, Alaska. This advanced software package helps businesses streamline their accounting processes and manage their finances more efficiently. With a wide range of robust features and user-friendly interface, this accounting package is an ideal tool for businesses to handle their financial tasks effectively. One of the key features of the Anchorage Alaska Small Business Accounting Package is its ability to handle all basic accounting functions. It enables businesses to easily track income and expenses, generate detailed financial reports, and reconcile bank statements. This software package also supports various accounting methods, such as cash-basis or accrual-basis, to accommodate different business needs. In addition to basic accounting functions, this package offers advanced features to enhance small business financial management. It includes tools for budgeting and forecasting, allowing businesses to set financial goals and make informed decisions. The software can also generate invoices, process payroll, and track inventory, providing a comprehensive overview of the business's financial health. Another notable feature of the Anchorage Alaska Small Business Accounting Package is its integration capabilities. It seamlessly integrates with other software applications commonly used by small businesses, such as customer relationship management (CRM) systems or e-commerce platforms. This integration ensures that financial data is accurately synced across different platforms, reducing manual data entry and minimizing the chances of errors. There are several types of Anchorage Alaska Small Business Accounting Packages available, each catering to specific business needs: 1. Basic Package: This package is designed for small businesses with minimal accounting requirements. It includes core accounting functions like bookkeeping, financial reporting, and bank reconciliation. 2. Advanced Package: This package is suitable for small businesses with more complex financial operations. It includes additional features like budgeting, forecasting, payroll processing, and inventory management. 3. Industry-Specific Package: This package is tailored to meet the accounting needs of businesses in specific industries, such as retail, manufacturing, or healthcare. It includes industry-specific modules and reporting capabilities to handle sector-specific financial tasks. 4. Cloud-Based Package: This package offers the flexibility of cloud-based accounting, allowing businesses to access their financial data from anywhere, anytime. It also provides automatic updates and data backups, ensuring data security and convenience. Overall, the Anchorage Alaska Small Business Accounting Package is a reliable and efficient solution for small businesses in Anchorage, Alaska, seeking to streamline their financial processes. With its comprehensive features, integration capabilities, and various package options, this accounting software is a valuable tool for driving financial success in the competitive business landscape.