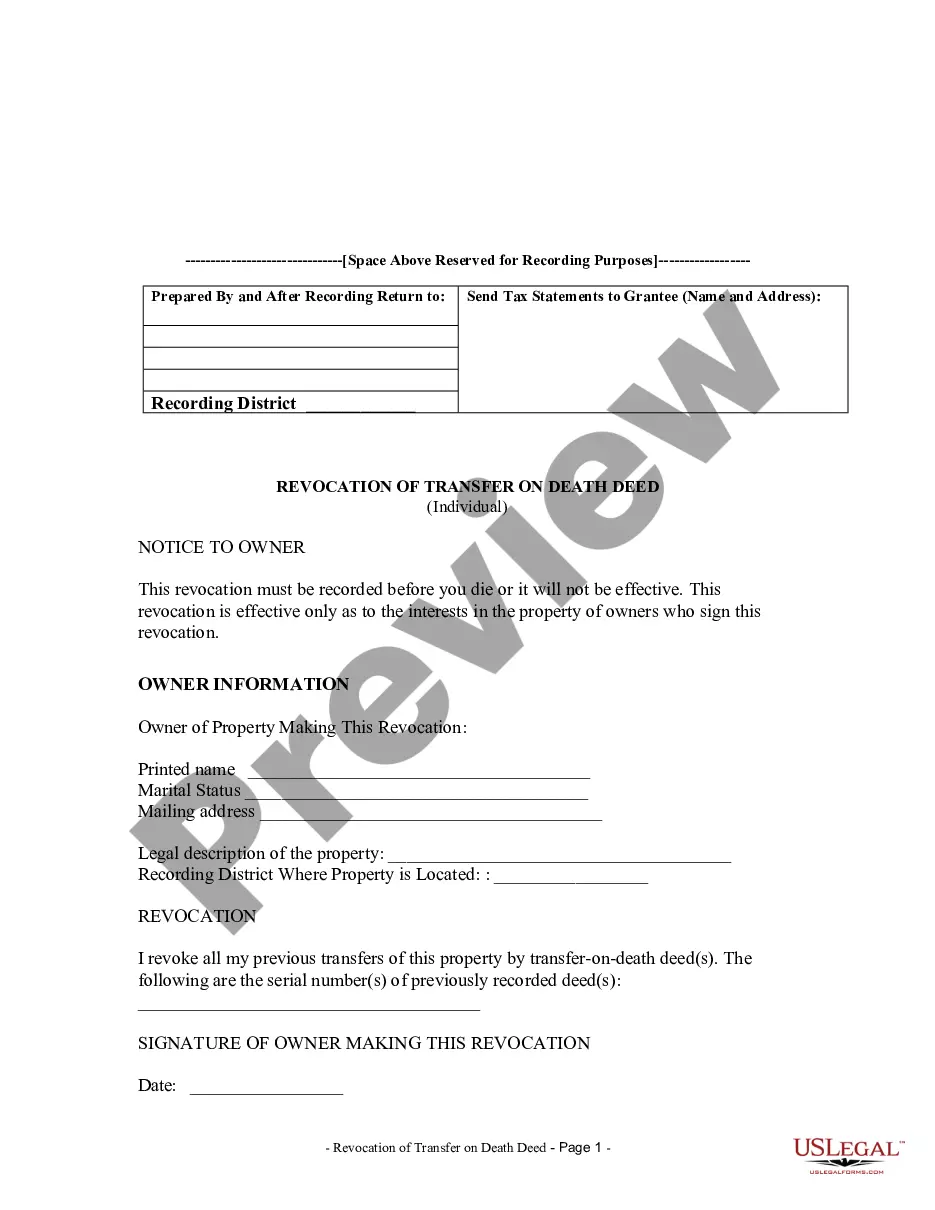

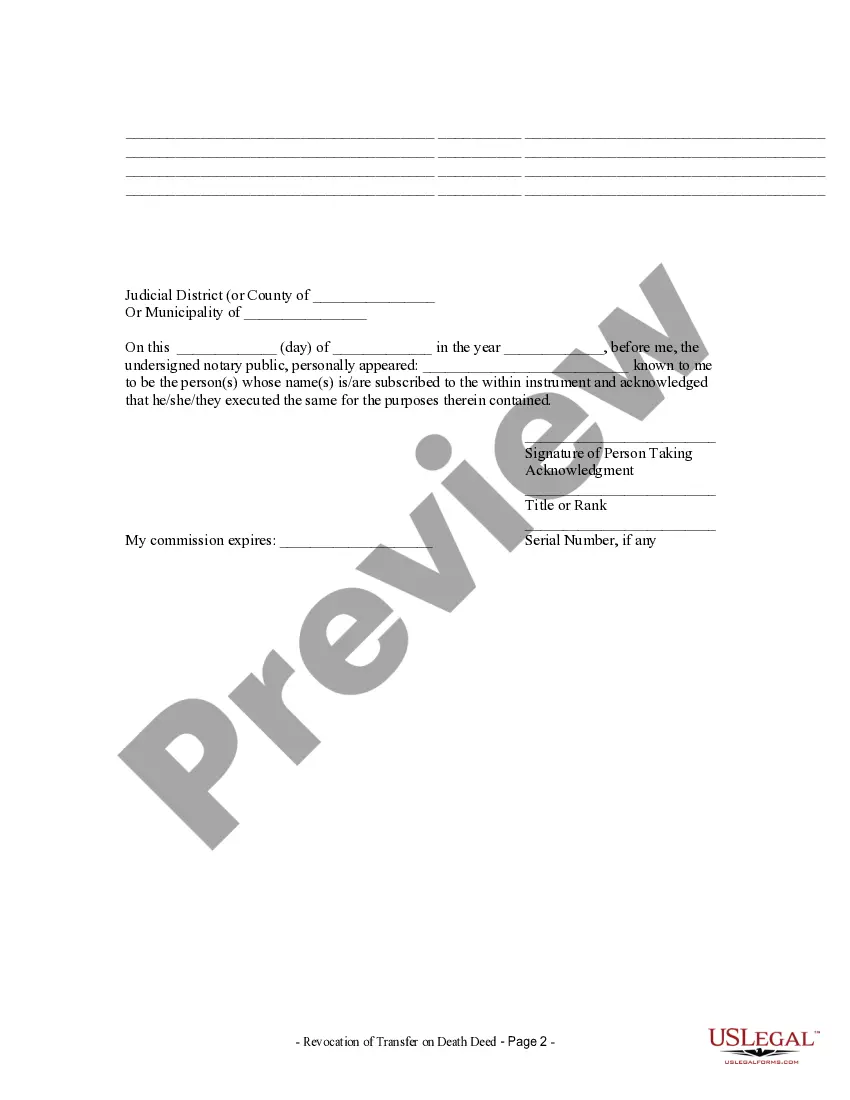

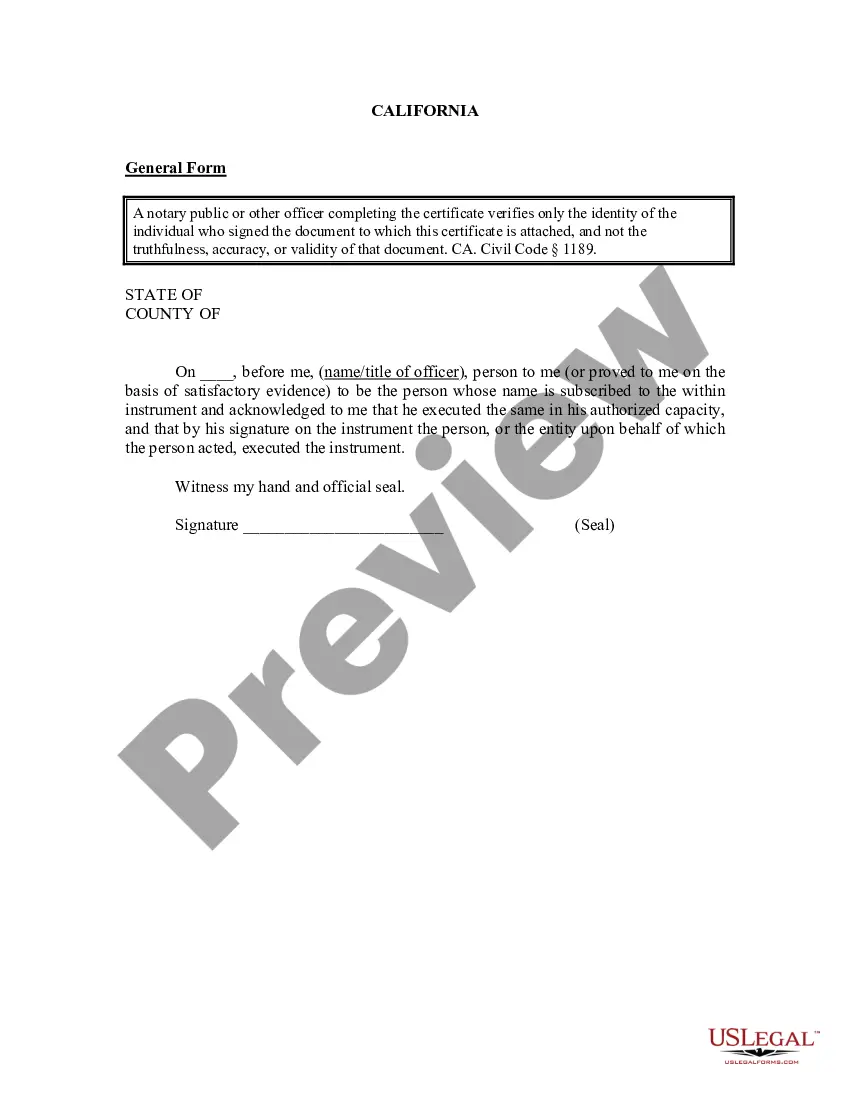

Anchorage Alaska Revocation of Transfer on Death Deed, also known as Beneficiary Deed for One Granter, is a legal document that allows an individual (granter) to transfer their property to a named beneficiary upon their death while retaining ownership and control over the property during their lifetime. However, there may be cases where the granter wishes to revoke or cancel the transfer on death deed, either due to changed circumstances or for personal reasons. In such situations, it becomes necessary to execute an Anchorage Alaska Revocation of Transfer on Death Deed — Beneficiary Deed for OnGranteror. Keywords: Anchorage Alaska, Revocation of Transfer on Death Deed, Beneficiary Deed, Granter, legal document, property transfer, named beneficiary, cancel, revoke, personal reasons, execution. Different types of Anchorage Alaska Revocation of Transfer on Death Deed — Beneficiary Deed for OnGranteror: 1. Voluntary Revocation: This type of revocation occurs when the granter willingly decides to cancel the transfer on death deed. It may be due to changed circumstances, such as a new beneficiary preference or a desire to retain control over the property. 2. Involuntary Revocation: In certain cases, the revocation may be involuntary, resulting from legal or procedural issues. For example, if the original transfer on death deed was deemed invalid or executed incorrectly, the court may order an involuntary revocation. 3. Absolute Revocation: An absolute revocation completely rescinds the transfer on death deed, removing any rights or claims the beneficiary had over the property. This type of revocation is often a permanent and final decision made by the granter. 4. Partial Revocation: A partial revocation modifies specific provisions within the transfer on death deed without completely canceling it. The granter may choose to change the distribution of assets, update the named beneficiary, or make other alterations while retaining the overall structure of the deed. 5. Conditional Revocation: This type of revocation includes specific conditions or contingencies that must be met for the revocation to take effect. It allows the granter to revoke the transfer on death deed if certain predetermined circumstances occur, giving them more control and flexibility over the property transfer. In summary, an Anchorage Alaska Revocation of Transfer on Death Deed — Beneficiary Deed for OnGranteror enables a granter to cancel or modify a previously executed transfer on death deed. Whether it's a voluntary or involuntary revocation, absolute or partial, or conditioned on specific events, this legal document allows the granter to assert their wishes regarding the ultimate distribution of their property.

Anchorage Alaska Revocation of Transfer on Death Deed, also known as Beneficiary Deed for One Granter, is a legal document that allows an individual (granter) to transfer their property to a named beneficiary upon their death while retaining ownership and control over the property during their lifetime. However, there may be cases where the granter wishes to revoke or cancel the transfer on death deed, either due to changed circumstances or for personal reasons. In such situations, it becomes necessary to execute an Anchorage Alaska Revocation of Transfer on Death Deed — Beneficiary Deed for OnGranteror. Keywords: Anchorage Alaska, Revocation of Transfer on Death Deed, Beneficiary Deed, Granter, legal document, property transfer, named beneficiary, cancel, revoke, personal reasons, execution. Different types of Anchorage Alaska Revocation of Transfer on Death Deed — Beneficiary Deed for OnGranteror: 1. Voluntary Revocation: This type of revocation occurs when the granter willingly decides to cancel the transfer on death deed. It may be due to changed circumstances, such as a new beneficiary preference or a desire to retain control over the property. 2. Involuntary Revocation: In certain cases, the revocation may be involuntary, resulting from legal or procedural issues. For example, if the original transfer on death deed was deemed invalid or executed incorrectly, the court may order an involuntary revocation. 3. Absolute Revocation: An absolute revocation completely rescinds the transfer on death deed, removing any rights or claims the beneficiary had over the property. This type of revocation is often a permanent and final decision made by the granter. 4. Partial Revocation: A partial revocation modifies specific provisions within the transfer on death deed without completely canceling it. The granter may choose to change the distribution of assets, update the named beneficiary, or make other alterations while retaining the overall structure of the deed. 5. Conditional Revocation: This type of revocation includes specific conditions or contingencies that must be met for the revocation to take effect. It allows the granter to revoke the transfer on death deed if certain predetermined circumstances occur, giving them more control and flexibility over the property transfer. In summary, an Anchorage Alaska Revocation of Transfer on Death Deed — Beneficiary Deed for OnGranteror enables a granter to cancel or modify a previously executed transfer on death deed. Whether it's a voluntary or involuntary revocation, absolute or partial, or conditioned on specific events, this legal document allows the granter to assert their wishes regarding the ultimate distribution of their property.