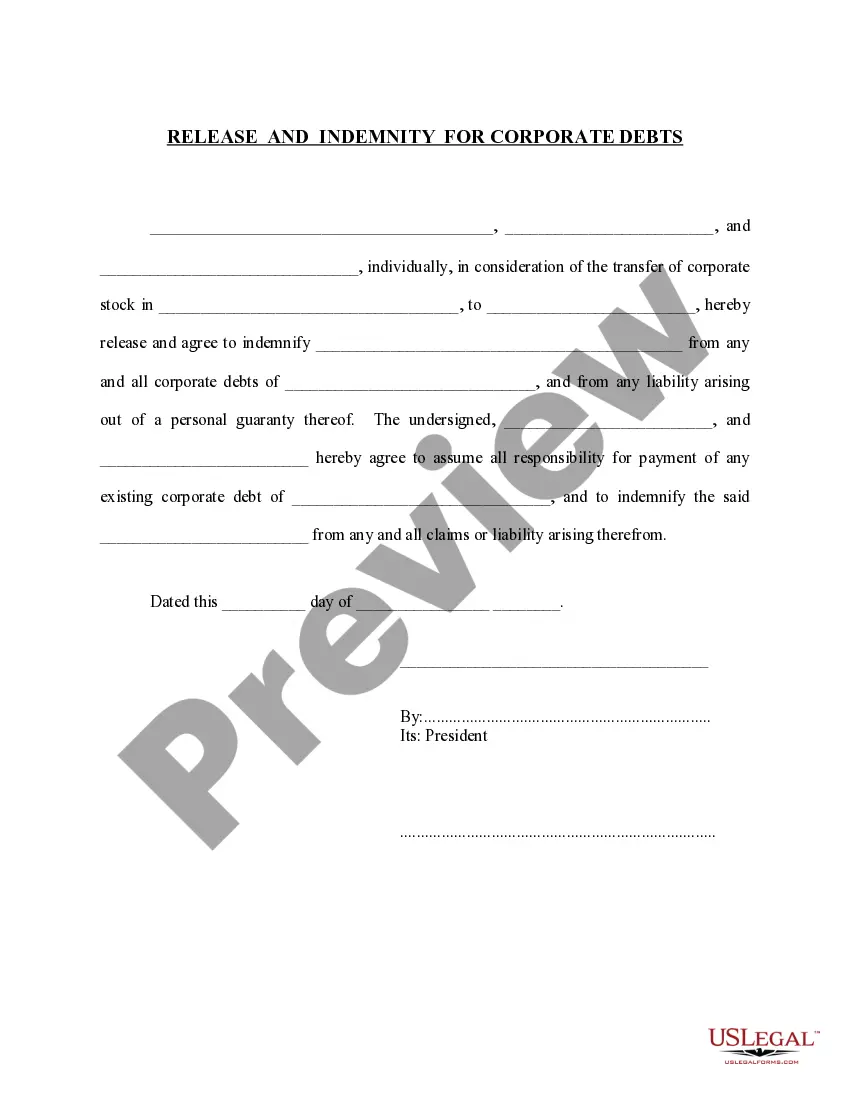

This form is a release and indemnity agreement for Corporate debts in exchange for a transfer of corporate stock. The form is available in both word and word perfect formats.

The Huntsville Alabama Release and Indemnity Agreement for Corporate Debts is a legal document that outlines the terms and conditions for releasing and indemnifying a corporate entity from any debts or liabilities. This agreement is designed to protect the corporation, its directors, officers, and shareholders from any potential financial obligations arising from past, present, or future debts. In this agreement, the debtor agrees to release the corporation from any claims, suits, judgments, or liens related to corporate debts. Additionally, they agree to indemnify the corporation against any losses, damages, costs, or expenses incurred as a result of these debts. The Huntsville Alabama Release and Indemnity Agreement for Corporate Debts provides a mechanism to ensure that the corporation can operate smoothly without being burdened by financial obligations that may hinder its ability to conduct business effectively. There are several types of Huntsville Alabama Release and Indemnity Agreements for Corporate Debts, each catering to specific scenarios or circumstances: 1. General Corporate Debt Release and Indemnity Agreement: This type of agreement covers the release and indemnification of a corporation for all types of debts, including loans, credit lines, mortgages, and any other financial obligations. 2. Specific Corporate Debt Release and Indemnity Agreement: This agreement is tailored to address a specific debt or liability issue faced by the corporation. It outlines the terms and conditions for the release and indemnification of the corporation only for that particular debt. 3. Third-Party Debt Release and Indemnity Agreement: Sometimes, a corporation may need to assume the debts of another entity, such as during a merger or acquisition. This agreement allows the corporation to release and indemnify itself from the debts of the third party. 4. Contingent Liability Release and Indemnity Agreement: In situations where the corporation may have contingent liabilities or potential financial obligations, this agreement provides a framework for the release and indemnification of the corporation from these contingencies. 5. Director and Officer Indemnification Agreement: This agreement focuses on indemnifying the directors and officers of the corporation from any liabilities or legal actions arising from corporate debts. It ensures that they are protected while acting on behalf of the corporation. The Huntsville Alabama Release and Indemnity Agreement for Corporate Debts is crucial for corporations operating in Huntsville, Alabama, as it safeguards their financial stability and protects them from potential legal disputes associated with debts. It is advisable to consult with a legal professional to draft or review these agreements to ensure they comply with local laws and effectively address the specific needs of the corporation.The Huntsville Alabama Release and Indemnity Agreement for Corporate Debts is a legal document that outlines the terms and conditions for releasing and indemnifying a corporate entity from any debts or liabilities. This agreement is designed to protect the corporation, its directors, officers, and shareholders from any potential financial obligations arising from past, present, or future debts. In this agreement, the debtor agrees to release the corporation from any claims, suits, judgments, or liens related to corporate debts. Additionally, they agree to indemnify the corporation against any losses, damages, costs, or expenses incurred as a result of these debts. The Huntsville Alabama Release and Indemnity Agreement for Corporate Debts provides a mechanism to ensure that the corporation can operate smoothly without being burdened by financial obligations that may hinder its ability to conduct business effectively. There are several types of Huntsville Alabama Release and Indemnity Agreements for Corporate Debts, each catering to specific scenarios or circumstances: 1. General Corporate Debt Release and Indemnity Agreement: This type of agreement covers the release and indemnification of a corporation for all types of debts, including loans, credit lines, mortgages, and any other financial obligations. 2. Specific Corporate Debt Release and Indemnity Agreement: This agreement is tailored to address a specific debt or liability issue faced by the corporation. It outlines the terms and conditions for the release and indemnification of the corporation only for that particular debt. 3. Third-Party Debt Release and Indemnity Agreement: Sometimes, a corporation may need to assume the debts of another entity, such as during a merger or acquisition. This agreement allows the corporation to release and indemnify itself from the debts of the third party. 4. Contingent Liability Release and Indemnity Agreement: In situations where the corporation may have contingent liabilities or potential financial obligations, this agreement provides a framework for the release and indemnification of the corporation from these contingencies. 5. Director and Officer Indemnification Agreement: This agreement focuses on indemnifying the directors and officers of the corporation from any liabilities or legal actions arising from corporate debts. It ensures that they are protected while acting on behalf of the corporation. The Huntsville Alabama Release and Indemnity Agreement for Corporate Debts is crucial for corporations operating in Huntsville, Alabama, as it safeguards their financial stability and protects them from potential legal disputes associated with debts. It is advisable to consult with a legal professional to draft or review these agreements to ensure they comply with local laws and effectively address the specific needs of the corporation.