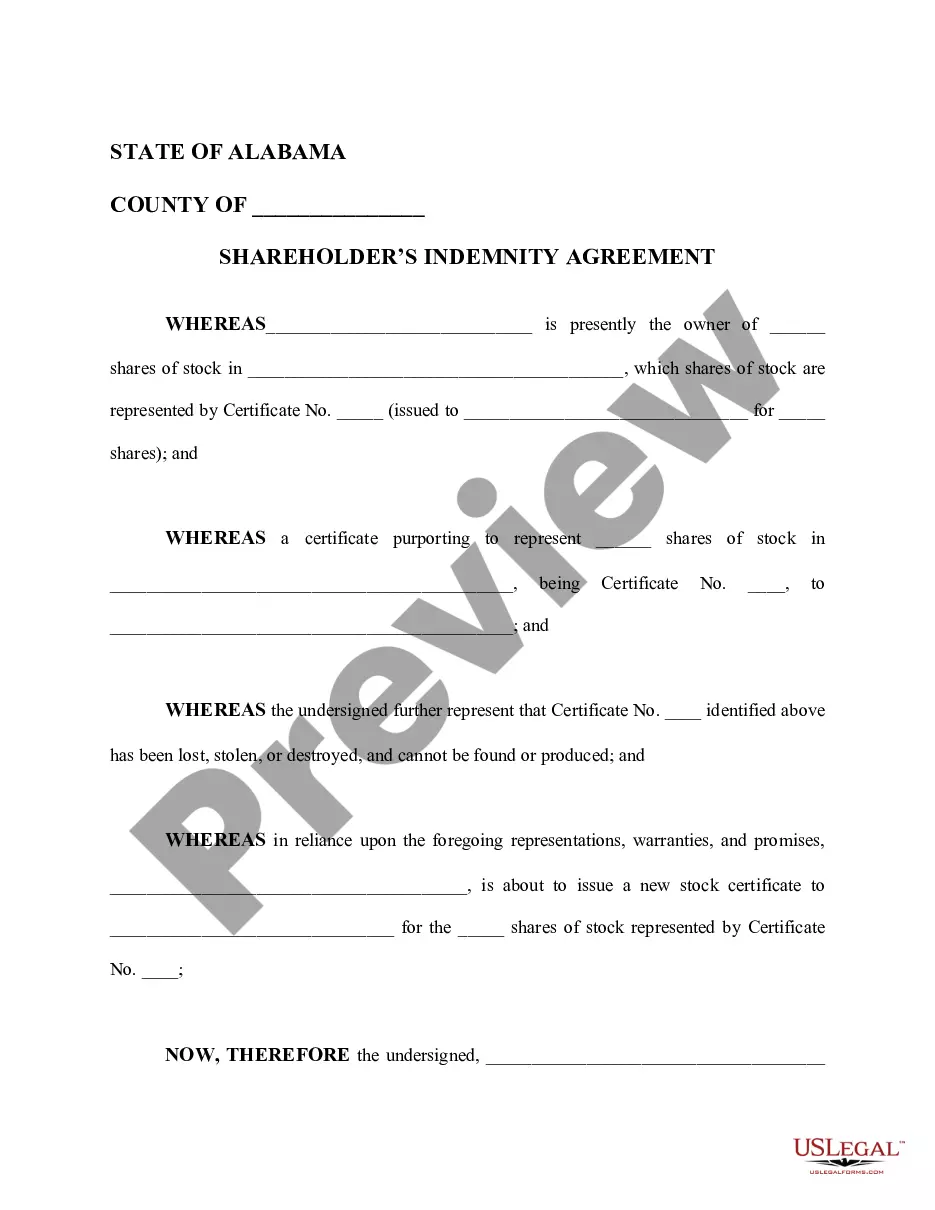

This form is used by the shareholder of a lost stock certificate to indemnify and hold harmless the officers, directors, shareholders, successors, and assigns of the corporation. The form is available in both word and word perfect formats.

Birmingham Alabama Shareholder's Indemnity Agreement is a legally binding contract designed to protect shareholders from potential financial losses or liabilities in the event of certain specified events. This agreement provides shareholders with a level of security, ensuring that they will not bear the full burden of any financial damages that may arise. The key purpose of the Birmingham Alabama Shareholder's Indemnity Agreement is to establish an indemnification framework where the company assumes responsibility for compensating shareholders for losses or liabilities incurred within certain defined parameters. Through this agreement, the company agrees to reimburse shareholders for any financial harm suffered due to a breach of fiduciary duty, negligence, or other detrimental actions, which are explicitly mentioned within the agreement. There are different types of Birmingham Alabama Shareholder's Indemnity Agreements that can be tailored to specific business needs. Firstly, there is the Standard Shareholder's Indemnity Agreement, which covers general liabilities arising from the actions or decisions of directors, officers, or employees that may negatively impact the shareholders' investments. Another type is the Breach of Contract Shareholder's Indemnity Agreement, which specifically protects shareholders in case of breach of contract by the company or other parties involved. This agreement ensures that shareholders do not face any financial repercussions arising from contractual disputes or failures. Further, the Birmingham Alabama Shareholder's Indemnity Agreement may include a Share Purchase Agreement, which safeguards shareholders during the process of purchasing or acquiring shares from other shareholders or third parties. This agreement helps mitigate risks associated with the purchase transaction and safeguards the buyer from any hidden liabilities or misrepresentation. Overall, a Birmingham Alabama Shareholder's Indemnity Agreement serves as a crucial protective measure for shareholders, avoiding potential financial losses and providing a secure investment environment. By outlining the specific circumstances under which indemnification is allowable, this agreement offers peace of mind and ensures that shareholders can focus on their investment goals without excessive risk exposure.