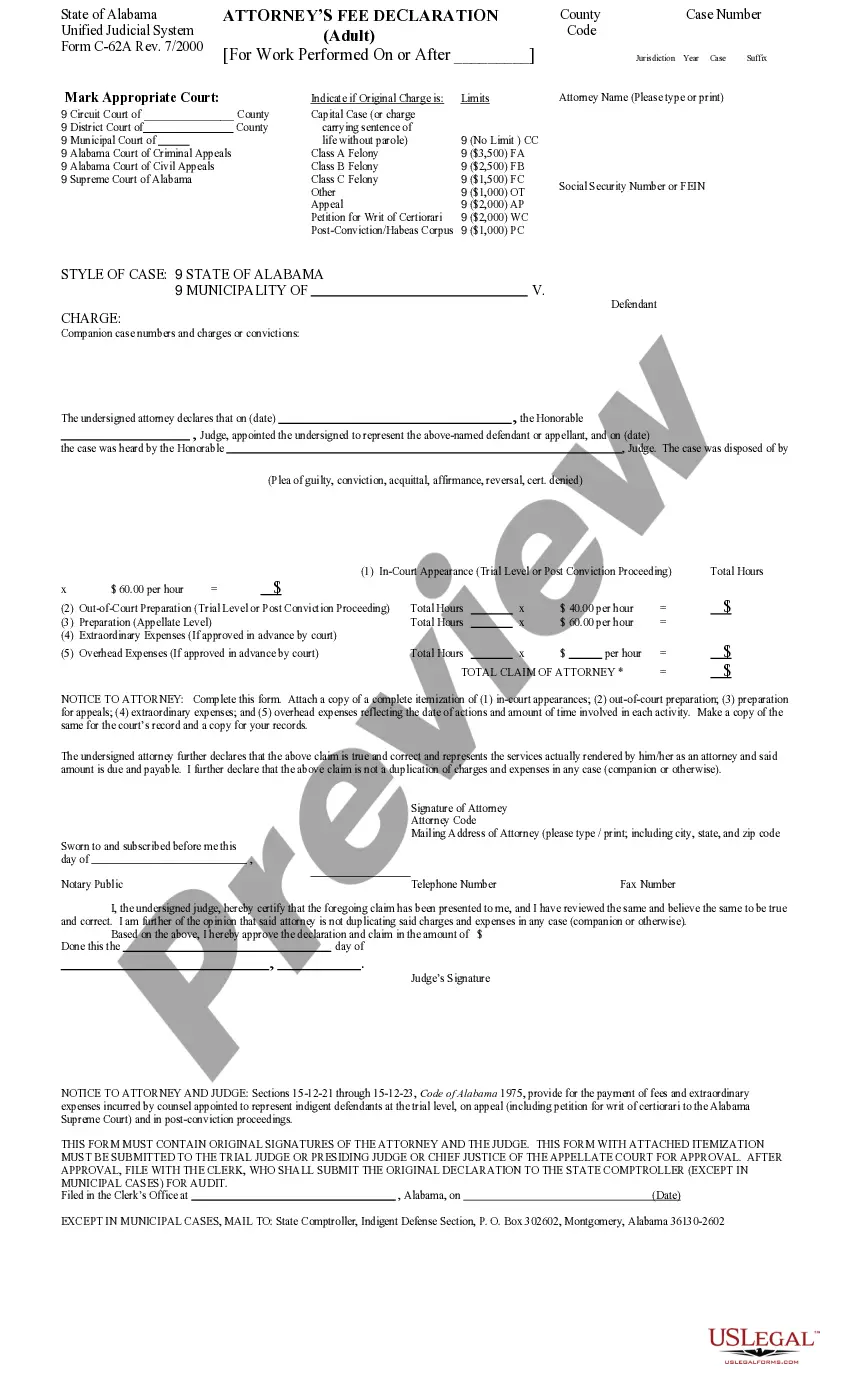

This form is a fee declaration by a defense attorney appointed by the Court. The form is available in both word and word perfect formats.

Huntsville Alabama Attorney Fee Declaration is a document that outlines the details and breakdown of legal fees charged by attorneys in Huntsville, Alabama. Attorneys are required to prepare and submit this declaration to their clients to provide transparency regarding their billing practices and ensure both parties are clear on the fees and expenses involved in legal representation. This written statement helps clients understand the fees associated with legal services they have received or will receive. The Huntsville Alabama Attorney Fee Declaration typically contains essential information, including the attorney's name, contact details, client's name, case or matter number, and a detailed breakdown of the fees and charges incurred during the legal process. Fees can be categorized into different types, such as: 1. Hourly Rate Fees: Attorneys may charge fees based on the amount of time spent working on the case. This includes the time spent in meetings, research, drafting documents, court appearances, and other legal tasks. The declaration will specify the hourly rate charged, the total hours worked, and the resulting fee. 2. Flat Fee: In some cases, attorneys may offer a flat fee for specific legal services. This means that a predetermined amount is charged for a particular legal task or service, regardless of the time spent on it. This fee type is useful for straightforward legal matters like drafting a will or a contract. 3. Contingency Fees: Contingency fees are commonly applicable in personal injury or accident cases. In this arrangement, the attorney's fees are contingent on the successful outcome of the case. If the attorney wins the case or negotiates a settlement, they receive a percentage of the compensation awarded to the client. If the case is unsuccessful, the client may not owe any attorney fees, but other expenses, such as court filing fees, may still be applicable. 4. Retainer Fees: Attorneys may require a retainer fee upfront, which serves as a deposit for their services. This fee is often based on an estimated number of hours the attorney anticipates working on the case. The attorney then deducts the fee from the retainer as work is performed and bills are generated. Supplemental payments or reimbursement may be requested if the retainer is depleted. 5. Additional Expenses: The Huntsville Alabama Attorney Fee Declaration may also include additional expenses known as disbursements or costs. These can include court filing fees, travel expenses, copying charges, expert witness fees, and other related expenses incurred during the legal process. It is important for clients to review the Huntsville Alabama Attorney Fee Declaration carefully to understand the fees, charges, and any potential additional expenses associated with their legal representation. Clients should feel free to discuss any concerns or seek clarification from their attorney regarding the fee declaration before proceeding with their case.Huntsville Alabama Attorney Fee Declaration is a document that outlines the details and breakdown of legal fees charged by attorneys in Huntsville, Alabama. Attorneys are required to prepare and submit this declaration to their clients to provide transparency regarding their billing practices and ensure both parties are clear on the fees and expenses involved in legal representation. This written statement helps clients understand the fees associated with legal services they have received or will receive. The Huntsville Alabama Attorney Fee Declaration typically contains essential information, including the attorney's name, contact details, client's name, case or matter number, and a detailed breakdown of the fees and charges incurred during the legal process. Fees can be categorized into different types, such as: 1. Hourly Rate Fees: Attorneys may charge fees based on the amount of time spent working on the case. This includes the time spent in meetings, research, drafting documents, court appearances, and other legal tasks. The declaration will specify the hourly rate charged, the total hours worked, and the resulting fee. 2. Flat Fee: In some cases, attorneys may offer a flat fee for specific legal services. This means that a predetermined amount is charged for a particular legal task or service, regardless of the time spent on it. This fee type is useful for straightforward legal matters like drafting a will or a contract. 3. Contingency Fees: Contingency fees are commonly applicable in personal injury or accident cases. In this arrangement, the attorney's fees are contingent on the successful outcome of the case. If the attorney wins the case or negotiates a settlement, they receive a percentage of the compensation awarded to the client. If the case is unsuccessful, the client may not owe any attorney fees, but other expenses, such as court filing fees, may still be applicable. 4. Retainer Fees: Attorneys may require a retainer fee upfront, which serves as a deposit for their services. This fee is often based on an estimated number of hours the attorney anticipates working on the case. The attorney then deducts the fee from the retainer as work is performed and bills are generated. Supplemental payments or reimbursement may be requested if the retainer is depleted. 5. Additional Expenses: The Huntsville Alabama Attorney Fee Declaration may also include additional expenses known as disbursements or costs. These can include court filing fees, travel expenses, copying charges, expert witness fees, and other related expenses incurred during the legal process. It is important for clients to review the Huntsville Alabama Attorney Fee Declaration carefully to understand the fees, charges, and any potential additional expenses associated with their legal representation. Clients should feel free to discuss any concerns or seek clarification from their attorney regarding the fee declaration before proceeding with their case.