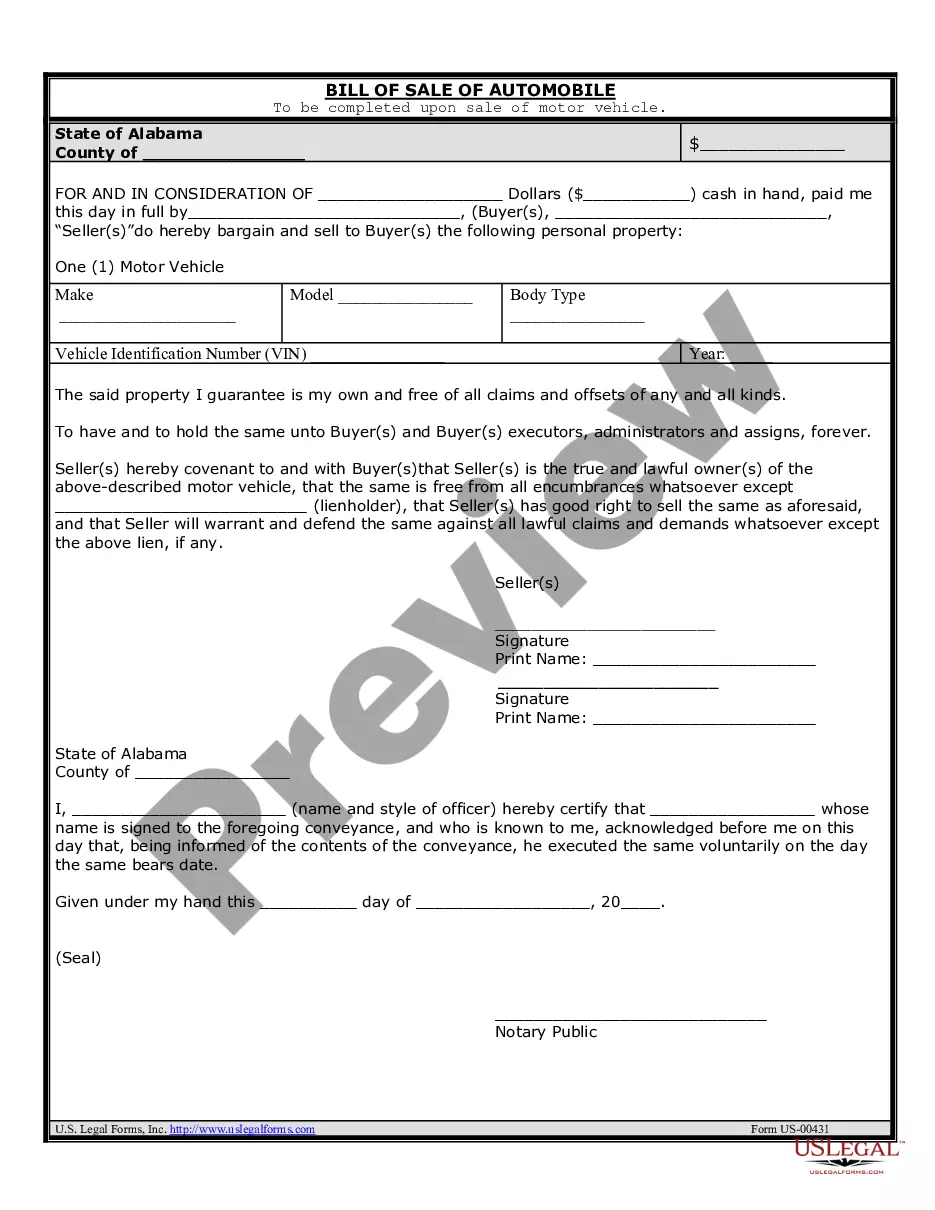

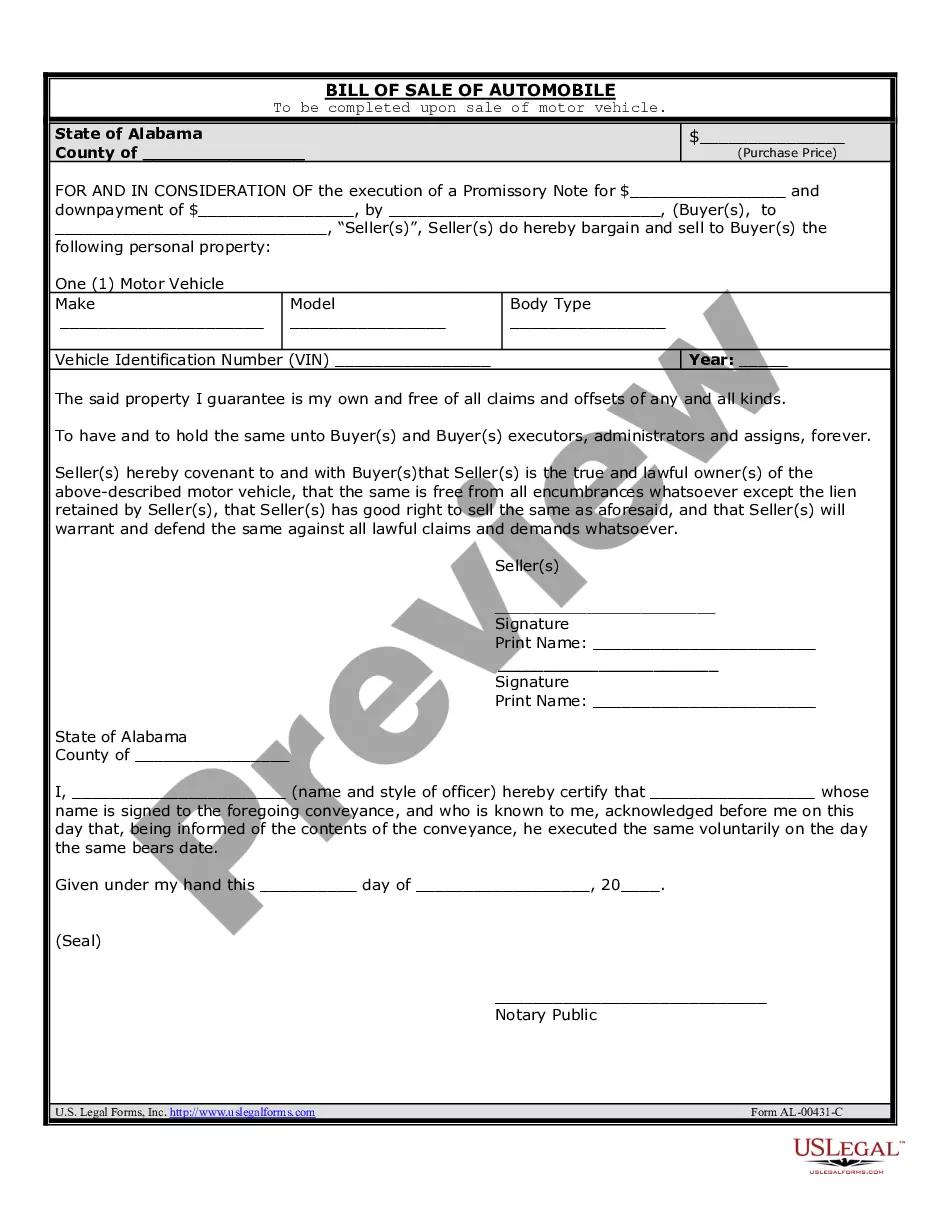

This is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

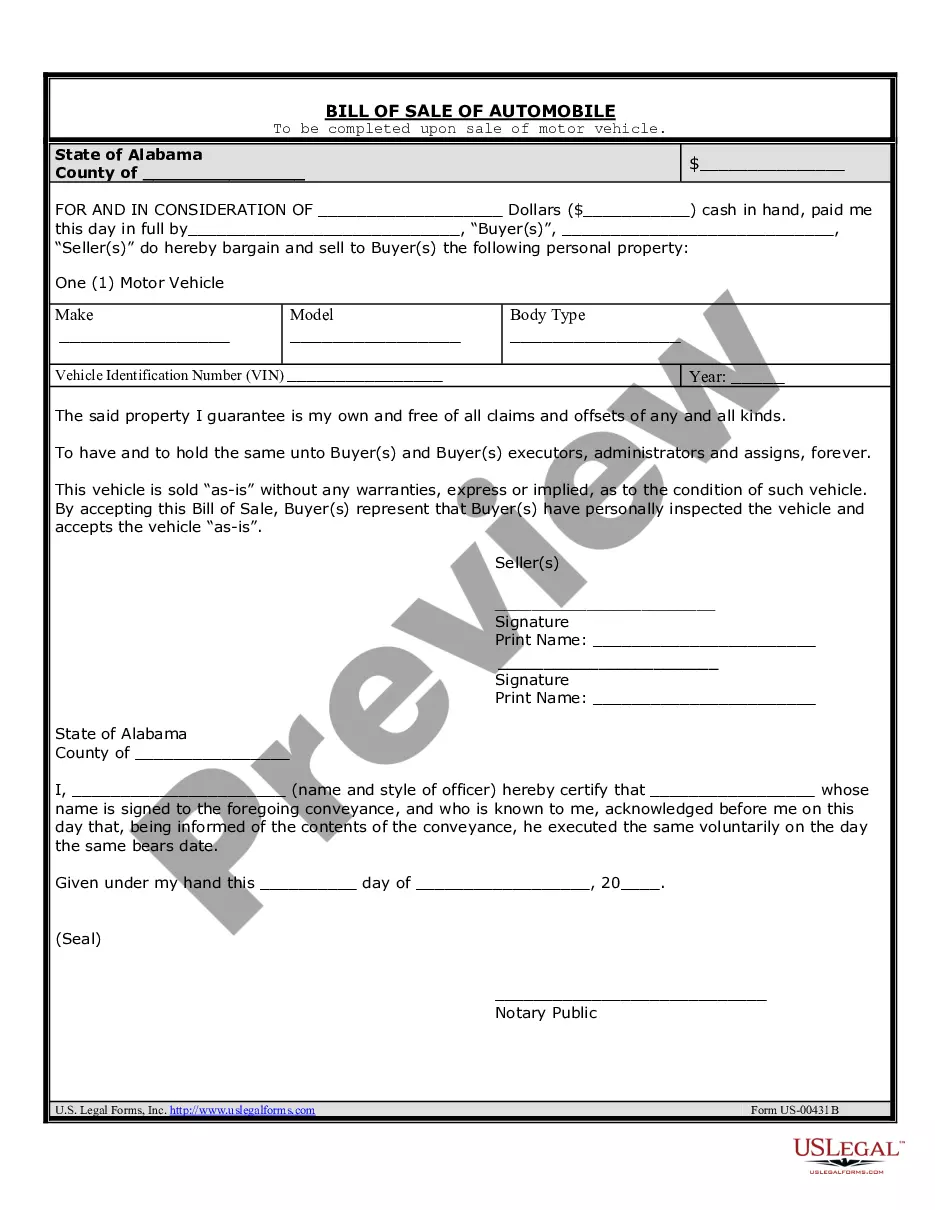

A Huntsville Alabama Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financial agreement between a buyer and a seller in the Huntsville, Alabama area. This promissory note serves as a written commitment that establishes the buyer's promise to repay the seller a specified amount of money for the purchase of a vehicle. It is an important document that ensures both parties are protected and that all agreed-upon terms are upheld. The Huntsville Alabama Promissory Note in Connection with Sale of Vehicle or Automobile includes various details related to the sale, such as the names, contact information, and signatures of both the buyer and the seller. It also includes information about the vehicle, such as its make, model, year, identification number (VIN), and any other relevant details. In addition to the vehicle information, the promissory note outlines the repayment details. It includes the total purchase price of the vehicle, the down payment amount (if any), the interest rate (if applicable), the duration of the loan, and the frequency and amount of installment payments. This information helps both parties understand their financial obligations and expectations. Different types of Huntsville Alabama Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. Simple Promissory Note: This is the most basic type of promissory note that outlines the repayment agreement without any complex terms or additional conditions. 2. Installment Promissory Note: This type of promissory note allows the buyer to repay the seller in installments over a specified period, often including interest. 3. Secured Promissory Note: In this type of note, the seller may request additional security, such as a lien or collateral, to protect themselves in case the buyer defaults on payments. 4. Balloon Promissory Note: A balloon note features smaller installment payments throughout the term, with a larger "balloon" payment due at the end of the loan period. Overall, a Huntsville Alabama Promissory Note in Connection with Sale of Vehicle or Automobile is a vital legal document that outlines the financial agreement between a buyer and a seller in the Huntsville, Alabama area when purchasing a vehicle. It acts as a safeguard for both parties, ensuring that the agreed-upon terms are met and providing clarity on repayment terms and conditions.