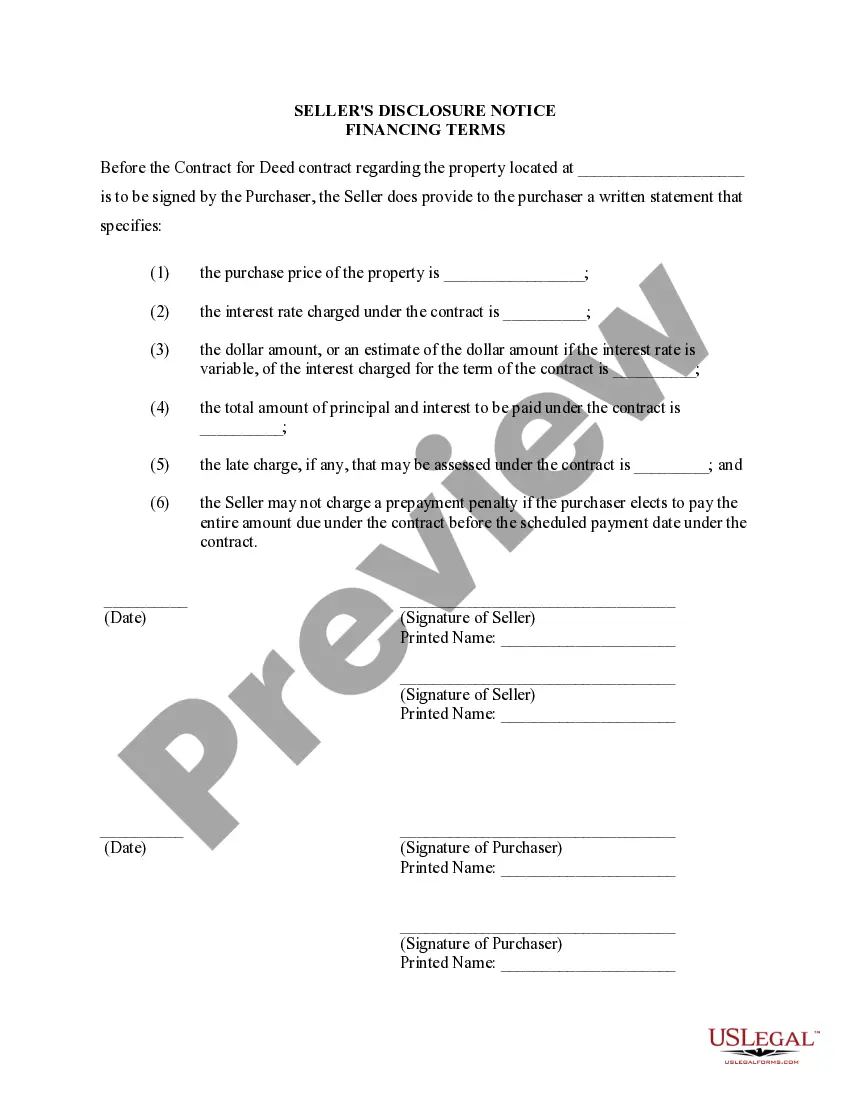

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Title: Birmingham Alabama Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract Introduction: In Birmingham, Alabama, when purchasing residential property through a Contract or Agreement for Deed, commonly known as a Land Contract, sellers are required to provide a detailed disclosure of the financing terms to the buyer. This disclosure is important as it outlines the specific terms related to the financing arrangement, ensuring transparency and understanding for both parties involved in the transaction. Let's explore the key information typically covered under Birmingham Alabama Seller's Disclosure of Financing Terms for Residential Property. 1. Type 1: Fixed-Term Financing: Under a fixed-term financing arrangement, the seller discloses the specific duration of the financing agreement. This includes the number of years or months during which the buyer would be making regular payments towards the property. The disclosure also highlights any applicable interest rates, penalties for late payments, and other relevant terms that both parties need to be aware of. 2. Type 2: Adjustable-Rate Financing: In some cases, the seller may offer adjustable-rate financing, wherein the interest rate is not fixed throughout the term of the agreement. This type of financing is commonly known as an ARM (Adjustable-Rate Mortgage). The disclosure document for this type of financing outlines the initial interest rate, potential changes in interest rates over time, and how adjustments will be calculated and communicated to the buyer. 3. Type 3: Balloon Payment Financing: A balloon payment financing arrangement allows for lower monthly payments initially, with a lump sum payment due at the end of the agreed-upon term. This type of financing is particularly relevant for buyers who expect a significant cash inflow at the end of the term. The Birmingham Alabama Seller's Disclosure of Financing Terms for Residential Property provides details about the size and timing of the balloon payment, along with other pertinent terms. 4. Type 4: Prepayment Privilege Financing: This financing type permits the buyer to pay off the remaining principal balance before the end of the term without incurring any penalties. Sellers offering prepayment privilege financing disclose the specific terms and conditions associated with this option, including whether any fees will be charged or if there are any restrictions on prepaying the loan amount. Conclusion: The Birmingham Alabama Seller's Disclosure of Financing Terms for Residential Property associated with a Contract or Agreement for Deed, also known as a Land Contract, aims to provide clear and comprehensive information regarding the financing arrangements between the seller and the buyer. By outlining financing types such as fixed-term, adjustable-rate, balloon payment, and prepayment privilege financing, this disclosure ensures that both parties are fully informed and can make well-informed decisions when engaging in property transactions.Title: Birmingham Alabama Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract Introduction: In Birmingham, Alabama, when purchasing residential property through a Contract or Agreement for Deed, commonly known as a Land Contract, sellers are required to provide a detailed disclosure of the financing terms to the buyer. This disclosure is important as it outlines the specific terms related to the financing arrangement, ensuring transparency and understanding for both parties involved in the transaction. Let's explore the key information typically covered under Birmingham Alabama Seller's Disclosure of Financing Terms for Residential Property. 1. Type 1: Fixed-Term Financing: Under a fixed-term financing arrangement, the seller discloses the specific duration of the financing agreement. This includes the number of years or months during which the buyer would be making regular payments towards the property. The disclosure also highlights any applicable interest rates, penalties for late payments, and other relevant terms that both parties need to be aware of. 2. Type 2: Adjustable-Rate Financing: In some cases, the seller may offer adjustable-rate financing, wherein the interest rate is not fixed throughout the term of the agreement. This type of financing is commonly known as an ARM (Adjustable-Rate Mortgage). The disclosure document for this type of financing outlines the initial interest rate, potential changes in interest rates over time, and how adjustments will be calculated and communicated to the buyer. 3. Type 3: Balloon Payment Financing: A balloon payment financing arrangement allows for lower monthly payments initially, with a lump sum payment due at the end of the agreed-upon term. This type of financing is particularly relevant for buyers who expect a significant cash inflow at the end of the term. The Birmingham Alabama Seller's Disclosure of Financing Terms for Residential Property provides details about the size and timing of the balloon payment, along with other pertinent terms. 4. Type 4: Prepayment Privilege Financing: This financing type permits the buyer to pay off the remaining principal balance before the end of the term without incurring any penalties. Sellers offering prepayment privilege financing disclose the specific terms and conditions associated with this option, including whether any fees will be charged or if there are any restrictions on prepaying the loan amount. Conclusion: The Birmingham Alabama Seller's Disclosure of Financing Terms for Residential Property associated with a Contract or Agreement for Deed, also known as a Land Contract, aims to provide clear and comprehensive information regarding the financing arrangements between the seller and the buyer. By outlining financing types such as fixed-term, adjustable-rate, balloon payment, and prepayment privilege financing, this disclosure ensures that both parties are fully informed and can make well-informed decisions when engaging in property transactions.