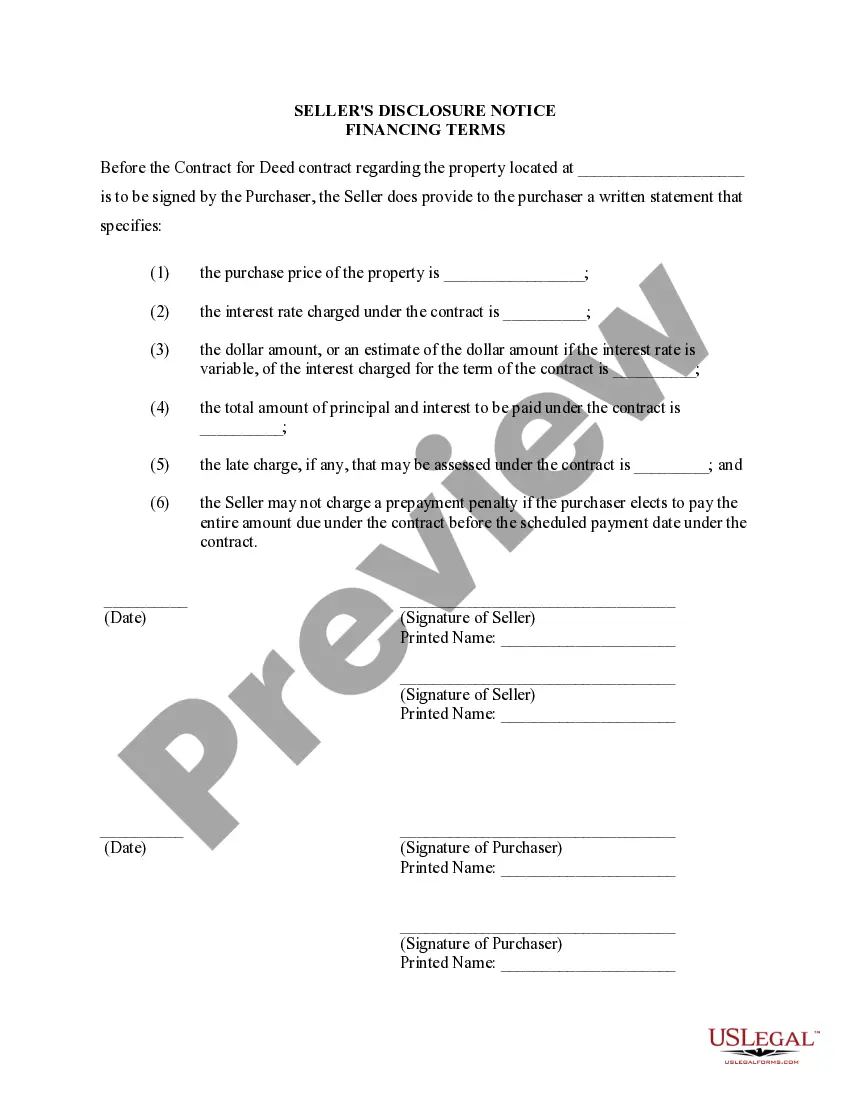

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Huntsville Alabama Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an essential document that outlines the specific financing terms and conditions associated with the purchase of residential property through a land contract or agreement for deed in Huntsville, Alabama. The Huntsville Alabama Seller's Disclosure of Financing Terms provides transparency and protection to both sellers and buyers who choose this alternative financing method. It ensures that all parties involved in the transaction understand the terms and conditions of the agreement and sets clear expectations for the purchase. The disclosure document includes various crucial elements that detail the financing terms and conditions imposed by the seller. Some relevant keywords associated with this topic include: 1. Down Payment: This section outlines the amount of money the buyer is required to pay upfront as a down payment towards the total purchase price of the property. It may also specify the acceptable forms of payment and any deadlines for submitting the down payment. 2. Purchase Price: The disclosure document will include the agreed-upon purchase price for the residential property. This section may also mention any provisions for price adjustments or changes, such as periodic increases or decreases. 3. Interest Rate: The document will clearly state the interest rate that will be applied to the remaining balance of the purchase price over the agreed-upon financing term. It may also specify whether the interest rate is fixed or adjustable and if there are any penalties for early repayment. 4. Financing Term: This section outlines the duration of the financing period, typically stated in months or years. It includes the start and end dates of the financing term, which impacts the total number of installments to be made towards the purchase price. 5. Installment Payments: The disclosure document will provide details on the frequency and amount of the installment payments the buyer is required to make to the seller. It may specify the due date, preferred payment method, and any penalties for late payments or bounced checks. 6. Rights and Responsibilities: This section clarifies the rights and responsibilities of both the seller and buyer throughout the term of the agreement. It may cover topics such as property maintenance, insurance requirements, and potential consequences for breach of contract. Different types of Huntsville Alabama Seller's Disclosure of Financing Terms for Residential Property may not exist, but the content and specific details included within the document may vary depending on the specific agreement between the parties involved. It is important to consult with legal professionals or real estate experts to ensure compliance with local laws and regulations governing land contracts and agreement for deed in Huntsville, Alabama.Huntsville Alabama Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an essential document that outlines the specific financing terms and conditions associated with the purchase of residential property through a land contract or agreement for deed in Huntsville, Alabama. The Huntsville Alabama Seller's Disclosure of Financing Terms provides transparency and protection to both sellers and buyers who choose this alternative financing method. It ensures that all parties involved in the transaction understand the terms and conditions of the agreement and sets clear expectations for the purchase. The disclosure document includes various crucial elements that detail the financing terms and conditions imposed by the seller. Some relevant keywords associated with this topic include: 1. Down Payment: This section outlines the amount of money the buyer is required to pay upfront as a down payment towards the total purchase price of the property. It may also specify the acceptable forms of payment and any deadlines for submitting the down payment. 2. Purchase Price: The disclosure document will include the agreed-upon purchase price for the residential property. This section may also mention any provisions for price adjustments or changes, such as periodic increases or decreases. 3. Interest Rate: The document will clearly state the interest rate that will be applied to the remaining balance of the purchase price over the agreed-upon financing term. It may also specify whether the interest rate is fixed or adjustable and if there are any penalties for early repayment. 4. Financing Term: This section outlines the duration of the financing period, typically stated in months or years. It includes the start and end dates of the financing term, which impacts the total number of installments to be made towards the purchase price. 5. Installment Payments: The disclosure document will provide details on the frequency and amount of the installment payments the buyer is required to make to the seller. It may specify the due date, preferred payment method, and any penalties for late payments or bounced checks. 6. Rights and Responsibilities: This section clarifies the rights and responsibilities of both the seller and buyer throughout the term of the agreement. It may cover topics such as property maintenance, insurance requirements, and potential consequences for breach of contract. Different types of Huntsville Alabama Seller's Disclosure of Financing Terms for Residential Property may not exist, but the content and specific details included within the document may vary depending on the specific agreement between the parties involved. It is important to consult with legal professionals or real estate experts to ensure compliance with local laws and regulations governing land contracts and agreement for deed in Huntsville, Alabama.