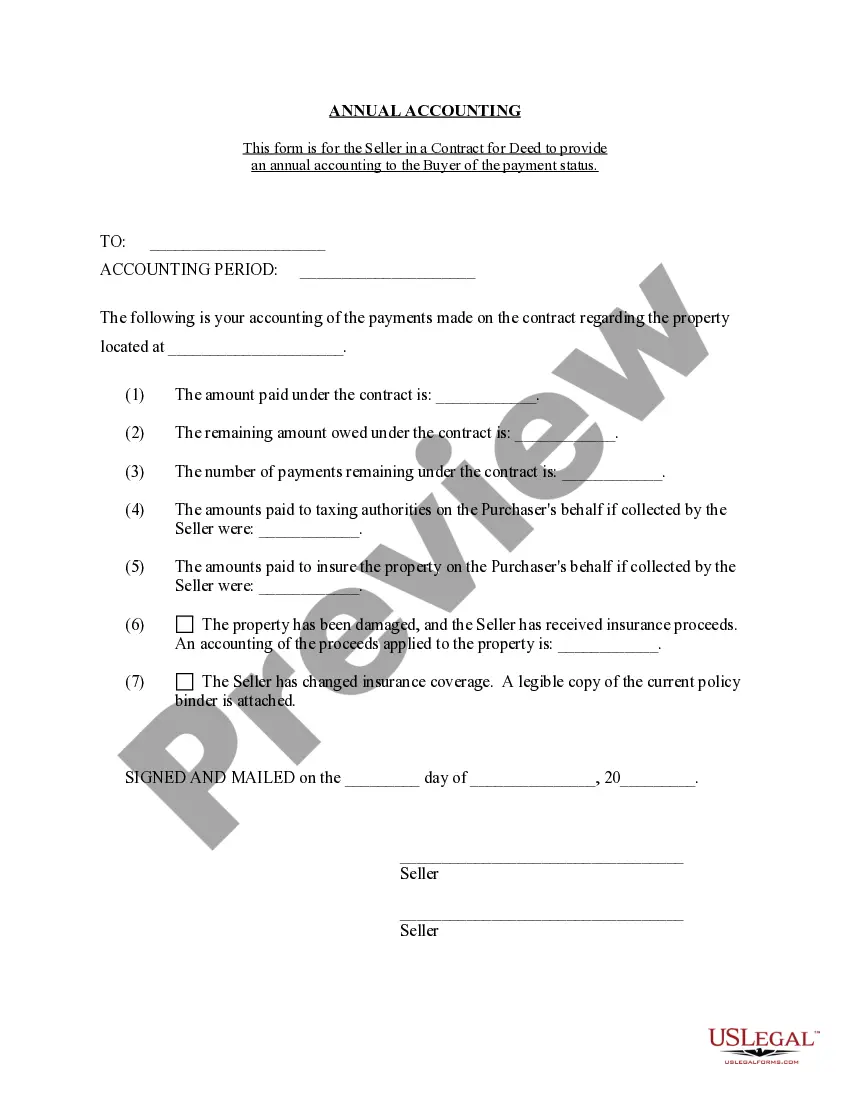

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

- US Legal Forms

- Localized Forms

- Alabama

- Birmingham

-

Alabama Contract for Deed Seller's Annual Accounting Statement

Birmingham Alabama Contract for Deed Seller's Annual Accounting Statement

Description

Related Forms

Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract

Buyer's Request for Accounting from Seller under Contract for Deed

Assignment of Contract for Deed by Seller

Notice of Assignment of Contract for Deed

Residential Real Estate Sales Disclosure Statement

Lead Based Paint Disclosure for Sales Transaction

View San Jose

View San Jose

View San Jose

View San Jose

View San Jose

Related legal definitions

How to fill out Birmingham Alabama Contract For Deed Seller's Annual Accounting Statement?

If you’ve already utilized our service before, log in to your account and save the Birmingham Alabama Contract for Deed Seller's Annual Accounting Statement on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Birmingham Alabama Contract for Deed Seller's Annual Accounting Statement. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!

Form Rating

Form popularity

FAQ

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

In Alabama, a seller can get out of a real estate contract if the buyer's contingencies are not met?these include financial, appraisal, inspection, insurance or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

Yes, as long as you follow Alabama state rules and regulations governing real estate transactions.

An Alabama land contract allows a buyer to purchase unimproved vacant land from a seller. The land, whether residential or commercial, requires only environmental and boundary due diligence as the property is being purchased without a structure.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

To have an enforceable contract, both sides must harbor an intent to perform under the contract when they sign it. Entering into a contract with no intent to perform is deemed fraud and deceit in Alabama.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

In Alabama, a seller can get out of a real estate contract if the buyer's contingencies are not met?these include financial, appraisal, inspection, insurance or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

Yes, as long as you follow Alabama state rules and regulations governing real estate transactions.

An Alabama land contract allows a buyer to purchase unimproved vacant land from a seller. The land, whether residential or commercial, requires only environmental and boundary due diligence as the property is being purchased without a structure.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

To have an enforceable contract, both sides must harbor an intent to perform under the contract when they sign it. Entering into a contract with no intent to perform is deemed fraud and deceit in Alabama.

Birmingham Alabama Contract for Deed Seller's Annual Accounting Statement Related Searches

-

contract for deed who pays property tax

-

typical contract for deed terms

-

contract for deed between family members

-

contract for deed income tax implications

-

land contract alabama

-

what happens if a seller fails to record the contract for deed

-

free contract for deed pdf

-

minnesota contract for deed statute

-

birmingham occupational tax reconciliation

-

haleyville, alabama occupational tax

Interesting Questions

A Contract for Deed Seller's Annual Accounting Statement is a yearly financial report provided by the seller of a property purchased through a contract for deed.

The Contract for Deed Seller's Annual Accounting Statement helps you understand the financial status of the property you purchased, including any payments made, interest charged, and outstanding balances.

The Contract for Deed Seller's Annual Accounting Statement is typically provided once a year, usually around the anniversary of your contract's start date.

The Contract for Deed Seller's Annual Accounting Statement includes details about your payment history, principal balance, interest charged, any late fees assessed, and the remaining balance on the contract.

You can request a copy of the Contract for Deed Seller's Annual Accounting Statement by contacting the seller or their representative directly. It's advisable to provide your contract details for easy retrieval.

If you spot any discrepancies or errors in the Contract for Deed Seller's Annual Accounting Statement, it's important to notify the seller or their representative immediately. They can investigate and resolve the issue accordingly.

More info

Contract with the Governor's Office of Management and Budget. Sec. 3026. Contract with the Department of Public Safety and Military Affairs. Sec. 3027. Contract with the Department of Health Security. Sec. 3028. Contract or agreement between the United States Department of Commerce--United State Department of Transportation and the Alabama Department of Transportation. Sec. 3029. Amendment to Section 13 of Transportation Alternatives Program of Federal Aid. Sec. 3030. Extension of authority of Federal National Highway Administration. Sec. 3031. Transfer of functions to the Secretary of Transportation and transfer of authority of the Secretary of Commerce to lease certain lands. Sec. 3032. Amendment to Title 49, Transportation. Sec. 3033. Agreement with State of Indiana to provide services for National Highway System. Sec. 3034. Establishment of regional transit planning councils. Sec. 3035. Federal transit administrative agency funding. Sec. 3036. Federal Transit Administrator.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming