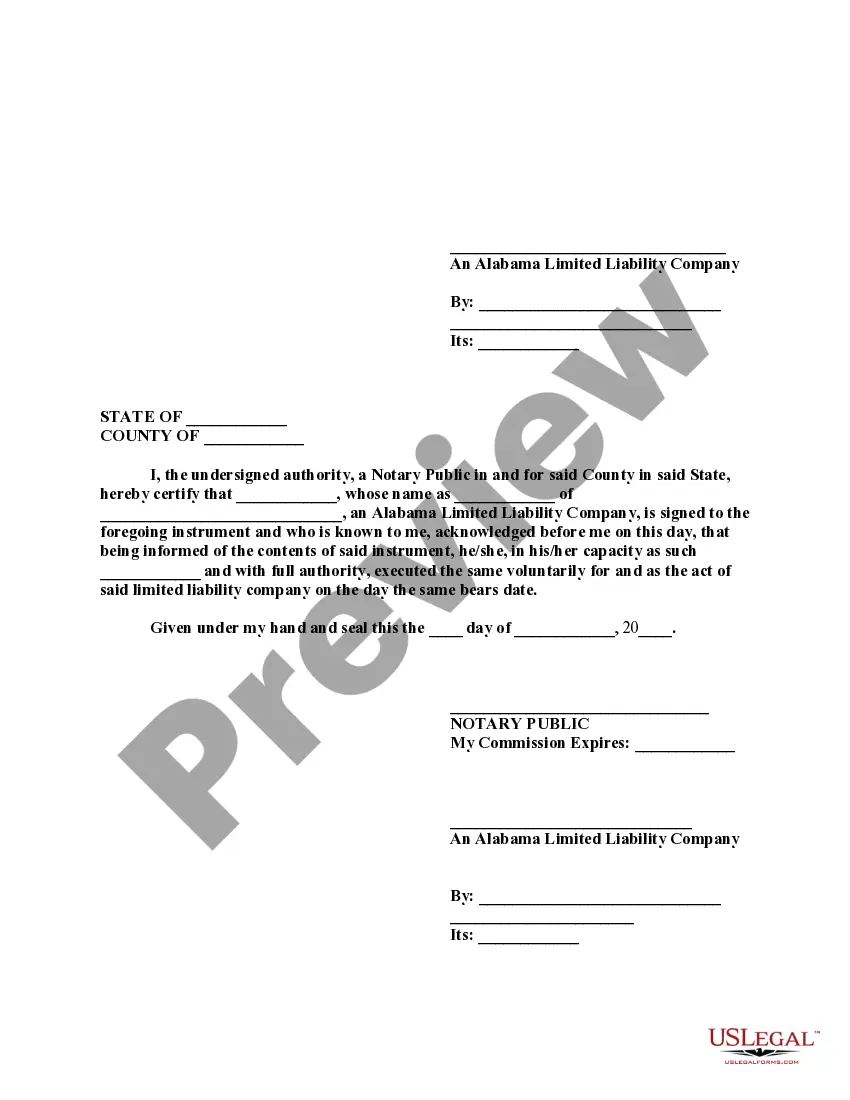

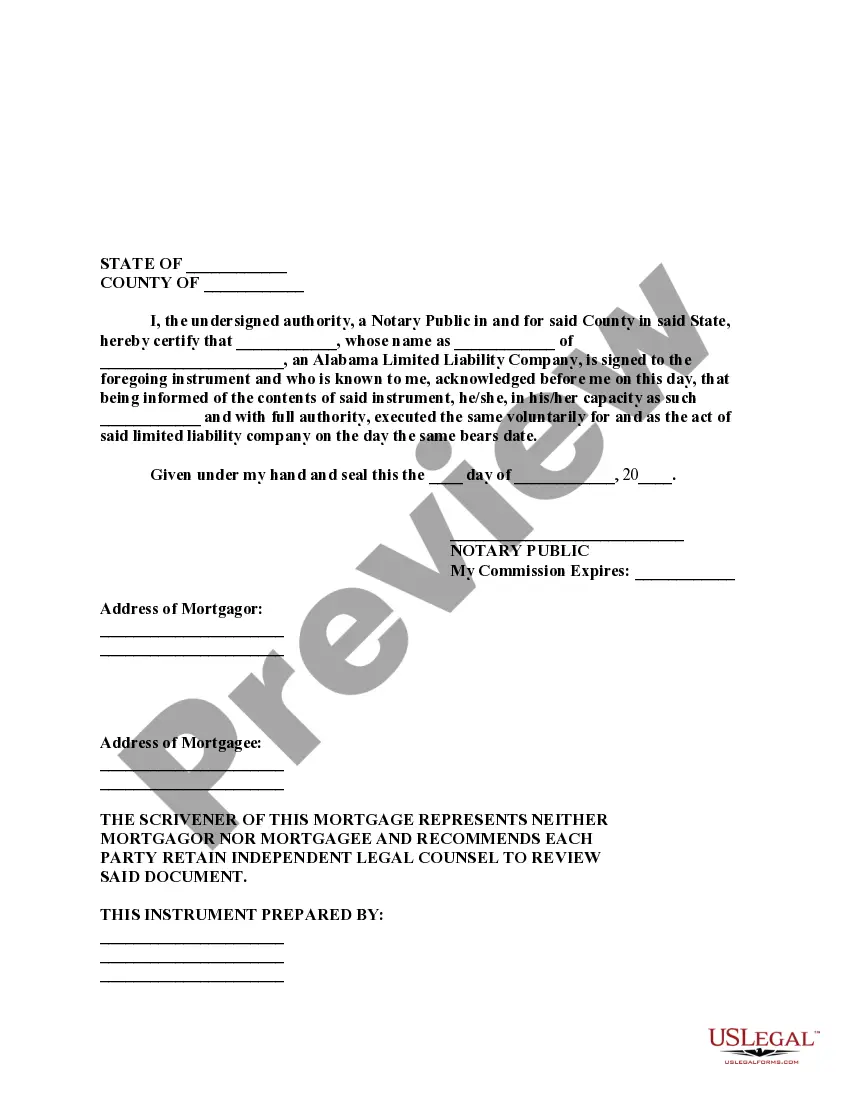

Birmingham Alabama Additional Collateral and Accommodation Mortgage, also known as a collateral mortgage, is a financial instrument commonly used in real estate transactions. It is a type of mortgage that allows borrowers to provide additional collateral or accommodations to secure their mortgage loan. In the context of Birmingham, Alabama, this type of mortgage offers flexibility and options for borrowers looking to purchase or refinance property in the region. By utilizing additional collateral or accommodations, borrowers can potentially access more favorable loan terms or secure a larger loan amount. Key features of Birmingham Alabama Additional Collateral and Accommodation Mortgage include: 1. Flexibility: This type of mortgage allows borrowers to secure their loan using additional collateral, which can be in the form of other properties, investments, or assets. This flexibility allows borrowers to leverage their existing assets to secure a mortgage and potentially enhance their borrowing capacity. 2. Increased Loan Amount: By providing additional collateral or accommodations, borrowers may be able to access higher loan amounts, enabling them to purchase valuable properties in Birmingham, Alabama. 3. Lower Interest Rates: Offering additional collateral or accommodations can provide borrowers a competitive advantage, as lenders may be more willing to offer lower interest rates and more favorable loan terms in exchange for higher security. 4. Improved Lending Terms: Borrowers utilizing additional collateral or accommodations may benefit from more flexible repayment options, longer loan terms, or reduced down payment requirements, leading to increased financial convenience. Different types of Birmingham Alabama Additional Collateral and Accommodation Mortgage may include: 1. Cross-Collateralization Mortgage: This type of mortgage involves securing the loan using multiple properties or assets that the borrower owns. The value of all collateral is combined to determine the loan amount and risk assessment. 2. Accommodation Mortgage: In some cases, borrowers may seek a co-signer or guarantor to secure the mortgage loan. This individual, usually a family member or trusted friend, agrees to take responsibility for the loan repayments in case the primary borrower defaults. 3. Investment Collateral Mortgage: This variant involves leveraging investment assets, such as stocks, bonds, or other securities, as additional collateral for the mortgage. The value of the investments is appraised and considered while determining loan terms. Birmingham Alabama Additional Collateral and Accommodation Mortgages provide a range of advantages for prospective homeowners or property investors in the region. By considering this type of mortgage, borrowers gain flexibility, potential cost savings, and increased loan opportunities to make their real estate goals a reality.

Birmingham Alabama Additional Collateral and Accommodation Mortgage

Description

How to fill out Birmingham Alabama Additional Collateral And Accommodation Mortgage?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we apply for attorney services that, as a rule, are very costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Birmingham Alabama Additional Collateral and Accommodation Mortgage or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Birmingham Alabama Additional Collateral and Accommodation Mortgage complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Birmingham Alabama Additional Collateral and Accommodation Mortgage is proper for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!