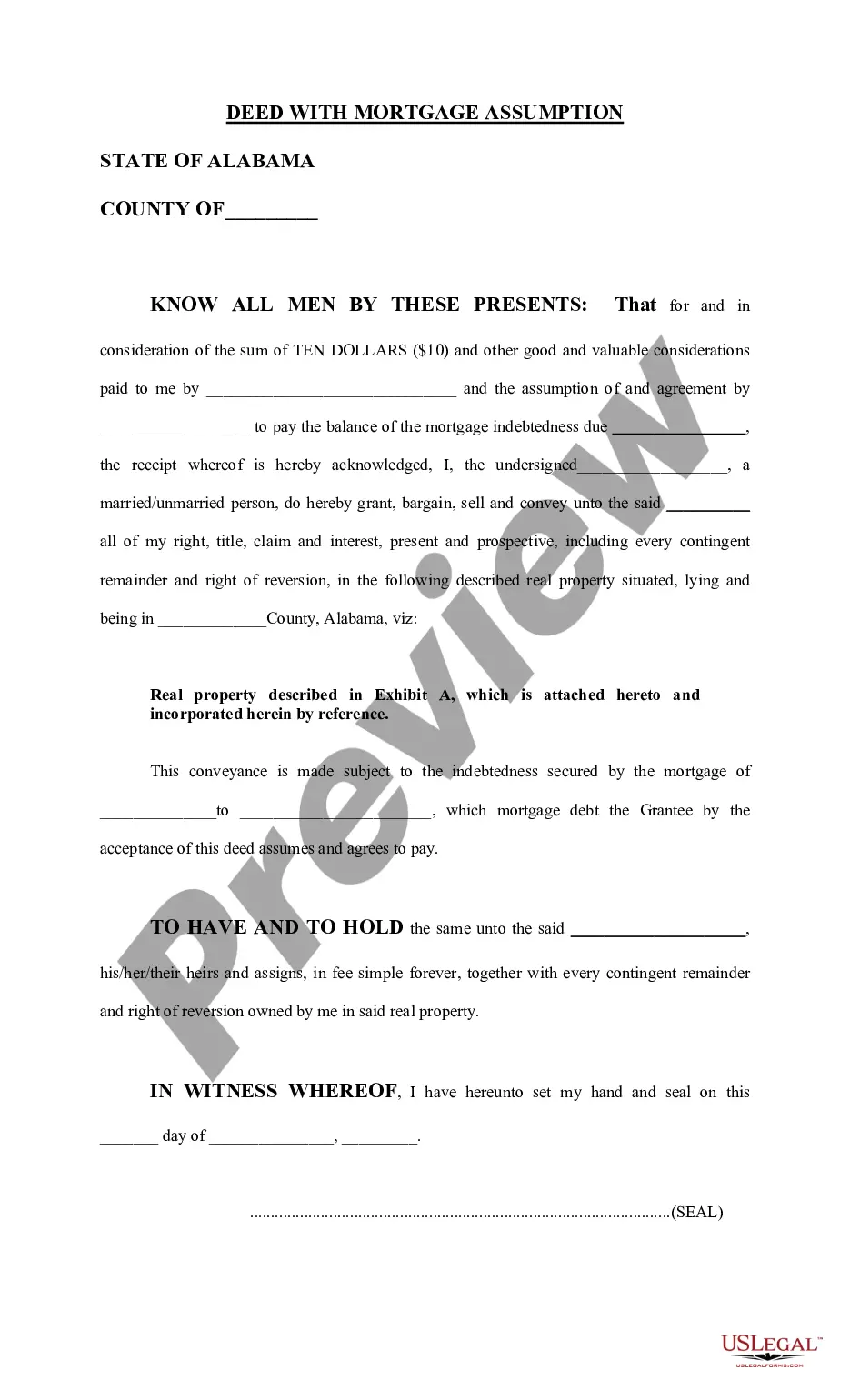

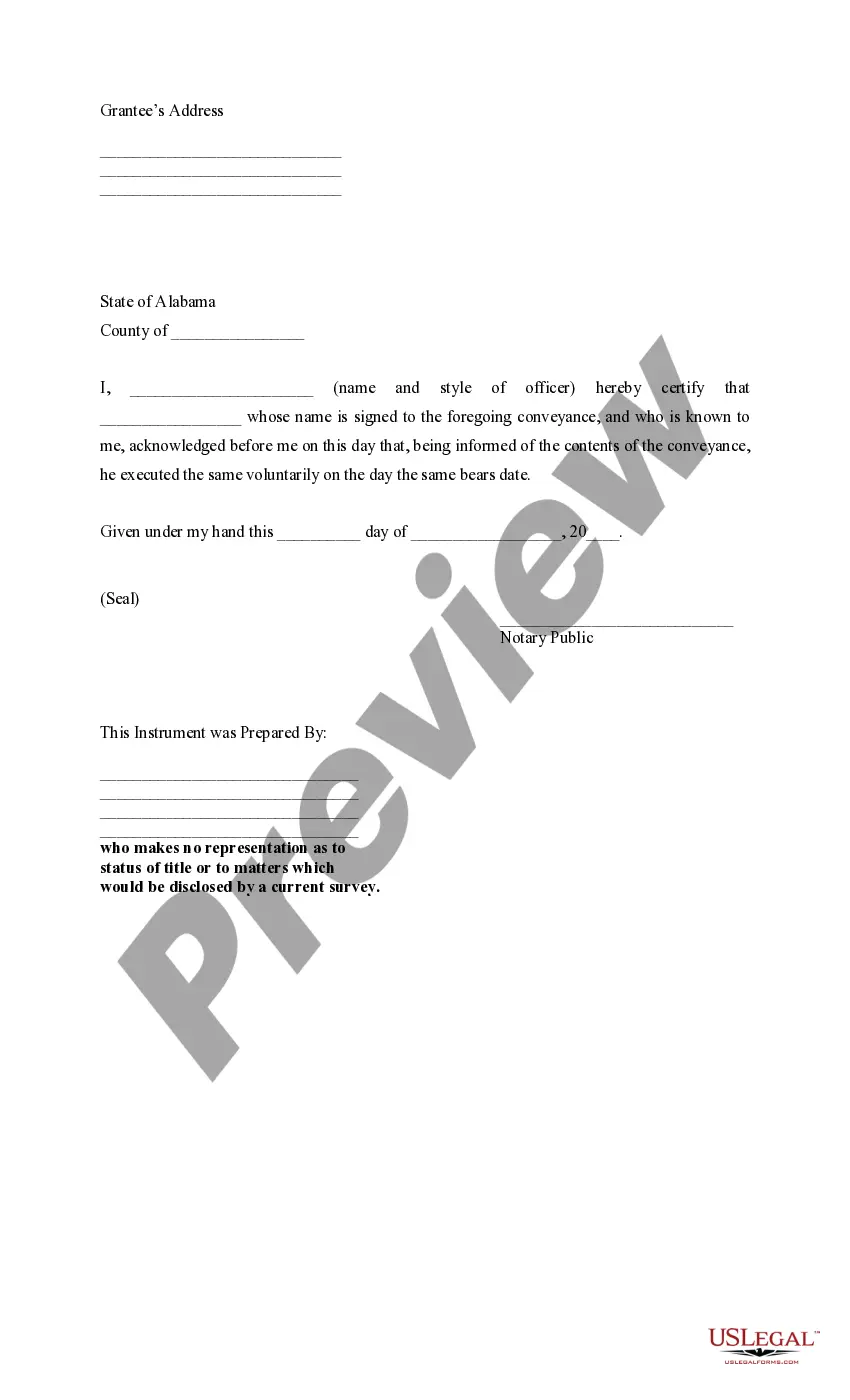

This deed conveys property to the grantee and the grantee agrees to pay the balance of the mortgage indebtedness due. The form is available in both word and word perfect formats.

Birmingham Alabama Deed with Mortgage Assumption

Description

How to fill out Alabama Deed With Mortgage Assumption?

If you have previously utilized our service, Log In to your account and store the Birmingham Alabama Deed with Mortgage Assumption on your device by selecting the Download button. Ensure that your subscription is active. If it is not, renew it as per your payment schedule.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your file.

You have lifelong access to all documents you have purchased: you can find it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Ensure you’ve identified the correct document. Review the description and use the Preview option, if available, to determine if it aligns with your needs. If it does not fulfill your criteria, employ the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and make a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Acquire your Birmingham Alabama Deed with Mortgage Assumption. Choose the file format for your document and save it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

For a transaction to qualify as a mortgage assumption, several key factors must be satisfied. First, the lender must approve the assumption process, as they must ensure the new buyer meets creditworthiness requirements. Additionally, the original mortgage documents must permit assumption, allowing this process without penalty. Understanding these conditions can help you navigate the process smoothly when dealing with a Birmingham, Alabama deed with mortgage assumption.

The conditions of the Birmingham Alabama Deed with Mortgage Assumption typically involve the obligations of both the buyer and seller. Generally, the buyer agrees to continue making payments on the existing mortgage. Additionally, the seller may need to meet specific requirements to ensure a smooth transfer of responsibility. Understanding these conditions is crucial for anyone considering an assumption.

If you need a quick deed in Alabama, you can request it through the county's website or clerk's office. Many counties offer expedited services for quick access to documents like the Birmingham Alabama Deed with Mortgage Assumption. Utilizing resources like uslegalforms can also help streamline your process and save you time.

Getting a copy of your house deed in Alabama is a straightforward process. You can visit the county clerk's office where your property is located and request a copy. For convenience, uslegalforms offers online services that assist in retrieving your Birmingham Alabama Deed with Mortgage Assumption.

To obtain a copy of your deed while holding a mortgage, you can contact your lender or visit the local county records office. They typically have copies of the Birmingham Alabama Deed with Mortgage Assumption on file. Additionally, online platforms like uslegalforms provide resources that make it easier for you to request these documents.

Yes, in Alabama, deeds are public records. This means anyone can access them, including the Birmingham Alabama Deed with Mortgage Assumption. You can find these records at the local county courthouse or online through various databases, ensuring transparency for homeowners and prospective buyers.

To obtain the deed to your house in Alabama, you can request a copy from the county probate office or the local recorder's office. You'll need to provide some basic information, such as the property's address and your identification. If you're dealing with a Birmingham Alabama Deed with Mortgage Assumption, having the deed is essential to confirm ownership and understand the mortgage terms. Many online services can assist in retrieving this essential document faster.

Transferring a deed after someone's death in Alabama involves filing a new deed, usually via a probate process. The heirs need to gather necessary documents, including the death certificate and any wills, to initiate this process. Utilizing services that specialize in Birmingham Alabama Deed with Mortgage Assumption can streamline this transfer. Legal assistance often simplifies the required procedures and ensures all paperwork is filed correctly.

In Alabama, a tax deed does not automatically extinguish a mortgage. When a property is sold through a tax deed, any existing mortgage retains its priority unless specifically addressed. For those dealing with a Birmingham Alabama Deed with Mortgage Assumption, understanding your obligations under a tax deed can be crucial. Consulting a legal expert can provide clarity on how tax deeds affect mortgages.

In Alabama, while it is not mandatory to have an attorney prepare a deed, it is highly recommended. An attorney's expertise can guide you through the nuances of a Birmingham Alabama Deed with Mortgage Assumption. They ensure that the deed complies with state laws and helps avoid potential issues in the future. Using legal services can offer peace of mind during this important transaction.