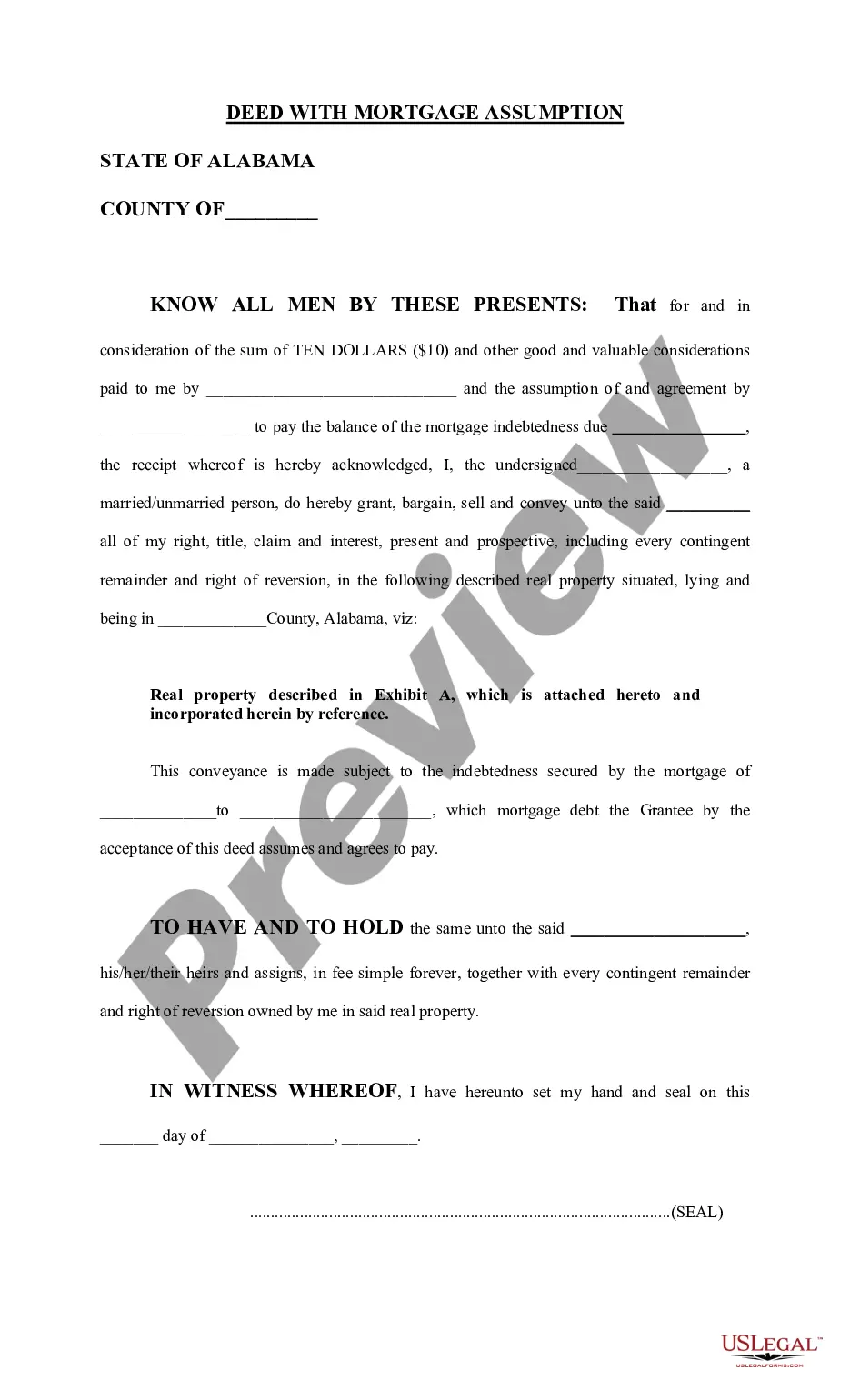

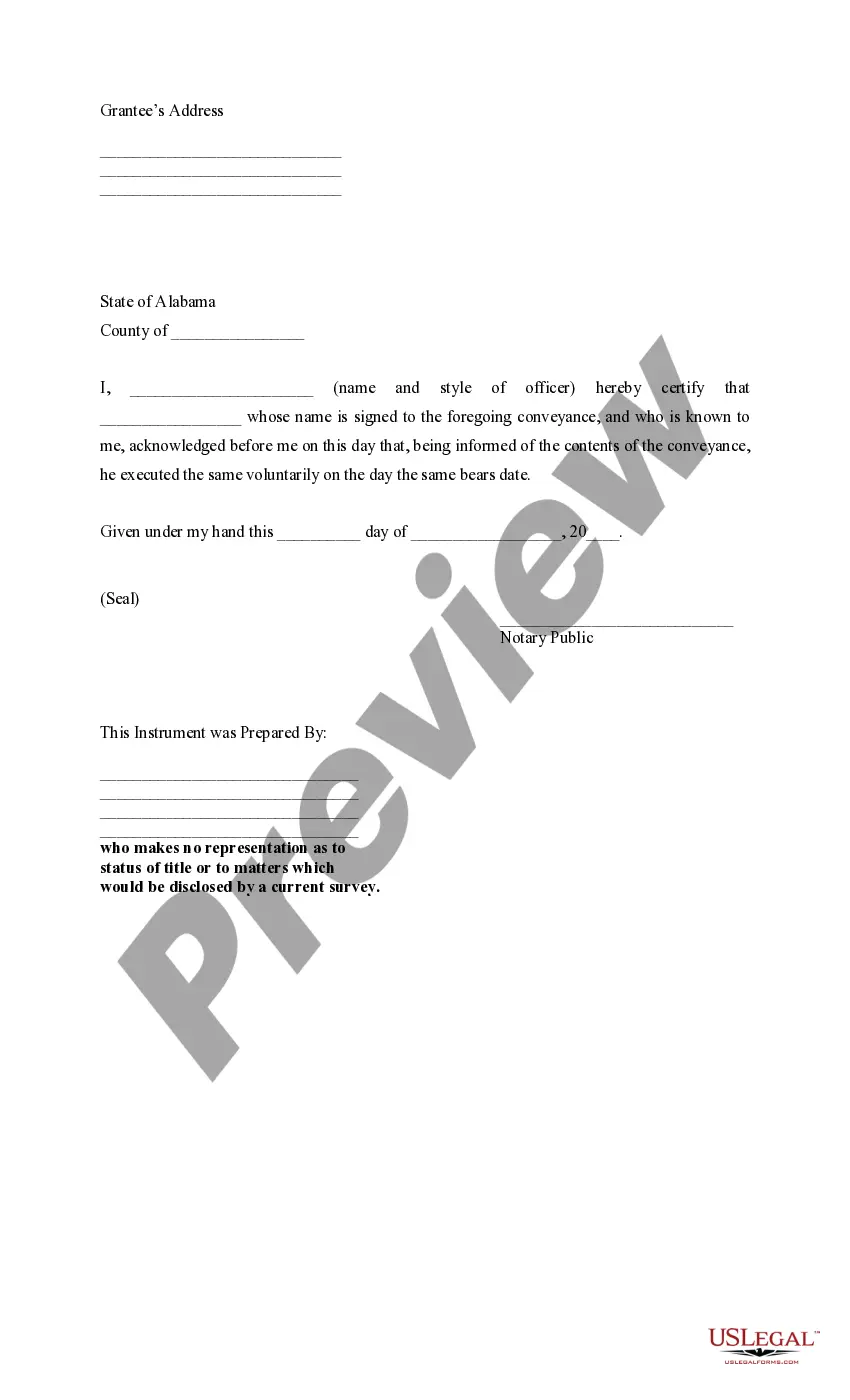

This deed conveys property to the grantee and the grantee agrees to pay the balance of the mortgage indebtedness due. The form is available in both word and word perfect formats.

Huntsville Alabama Deed with Mortgage Assumption is a legal document that transfers property ownership while allowing the assumption of an existing mortgage by the new buyer. This practice is particularly common in real estate transactions involving the transfer of properties in Huntsville, Alabama. With this type of transaction, the buyer takes over the responsibility of paying the existing mortgage on the property, in addition to accepting ownership. There are two main types of Huntsville Alabama Deed with Mortgage Assumption: 1. General Huntsville Alabama Deed with Mortgage Assumption: This form of agreement allows the buyer to assume the entire mortgage loan amount and all associated terms and conditions. The buyer becomes responsible for making mortgage payments and complying with the existing mortgage agreement. 2. Partial Huntsville Alabama Deed with Mortgage Assumption: In this case, the buyer assumes only a portion of the existing mortgage debt. This can be structured in various ways, such as a specific percentage or a fixed amount. The remaining mortgage balance remains the responsibility of the seller, who continues to make mortgage payments to the lender. When engaging in a Huntsville Alabama Deed with Mortgage Assumption, it is crucial to consult legal professionals and conduct thorough due diligence. Key considerations for both buyers and sellers include understanding the terms and conditions of the original mortgage, assessing the financial stability of the buyer assuming the mortgage, and ensuring proper legal documentation and filing of the transaction. Buyers opting for this type of agreement may benefit from certain advantages. These include potentially obtaining a property with a lower interest rate compared to current market rates, avoiding certain closing costs associated with obtaining a new mortgage, and reducing the time-consuming process of securing a new mortgage loan. However, it is essential to be aware of the potential risks and drawbacks associated with Huntsville Alabama Deed with Mortgage Assumption. Buyers need to evaluate the financial stability and creditworthiness of the seller to ensure they can meet their mortgage obligations. Furthermore, buyers should carefully review the original mortgage terms, including interest rates, prepayment penalties, and any potential legal restrictions on assumption. In conclusion, the Huntsville Alabama Deed with Mortgage Assumption is a legal agreement commonly used in real estate transactions, facilitating the transfer of property ownership while continuing the existing mortgage obligation. Both general and partial forms exist, with different advantages and considerations. Seeking professional legal advice and conducting thorough due diligence is crucial to ensure a smooth and successful transaction.Huntsville Alabama Deed with Mortgage Assumption is a legal document that transfers property ownership while allowing the assumption of an existing mortgage by the new buyer. This practice is particularly common in real estate transactions involving the transfer of properties in Huntsville, Alabama. With this type of transaction, the buyer takes over the responsibility of paying the existing mortgage on the property, in addition to accepting ownership. There are two main types of Huntsville Alabama Deed with Mortgage Assumption: 1. General Huntsville Alabama Deed with Mortgage Assumption: This form of agreement allows the buyer to assume the entire mortgage loan amount and all associated terms and conditions. The buyer becomes responsible for making mortgage payments and complying with the existing mortgage agreement. 2. Partial Huntsville Alabama Deed with Mortgage Assumption: In this case, the buyer assumes only a portion of the existing mortgage debt. This can be structured in various ways, such as a specific percentage or a fixed amount. The remaining mortgage balance remains the responsibility of the seller, who continues to make mortgage payments to the lender. When engaging in a Huntsville Alabama Deed with Mortgage Assumption, it is crucial to consult legal professionals and conduct thorough due diligence. Key considerations for both buyers and sellers include understanding the terms and conditions of the original mortgage, assessing the financial stability of the buyer assuming the mortgage, and ensuring proper legal documentation and filing of the transaction. Buyers opting for this type of agreement may benefit from certain advantages. These include potentially obtaining a property with a lower interest rate compared to current market rates, avoiding certain closing costs associated with obtaining a new mortgage, and reducing the time-consuming process of securing a new mortgage loan. However, it is essential to be aware of the potential risks and drawbacks associated with Huntsville Alabama Deed with Mortgage Assumption. Buyers need to evaluate the financial stability and creditworthiness of the seller to ensure they can meet their mortgage obligations. Furthermore, buyers should carefully review the original mortgage terms, including interest rates, prepayment penalties, and any potential legal restrictions on assumption. In conclusion, the Huntsville Alabama Deed with Mortgage Assumption is a legal agreement commonly used in real estate transactions, facilitating the transfer of property ownership while continuing the existing mortgage obligation. Both general and partial forms exist, with different advantages and considerations. Seeking professional legal advice and conducting thorough due diligence is crucial to ensure a smooth and successful transaction.