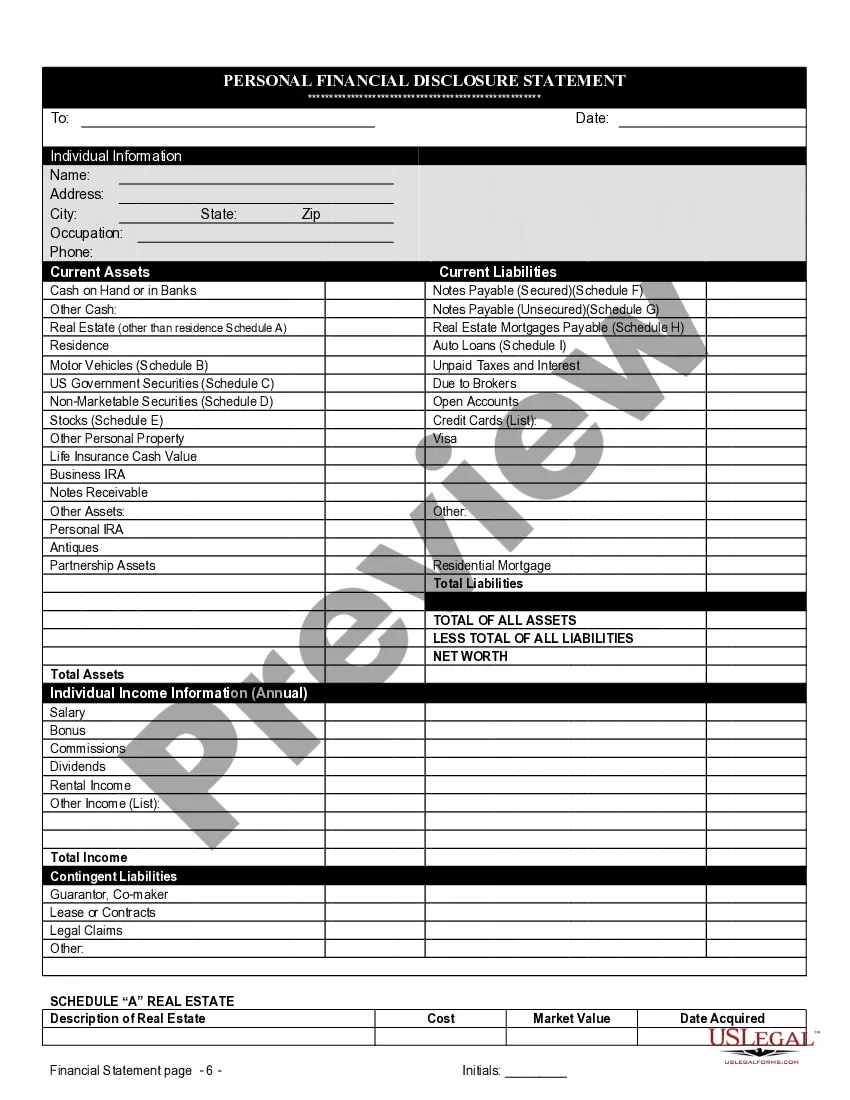

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

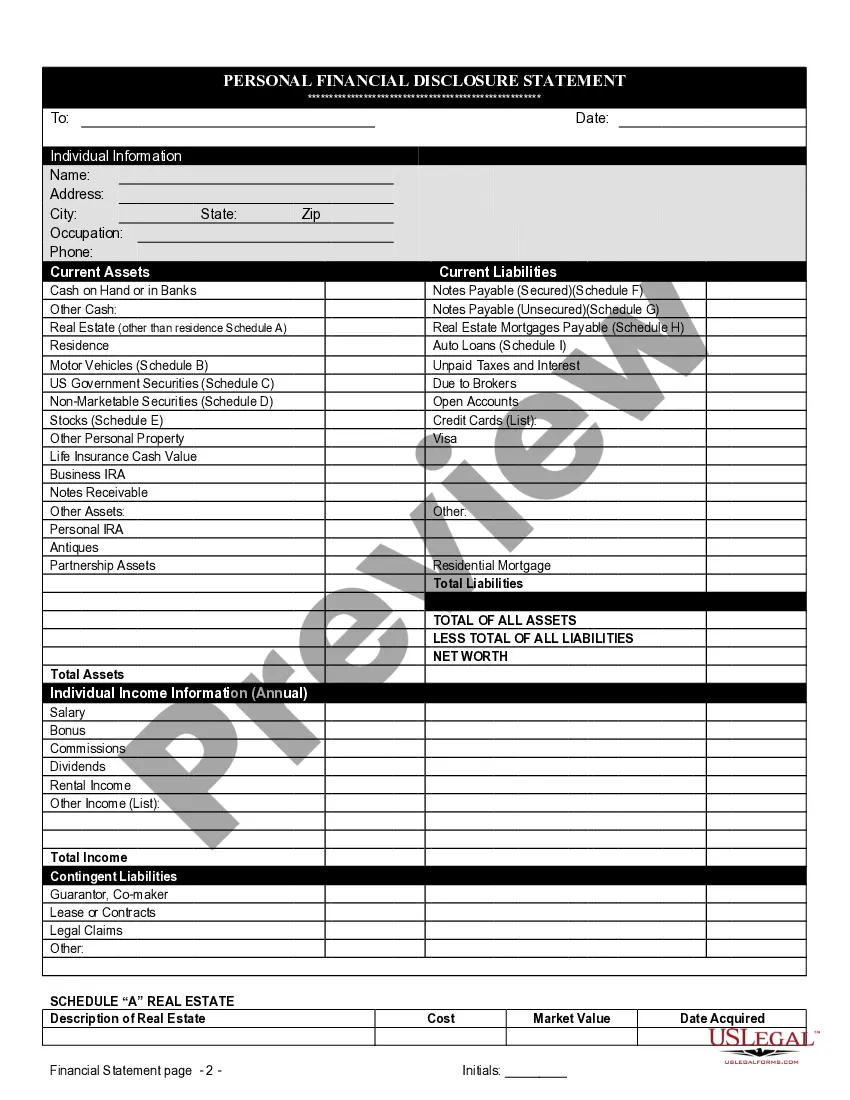

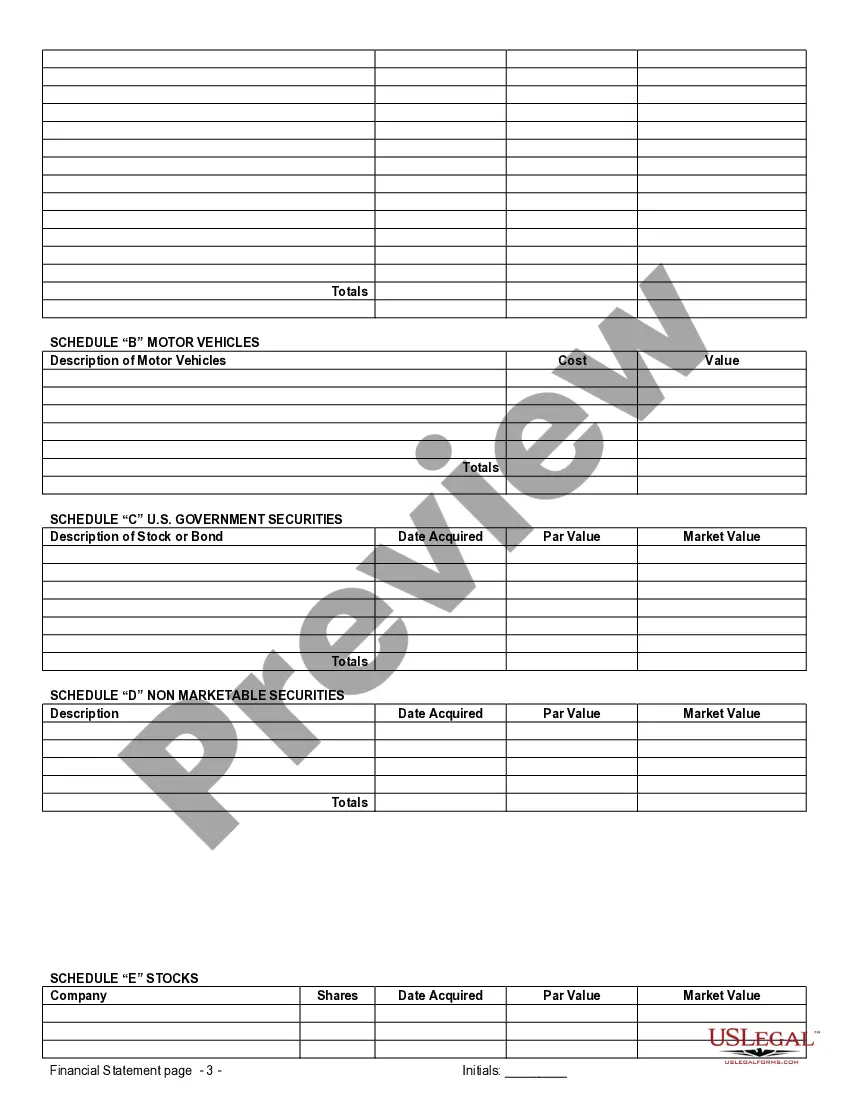

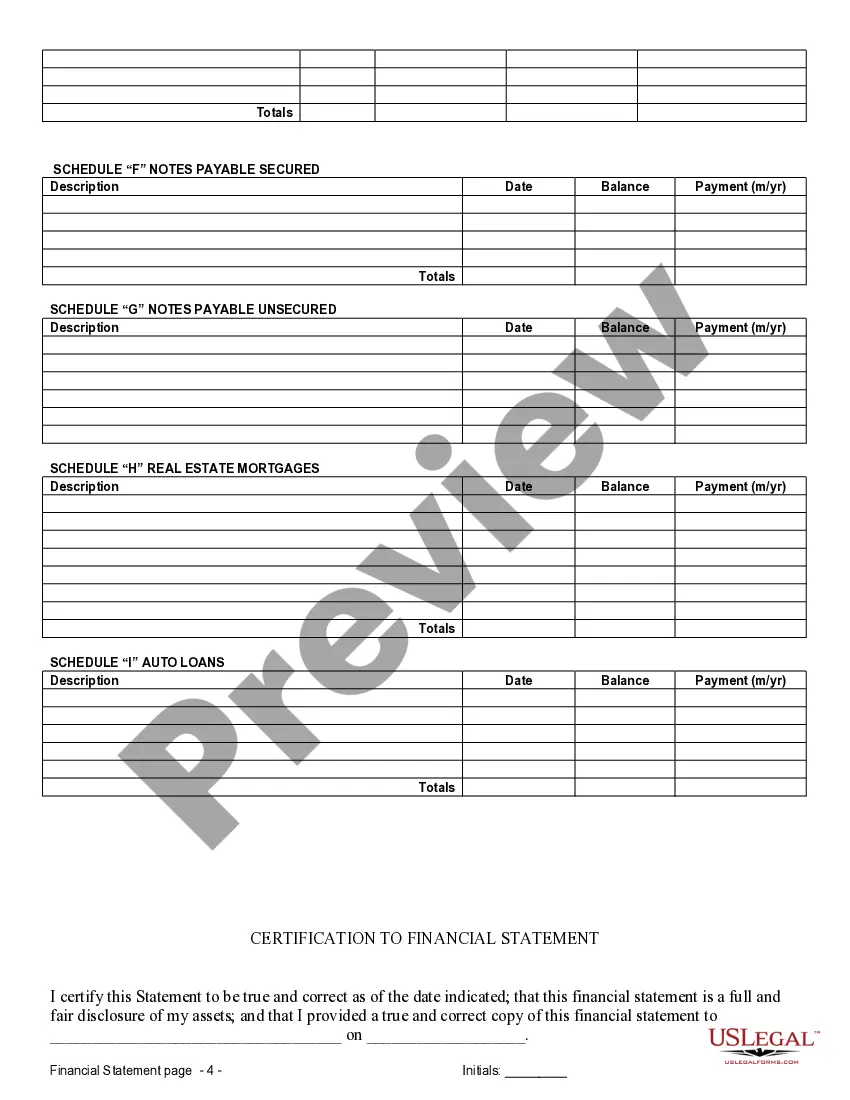

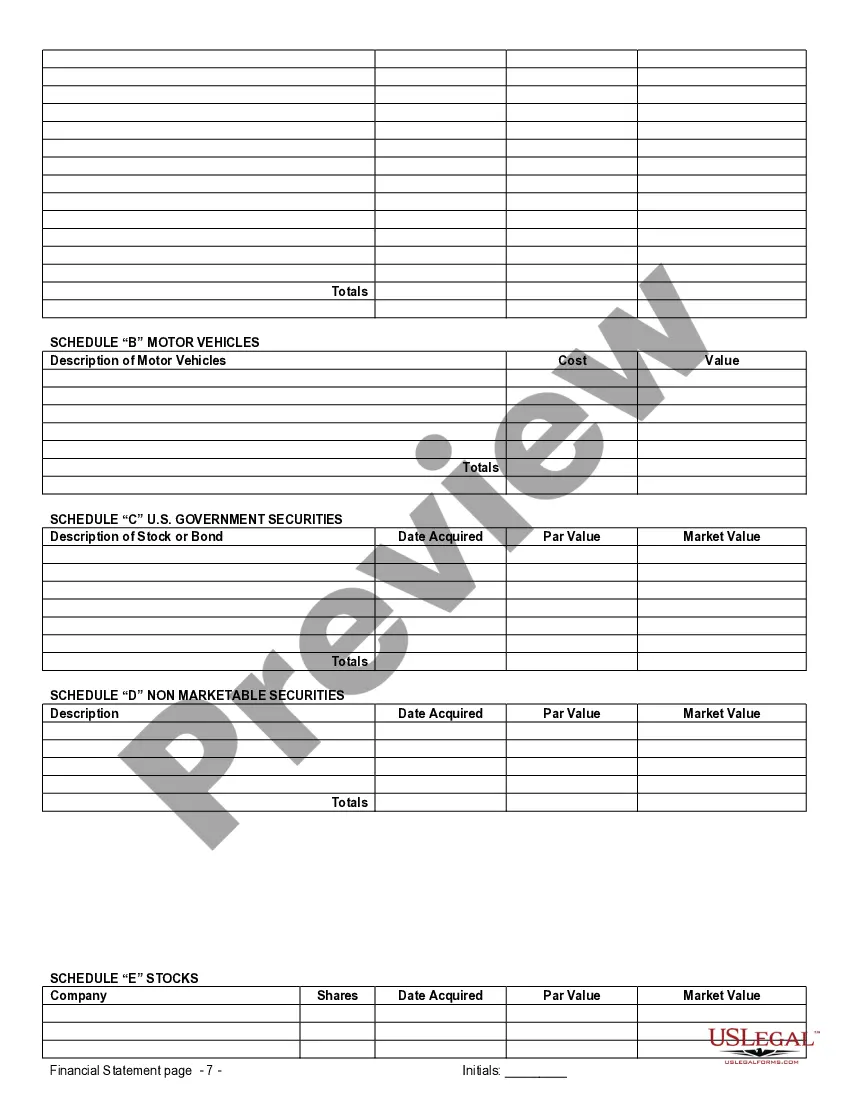

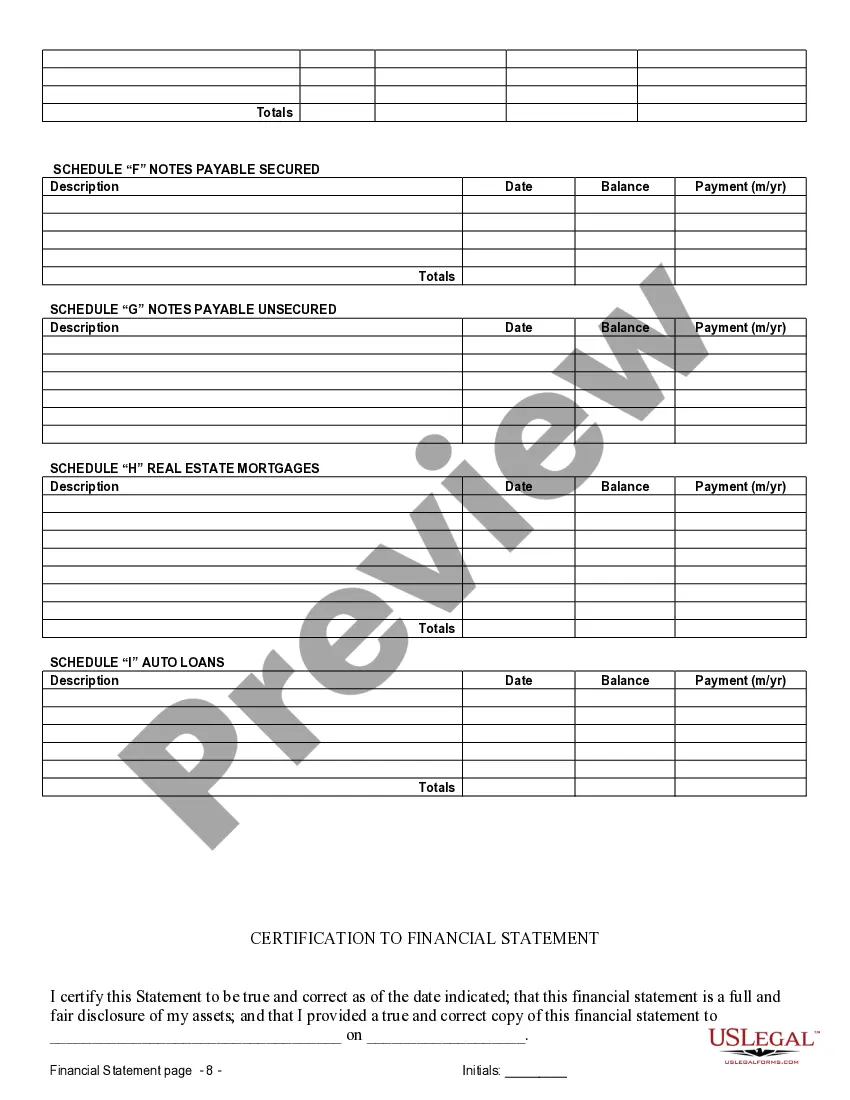

Huntsville Alabama Financial Statements in Connection with Prenuptial Premarital Agreement provide crucial information about an individual's financial status, assets, and liabilities before entering into a marital contract. These statements offer a transparent and comprehensive overview of each party's financial situation, ensuring fairness and clarity in the event of divorce or separation. There are two main types of financial statements often required for Huntsville Alabama prenuptial agreements: 1. Personal Financial Statement: This statement includes all the essential financial details of each individual involved in the prenuptial agreement. It covers information such as income, expenses, assets, liabilities, investments, retirement savings, real estate, and any outstanding debts. Providing accurate and up-to-date data in this statement is vital for a successful prenuptial agreement. 2. Business Financial Statement: In cases where either party owns a business or holds ownership shares in a company, a business financial statement becomes necessary. It provides a detailed snapshot of the business's financial health, including profit and loss statements, balance sheets, cash flow reports, and any other relevant financial documents. When preparing Huntsville Alabama Financial Statements for prenuptial or premarital agreements, it is essential to include the following relevant information and keywords: — Income: Provide a comprehensive breakdown of each party's income sources, including wages, self-employment earnings, investments, rental income, and any additional sources of revenue. — Assets: List all assets owned individually or jointly, such as real estate properties, vehicles, bank accounts, stocks and bonds, retirement accounts, and any valuable personal belongings. — Liabilities: Disclose any outstanding debts, loans, mortgages, credit card balances, or any other financial obligations both individually and jointly held. — Investments: Specify any investment portfolios, stocks, mutual funds, or other financial investments that may exist. — Retirement Savings: Outline the details of retirement plans, such as 401(k), IRAs, pensions, or annuities, along with their current and anticipated future value. — Real Estate: Include detailed information about any properties owned, including residential homes, commercial buildings, rental properties, or land. — Business Ownership: If applicable, provide complete details about any businesses owned or co-owned, including the financial standing, profitability, and market value of the enterprise. — Debts and Obligations: Identify any legal obligations or financial commitments, such as alimony, child support payments, or pending lawsuits. Remember that these financial statements are essential to ensure a fair and legally binding prenuptial agreement. Full transparency is crucial, and accuracy in providing all relevant financial information is necessary to prevent potential conflicts or misunderstandings in the future. Consulting a qualified financial advisor or attorney can provide further guidance in compiling these statements effectively.Huntsville Alabama Financial Statements in Connection with Prenuptial Premarital Agreement provide crucial information about an individual's financial status, assets, and liabilities before entering into a marital contract. These statements offer a transparent and comprehensive overview of each party's financial situation, ensuring fairness and clarity in the event of divorce or separation. There are two main types of financial statements often required for Huntsville Alabama prenuptial agreements: 1. Personal Financial Statement: This statement includes all the essential financial details of each individual involved in the prenuptial agreement. It covers information such as income, expenses, assets, liabilities, investments, retirement savings, real estate, and any outstanding debts. Providing accurate and up-to-date data in this statement is vital for a successful prenuptial agreement. 2. Business Financial Statement: In cases where either party owns a business or holds ownership shares in a company, a business financial statement becomes necessary. It provides a detailed snapshot of the business's financial health, including profit and loss statements, balance sheets, cash flow reports, and any other relevant financial documents. When preparing Huntsville Alabama Financial Statements for prenuptial or premarital agreements, it is essential to include the following relevant information and keywords: — Income: Provide a comprehensive breakdown of each party's income sources, including wages, self-employment earnings, investments, rental income, and any additional sources of revenue. — Assets: List all assets owned individually or jointly, such as real estate properties, vehicles, bank accounts, stocks and bonds, retirement accounts, and any valuable personal belongings. — Liabilities: Disclose any outstanding debts, loans, mortgages, credit card balances, or any other financial obligations both individually and jointly held. — Investments: Specify any investment portfolios, stocks, mutual funds, or other financial investments that may exist. — Retirement Savings: Outline the details of retirement plans, such as 401(k), IRAs, pensions, or annuities, along with their current and anticipated future value. — Real Estate: Include detailed information about any properties owned, including residential homes, commercial buildings, rental properties, or land. — Business Ownership: If applicable, provide complete details about any businesses owned or co-owned, including the financial standing, profitability, and market value of the enterprise. — Debts and Obligations: Identify any legal obligations or financial commitments, such as alimony, child support payments, or pending lawsuits. Remember that these financial statements are essential to ensure a fair and legally binding prenuptial agreement. Full transparency is crucial, and accuracy in providing all relevant financial information is necessary to prevent potential conflicts or misunderstandings in the future. Consulting a qualified financial advisor or attorney can provide further guidance in compiling these statements effectively.