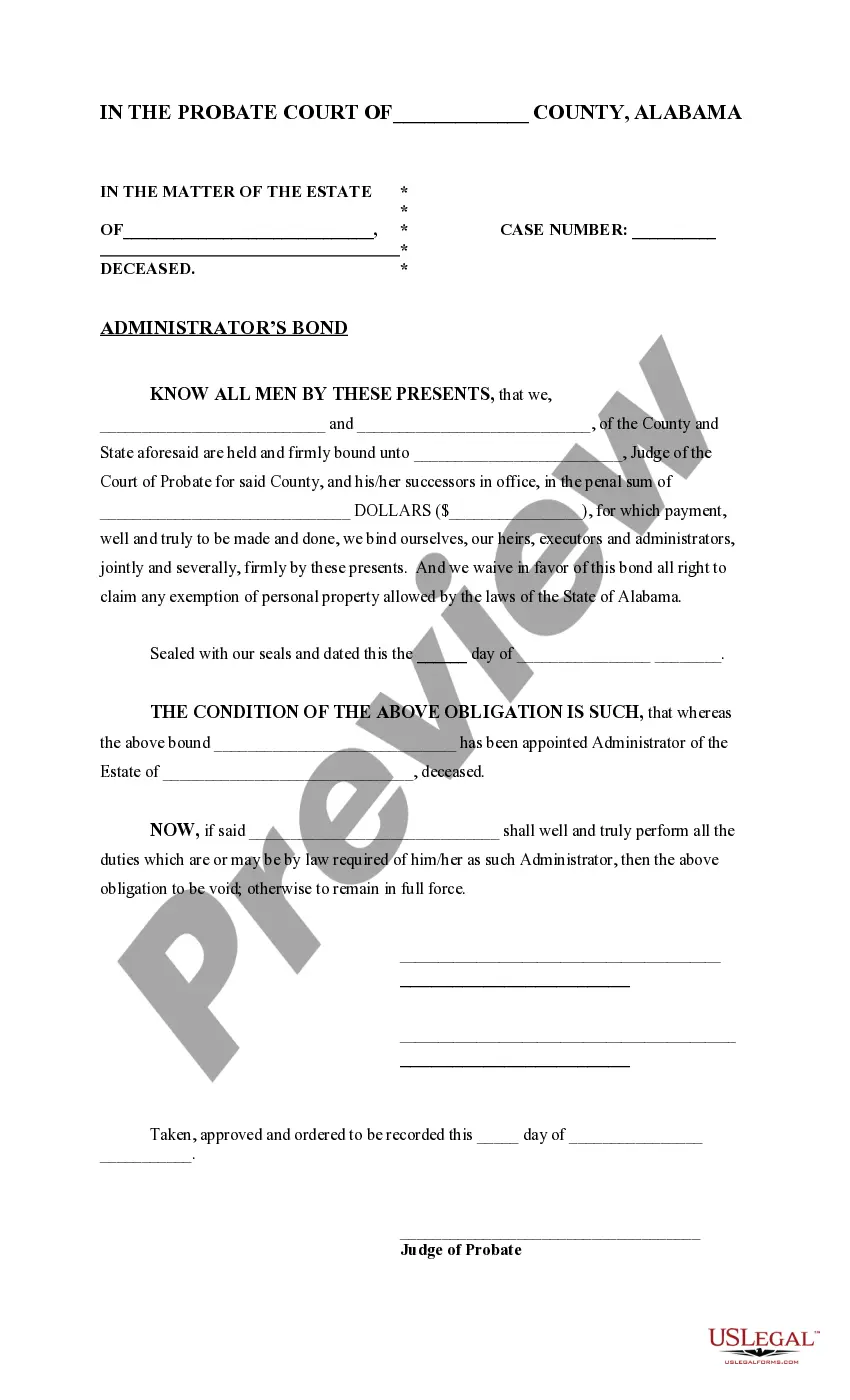

The administrator of an estate is required to post a bond in a certain amount to ensure that they carry out all the duties required of them in good faith. The bond provides protection against the possibility of fraud or embezzlement. The form is available in both word and word perfect formats.

Huntsville Alabama Administrator's Bond is a type of surety bond required by the state of Alabama for individuals who have been appointed as an administrator of an estate. This bond serves as a financial guarantee that the administrator will fulfill his or her duties ethically, honestly, and in compliance with the law. The primary purpose of this bond is to protect the heirs and creditors of an estate in case the administrator mismanages or misappropriates the estate's assets. In the event of any misconduct, negligence, or fraudulent activities committed by the administrator, the bond ensures financial compensation to the parties affected. There are two main types of Huntsville Alabama Administrator's Bond: 1. Full Administrator's Bond: This type of bond is required for administrators who have been granted full authority to handle the entire estate. It covers the entire value of the estate, including its assets, finances, and properties. 2. Limited Administrator's Bond: This bond is required for administrators who have been given limited authority to handle only specific aspects of the estate. It covers a portion of the estate's value corresponding to the administrator's responsibilities. The process of obtaining a Huntsville Alabama Administrator's Bond involves selecting a reputable surety bond company that specializes in probate bonds. The administrator must complete an application, provide the necessary documentation, and undergo a credit check. The bond premium, which is a percentage of the bond amount, is determined based on the administrator's creditworthiness. It is important to note that Huntsville Alabama Administrator's Bond is a legal requirement for individuals assuming the role of an estate administrator. Failure to secure the bond may result in the inability to act as an administrator or face legal consequences. Administrators should consult with their legal advisor or the probate court to understand the specific bond requirements and obligations. Keywords: Huntsville Alabama Administrator's Bond, surety bond, estate administrator, financial guarantee, mismanagement, misappropriation, heirs, creditors, legal requirement, probate bond, full administrator's bond, limited administrator's bond, estate assets, estate finances, estate properties, application, documentation, credit check, bond premium, legal advisor, probate court, obligations.Huntsville Alabama Administrator's Bond is a type of surety bond required by the state of Alabama for individuals who have been appointed as an administrator of an estate. This bond serves as a financial guarantee that the administrator will fulfill his or her duties ethically, honestly, and in compliance with the law. The primary purpose of this bond is to protect the heirs and creditors of an estate in case the administrator mismanages or misappropriates the estate's assets. In the event of any misconduct, negligence, or fraudulent activities committed by the administrator, the bond ensures financial compensation to the parties affected. There are two main types of Huntsville Alabama Administrator's Bond: 1. Full Administrator's Bond: This type of bond is required for administrators who have been granted full authority to handle the entire estate. It covers the entire value of the estate, including its assets, finances, and properties. 2. Limited Administrator's Bond: This bond is required for administrators who have been given limited authority to handle only specific aspects of the estate. It covers a portion of the estate's value corresponding to the administrator's responsibilities. The process of obtaining a Huntsville Alabama Administrator's Bond involves selecting a reputable surety bond company that specializes in probate bonds. The administrator must complete an application, provide the necessary documentation, and undergo a credit check. The bond premium, which is a percentage of the bond amount, is determined based on the administrator's creditworthiness. It is important to note that Huntsville Alabama Administrator's Bond is a legal requirement for individuals assuming the role of an estate administrator. Failure to secure the bond may result in the inability to act as an administrator or face legal consequences. Administrators should consult with their legal advisor or the probate court to understand the specific bond requirements and obligations. Keywords: Huntsville Alabama Administrator's Bond, surety bond, estate administrator, financial guarantee, mismanagement, misappropriation, heirs, creditors, legal requirement, probate bond, full administrator's bond, limited administrator's bond, estate assets, estate finances, estate properties, application, documentation, credit check, bond premium, legal advisor, probate court, obligations.