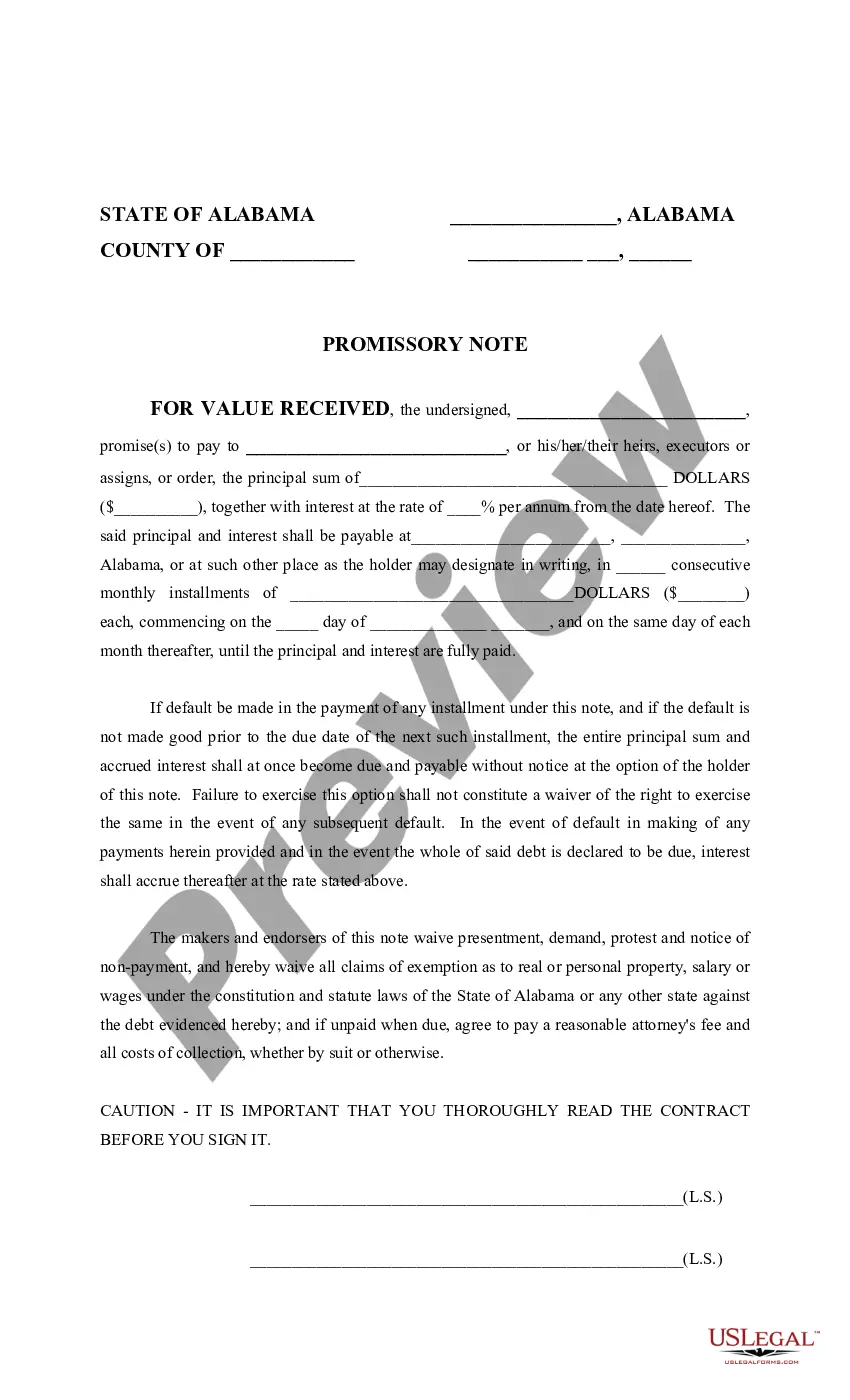

This form is a written promise to pay a debt. It is an unconditional promise to pay, on demand or at a fixed or determined future time, a particular sum of money to, or to the order of, a specified person or to the bearer.

Huntsville Alabama Promissory Note: A Comprehensive Overview A Huntsville Alabama Promissory Note is a legally binding document that outlines an agreement between a lender and a borrower. It serves as a written promise from the borrower to repay a specific amount of money borrowed from the lender, usually with predetermined interest and a specified repayment schedule. This document acts as a form of debt obligation, providing security for both parties involved in a financial transaction. There are different types of Promissory Notes commonly used in Huntsville, Alabama. These include: 1. Secured Promissory Note: This type of Promissory Note requires the borrower to provide collateral to the lender, protecting their investment in case of default. The collateral can be any valuable asset, such as real estate, vehicles, or other tangible property. 2. Unsecured Promissory Note: Unlike a secured Promissory Note, this type does not require collateral. It relies solely on the borrower's creditworthiness and trustworthiness, making it riskier for the lender. Unsecured Promissory Notes often have higher interest rates to compensate for the increased risk. 3. Demand Promissory Note: A demand Promissory Note allows the lender to demand repayment from the borrower at any given time. This type of note does not have a fixed repayment schedule; instead, the lender has the right to request full payment whenever they choose. 4. Installment Promissory Note: An Installment Promissory Note specifies a fixed repayment schedule, dividing the borrowed amount, including interest, into equal installments paid over a predetermined period. This type of Promissory Note provides a structured repayment plan for both parties. 5. Balloon Promissory Note: This type of Promissory Note involves regular installment payments over a specific term, usually shorter than the total loan duration. However, the final payment, termed as the "balloon payment," is significantly larger than the preceding installments, covering the remaining principal balance. It is crucial for both lenders and borrowers in Huntsville, Alabama, to understand the terms and conditions outlined in the Promissory Note before signing. Key details typically found in a Promissory Note include the loan principal amount, repayment schedule, interest rate, installment amounts, any applicable late fees or penalties, and any specific provisions or conditions agreed upon by both parties. Legal enforcement of Promissory Notes in Huntsville, Alabama, is upheld through state laws and regulations. Parties involved are recommended to consult legal professionals to ensure compliance with relevant statutes and proper drafting of the Promissory Note. In conclusion, a Huntsville Alabama Promissory Note is a legally binding agreement between a lender and a borrower, outlining the terms and conditions of borrowed money repayment. Various types of Promissory Notes exist, including secured, unsecured, demand, installment, and balloon notes. Understanding the specific type of Promissory Note and its contents is crucial for all parties involved to maintain trust and avoid any disputes in the future.Huntsville Alabama Promissory Note: A Comprehensive Overview A Huntsville Alabama Promissory Note is a legally binding document that outlines an agreement between a lender and a borrower. It serves as a written promise from the borrower to repay a specific amount of money borrowed from the lender, usually with predetermined interest and a specified repayment schedule. This document acts as a form of debt obligation, providing security for both parties involved in a financial transaction. There are different types of Promissory Notes commonly used in Huntsville, Alabama. These include: 1. Secured Promissory Note: This type of Promissory Note requires the borrower to provide collateral to the lender, protecting their investment in case of default. The collateral can be any valuable asset, such as real estate, vehicles, or other tangible property. 2. Unsecured Promissory Note: Unlike a secured Promissory Note, this type does not require collateral. It relies solely on the borrower's creditworthiness and trustworthiness, making it riskier for the lender. Unsecured Promissory Notes often have higher interest rates to compensate for the increased risk. 3. Demand Promissory Note: A demand Promissory Note allows the lender to demand repayment from the borrower at any given time. This type of note does not have a fixed repayment schedule; instead, the lender has the right to request full payment whenever they choose. 4. Installment Promissory Note: An Installment Promissory Note specifies a fixed repayment schedule, dividing the borrowed amount, including interest, into equal installments paid over a predetermined period. This type of Promissory Note provides a structured repayment plan for both parties. 5. Balloon Promissory Note: This type of Promissory Note involves regular installment payments over a specific term, usually shorter than the total loan duration. However, the final payment, termed as the "balloon payment," is significantly larger than the preceding installments, covering the remaining principal balance. It is crucial for both lenders and borrowers in Huntsville, Alabama, to understand the terms and conditions outlined in the Promissory Note before signing. Key details typically found in a Promissory Note include the loan principal amount, repayment schedule, interest rate, installment amounts, any applicable late fees or penalties, and any specific provisions or conditions agreed upon by both parties. Legal enforcement of Promissory Notes in Huntsville, Alabama, is upheld through state laws and regulations. Parties involved are recommended to consult legal professionals to ensure compliance with relevant statutes and proper drafting of the Promissory Note. In conclusion, a Huntsville Alabama Promissory Note is a legally binding agreement between a lender and a borrower, outlining the terms and conditions of borrowed money repayment. Various types of Promissory Notes exist, including secured, unsecured, demand, installment, and balloon notes. Understanding the specific type of Promissory Note and its contents is crucial for all parties involved to maintain trust and avoid any disputes in the future.