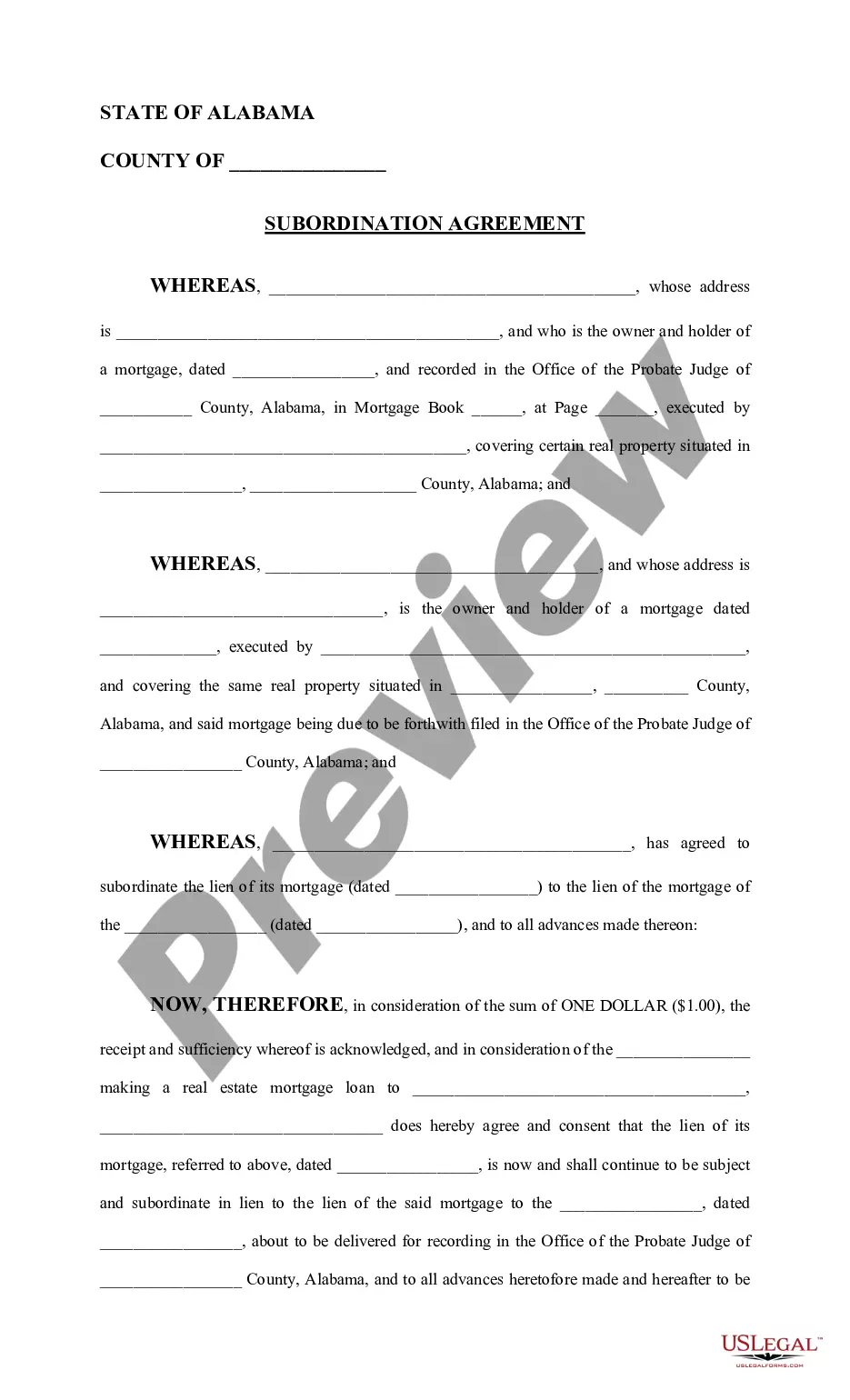

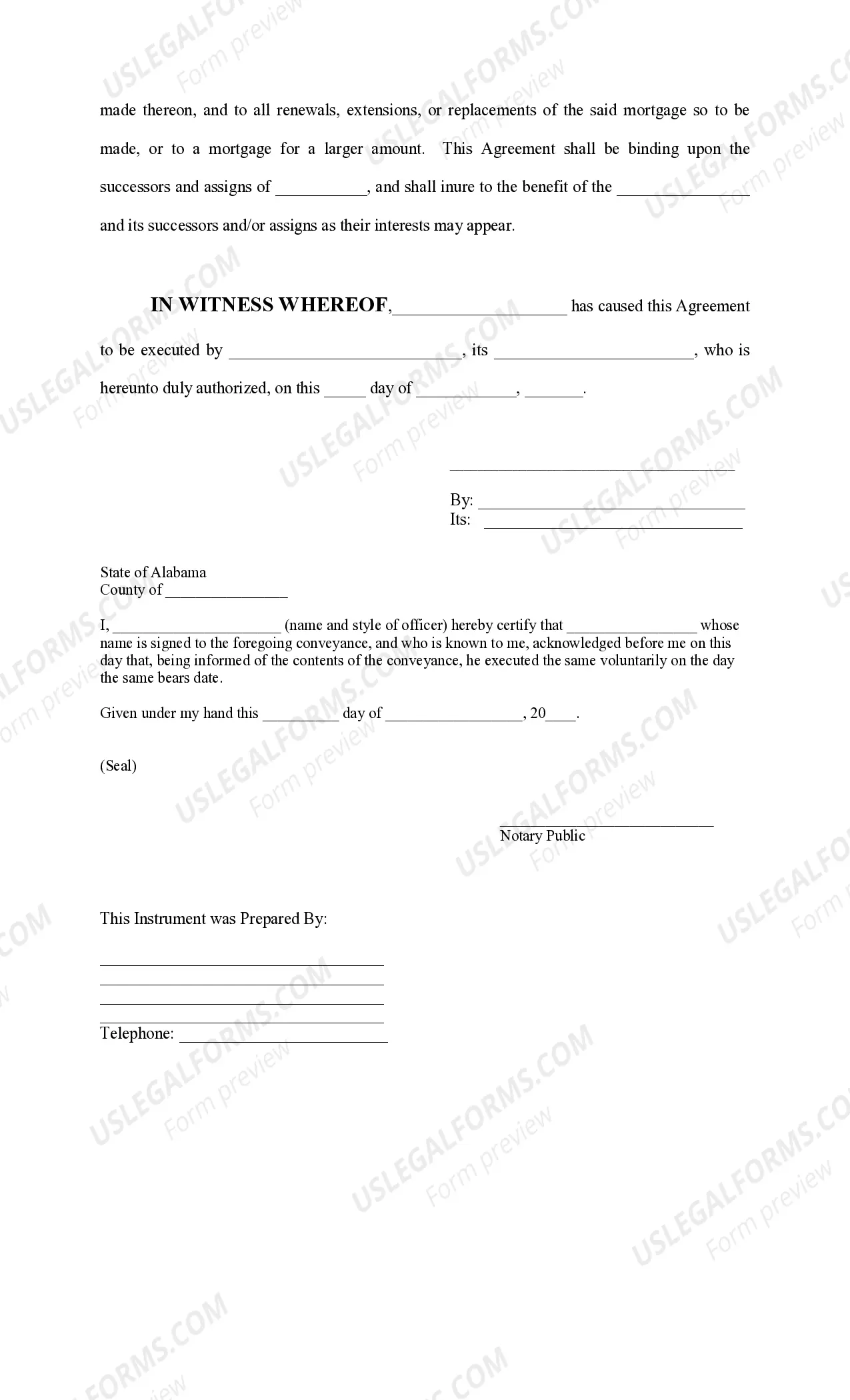

This form is an subordination agreement which puts a debt or claim which has priority in a lower position behind another debt, particularly a new loan. It is a contract in which a junior creditor agrees that its claims against a debtor will not be paid until all senior indebtedness of the debtor is repaid.

A Huntsville Alabama subordination agreement refers to a legal document that dictates the order of priority for certain rights or claims on a property. It is commonly used in real estate transactions or financing arrangements when there are multiple parties involved. This agreement allows one party to waive or subordinate their rights to another party in order to secure a loan or establish priority in the event of default or foreclosure. In Huntsville, Alabama, there are several types of subordination agreements that may be encountered, including: 1. Huntsville Alabama Mortgage Subordination Agreement: This type of agreement is commonly used when a homeowner wants to refinance their existing mortgage but has a second mortgage or other lien on the property. By signing a mortgage subordination agreement, the second mortgage holder agrees to subordinate their lien position to the new refinanced mortgage, allowing it to take priority. 2. Huntsville Alabama Lease Subordination Agreement: In commercial real estate, a lease subordination agreement may be necessary when a tenant wishes to lease property that already has a mortgage in place. The tenant enters into an agreement with the lender to subordinate their leasehold interest to the mortgage, ensuring that the lender has priority in case of default or foreclosure. 3. Huntsville Alabama Subordination of Judgment Agreement: This type of subordination agreement occurs when a judgment creditor agrees to subordinate their claim to another creditor. It is typically used when the debtor seeks additional financing secured by the same property, and the new lender requires priority over the existing judgment creditor. 4. Huntsville Alabama Subordination of Mechanic's Lien Agreement: A mechanic's lien is a claim placed on a property by a contractor or supplier who has provided labor or materials but has not been paid. A subordination of mechanic's lien agreement allows the lien holder to agree to subordinate their claim to a new mortgage or other financing, giving the lender priority in case of foreclosure. It is important to note that each subordination agreement may have its own specific terms and conditions, which should be carefully reviewed and negotiated by all parties involved. Consulting with a knowledgeable attorney or real estate professional in Huntsville, Alabama is recommended to ensure compliance with local laws and to protect the interests of all parties involved in the agreement.A Huntsville Alabama subordination agreement refers to a legal document that dictates the order of priority for certain rights or claims on a property. It is commonly used in real estate transactions or financing arrangements when there are multiple parties involved. This agreement allows one party to waive or subordinate their rights to another party in order to secure a loan or establish priority in the event of default or foreclosure. In Huntsville, Alabama, there are several types of subordination agreements that may be encountered, including: 1. Huntsville Alabama Mortgage Subordination Agreement: This type of agreement is commonly used when a homeowner wants to refinance their existing mortgage but has a second mortgage or other lien on the property. By signing a mortgage subordination agreement, the second mortgage holder agrees to subordinate their lien position to the new refinanced mortgage, allowing it to take priority. 2. Huntsville Alabama Lease Subordination Agreement: In commercial real estate, a lease subordination agreement may be necessary when a tenant wishes to lease property that already has a mortgage in place. The tenant enters into an agreement with the lender to subordinate their leasehold interest to the mortgage, ensuring that the lender has priority in case of default or foreclosure. 3. Huntsville Alabama Subordination of Judgment Agreement: This type of subordination agreement occurs when a judgment creditor agrees to subordinate their claim to another creditor. It is typically used when the debtor seeks additional financing secured by the same property, and the new lender requires priority over the existing judgment creditor. 4. Huntsville Alabama Subordination of Mechanic's Lien Agreement: A mechanic's lien is a claim placed on a property by a contractor or supplier who has provided labor or materials but has not been paid. A subordination of mechanic's lien agreement allows the lien holder to agree to subordinate their claim to a new mortgage or other financing, giving the lender priority in case of foreclosure. It is important to note that each subordination agreement may have its own specific terms and conditions, which should be carefully reviewed and negotiated by all parties involved. Consulting with a knowledgeable attorney or real estate professional in Huntsville, Alabama is recommended to ensure compliance with local laws and to protect the interests of all parties involved in the agreement.