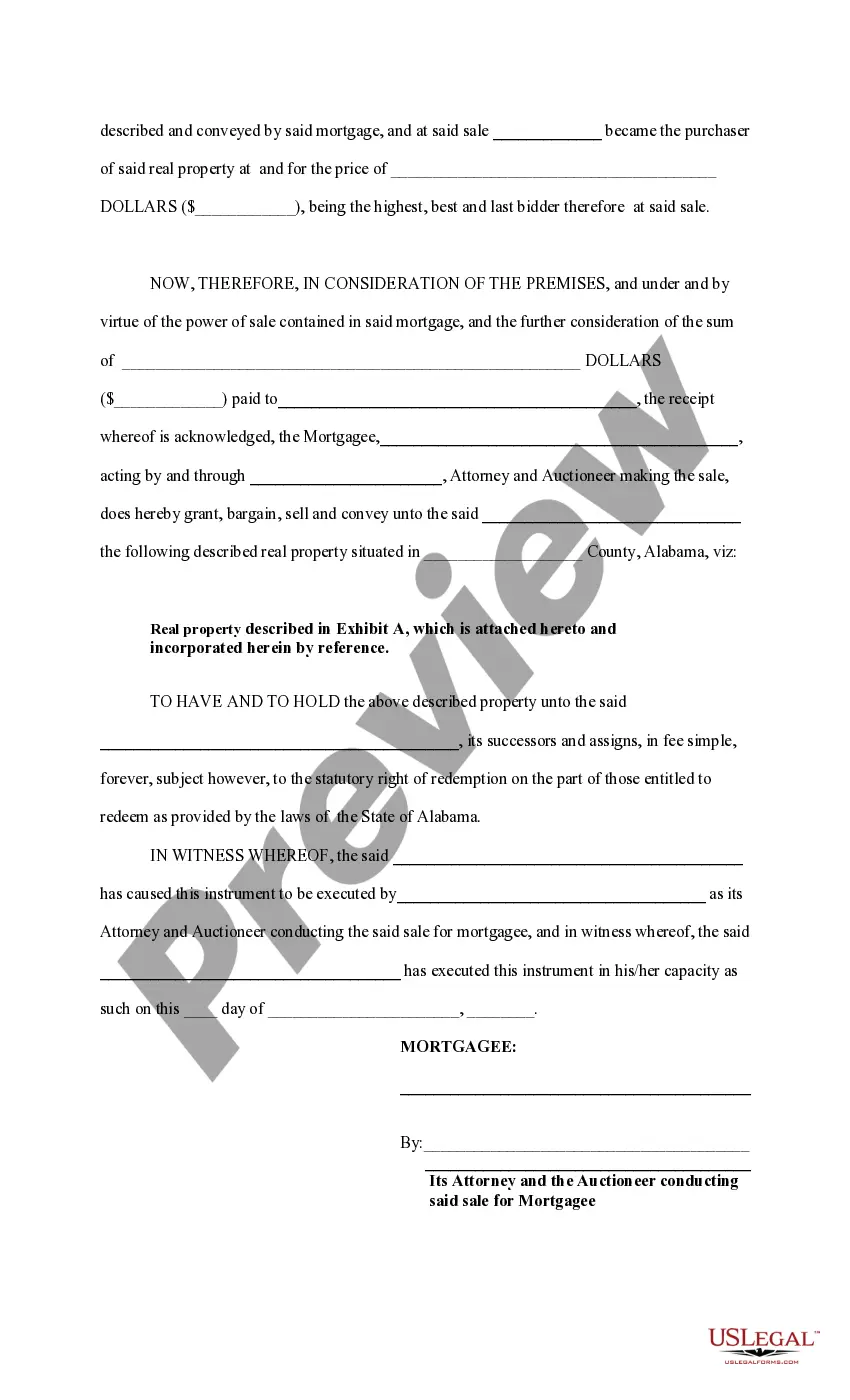

This form is a deed that is used when a mortgage loan is in default and the sale of the mortgaged property is performed in order to satisfy the unpaid debt. This form is available in Word and Wordperfect formats.

Huntsville Alabama Mortgage Foreclosure Deed is a legal document that outlines the transfer of ownership of a property in Huntsville, Alabama, due to a mortgage foreclosure. This document serves as proof of the foreclosure process and the transfer of the property from the borrower to the lender or new owner. In the state of Alabama, there are two primary types of mortgage foreclosure deeds applicable to Huntsville, Alabama: 1. Judicial Foreclosure Deed: This type of foreclosure deed is issued as a result of a foreclosure proceeding carried out through the court system. In a judicial foreclosure, the lender files a lawsuit against the borrower to obtain a court order authorizing the sale of the property. If the court rules in favor of the lender, a judicial foreclosure deed is issued, facilitating the transfer of the property to the lender or a third-party buyer. 2. Non-judicial Foreclosure Deed: In contrast to a judicial foreclosure, a non-judicial foreclosure deed is utilized when the original mortgage agreement contains a "power of sale" clause. This clause grants the lender the authority to sell the property to recover the outstanding debt without involvement from the court. Non-judicial foreclosure deeds are governed by strict statutory requirements, ensuring the borrower receives appropriate notice and an opportunity to cure the default before the property is sold. Both types of foreclosure deed in Huntsville, Alabama, ultimately enable the lender or new owner to take possession of the foreclosed property. It's essential for borrowers to understand the implications of a mortgage foreclosure to protect their rights and explore potential alternatives such as loan modifications or short sales. Keywords: Huntsville Alabama, Mortgage Foreclosure Deed, legal document, transfer of ownership, proof, foreclosure process, borrower, lender, new owner, judicial foreclosure, court system, lawsuit, court order, sale of property, non-judicial foreclosure, power of sale, contractual clause, outstanding debt, statutory requirements, notice, opportunity to cure default, possession, foreclosed property, borrower rights, alternatives, loan modifications, short sales.Huntsville Alabama Mortgage Foreclosure Deed is a legal document that outlines the transfer of ownership of a property in Huntsville, Alabama, due to a mortgage foreclosure. This document serves as proof of the foreclosure process and the transfer of the property from the borrower to the lender or new owner. In the state of Alabama, there are two primary types of mortgage foreclosure deeds applicable to Huntsville, Alabama: 1. Judicial Foreclosure Deed: This type of foreclosure deed is issued as a result of a foreclosure proceeding carried out through the court system. In a judicial foreclosure, the lender files a lawsuit against the borrower to obtain a court order authorizing the sale of the property. If the court rules in favor of the lender, a judicial foreclosure deed is issued, facilitating the transfer of the property to the lender or a third-party buyer. 2. Non-judicial Foreclosure Deed: In contrast to a judicial foreclosure, a non-judicial foreclosure deed is utilized when the original mortgage agreement contains a "power of sale" clause. This clause grants the lender the authority to sell the property to recover the outstanding debt without involvement from the court. Non-judicial foreclosure deeds are governed by strict statutory requirements, ensuring the borrower receives appropriate notice and an opportunity to cure the default before the property is sold. Both types of foreclosure deed in Huntsville, Alabama, ultimately enable the lender or new owner to take possession of the foreclosed property. It's essential for borrowers to understand the implications of a mortgage foreclosure to protect their rights and explore potential alternatives such as loan modifications or short sales. Keywords: Huntsville Alabama, Mortgage Foreclosure Deed, legal document, transfer of ownership, proof, foreclosure process, borrower, lender, new owner, judicial foreclosure, court system, lawsuit, court order, sale of property, non-judicial foreclosure, power of sale, contractual clause, outstanding debt, statutory requirements, notice, opportunity to cure default, possession, foreclosed property, borrower rights, alternatives, loan modifications, short sales.