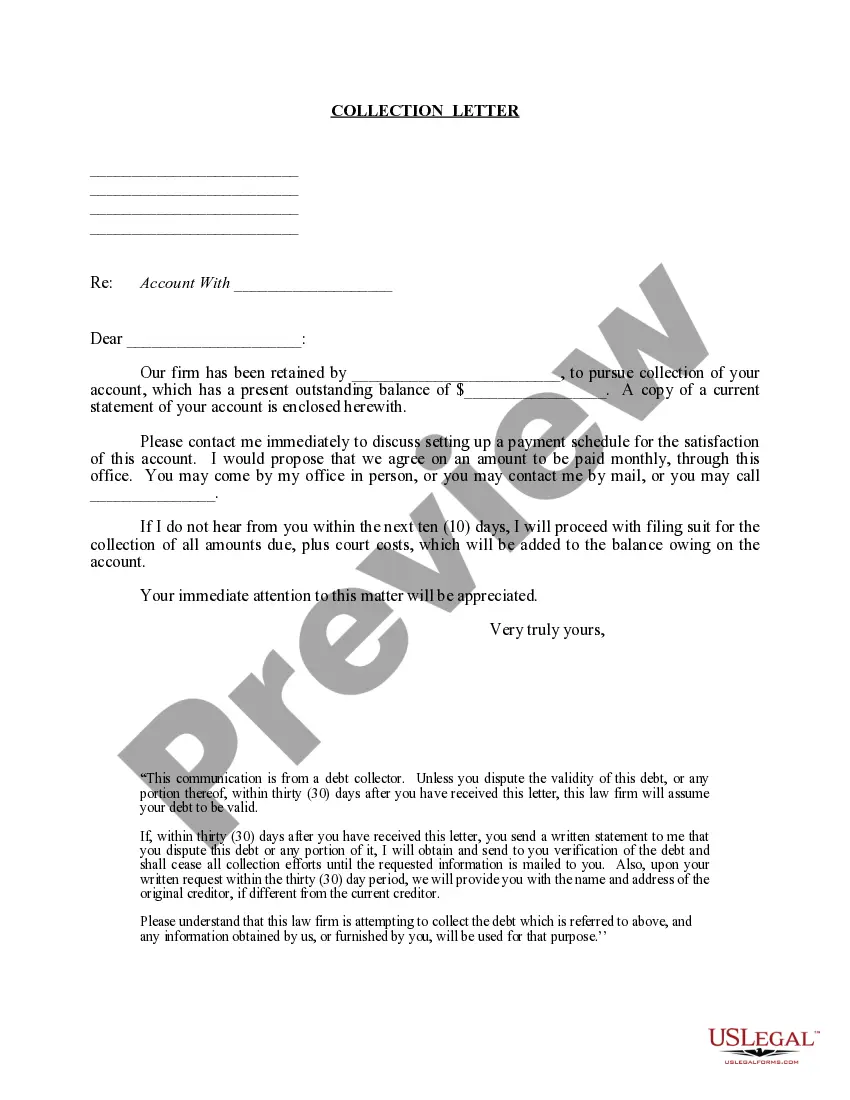

This form is used in the effort to collect money owed when one party is unable to pay a monetary debt to another. This form is available in Word and Wordperfect formats.

Birmingham Alabama Collection Letter is a formal written notice sent by a collection agency or a creditor to an individual or business located in Birmingham, Alabama, to demand payment for an outstanding debt. It serves as a reminder and an attempt to collect the overdue payment. The purpose of a Birmingham Alabama Collection Letter is to inform the debtor about the outstanding balance, the consequences of non-payment, and the steps that may be taken if the debt remains unpaid. The letter usually includes specific details such as the original amount owed, any interest or penalties accrued, and the total amount due at the time of the notice. The content of a Birmingham Alabama Collection Letter should be handled professionally and adhere to the Fair Debt Collection Practices Act (FD CPA) guidelines. It should clearly state the creditor's or collection agency's contact information, the debtor's name, and the account number to ensure proper identification. Additionally, keywords that may be relevant to a Birmingham Alabama Collection Letter include: 1. Collection Agency: A company hired or contracted by a creditor to collect outstanding debts. 2. Debt Collection: The process of pursuing payment of debts owed by individuals or businesses. 3. Creditor: The individual or company to whom the debt is owed. 4. Debtor: The individual or business responsible for repaying the debt. 5. Outstanding Debt: An unpaid balance or amount that remains due from the debtor. 6. Remittance: A request for payment, usually in the form of a check or money order, enclosed with the letter. 7. Past-Due Notice: A notification sent when the deadline for payment has passed without remittance. 8. Legal Action: The potential consequence of continued non-payment, which may result in a lawsuit or debt collection lawsuit. 9. Credit Report: An individual's financial history that includes information about open accounts, payment history, and outstanding debts. 10. FD CPA: The Fair Debt Collection Practices Act, a federal law that outlines the rights of debtors and regulates the conduct of debt collectors. It's important to note that although there may be multiple types of collections letters sent in Birmingham, Alabama, the key components mentioned above generally remain the same.Birmingham Alabama Collection Letter is a formal written notice sent by a collection agency or a creditor to an individual or business located in Birmingham, Alabama, to demand payment for an outstanding debt. It serves as a reminder and an attempt to collect the overdue payment. The purpose of a Birmingham Alabama Collection Letter is to inform the debtor about the outstanding balance, the consequences of non-payment, and the steps that may be taken if the debt remains unpaid. The letter usually includes specific details such as the original amount owed, any interest or penalties accrued, and the total amount due at the time of the notice. The content of a Birmingham Alabama Collection Letter should be handled professionally and adhere to the Fair Debt Collection Practices Act (FD CPA) guidelines. It should clearly state the creditor's or collection agency's contact information, the debtor's name, and the account number to ensure proper identification. Additionally, keywords that may be relevant to a Birmingham Alabama Collection Letter include: 1. Collection Agency: A company hired or contracted by a creditor to collect outstanding debts. 2. Debt Collection: The process of pursuing payment of debts owed by individuals or businesses. 3. Creditor: The individual or company to whom the debt is owed. 4. Debtor: The individual or business responsible for repaying the debt. 5. Outstanding Debt: An unpaid balance or amount that remains due from the debtor. 6. Remittance: A request for payment, usually in the form of a check or money order, enclosed with the letter. 7. Past-Due Notice: A notification sent when the deadline for payment has passed without remittance. 8. Legal Action: The potential consequence of continued non-payment, which may result in a lawsuit or debt collection lawsuit. 9. Credit Report: An individual's financial history that includes information about open accounts, payment history, and outstanding debts. 10. FD CPA: The Fair Debt Collection Practices Act, a federal law that outlines the rights of debtors and regulates the conduct of debt collectors. It's important to note that although there may be multiple types of collections letters sent in Birmingham, Alabama, the key components mentioned above generally remain the same.