Alabama recognizes legal separation, and shall enter a decree of legal separation if all of the following requirements are satisfied: (1) The court determines that the jurisdictional requirements for the dissolution of a marriage have been met. (2) The court determines the marriage is irretrievably broken or there exists a complete incompatibility of temperament or one or both of the parties desires to live separate and apart. (3) To the extent that it has jurisdiction to do so, the court has considered, approved, or provided for child custody, and has entered an order for child support in compliance with Rule 32 of the Alabama Rules of Judicial Administration. A decree of legal separation does not terminate the marital status of the parties.

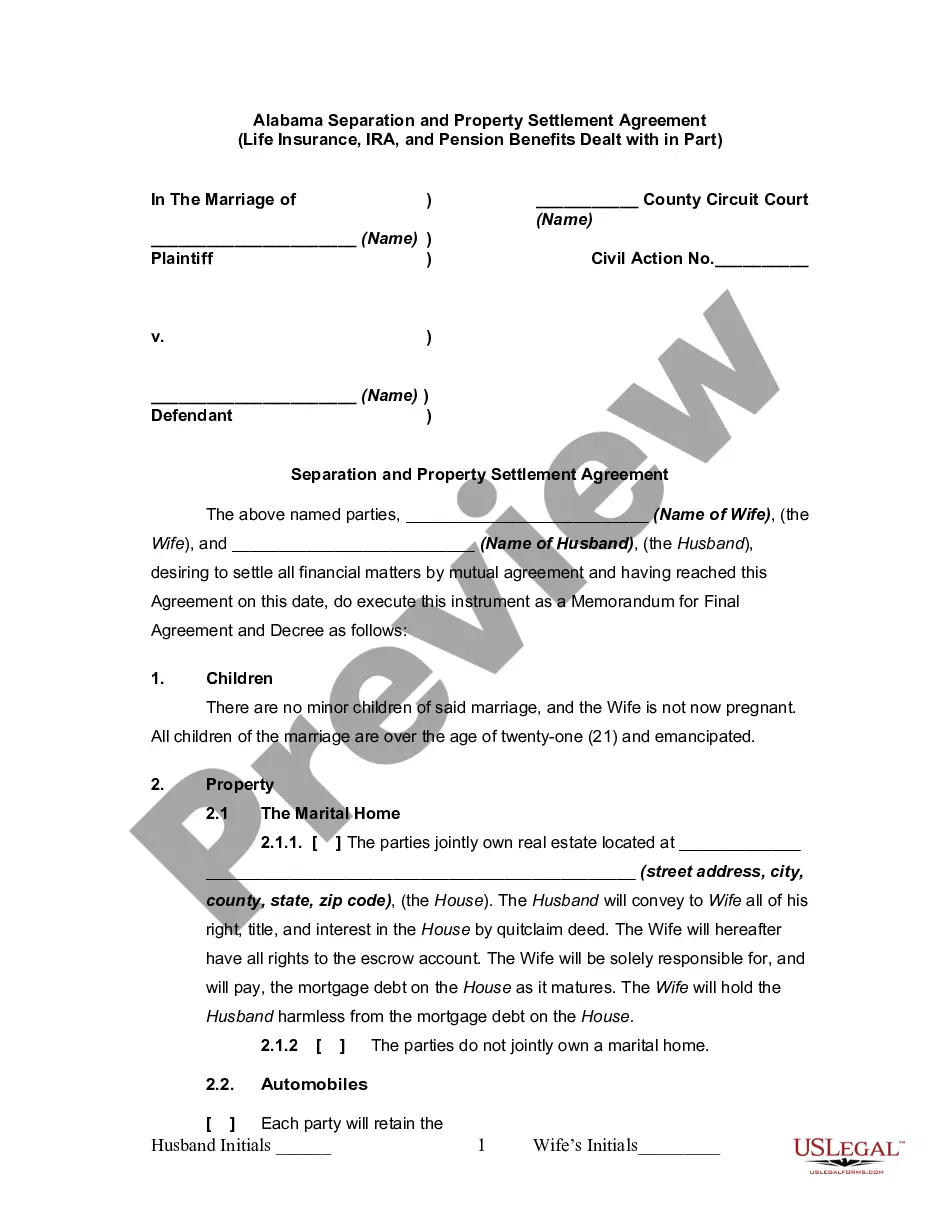

Huntsville Alabama Legal Separation and Property Settlement Agreement — Life Insurance, IRA, and Pension Benefits Dealt with in Part In Huntsville, Alabama, legal separation and property settlement agreements play a crucial role in resolving the allocation of assets and financial responsibilities between divorcing spouses. This comprehensive agreement aims to address various aspects, including the handling of life insurance policies, individual retirement accounts (IRAs), and pension benefits. Let's delve into how these specific benefits are dealt with in part in such agreements. 1. Life Insurance: Life insurance policies are often considered marital assets subject to equitable distribution during a legal separation or divorce. In Huntsville, Alabama, the separating spouses may include specific provisions within the agreement regarding the treatment of life insurance policies. These provisions may outline the following: a. Ownership and Beneficiary Designation: The agreement may identify the spouse who will retain ownership of the policy and the designated beneficiaries. It is crucial to update the beneficiary designation to reflect the changed circumstances accurately. b. Maintenance and Premium Payments: The agreement may specify the responsibilities of each spouse concerning the continuation and payment of premiums for existing policies. It could also outline the obligation to maintain a policy's face value, ensuring financial protection for the designated beneficiaries. c. Policy Termination: In certain cases, the agreement may address the termination of specific life insurance policies, especially if both spouses agree that the policies are no longer necessary or affordable. 2. Individual Retirement Accounts (IRAs): IRAs are financial vehicles that allow individuals to save for retirement. During a legal separation in Huntsville, Alabama, the property settlement agreement may address multiple aspects related to IRAs: a. Ownership and Distribution: The agreement may determine the ownership rights of each spouse over their respective IRAs. It may also specify how they will divide any jointly owned or commingled IRAs, including rollovers, transfers, or direct distributions. b. Valuation and Equitable Distribution: The agreement may establish the value of the IRAs and stipulate an equitable distribution between the spouses based on various factors, such as the length of the marriage, contributions made, and individual financial circumstances. c. Tax Considerations: It is crucial to consider the tax implications of IRA division or distribution during a legal separation. The agreement may outline how any taxes, penalties, or potential future tax liabilities resulting from IRA transactions will be allocated between the spouses. 3. Pension Benefits: Pension benefits, often accumulated during the course of a marriage, can represent a significant portion of the marital estate. Huntsville, Alabama legal separation and property settlement agreements may address the following matters related to pension benefits: a. Division and Distribution: The agreement may establish how pension benefits will be divided, whether by a percentage-based formula, a fixed dollar amount, or other agreed-upon methods. This division could occur through a qualified domestic relations order (QDR) or other appropriate means. b. Survivor Benefits: If applicable, the agreement may specify the rights of each spouse regarding survivor benefits stemming from pension plans. This ensures that the surviving spouse can continue receiving benefits in the event of the other spouse's death. c. Valuation and Payment: The agreement may require the valuation of pension benefits and detail the payment arrangements, whether in a lump sum, periodic payments, or through a shared interest in the pension plan. Overall, a Huntsville Alabama Legal Separation and Property Settlement Agreement comprehensively addresses the handling of life insurance policies, IRAs, and pension benefits during a legal separation. Specific terms may vary depending on the unique circumstances of each case, and it is advisable to consult with legal professionals familiar with Alabama family law to ensure accurate and fair resolution.Huntsville Alabama Legal Separation and Property Settlement Agreement — Life Insurance, IRA, and Pension Benefits Dealt with in Part In Huntsville, Alabama, legal separation and property settlement agreements play a crucial role in resolving the allocation of assets and financial responsibilities between divorcing spouses. This comprehensive agreement aims to address various aspects, including the handling of life insurance policies, individual retirement accounts (IRAs), and pension benefits. Let's delve into how these specific benefits are dealt with in part in such agreements. 1. Life Insurance: Life insurance policies are often considered marital assets subject to equitable distribution during a legal separation or divorce. In Huntsville, Alabama, the separating spouses may include specific provisions within the agreement regarding the treatment of life insurance policies. These provisions may outline the following: a. Ownership and Beneficiary Designation: The agreement may identify the spouse who will retain ownership of the policy and the designated beneficiaries. It is crucial to update the beneficiary designation to reflect the changed circumstances accurately. b. Maintenance and Premium Payments: The agreement may specify the responsibilities of each spouse concerning the continuation and payment of premiums for existing policies. It could also outline the obligation to maintain a policy's face value, ensuring financial protection for the designated beneficiaries. c. Policy Termination: In certain cases, the agreement may address the termination of specific life insurance policies, especially if both spouses agree that the policies are no longer necessary or affordable. 2. Individual Retirement Accounts (IRAs): IRAs are financial vehicles that allow individuals to save for retirement. During a legal separation in Huntsville, Alabama, the property settlement agreement may address multiple aspects related to IRAs: a. Ownership and Distribution: The agreement may determine the ownership rights of each spouse over their respective IRAs. It may also specify how they will divide any jointly owned or commingled IRAs, including rollovers, transfers, or direct distributions. b. Valuation and Equitable Distribution: The agreement may establish the value of the IRAs and stipulate an equitable distribution between the spouses based on various factors, such as the length of the marriage, contributions made, and individual financial circumstances. c. Tax Considerations: It is crucial to consider the tax implications of IRA division or distribution during a legal separation. The agreement may outline how any taxes, penalties, or potential future tax liabilities resulting from IRA transactions will be allocated between the spouses. 3. Pension Benefits: Pension benefits, often accumulated during the course of a marriage, can represent a significant portion of the marital estate. Huntsville, Alabama legal separation and property settlement agreements may address the following matters related to pension benefits: a. Division and Distribution: The agreement may establish how pension benefits will be divided, whether by a percentage-based formula, a fixed dollar amount, or other agreed-upon methods. This division could occur through a qualified domestic relations order (QDR) or other appropriate means. b. Survivor Benefits: If applicable, the agreement may specify the rights of each spouse regarding survivor benefits stemming from pension plans. This ensures that the surviving spouse can continue receiving benefits in the event of the other spouse's death. c. Valuation and Payment: The agreement may require the valuation of pension benefits and detail the payment arrangements, whether in a lump sum, periodic payments, or through a shared interest in the pension plan. Overall, a Huntsville Alabama Legal Separation and Property Settlement Agreement comprehensively addresses the handling of life insurance policies, IRAs, and pension benefits during a legal separation. Specific terms may vary depending on the unique circumstances of each case, and it is advisable to consult with legal professionals familiar with Alabama family law to ensure accurate and fair resolution.