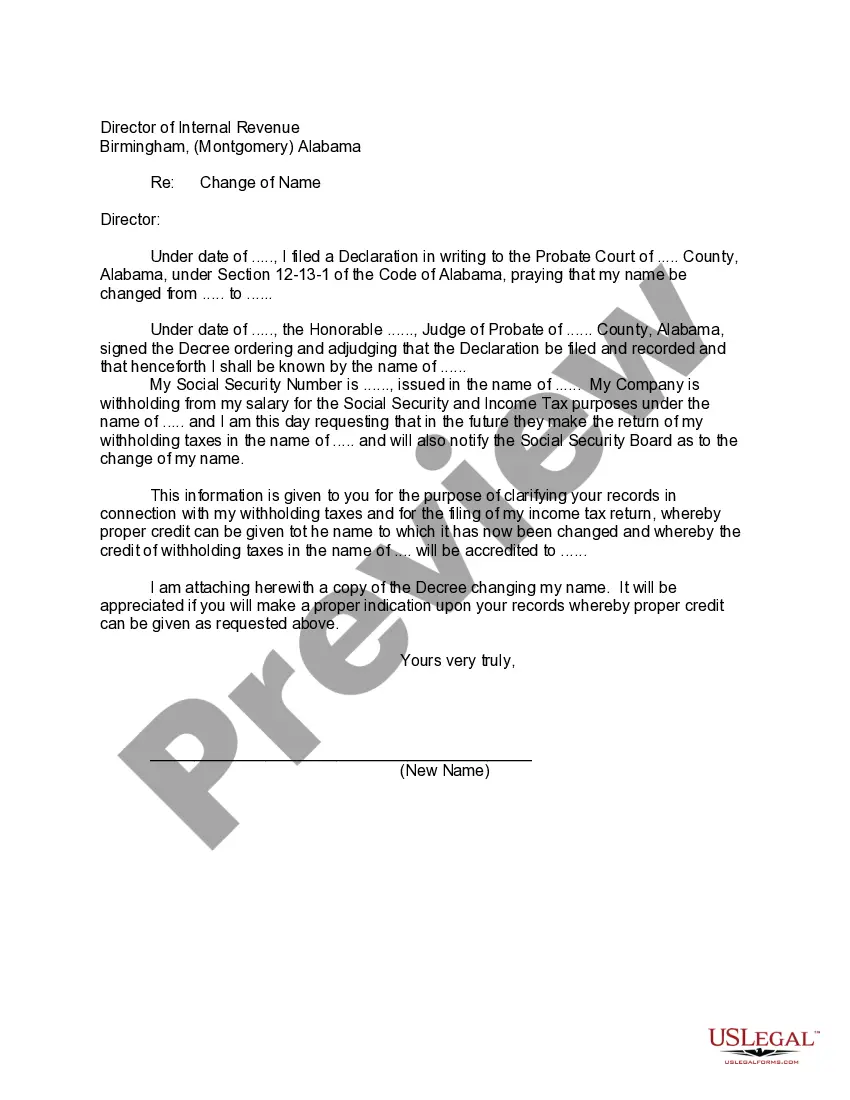

This is a sample letter to the Internal Revenue Service notifying them of a Name Change order granted by the Alabama probate court.

Huntsville, Alabama Notice to Internal Revenue Service of Name Change is an important document that individuals or businesses need to submit to the Internal Revenue Service (IRS) when there is a change in their legal name. This notice is essential to ensure accurate records and proper communication between taxpayers and the IRS. When it comes to different types of Huntsville, Alabama Notice to Internal Revenue Service of Name Change, there are various situations where individuals or businesses may need to file this notice. These situations may include: 1. Personal Name Change: If an individual legally changes their name due to marriage, divorce, adoption, or any other reason, it is crucial to notify the IRS through the Huntsville, Alabama Notice to Internal Revenue Service of Name Change. This ensures that their tax records are updated with the correct information. 2. Business Name Change: When a business undergoes a name change, such as rebranding, merging with another company, or changing the legal structure, they must file the Huntsville, Alabama Notice to Internal Revenue Service of Name Change. This allows the IRS to update their records and ensures proper taxation processes going forward. 3. Estate or Trust Name Change: In the case of an estate or trust, if the name of the entity changes, it is essential to notify the IRS using the Huntsville, Alabama Notice to Internal Revenue Service of Name Change. This ensures accurate reporting and taxation of income and assets associated with the new name. To successfully complete the Huntsville, Alabama Notice to Internal Revenue Service of Name Change, individuals or businesses need to provide specific details. These may include: 1. Previous Name: The name used before the change. 2. New Name: The updated, legal name after the change. 3. Taxpayer Identification Number: The taxpayer's Social Security Number (SSN) or Employer Identification Number (EIN). 4. Contact Information: Current mailing address, phone number, and email address. 5. Signature: The document should be signed by the taxpayer or an authorized representative. It is crucial to submit the Huntsville, Alabama Notice to Internal Revenue Service of Name Change as soon as the name change occurs. Failure to provide this notification may result in discrepancies, delays, or issues with tax filings and communications with the IRS. Remember, this description provides general information on Huntsville, Alabama Notice to Internal Revenue Service of Name Change. It is always recommended consulting an attorney or tax professional to ensure accurate completion and submission of this notice according to the specific requirements and guidelines set by the IRS.Huntsville, Alabama Notice to Internal Revenue Service of Name Change is an important document that individuals or businesses need to submit to the Internal Revenue Service (IRS) when there is a change in their legal name. This notice is essential to ensure accurate records and proper communication between taxpayers and the IRS. When it comes to different types of Huntsville, Alabama Notice to Internal Revenue Service of Name Change, there are various situations where individuals or businesses may need to file this notice. These situations may include: 1. Personal Name Change: If an individual legally changes their name due to marriage, divorce, adoption, or any other reason, it is crucial to notify the IRS through the Huntsville, Alabama Notice to Internal Revenue Service of Name Change. This ensures that their tax records are updated with the correct information. 2. Business Name Change: When a business undergoes a name change, such as rebranding, merging with another company, or changing the legal structure, they must file the Huntsville, Alabama Notice to Internal Revenue Service of Name Change. This allows the IRS to update their records and ensures proper taxation processes going forward. 3. Estate or Trust Name Change: In the case of an estate or trust, if the name of the entity changes, it is essential to notify the IRS using the Huntsville, Alabama Notice to Internal Revenue Service of Name Change. This ensures accurate reporting and taxation of income and assets associated with the new name. To successfully complete the Huntsville, Alabama Notice to Internal Revenue Service of Name Change, individuals or businesses need to provide specific details. These may include: 1. Previous Name: The name used before the change. 2. New Name: The updated, legal name after the change. 3. Taxpayer Identification Number: The taxpayer's Social Security Number (SSN) or Employer Identification Number (EIN). 4. Contact Information: Current mailing address, phone number, and email address. 5. Signature: The document should be signed by the taxpayer or an authorized representative. It is crucial to submit the Huntsville, Alabama Notice to Internal Revenue Service of Name Change as soon as the name change occurs. Failure to provide this notification may result in discrepancies, delays, or issues with tax filings and communications with the IRS. Remember, this description provides general information on Huntsville, Alabama Notice to Internal Revenue Service of Name Change. It is always recommended consulting an attorney or tax professional to ensure accurate completion and submission of this notice according to the specific requirements and guidelines set by the IRS.