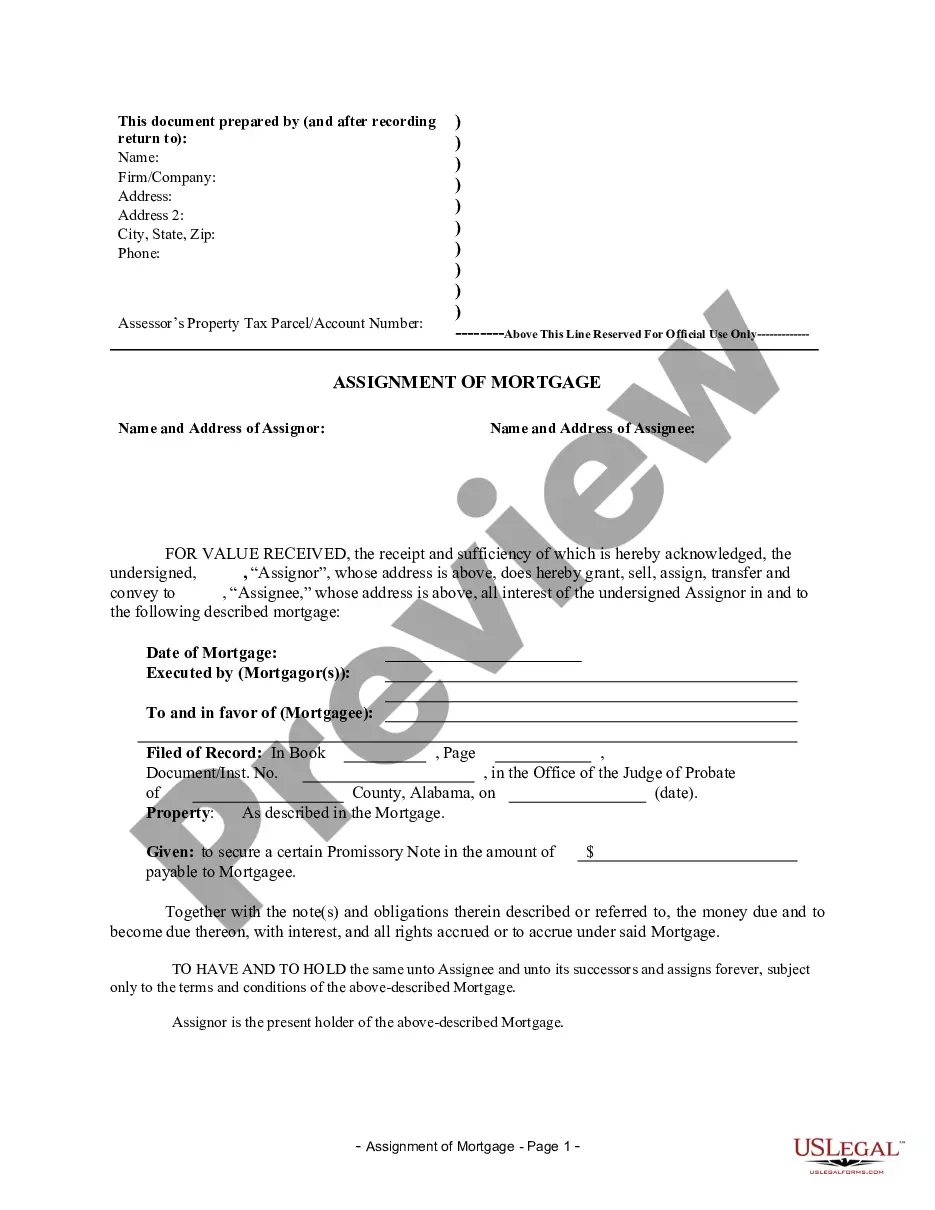

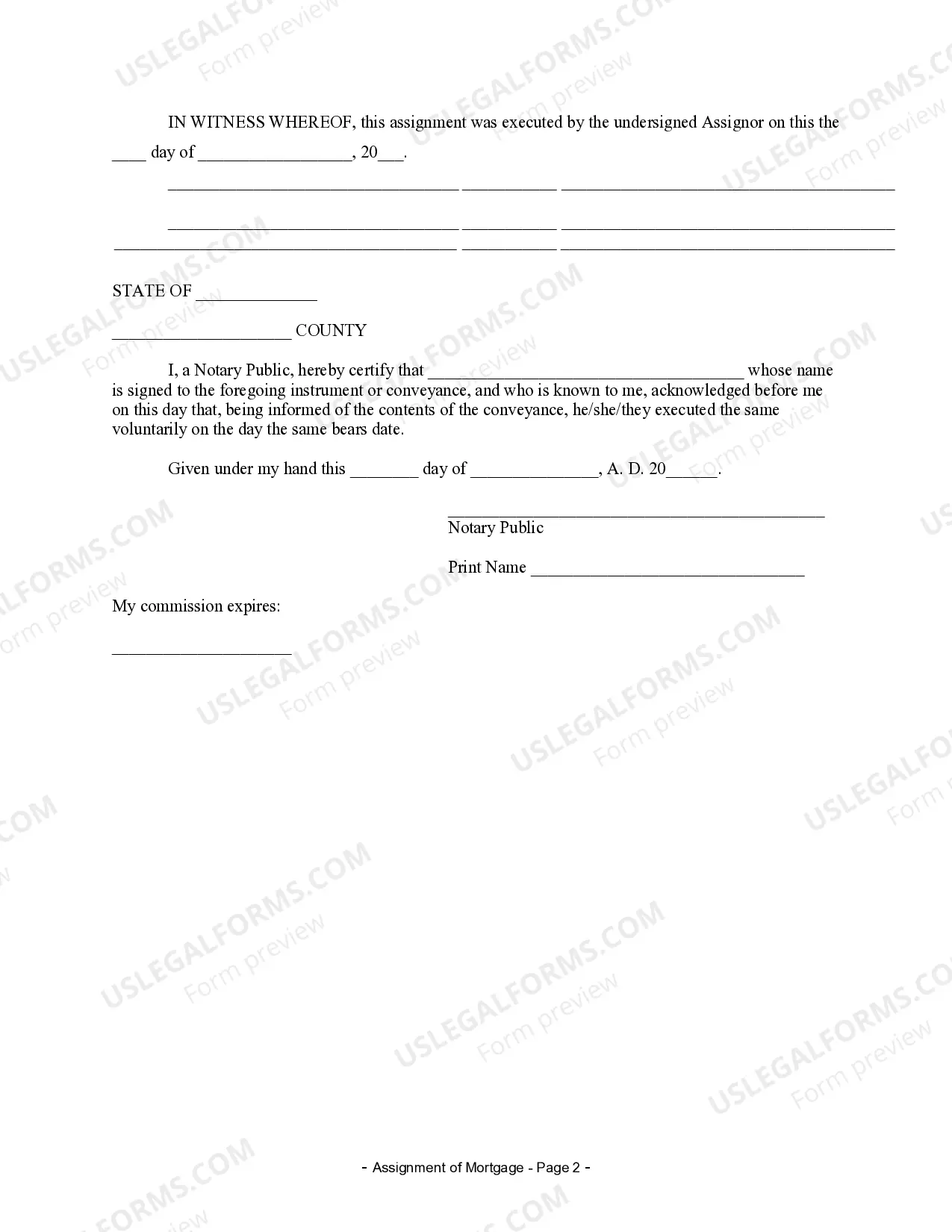

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Huntsville Alabama Assignment of Mortgage by Individual Mortgage Holder refers to the legal transfer of a mortgage loan from one individual mortgage holder to another in Huntsville, Alabama. This process allows the original mortgage holder to transfer their rights and interest in the mortgage loan to a new party. The Assignment of Mortgage by Individual Mortgage Holder is typically used when an individual who holds a mortgage loan decides to sell or transfer their ownership rights to another individual. This could be due to various reasons such as financial obligations, relocation, or changing investment strategies. By assigning the mortgage to another individual, the original mortgage holder can release their obligations and transfer the responsibility of loan repayment to the new mortgage holder. In Huntsville, Alabama, there may be different types of Assignment of Mortgage by Individual Mortgage Holder, including: 1. Standard Assignment of Mortgage: This is the most common type of assignment where the original mortgage holder transfers their mortgage loan to another individual. The new mortgage holder assumes all the rights, responsibilities, and obligations associated with the mortgage. 2. Partial Assignment of Mortgage: In some cases, a mortgage holder may choose to assign only a portion of their mortgage loan to another individual. This could be done to share the financial burden or to facilitate investment opportunities. 3. Subject-To Assignment of Mortgage: This type of assignment occurs when the original mortgage holder transfers the mortgage to another individual, who takes over the loan payments without actually assuming legal ownership of the property. This can be a beneficial arrangement when the original mortgage holder wants to avoid foreclosure or financial difficulties. It is essential to consult with legal professionals and mortgage experts when considering an Assignment of Mortgage by Individual Mortgage Holder in Huntsville, Alabama. Local real estate laws, regulations, and mortgage contract terms may vary, and it is crucial to ensure that all necessary legal steps are followed to facilitate a smooth transfer of the mortgage loan. In summary, the Huntsville Alabama Assignment of Mortgage by Individual Mortgage Holder refers to the transfer of a mortgage loan from one individual mortgage holder to another. This legal process allows the original mortgage holder to transfer their ownership rights and obligations to a new party. Different types of assignments, such as standard, partial, and subject-to, may exist, providing flexibility and options for both parties involved. However, seeking professional advice is crucial to ensure compliance with local laws and regulations.Huntsville Alabama Assignment of Mortgage by Individual Mortgage Holder refers to the legal transfer of a mortgage loan from one individual mortgage holder to another in Huntsville, Alabama. This process allows the original mortgage holder to transfer their rights and interest in the mortgage loan to a new party. The Assignment of Mortgage by Individual Mortgage Holder is typically used when an individual who holds a mortgage loan decides to sell or transfer their ownership rights to another individual. This could be due to various reasons such as financial obligations, relocation, or changing investment strategies. By assigning the mortgage to another individual, the original mortgage holder can release their obligations and transfer the responsibility of loan repayment to the new mortgage holder. In Huntsville, Alabama, there may be different types of Assignment of Mortgage by Individual Mortgage Holder, including: 1. Standard Assignment of Mortgage: This is the most common type of assignment where the original mortgage holder transfers their mortgage loan to another individual. The new mortgage holder assumes all the rights, responsibilities, and obligations associated with the mortgage. 2. Partial Assignment of Mortgage: In some cases, a mortgage holder may choose to assign only a portion of their mortgage loan to another individual. This could be done to share the financial burden or to facilitate investment opportunities. 3. Subject-To Assignment of Mortgage: This type of assignment occurs when the original mortgage holder transfers the mortgage to another individual, who takes over the loan payments without actually assuming legal ownership of the property. This can be a beneficial arrangement when the original mortgage holder wants to avoid foreclosure or financial difficulties. It is essential to consult with legal professionals and mortgage experts when considering an Assignment of Mortgage by Individual Mortgage Holder in Huntsville, Alabama. Local real estate laws, regulations, and mortgage contract terms may vary, and it is crucial to ensure that all necessary legal steps are followed to facilitate a smooth transfer of the mortgage loan. In summary, the Huntsville Alabama Assignment of Mortgage by Individual Mortgage Holder refers to the transfer of a mortgage loan from one individual mortgage holder to another. This legal process allows the original mortgage holder to transfer their ownership rights and obligations to a new party. Different types of assignments, such as standard, partial, and subject-to, may exist, providing flexibility and options for both parties involved. However, seeking professional advice is crucial to ensure compliance with local laws and regulations.