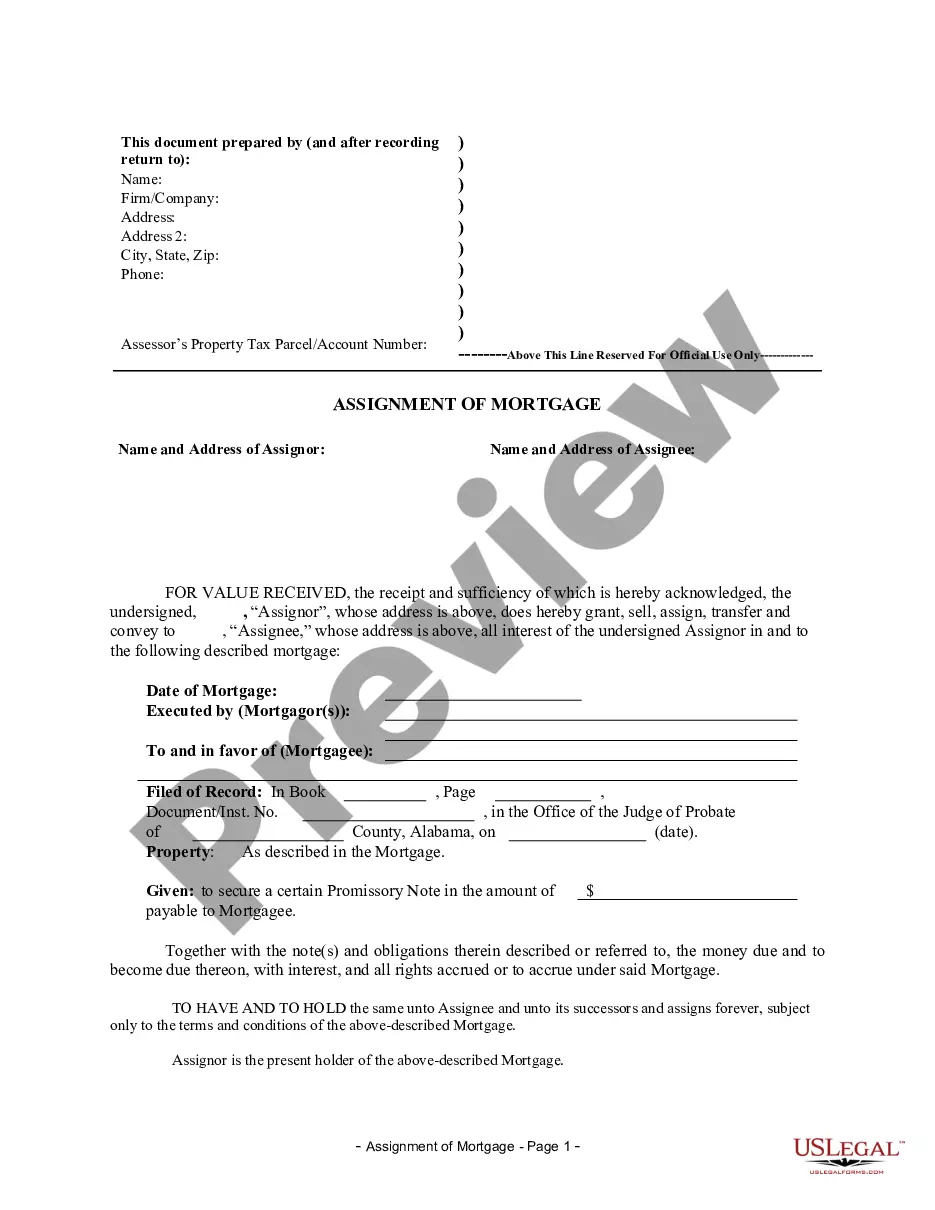

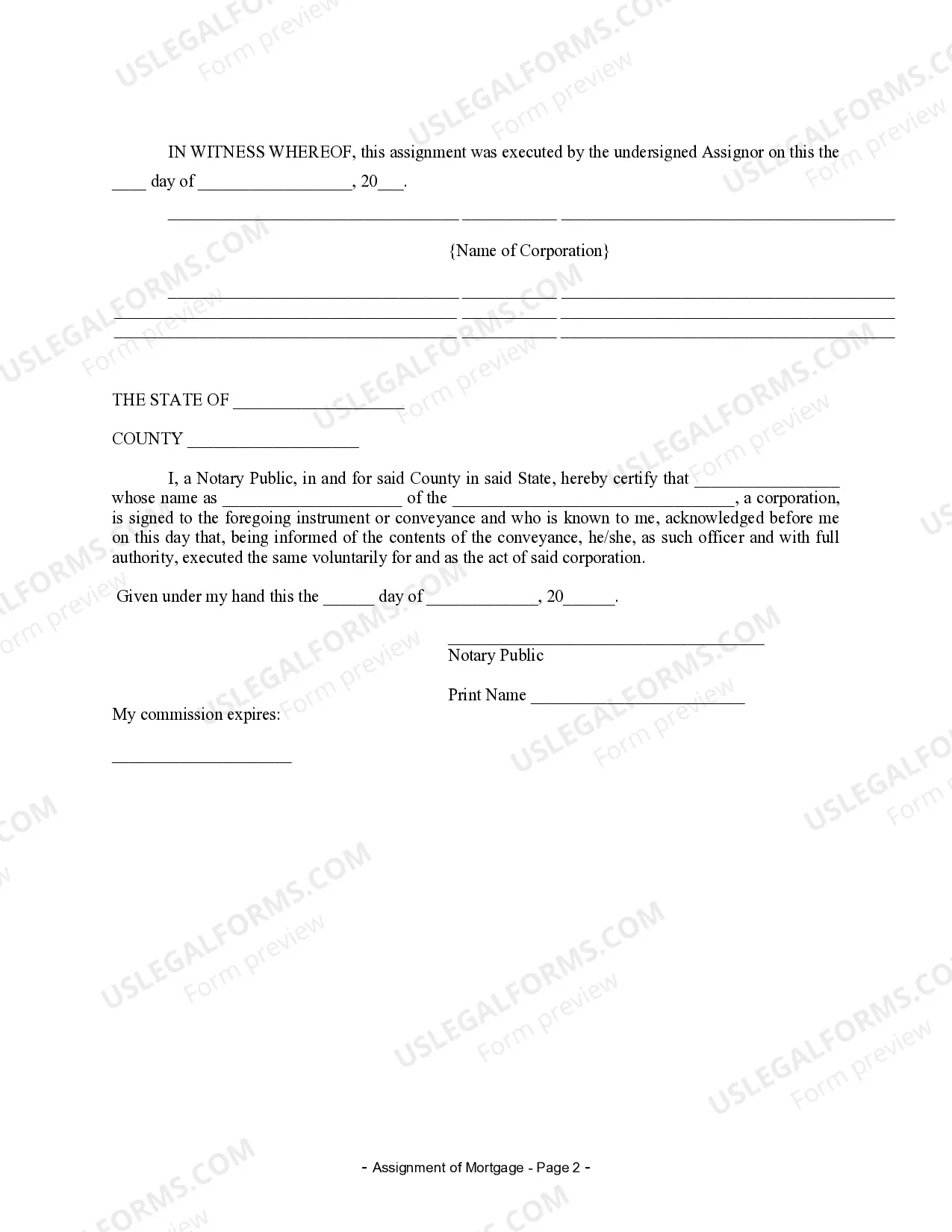

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Huntsville Alabama Assignment of Mortgage by Corporate Mortgage Holder: A Comprehensive Overview In Huntsville, Alabama, the Assignment of Mortgage by Corporate Mortgage Holder is an essential legal process that involves the transfer of a mortgage from one lender or holder to another. This transfer is generally done when the original lender or mortgage holder decides to sell or transfer the mortgage to another financial institution or investor. Keywords: Huntsville Alabama, Assignment of Mortgage, Corporate Mortgage Holder, lender, transfer, financial institution, investor. Assignment of Mortgage by Corporate Mortgage Holder is a crucial component of real estate transactions, as it outlines the legal transfer of the mortgage rights and obligations from one party to another. The transfer is documented through a written agreement, ensuring clarity and transparency in the process. There are different types of Assignment of Mortgage by Corporate Mortgage Holder in Huntsville, Alabama, depending on the specific circumstances and parties involved. Let's explore a few of them: 1. Standard Assignment: This type of assignment occurs when a corporate mortgage holder assigns the mortgage to another institution or lender. The reasons behind this transfer can vary, including debt restructuring, consolidation, or investment strategy. 2. Secondary Market Assignment: In some cases, corporate mortgage holders may choose to assign mortgages to government-sponsored enterprises like Fannie Mae or Freddie Mac. This type of assignment allows the original lender to sell their mortgage loans to these entities, freeing up capital to fund new loans. 3. Servicing Rights Assignment: Instead of transferring the entire mortgage, corporate mortgage holders may choose to assign the rights to service the loan to another institution. This assignment allows the assignee to collect payments from the borrower and handle administrative tasks related to the mortgage, such as managing escrow accounts and handling delinquencies. 4. Bulk Transfer Assignment: This type of assignment occurs when a corporate mortgage holder chooses to transfer multiple mortgages to a single entity. Bulk transfers are often seen in cases where financial institutions merge or when investors purchase a portfolio of loans. Regardless of the type of Assignment of Mortgage by Corporate Mortgage Holder, the process typically involves drafting a legally binding agreement that outlines the terms, conditions, and obligations of the transfer. This document is then recorded with the appropriate county office to ensure public notice of the change in ownership. Overall, Huntsville Alabama Assignment of Mortgage by Corporate Mortgage Holder plays a vital role in the real estate landscape, facilitating the transfer of mortgage loans between lenders and institutions. It allows financial entities to streamline their portfolios, adjust risk exposure, and adapt to changing market conditions while providing borrowers with consistent mortgage servicing. In conclusion, the Assignment of Mortgage by Corporate Mortgage Holder in Huntsville, Alabama, is a complex and vital process that requires legal documentation and ensures the smooth transfer of mortgage rights and obligations. Understanding the different types of assignments helps both lenders and borrowers navigate the intricacies of real estate transactions effectively.Huntsville Alabama Assignment of Mortgage by Corporate Mortgage Holder: A Comprehensive Overview In Huntsville, Alabama, the Assignment of Mortgage by Corporate Mortgage Holder is an essential legal process that involves the transfer of a mortgage from one lender or holder to another. This transfer is generally done when the original lender or mortgage holder decides to sell or transfer the mortgage to another financial institution or investor. Keywords: Huntsville Alabama, Assignment of Mortgage, Corporate Mortgage Holder, lender, transfer, financial institution, investor. Assignment of Mortgage by Corporate Mortgage Holder is a crucial component of real estate transactions, as it outlines the legal transfer of the mortgage rights and obligations from one party to another. The transfer is documented through a written agreement, ensuring clarity and transparency in the process. There are different types of Assignment of Mortgage by Corporate Mortgage Holder in Huntsville, Alabama, depending on the specific circumstances and parties involved. Let's explore a few of them: 1. Standard Assignment: This type of assignment occurs when a corporate mortgage holder assigns the mortgage to another institution or lender. The reasons behind this transfer can vary, including debt restructuring, consolidation, or investment strategy. 2. Secondary Market Assignment: In some cases, corporate mortgage holders may choose to assign mortgages to government-sponsored enterprises like Fannie Mae or Freddie Mac. This type of assignment allows the original lender to sell their mortgage loans to these entities, freeing up capital to fund new loans. 3. Servicing Rights Assignment: Instead of transferring the entire mortgage, corporate mortgage holders may choose to assign the rights to service the loan to another institution. This assignment allows the assignee to collect payments from the borrower and handle administrative tasks related to the mortgage, such as managing escrow accounts and handling delinquencies. 4. Bulk Transfer Assignment: This type of assignment occurs when a corporate mortgage holder chooses to transfer multiple mortgages to a single entity. Bulk transfers are often seen in cases where financial institutions merge or when investors purchase a portfolio of loans. Regardless of the type of Assignment of Mortgage by Corporate Mortgage Holder, the process typically involves drafting a legally binding agreement that outlines the terms, conditions, and obligations of the transfer. This document is then recorded with the appropriate county office to ensure public notice of the change in ownership. Overall, Huntsville Alabama Assignment of Mortgage by Corporate Mortgage Holder plays a vital role in the real estate landscape, facilitating the transfer of mortgage loans between lenders and institutions. It allows financial entities to streamline their portfolios, adjust risk exposure, and adapt to changing market conditions while providing borrowers with consistent mortgage servicing. In conclusion, the Assignment of Mortgage by Corporate Mortgage Holder in Huntsville, Alabama, is a complex and vital process that requires legal documentation and ensures the smooth transfer of mortgage rights and obligations. Understanding the different types of assignments helps both lenders and borrowers navigate the intricacies of real estate transactions effectively.