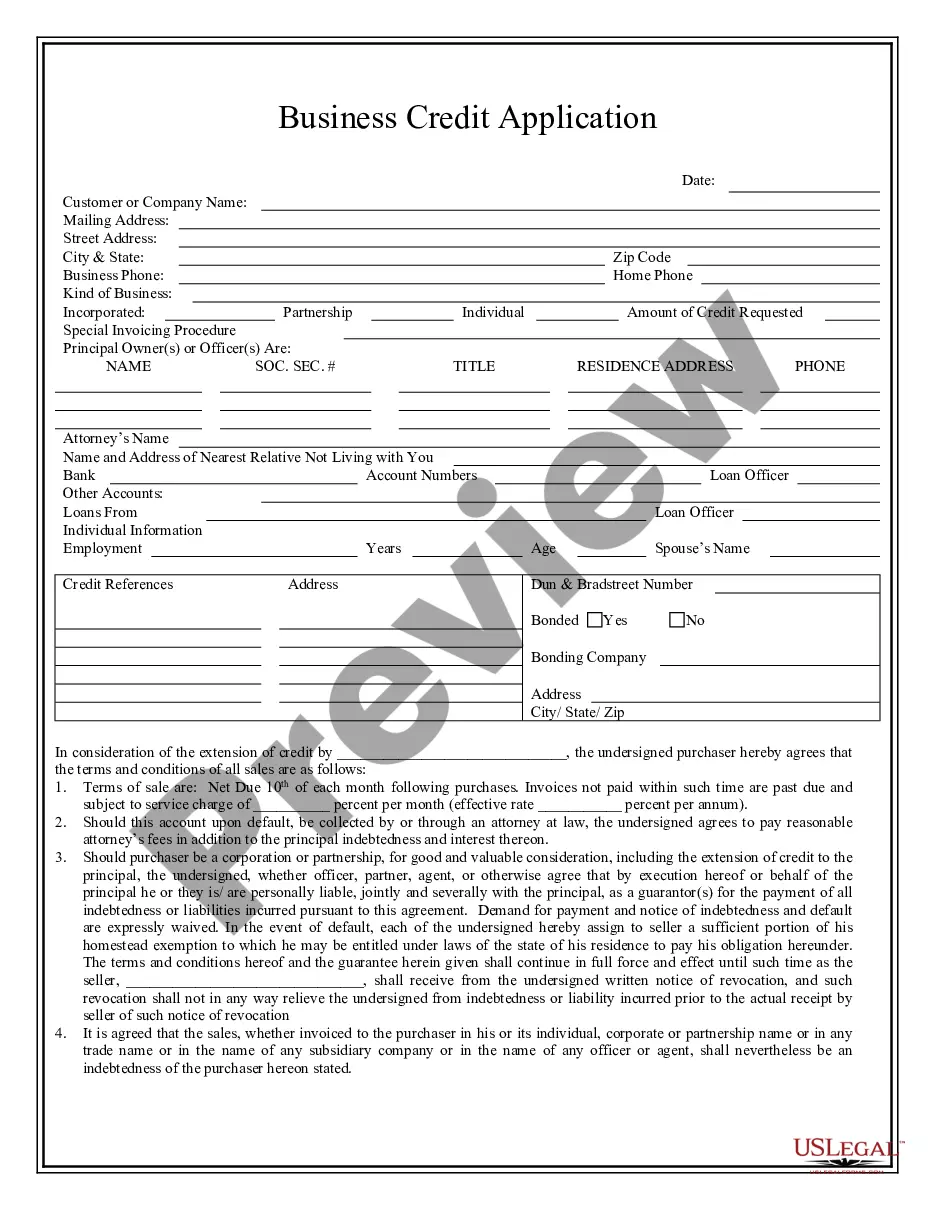

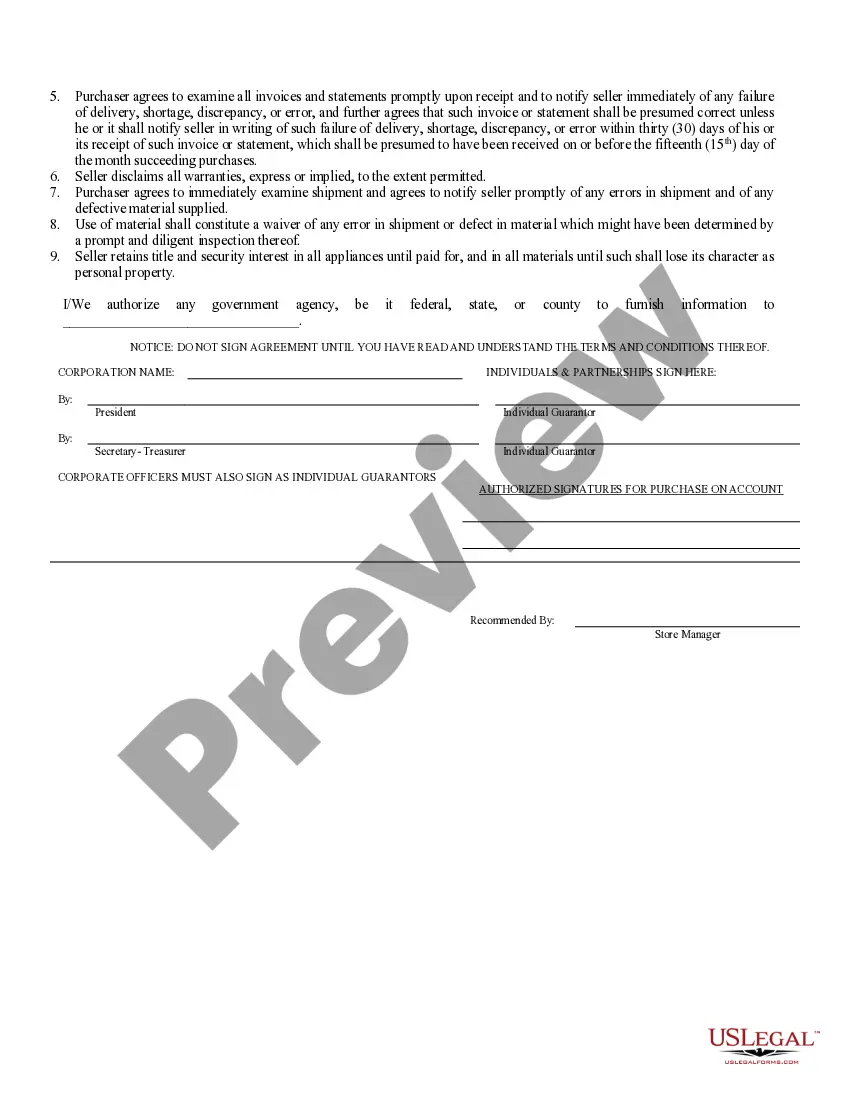

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Birmingham Alabama Business Credit Application is a comprehensive form utilized by businesses in Birmingham, Alabama, to apply for credit from various financial institutions or lenders. This application is specifically designed to gather essential information about the business, its financial status, and creditworthiness, aiding lenders in assessing the risk associated with granting credit. Keywords: Birmingham Alabama, business credit, application, financial institutions, lenders, creditworthiness, credit application. Different types of Birmingham Alabama Business Credit Applications: 1. Small Business Credit Application: This type of application is tailored for small businesses operating in Birmingham, Alabama. It considers the unique needs and characteristics of small enterprises, including their revenue, assets, and previous business history. 2. Corporate Credit Application: Catering to larger corporations in Birmingham, Alabama, the corporate credit application delves into more complex financial aspects. It requires detailed information about corporate structure, financial statements, tax records, and legal documentation. 3. Start-up Business Credit Application: Aimed at newly established businesses in Birmingham, Alabama, the start-up business credit application focuses on the owner's personal financial history, business plan, as well as any existing assets or funding sources. 4. Industry-Specific Credit Application: Some industries in Birmingham, Alabama, may require specialized credit applications tailored to their unique requirements. Examples include construction credit applications, retail credit applications, healthcare credit applications, and many others. 5. Supplier Credit Application: Businesses in Birmingham, Alabama, frequently apply for credit from suppliers to receive goods or services on credit terms. The supplier credit application focuses on the specific needs of businesses seeking credit exclusively from suppliers. 6. Vendor Credit Application: Similar to the supplier credit application, the vendor credit application is designed for Birmingham, Alabama businesses looking to establish credit arrangements with vendors for ongoing business operations. 7. Business Line of Credit Application: This application is specifically for businesses in Birmingham, Alabama, seeking a revolving line of credit. It encompasses the evaluation of borrowing needs, collateral, financial statements, and credit history. By tailoring the credit application to different Birmingham, Alabama business types and industries, these variations ensure a more accurate assessment of creditworthiness and suitability for various lending situations.The Birmingham Alabama Business Credit Application is a comprehensive form utilized by businesses in Birmingham, Alabama, to apply for credit from various financial institutions or lenders. This application is specifically designed to gather essential information about the business, its financial status, and creditworthiness, aiding lenders in assessing the risk associated with granting credit. Keywords: Birmingham Alabama, business credit, application, financial institutions, lenders, creditworthiness, credit application. Different types of Birmingham Alabama Business Credit Applications: 1. Small Business Credit Application: This type of application is tailored for small businesses operating in Birmingham, Alabama. It considers the unique needs and characteristics of small enterprises, including their revenue, assets, and previous business history. 2. Corporate Credit Application: Catering to larger corporations in Birmingham, Alabama, the corporate credit application delves into more complex financial aspects. It requires detailed information about corporate structure, financial statements, tax records, and legal documentation. 3. Start-up Business Credit Application: Aimed at newly established businesses in Birmingham, Alabama, the start-up business credit application focuses on the owner's personal financial history, business plan, as well as any existing assets or funding sources. 4. Industry-Specific Credit Application: Some industries in Birmingham, Alabama, may require specialized credit applications tailored to their unique requirements. Examples include construction credit applications, retail credit applications, healthcare credit applications, and many others. 5. Supplier Credit Application: Businesses in Birmingham, Alabama, frequently apply for credit from suppliers to receive goods or services on credit terms. The supplier credit application focuses on the specific needs of businesses seeking credit exclusively from suppliers. 6. Vendor Credit Application: Similar to the supplier credit application, the vendor credit application is designed for Birmingham, Alabama businesses looking to establish credit arrangements with vendors for ongoing business operations. 7. Business Line of Credit Application: This application is specifically for businesses in Birmingham, Alabama, seeking a revolving line of credit. It encompasses the evaluation of borrowing needs, collateral, financial statements, and credit history. By tailoring the credit application to different Birmingham, Alabama business types and industries, these variations ensure a more accurate assessment of creditworthiness and suitability for various lending situations.