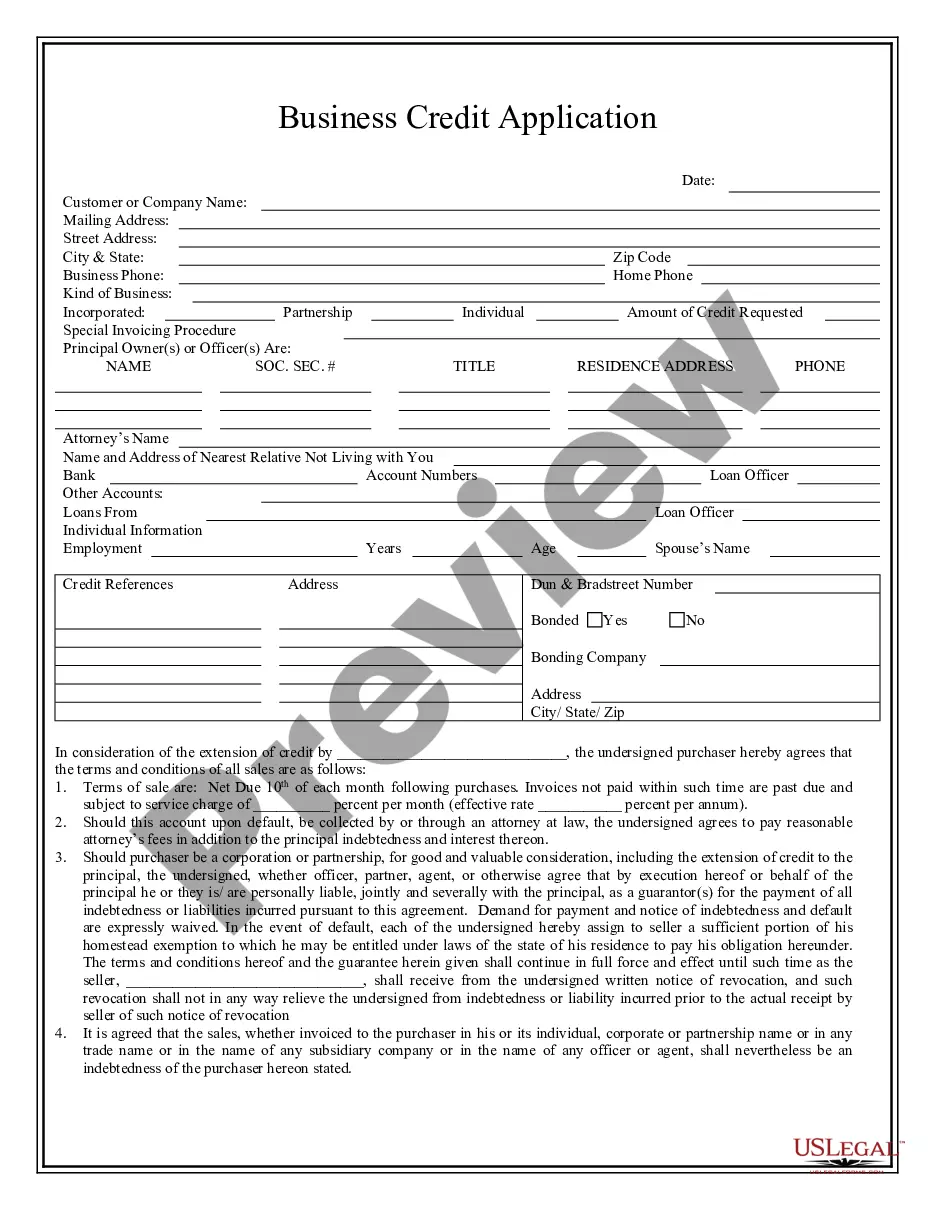

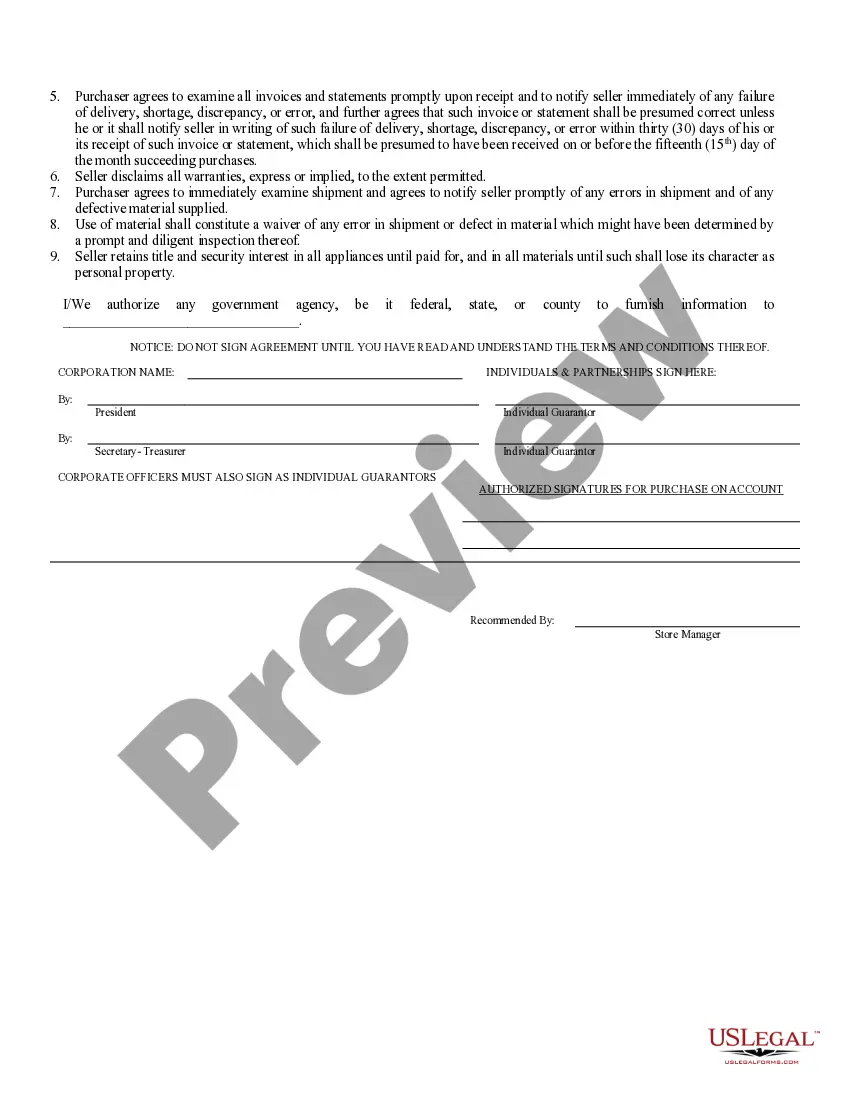

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Huntsville Alabama Business Credit Application is an essential document required by businesses in the city of Huntsville, Alabama, to apply for credit from financial institutions, suppliers, and vendors. This application allows businesses to establish creditworthiness and demonstrates their ability to repay debts incurred through transactions. The Huntsville Alabama Business Credit Application serves as a comprehensive tool that helps analyze the financial standing, business operations, and credit history of a company. It requires the applicant to provide various details to assess their eligibility for credit. These details typically include: 1. Business Information: The application requests general information about the business, such as the company name, address, contact information, and date of establishment. It may also require the applicant to share the legal structure of the business (e.g., sole proprietorship, partnership, corporation). 2. Owner/Principal Information: This section requires the disclosure of personal information about the principal or owner of the business, such as their name, address, contact details, and social security number. This ensures transparency and allows the lender to evaluate the individual's creditworthiness as well. 3. Financial Statements: The credit application may ask for financial statements to assess the company's financial health. These statements usually include income statements, balance sheets, and cash flow statements. Lenders review these documents to determine the business's ability to meet financial obligations. 4. Trade References: The application often requests trade references—previous creditors or suppliers with whom the business has conducted transactions. These references provide insight into the business's payment history and relationships with other creditors. 5. Bank References: The applicant may be asked to provide references from their bank or banks where they hold business accounts. These references help the lender assess the company's banking history, account balances, and overall financial stability. Different types of Huntsville Alabama Business Credit Applications may exist, tailored to specific purposes or industries. Some variations may include: 1. Small Business Credit Application: This type of application specifically caters to small businesses in Huntsville, Alabama. It considers the unique financial circumstances and requirements of small-scale enterprises. 2. Vendor Credit Application: Vendor credit applications are designed for businesses seeking credit specifically from suppliers and vendors. These applications may focus on assessing the company's relationship with suppliers, previous credit history, and payment terms. 3. Corporate Credit Application: Large corporations and established businesses often require extensive credit facilities. Corporate credit applications capture detailed information about multiple business entities, subsidiaries, and their respective financial data. 4. Startup Business Credit Application: Startups in Huntsville, Alabama, might have different credit application requirements due to limited operating history. Startups may be required to provide comprehensive business plans, financial projections, and personal guarantees from the owners for credit evaluation. It is essential for businesses in Huntsville, Alabama, to complete a comprehensive and accurate credit application to maximize their chances of obtaining credit. Providing detailed information and maintaining a good credit history are critical for businesses to secure favorable credit terms and enhance their financial stability.The Huntsville Alabama Business Credit Application is an essential document required by businesses in the city of Huntsville, Alabama, to apply for credit from financial institutions, suppliers, and vendors. This application allows businesses to establish creditworthiness and demonstrates their ability to repay debts incurred through transactions. The Huntsville Alabama Business Credit Application serves as a comprehensive tool that helps analyze the financial standing, business operations, and credit history of a company. It requires the applicant to provide various details to assess their eligibility for credit. These details typically include: 1. Business Information: The application requests general information about the business, such as the company name, address, contact information, and date of establishment. It may also require the applicant to share the legal structure of the business (e.g., sole proprietorship, partnership, corporation). 2. Owner/Principal Information: This section requires the disclosure of personal information about the principal or owner of the business, such as their name, address, contact details, and social security number. This ensures transparency and allows the lender to evaluate the individual's creditworthiness as well. 3. Financial Statements: The credit application may ask for financial statements to assess the company's financial health. These statements usually include income statements, balance sheets, and cash flow statements. Lenders review these documents to determine the business's ability to meet financial obligations. 4. Trade References: The application often requests trade references—previous creditors or suppliers with whom the business has conducted transactions. These references provide insight into the business's payment history and relationships with other creditors. 5. Bank References: The applicant may be asked to provide references from their bank or banks where they hold business accounts. These references help the lender assess the company's banking history, account balances, and overall financial stability. Different types of Huntsville Alabama Business Credit Applications may exist, tailored to specific purposes or industries. Some variations may include: 1. Small Business Credit Application: This type of application specifically caters to small businesses in Huntsville, Alabama. It considers the unique financial circumstances and requirements of small-scale enterprises. 2. Vendor Credit Application: Vendor credit applications are designed for businesses seeking credit specifically from suppliers and vendors. These applications may focus on assessing the company's relationship with suppliers, previous credit history, and payment terms. 3. Corporate Credit Application: Large corporations and established businesses often require extensive credit facilities. Corporate credit applications capture detailed information about multiple business entities, subsidiaries, and their respective financial data. 4. Startup Business Credit Application: Startups in Huntsville, Alabama, might have different credit application requirements due to limited operating history. Startups may be required to provide comprehensive business plans, financial projections, and personal guarantees from the owners for credit evaluation. It is essential for businesses in Huntsville, Alabama, to complete a comprehensive and accurate credit application to maximize their chances of obtaining credit. Providing detailed information and maintaining a good credit history are critical for businesses to secure favorable credit terms and enhance their financial stability.