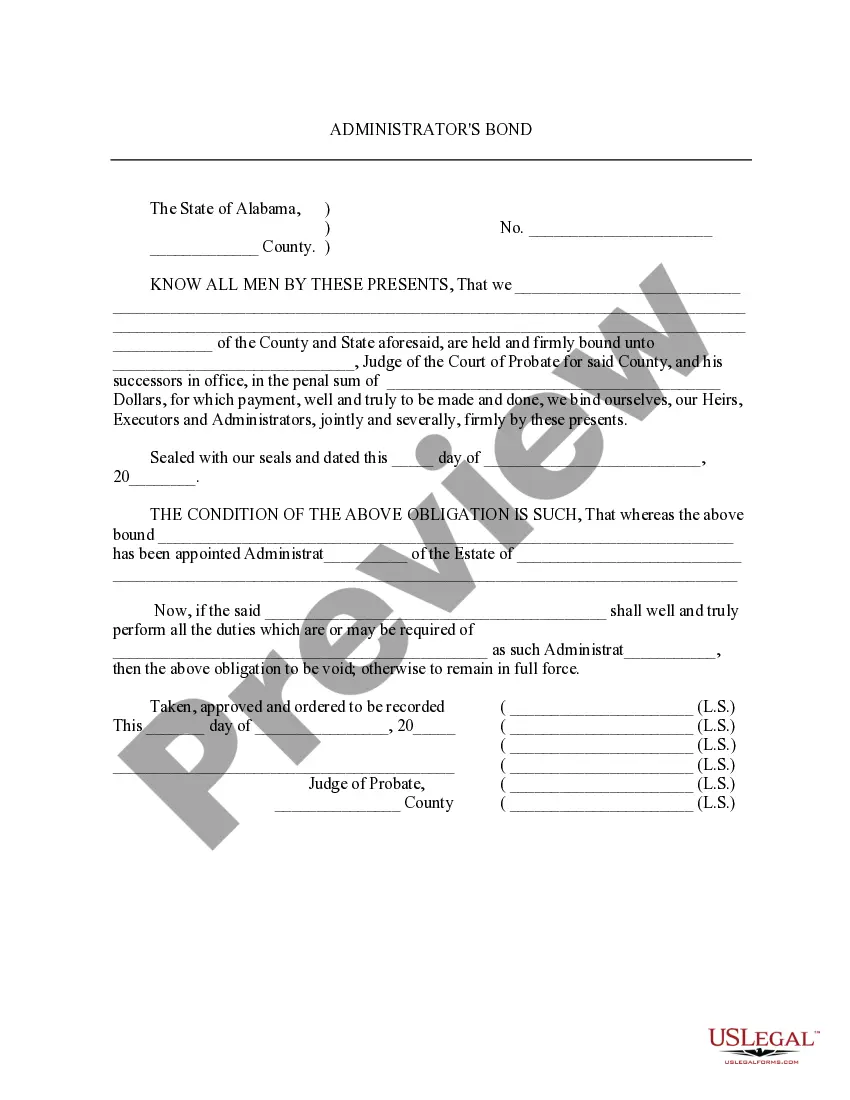

This is a sample Administrator's Bond offered during the administration of an estate to ensure that administration is completed and done accurately.

The Huntsville Alabama Administrator's Bond is a legally required surety bond that ensures the proper and faithful handling of estates, trusts, or assets by administrators in Huntsville, Alabama. This bond acts as a financial guarantee for the beneficiaries that the administrator will fulfill their duties honestly, diligently, and in compliance with the law. Administering an estate or a trust involves managing and distributing assets, paying debts and taxes, resolving legal matters, and accounting for all transactions involved. During this process, an administrator may be tasked with handling significant sums of money and dealing with complex financial matters. The Huntsville Alabama Administrator's Bond provides protection and reassurance to the beneficiaries that their interests will be safeguarded. This bond serves as a form of insurance. In the event that the administrator engages in fraudulent activities, misappropriates funds, fails to fulfill their obligations, or breaches their fiduciary duties, the bond can compensate the beneficiaries for their financial losses. It also provides a legal avenue for recourse in case of any misconduct or negligence by the administrator. There are several types of Huntsville Alabama Administrator's Bond, including: 1. Estate Administrator's Bond: This bond is specifically designed for administrators overseeing the probate process of a deceased person's estate. It ensures that the administrator manages the estate's assets properly, pays off outstanding debts and taxes, and distributes the remaining assets to beneficiaries according to the will or Alabama state law. 2. Trust Administrator's Bond: This type of bond is required when an administrator is appointed to manage a trust. Whether it is a testamentary trust established by a will or a living trust created during the granter's lifetime, the bond guarantees that the administrator will handle the trust assets competently, make appropriate investments, and disburse funds as stipulated in the trust document. 3. Conservator's Bond: In cases where an individual is appointed as a conservator to manage the financial affairs of a minor or incapacitated adult, the Huntsville Alabama Administrator's Bond serves as a protective measure. It ensures that the conservator will act in the best interests of the ward, responsibly handle their assets, and provide accurate accounting of all transactions. 4. Guardian's Bond: When someone is appointed as a guardian to care for a minor or an incapacitated adult, this bond ensures the guardian's responsible management of the individual's personal affairs, assets, and general well-being. In summary, the Huntsville Alabama Administrator's Bond is a crucial requirement for administrators overseeing estates, trusts, conservatorships, and guardianship. It provides beneficiaries with financial protection and legal recourse in case of any malfeasance by the administrator. When obtaining such a bond, it is important to consult a reputable surety bond provider in Huntsville, Alabama, for accurate guidance and compliance with all legal requirements.The Huntsville Alabama Administrator's Bond is a legally required surety bond that ensures the proper and faithful handling of estates, trusts, or assets by administrators in Huntsville, Alabama. This bond acts as a financial guarantee for the beneficiaries that the administrator will fulfill their duties honestly, diligently, and in compliance with the law. Administering an estate or a trust involves managing and distributing assets, paying debts and taxes, resolving legal matters, and accounting for all transactions involved. During this process, an administrator may be tasked with handling significant sums of money and dealing with complex financial matters. The Huntsville Alabama Administrator's Bond provides protection and reassurance to the beneficiaries that their interests will be safeguarded. This bond serves as a form of insurance. In the event that the administrator engages in fraudulent activities, misappropriates funds, fails to fulfill their obligations, or breaches their fiduciary duties, the bond can compensate the beneficiaries for their financial losses. It also provides a legal avenue for recourse in case of any misconduct or negligence by the administrator. There are several types of Huntsville Alabama Administrator's Bond, including: 1. Estate Administrator's Bond: This bond is specifically designed for administrators overseeing the probate process of a deceased person's estate. It ensures that the administrator manages the estate's assets properly, pays off outstanding debts and taxes, and distributes the remaining assets to beneficiaries according to the will or Alabama state law. 2. Trust Administrator's Bond: This type of bond is required when an administrator is appointed to manage a trust. Whether it is a testamentary trust established by a will or a living trust created during the granter's lifetime, the bond guarantees that the administrator will handle the trust assets competently, make appropriate investments, and disburse funds as stipulated in the trust document. 3. Conservator's Bond: In cases where an individual is appointed as a conservator to manage the financial affairs of a minor or incapacitated adult, the Huntsville Alabama Administrator's Bond serves as a protective measure. It ensures that the conservator will act in the best interests of the ward, responsibly handle their assets, and provide accurate accounting of all transactions. 4. Guardian's Bond: When someone is appointed as a guardian to care for a minor or an incapacitated adult, this bond ensures the guardian's responsible management of the individual's personal affairs, assets, and general well-being. In summary, the Huntsville Alabama Administrator's Bond is a crucial requirement for administrators overseeing estates, trusts, conservatorships, and guardianship. It provides beneficiaries with financial protection and legal recourse in case of any malfeasance by the administrator. When obtaining such a bond, it is important to consult a reputable surety bond provider in Huntsville, Alabama, for accurate guidance and compliance with all legal requirements.