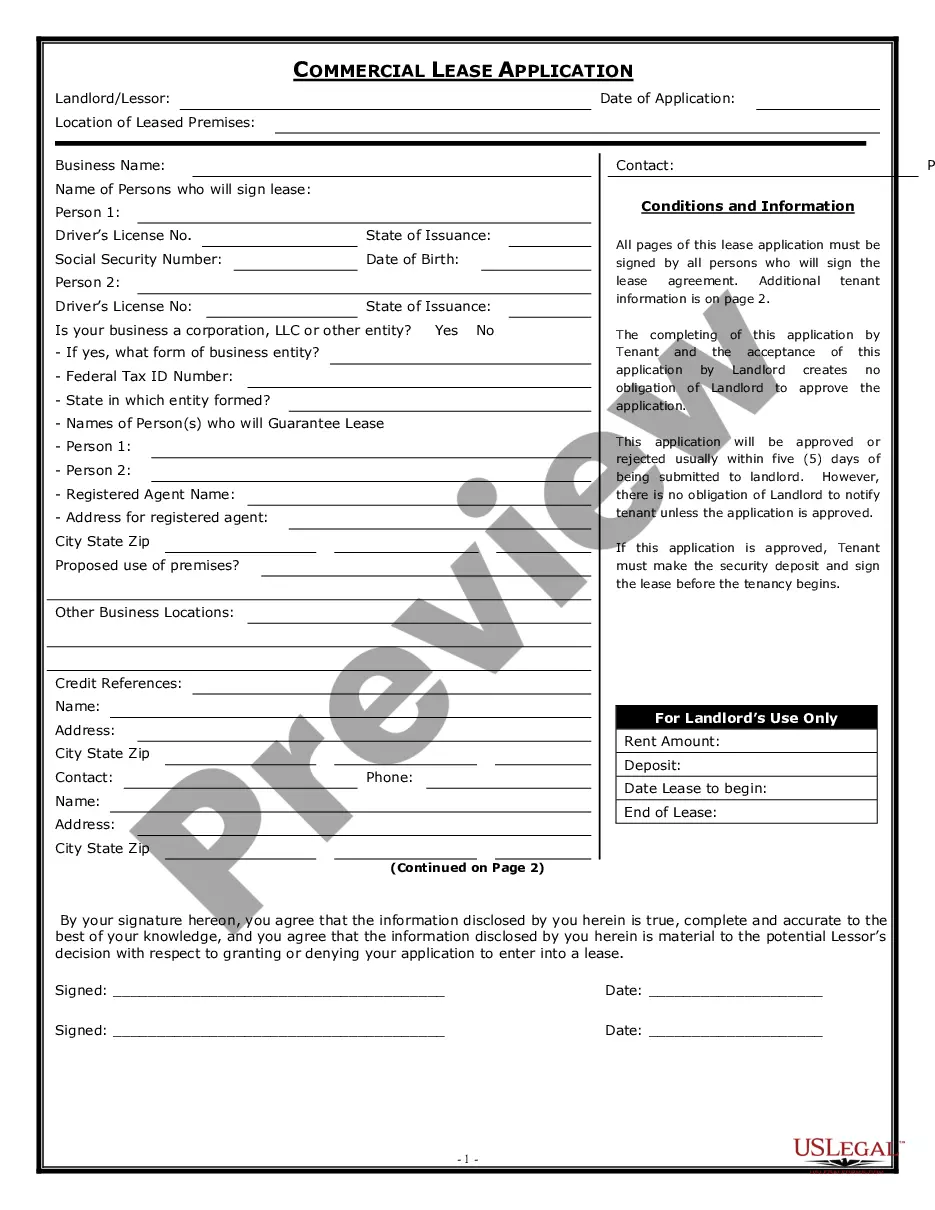

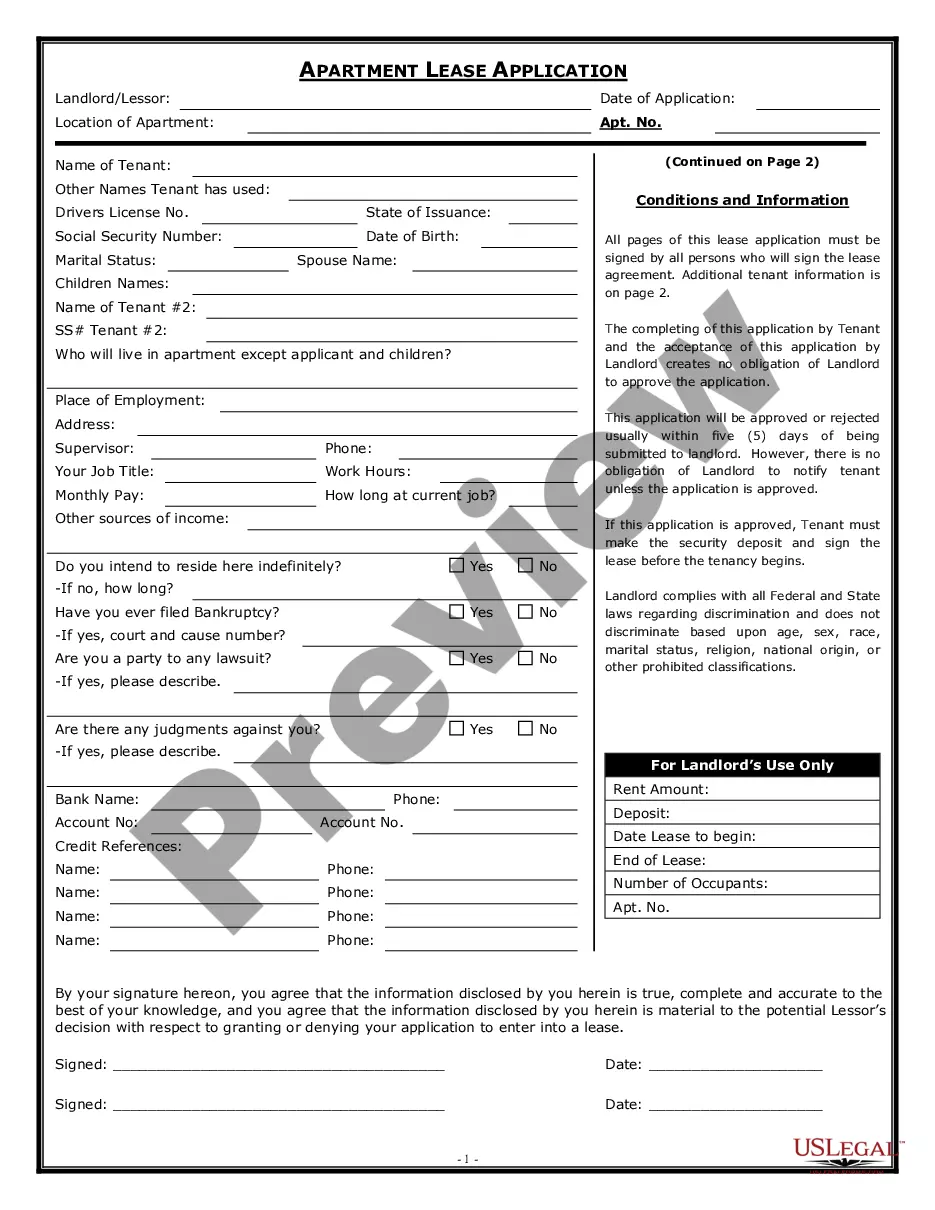

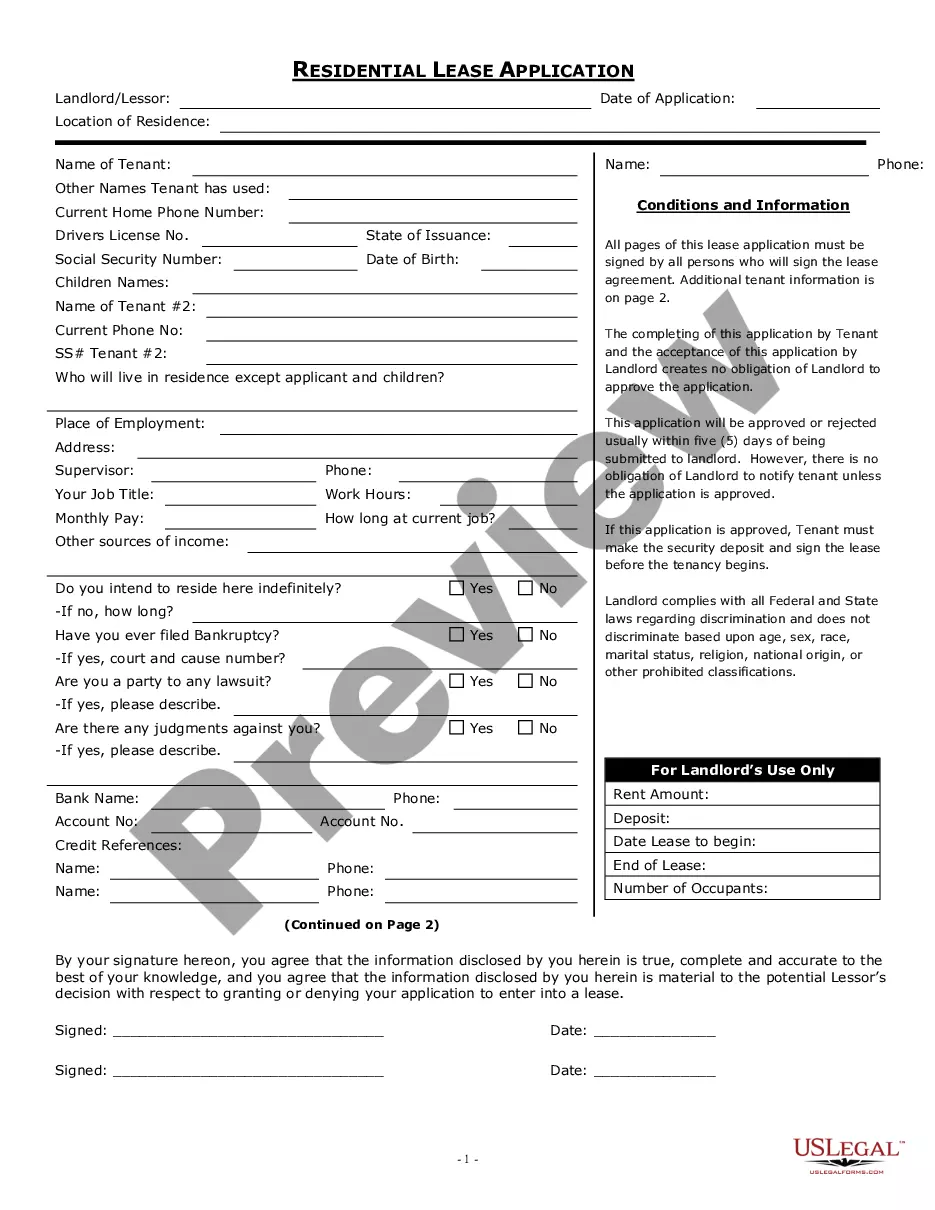

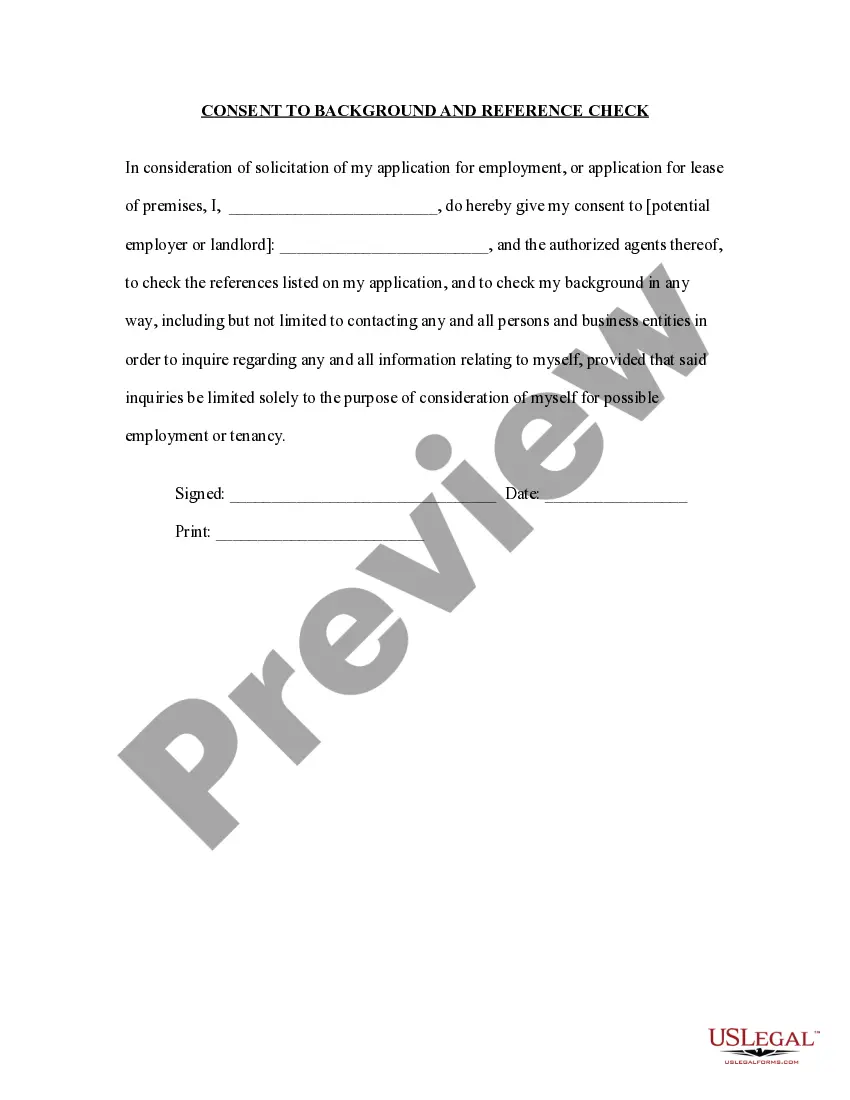

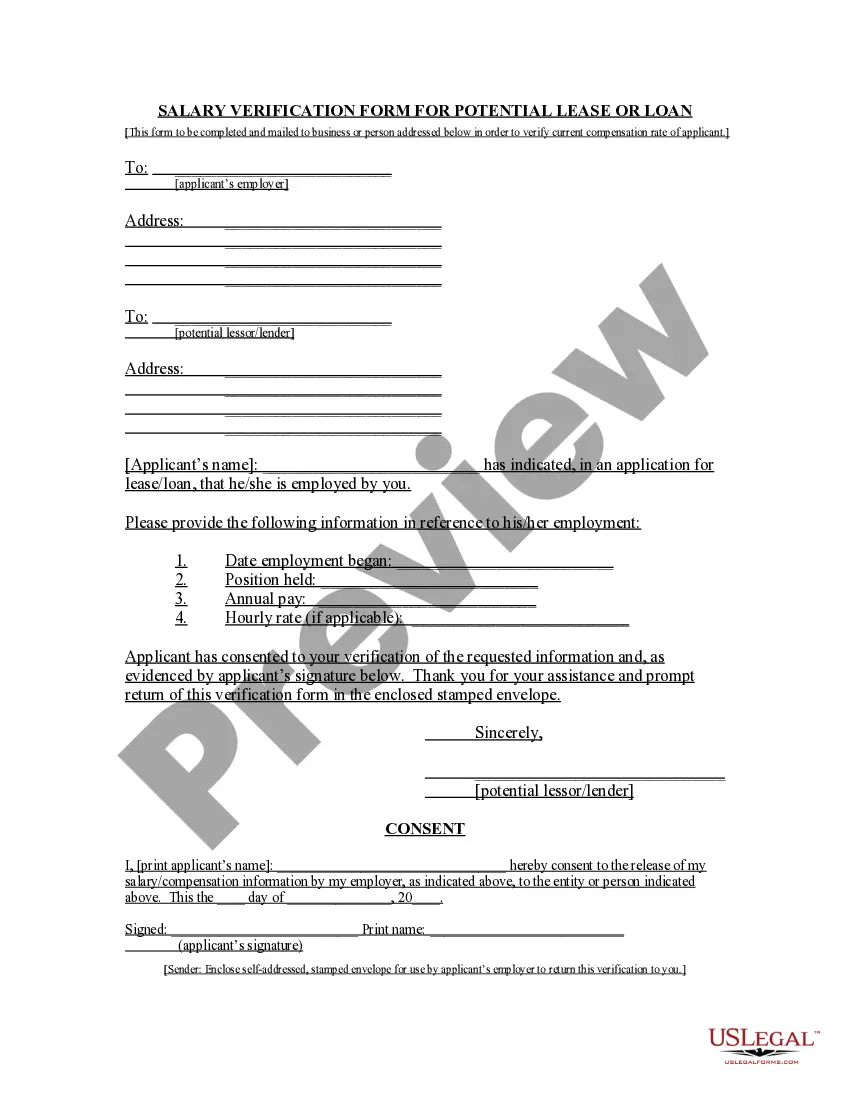

This Salary Verification form for Potential Lease is a form to be sent to a potential tenant's employer, in order for the Landlord to verify the lease applicant's income as reported on an application for lease (please see Form -827LT "Application for Residential Lease"). A Tenant Consent Form comes with the Salary Verification Form, and should also be sent to the employer.

In Birmingham, Alabama, a Salary Verification form for Potential Lease is a crucial document used by landlords and property managers to assess the financial stability and capability of potential tenants to meet their monthly housing obligations. This form acts as evidence of income and allows the landlord to verify the applicant's salary or wages. The Birmingham Alabama Salary Verification form for Potential Lease typically requests detailed information about the applicant's employment, including the name and address of the employer, job title, and length of employment. It may also require the applicant to state their current salary or hourly wage, number of hours worked per week, and any additional sources of income. Moreover, the form often includes sections to disclose other financial assets such as investments, bank accounts, and relevant debts. This information helps landlords assess the overall financial health of the applicant and evaluate their ability to consistently pay rent on time. Different types of Birmingham Alabama Salary Verification forms for Potential Lease can vary based on the specific requirements of individual landlords or property management companies. Some variations may include additional sections requesting information about the applicant's rental history, including previous addresses and landlord references. Additionally, certain landlords may demand more detailed income documentation beyond the basic form. This can include recent pay stubs, bank statements, or tax returns to provide further evidence of the applicant's income and financial stability. Overall, the purpose of the Birmingham Alabama Salary Verification form for Potential Lease is to allow landlords and property managers to make informed decisions when selecting tenants. It ensures that the chosen tenant has a steady income to sustain the lease agreement, minimizing the risk of late payments or potential eviction.In Birmingham, Alabama, a Salary Verification form for Potential Lease is a crucial document used by landlords and property managers to assess the financial stability and capability of potential tenants to meet their monthly housing obligations. This form acts as evidence of income and allows the landlord to verify the applicant's salary or wages. The Birmingham Alabama Salary Verification form for Potential Lease typically requests detailed information about the applicant's employment, including the name and address of the employer, job title, and length of employment. It may also require the applicant to state their current salary or hourly wage, number of hours worked per week, and any additional sources of income. Moreover, the form often includes sections to disclose other financial assets such as investments, bank accounts, and relevant debts. This information helps landlords assess the overall financial health of the applicant and evaluate their ability to consistently pay rent on time. Different types of Birmingham Alabama Salary Verification forms for Potential Lease can vary based on the specific requirements of individual landlords or property management companies. Some variations may include additional sections requesting information about the applicant's rental history, including previous addresses and landlord references. Additionally, certain landlords may demand more detailed income documentation beyond the basic form. This can include recent pay stubs, bank statements, or tax returns to provide further evidence of the applicant's income and financial stability. Overall, the purpose of the Birmingham Alabama Salary Verification form for Potential Lease is to allow landlords and property managers to make informed decisions when selecting tenants. It ensures that the chosen tenant has a steady income to sustain the lease agreement, minimizing the risk of late payments or potential eviction.