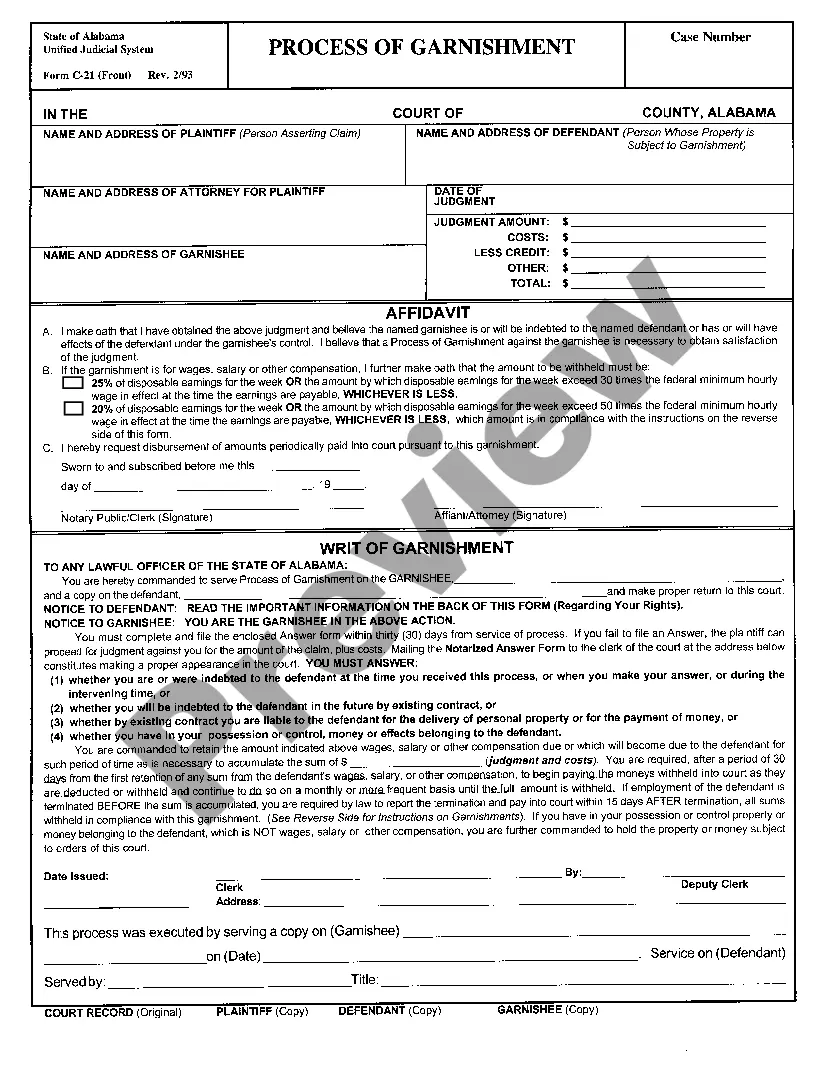

Alabama Official Form - Process of Garnishment to be served on garnishee.

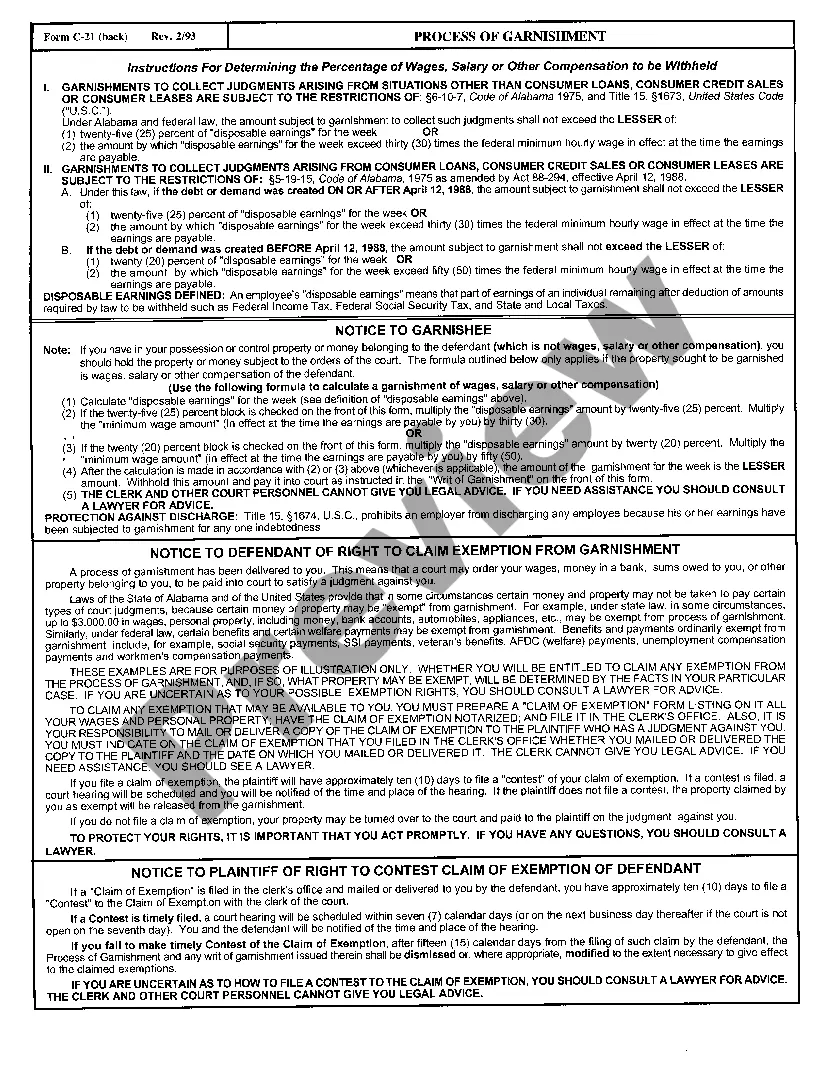

Birmingham Alabama Process of Garnishment is a legal procedure through which a creditor can collect a debt by obtaining a court order to seize a portion of a debtor's wages, bank accounts, or personal property. This process involves various steps and should be properly understood by both debtors and creditors. One type of garnishment in Birmingham, Alabama is Wage Garnishment. This occurs when a creditor, after securing a judgment against a debtor, seeks to collect the debt by taking a portion of the debtor's wages directly from their employer. The garnishment process begins with the creditor filing a lawsuit against the debtor, obtaining a judgment, and then filing a Garnishment Affidavit with the court. The debtor's employer is then required to withhold a percentage of the debtor's wages and remit it to the court or the creditor until the debt is satisfied. Another type of garnishment is Bank Account Garnishment. This process involves creditors obtaining a judgment against the debtor and then securing a court order to freeze the debtor's bank account or seize funds from it. The creditor initiates the process by filing a lawsuit and obtaining a judgment. They then file a Garnishment Affidavit, which is served on the debtor's bank. The bank is then required to freeze the debtor's account up to the amount owed to the creditor, providing an opportunity for the debtor to challenge the garnishment. If the debtor fails to assert any legal defenses, the funds may be released to the creditor. It is important to note that there are exemptions to garnishment in Birmingham, Alabama, including certain types of income like social security benefits, retirement funds, and disability payments. Additionally, garnishment limits apply to the amount that can be taken from a debtor's wages or bank account. The Birmingham Alabama Process of Garnishment ensures that creditors have a legal means to collect outstanding debts. However, debtors also have rights and protections under the law, and they should seek legal advice if faced with garnishment. Understanding the process, exemptions, and limitations can help both parties navigate this legal procedure effectively.Birmingham Alabama Process of Garnishment is a legal procedure through which a creditor can collect a debt by obtaining a court order to seize a portion of a debtor's wages, bank accounts, or personal property. This process involves various steps and should be properly understood by both debtors and creditors. One type of garnishment in Birmingham, Alabama is Wage Garnishment. This occurs when a creditor, after securing a judgment against a debtor, seeks to collect the debt by taking a portion of the debtor's wages directly from their employer. The garnishment process begins with the creditor filing a lawsuit against the debtor, obtaining a judgment, and then filing a Garnishment Affidavit with the court. The debtor's employer is then required to withhold a percentage of the debtor's wages and remit it to the court or the creditor until the debt is satisfied. Another type of garnishment is Bank Account Garnishment. This process involves creditors obtaining a judgment against the debtor and then securing a court order to freeze the debtor's bank account or seize funds from it. The creditor initiates the process by filing a lawsuit and obtaining a judgment. They then file a Garnishment Affidavit, which is served on the debtor's bank. The bank is then required to freeze the debtor's account up to the amount owed to the creditor, providing an opportunity for the debtor to challenge the garnishment. If the debtor fails to assert any legal defenses, the funds may be released to the creditor. It is important to note that there are exemptions to garnishment in Birmingham, Alabama, including certain types of income like social security benefits, retirement funds, and disability payments. Additionally, garnishment limits apply to the amount that can be taken from a debtor's wages or bank account. The Birmingham Alabama Process of Garnishment ensures that creditors have a legal means to collect outstanding debts. However, debtors also have rights and protections under the law, and they should seek legal advice if faced with garnishment. Understanding the process, exemptions, and limitations can help both parties navigate this legal procedure effectively.