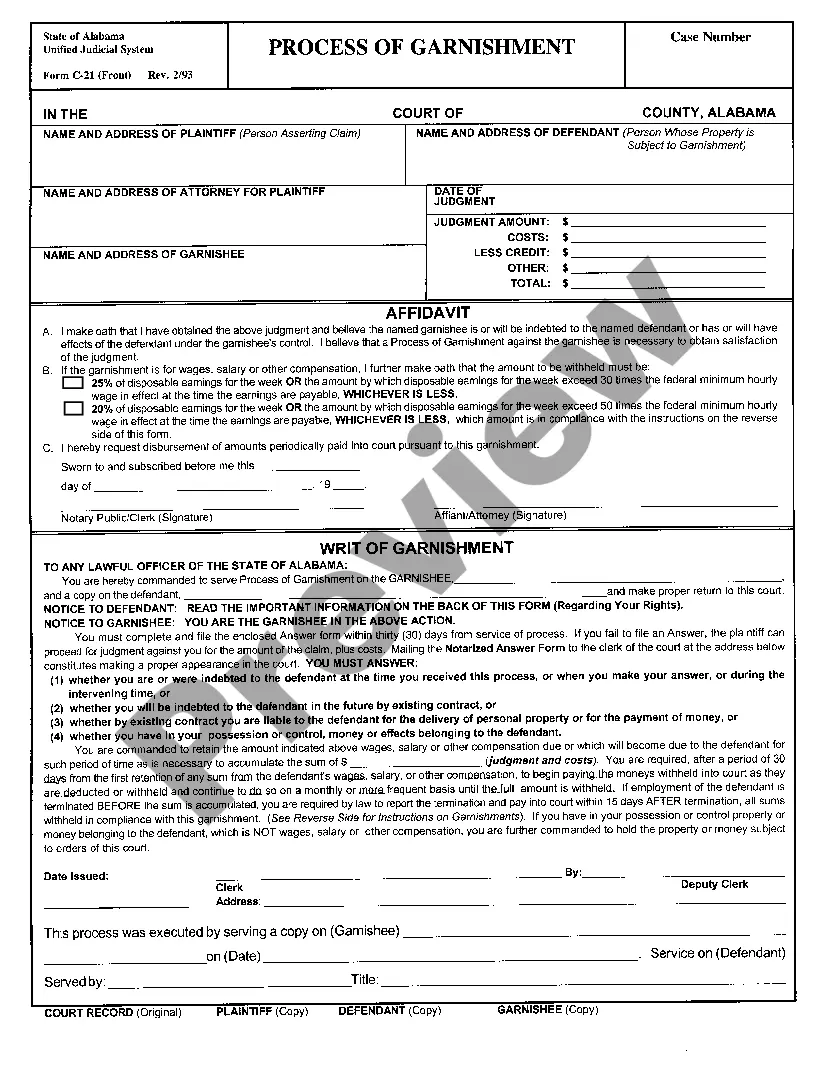

Alabama Official Form - Process of Garnishment to be served on garnishee.

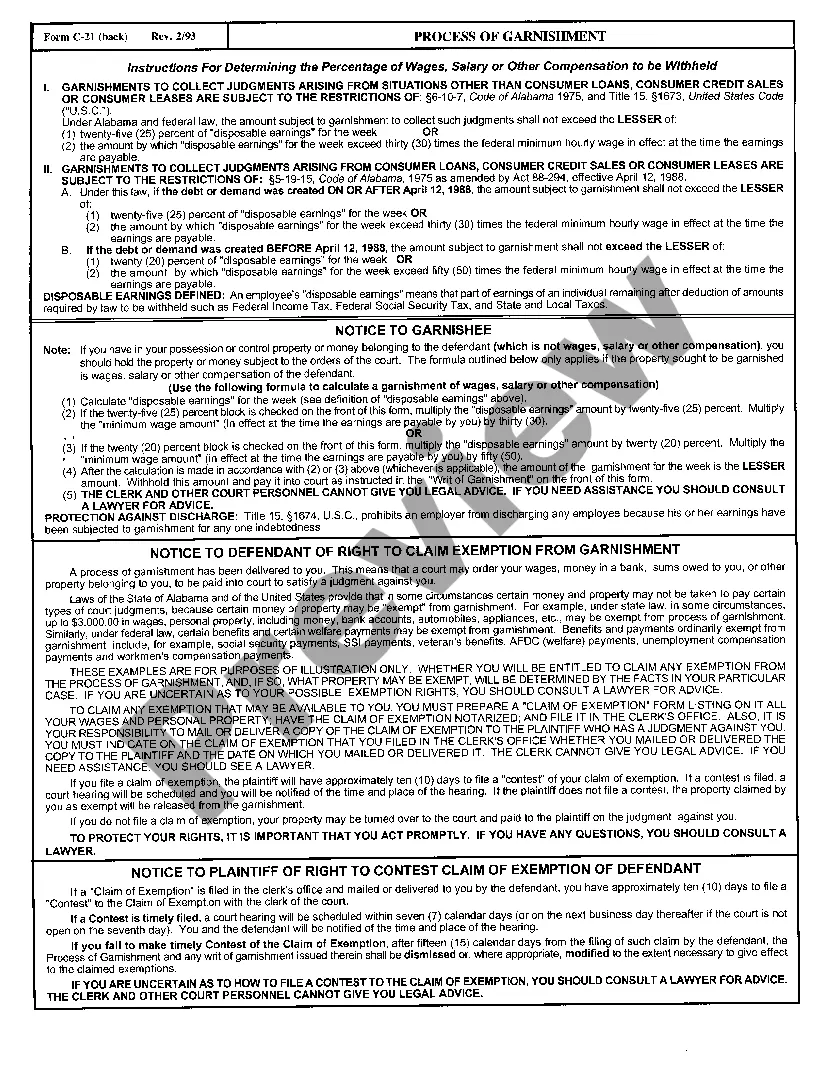

Huntsville, Alabama Process of Garnishment: An In-depth Overview and Types In Huntsville, Alabama, the process of garnishment refers to the legal method of collecting a debt owed by an individual through the seizure of their wages, assets, or funds held by third parties. It is an important tool utilized by creditors seeking to recover debts owed to them by debtors based in Huntsville, Alabama. Understanding the process and the different types of garnishment available is crucial for both creditors and debtors. 1. Wage Garnishment: One of the most common types of garnishment in Huntsville, Alabama is wage garnishment. With wage garnishment, creditors can legally request a portion of a debtor's wages be withheld by their employer. The employer then sends this withheld amount to the creditor until the debt is entirely repaid. The process involves filing a lawsuit against the debtor, obtaining a judgment, and sending a notice of garnishment to their employer, who must comply with the instructions provided. 2. Bank Account Garnishment: Another type of garnishment is bank account garnishment. Creditors can seek to collect unpaid debts by freezing a debtor's bank account and requiring the bank to transfer funds to satisfy the debt. This process typically involves obtaining a judgment against the debtor and serving a notice of garnishment to their bank. Once the bank receives the notice, they freeze the account and distribute the funds to the creditor, up to the amount owed. 3. Property Garnishment: Property garnishment, also known as attachment or sheriff sale, allows creditors to seize and sell a debtor's property to recover a debt. This type of garnishment is typically used for significant debts, where the creditor seeks to satisfy the debt by liquidating valuable assets such as vehicles, real estate, or non-exempt personal property. The process involves obtaining a judgment and working with the sheriff's department to execute the sale and transfer the funds to the creditor. 4. Child Support and Alimony Garnishment: In Huntsville, Alabama, garnishment is also utilized for the collection of unpaid child support or alimony payments. The Department of Human Resources (DHR) can garnish wages, tax refunds, and other income sources to ensure that individuals fulfill their financial obligations towards their children or former spouses. DHR can initiate this process without obtaining a judgment, under specific circumstances where it is authorized by law. It is important to note that Huntsville, Alabama follows both state and federal garnishment laws, including the Fair Debt Collection Practices Act (FD CPA) and the Alabama Code. These laws establish guidelines and limitations to protect debtors' rights while allowing creditors to recover their debts lawfully. If you find yourself subject to the Huntsville, Alabama process of garnishment, it is essential to seek legal advice to understand your rights and options for potential resolution.Huntsville, Alabama Process of Garnishment: An In-depth Overview and Types In Huntsville, Alabama, the process of garnishment refers to the legal method of collecting a debt owed by an individual through the seizure of their wages, assets, or funds held by third parties. It is an important tool utilized by creditors seeking to recover debts owed to them by debtors based in Huntsville, Alabama. Understanding the process and the different types of garnishment available is crucial for both creditors and debtors. 1. Wage Garnishment: One of the most common types of garnishment in Huntsville, Alabama is wage garnishment. With wage garnishment, creditors can legally request a portion of a debtor's wages be withheld by their employer. The employer then sends this withheld amount to the creditor until the debt is entirely repaid. The process involves filing a lawsuit against the debtor, obtaining a judgment, and sending a notice of garnishment to their employer, who must comply with the instructions provided. 2. Bank Account Garnishment: Another type of garnishment is bank account garnishment. Creditors can seek to collect unpaid debts by freezing a debtor's bank account and requiring the bank to transfer funds to satisfy the debt. This process typically involves obtaining a judgment against the debtor and serving a notice of garnishment to their bank. Once the bank receives the notice, they freeze the account and distribute the funds to the creditor, up to the amount owed. 3. Property Garnishment: Property garnishment, also known as attachment or sheriff sale, allows creditors to seize and sell a debtor's property to recover a debt. This type of garnishment is typically used for significant debts, where the creditor seeks to satisfy the debt by liquidating valuable assets such as vehicles, real estate, or non-exempt personal property. The process involves obtaining a judgment and working with the sheriff's department to execute the sale and transfer the funds to the creditor. 4. Child Support and Alimony Garnishment: In Huntsville, Alabama, garnishment is also utilized for the collection of unpaid child support or alimony payments. The Department of Human Resources (DHR) can garnish wages, tax refunds, and other income sources to ensure that individuals fulfill their financial obligations towards their children or former spouses. DHR can initiate this process without obtaining a judgment, under specific circumstances where it is authorized by law. It is important to note that Huntsville, Alabama follows both state and federal garnishment laws, including the Fair Debt Collection Practices Act (FD CPA) and the Alabama Code. These laws establish guidelines and limitations to protect debtors' rights while allowing creditors to recover their debts lawfully. If you find yourself subject to the Huntsville, Alabama process of garnishment, it is essential to seek legal advice to understand your rights and options for potential resolution.