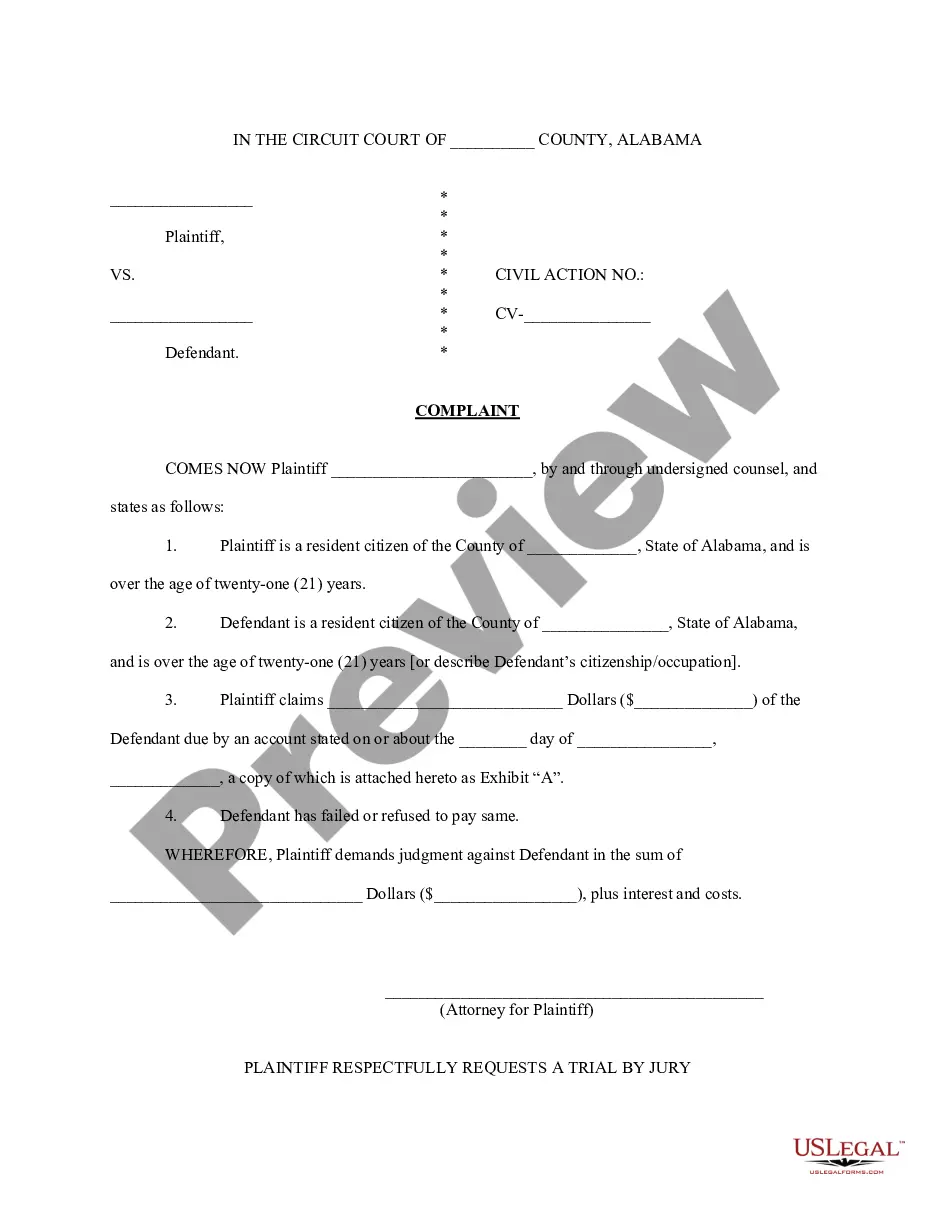

Alabama sample complaint filed in Circuit Court to collect a debt.

Title: Birmingham Alabama Complaint for Account Stated: Understanding the Essential Elements and Types Introduction: A Complaint for Account Stated in Birmingham, Alabama is a legal document filed by a plaintiff against a defendant alleging that the defendant owes a specific sum of money for goods, services, or credit granted, with the expectation of payment. In this article, we will delve into the key elements of a complaint for account stated and explore the different types that exist within Birmingham, Alabama's legal jurisdiction. 1. Elements of a Birmingham Alabama Complaint for Account Stated: — Mutual Agreement: The plaintiff must establish that an agreement or understanding existed between the parties, indicating that the defendant would pay a specific sum of money for the received goods, services, or credit. — Prior Dealings: The complaint should demonstrate a course of conduct where the defendant acknowledged and accepted previous transactions or invoices. — Unpaid Balance: The plaintiff must prove that a certain sum remains unpaid by the defendant. — Invoice or Statement: The plaintiff should provide supporting documents such as invoices, account statements, or records to validate the claim. 2. Types of Birmingham Alabama Complaint for Account Stated: a. Commercial Account Stated: This type of account stated is commonly used in commercial disputes, involving businesses and suppliers. It seeks to establish a mutual agreement and record of transactions where the defendant failed to pay the outstanding balance owed to the plaintiff. b. Personal Account Stated: In personal account stated claims, the parties involved are typically individuals engaged in a personal or non-commercial relationship. Examples may include a landlord-tenant dispute over unpaid rent or a personal loan that remains unpaid. c. Credit Card Account Stated: This type of account stated complaint is specific to credit card transactions. It asserts that the defendant agreed to pay the credit card issuer for charges made on the account but subsequently failed to fulfill the payment obligations. d. Medical Account Stated: Medical account stated complaints typically involve unresolved medical bills. Hospitals, doctors, or healthcare providers may file such complaints when a patient fails to pay the outstanding balance for services received. e. Professional Services Account Stated: This category applies to disputes involving professional service providers, such as lawyers, accountants, or consultants. It claims that the defendant agreed to pay the specified fees for the services rendered but has not done so. Conclusion: A Complaint for Account Stated is an essential legal tool for pursuing unpaid debts in Birmingham, Alabama. By understanding the elements required for a successful claim and the different types of account stated complaints, individuals and businesses can effectively assert their rights and seek appropriate remedies with the help of legal professionals.Title: Birmingham Alabama Complaint for Account Stated: Understanding the Essential Elements and Types Introduction: A Complaint for Account Stated in Birmingham, Alabama is a legal document filed by a plaintiff against a defendant alleging that the defendant owes a specific sum of money for goods, services, or credit granted, with the expectation of payment. In this article, we will delve into the key elements of a complaint for account stated and explore the different types that exist within Birmingham, Alabama's legal jurisdiction. 1. Elements of a Birmingham Alabama Complaint for Account Stated: — Mutual Agreement: The plaintiff must establish that an agreement or understanding existed between the parties, indicating that the defendant would pay a specific sum of money for the received goods, services, or credit. — Prior Dealings: The complaint should demonstrate a course of conduct where the defendant acknowledged and accepted previous transactions or invoices. — Unpaid Balance: The plaintiff must prove that a certain sum remains unpaid by the defendant. — Invoice or Statement: The plaintiff should provide supporting documents such as invoices, account statements, or records to validate the claim. 2. Types of Birmingham Alabama Complaint for Account Stated: a. Commercial Account Stated: This type of account stated is commonly used in commercial disputes, involving businesses and suppliers. It seeks to establish a mutual agreement and record of transactions where the defendant failed to pay the outstanding balance owed to the plaintiff. b. Personal Account Stated: In personal account stated claims, the parties involved are typically individuals engaged in a personal or non-commercial relationship. Examples may include a landlord-tenant dispute over unpaid rent or a personal loan that remains unpaid. c. Credit Card Account Stated: This type of account stated complaint is specific to credit card transactions. It asserts that the defendant agreed to pay the credit card issuer for charges made on the account but subsequently failed to fulfill the payment obligations. d. Medical Account Stated: Medical account stated complaints typically involve unresolved medical bills. Hospitals, doctors, or healthcare providers may file such complaints when a patient fails to pay the outstanding balance for services received. e. Professional Services Account Stated: This category applies to disputes involving professional service providers, such as lawyers, accountants, or consultants. It claims that the defendant agreed to pay the specified fees for the services rendered but has not done so. Conclusion: A Complaint for Account Stated is an essential legal tool for pursuing unpaid debts in Birmingham, Alabama. By understanding the elements required for a successful claim and the different types of account stated complaints, individuals and businesses can effectively assert their rights and seek appropriate remedies with the help of legal professionals.