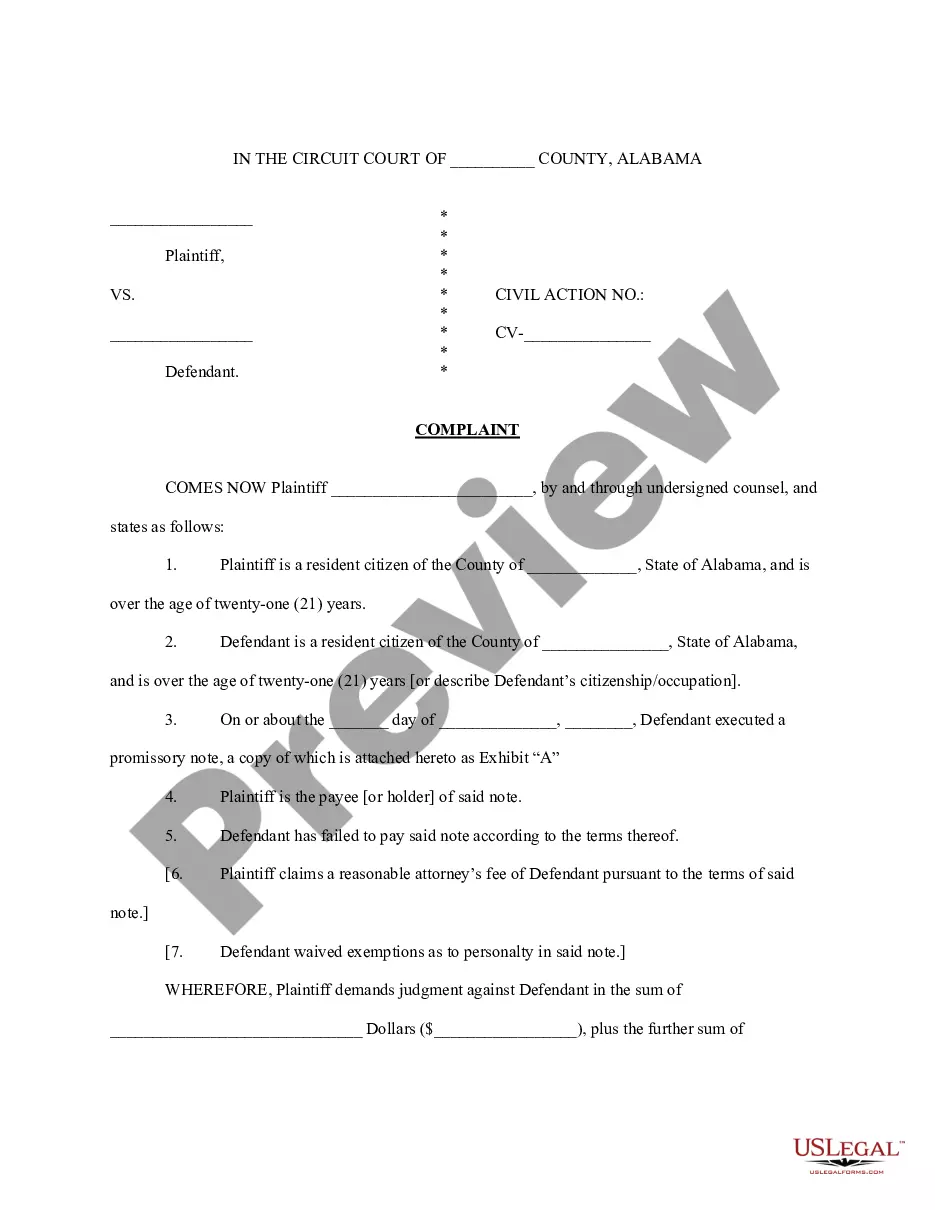

Alabama sample complaint filed in Circuit Court to Collect on a Promissory Notice.

Title: Birmingham Alabama Complaint to Collect on a Promissory Note: A Detailed Description Introduction: When a debtor fails to repay their financial obligations as outlined in a promissory note, the creditor may file a legal complaint to collect what is owed. In Birmingham, Alabama, there are specific procedures and regulations in place to address such cases. This article aims to provide a comprehensive overview of the Birmingham Alabama Complaint to Collect on a Promissory Note, guiding you through its key steps and highlighting different types of complaints that may arise. Types of Birmingham Alabama Complaints to Collect on a Promissory Note: 1. Complaint for Breach of Promissory Note: This type of complaint is filed when a debtor has failed to make any payment as agreed upon in the promissory note. It focuses on the debtor's violation of the repayment terms, highlighting the amount due and seeking recovery through legal means. 2. Complaint for Default on Promissory Note: If a debtor initially made payments, but has now defaulted on the promissory note by missing multiple payments or failing to comply with the repayment schedule, a complaint for default might be filed. This complaint outlines the specific instances of default and the subsequent legal actions the creditor seeks. 3. Complaint for Fraudulent Promissory Note: In situations where a debtor intentionally misled a creditor by providing false information or forged signatures on the promissory note, a complaint for fraudulent promissory note is appropriate. This complaint asserts the creditor's right to recover the owed amount due to deceit or fraudulent actions. Key Steps in Filing a Complaint in Birmingham Alabama: 1. Accurate Documentation: Gather all necessary documents, including the promissory note, proof of communication between the parties, and any evidence supporting your claim. 2. Consult Legal Counsel: It is advisable to consult an experienced attorney specializing in debt collection and promissory note disputes. They will guide you through the legal process. 3. Drafting the Complaint: Your attorney will draft a detailed complaint, clearly articulating the claims against the debtor, the amount owed, and the legal basis for the complaint. 4. Filing the Complaint: The complaint is filed with the appropriate court in Birmingham, Alabama, along with the required fees. 5. Legal Proceedings and Discovery: The court will inform the debtor about the complaint, initiating the legal proceedings. The discovery process allows both parties to exchange relevant information and evidence pertaining to the dispute. 6. Settlement Negotiations or Trial: Depending on the circumstances, settlement negotiations may take place to resolve the matter. If no agreement is reached, the case may proceed to trial, where a judge or jury will decide the outcome of the complaint. Conclusion: The Birmingham Alabama Complaint to Collect on a Promissory Note serves as an essential legal tool to pursue the recovery of outstanding debts. By understanding the different types of complaints and following the proper procedures, creditors can protect their rights and seek appropriate remedies. Seeking legal advice from an attorney knowledgeable in debt collection laws greatly enhances the chances of a successful outcome in these matters.Title: Birmingham Alabama Complaint to Collect on a Promissory Note: A Detailed Description Introduction: When a debtor fails to repay their financial obligations as outlined in a promissory note, the creditor may file a legal complaint to collect what is owed. In Birmingham, Alabama, there are specific procedures and regulations in place to address such cases. This article aims to provide a comprehensive overview of the Birmingham Alabama Complaint to Collect on a Promissory Note, guiding you through its key steps and highlighting different types of complaints that may arise. Types of Birmingham Alabama Complaints to Collect on a Promissory Note: 1. Complaint for Breach of Promissory Note: This type of complaint is filed when a debtor has failed to make any payment as agreed upon in the promissory note. It focuses on the debtor's violation of the repayment terms, highlighting the amount due and seeking recovery through legal means. 2. Complaint for Default on Promissory Note: If a debtor initially made payments, but has now defaulted on the promissory note by missing multiple payments or failing to comply with the repayment schedule, a complaint for default might be filed. This complaint outlines the specific instances of default and the subsequent legal actions the creditor seeks. 3. Complaint for Fraudulent Promissory Note: In situations where a debtor intentionally misled a creditor by providing false information or forged signatures on the promissory note, a complaint for fraudulent promissory note is appropriate. This complaint asserts the creditor's right to recover the owed amount due to deceit or fraudulent actions. Key Steps in Filing a Complaint in Birmingham Alabama: 1. Accurate Documentation: Gather all necessary documents, including the promissory note, proof of communication between the parties, and any evidence supporting your claim. 2. Consult Legal Counsel: It is advisable to consult an experienced attorney specializing in debt collection and promissory note disputes. They will guide you through the legal process. 3. Drafting the Complaint: Your attorney will draft a detailed complaint, clearly articulating the claims against the debtor, the amount owed, and the legal basis for the complaint. 4. Filing the Complaint: The complaint is filed with the appropriate court in Birmingham, Alabama, along with the required fees. 5. Legal Proceedings and Discovery: The court will inform the debtor about the complaint, initiating the legal proceedings. The discovery process allows both parties to exchange relevant information and evidence pertaining to the dispute. 6. Settlement Negotiations or Trial: Depending on the circumstances, settlement negotiations may take place to resolve the matter. If no agreement is reached, the case may proceed to trial, where a judge or jury will decide the outcome of the complaint. Conclusion: The Birmingham Alabama Complaint to Collect on a Promissory Note serves as an essential legal tool to pursue the recovery of outstanding debts. By understanding the different types of complaints and following the proper procedures, creditors can protect their rights and seek appropriate remedies. Seeking legal advice from an attorney knowledgeable in debt collection laws greatly enhances the chances of a successful outcome in these matters.