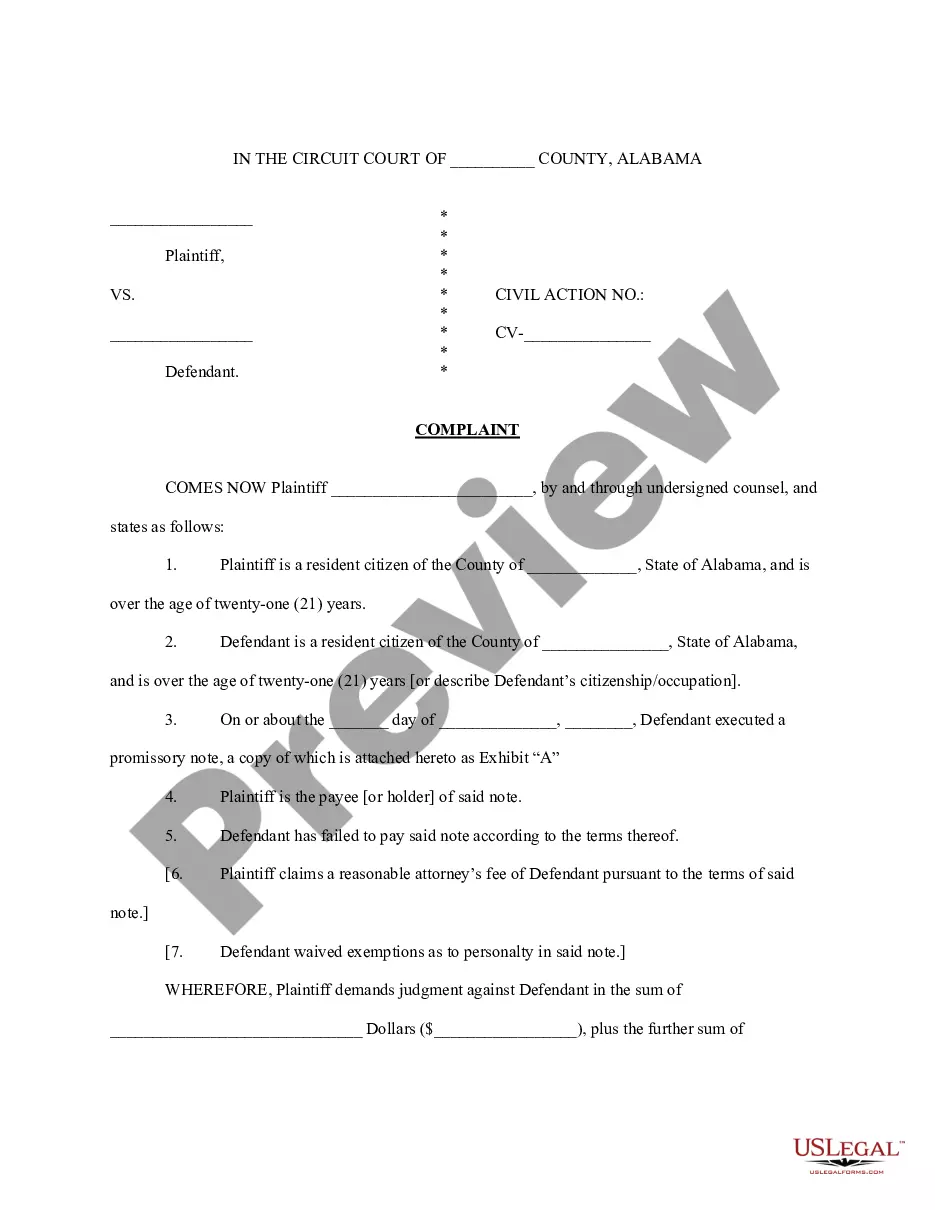

Alabama sample complaint filed in Circuit Court to Collect on a Promissory Notice.

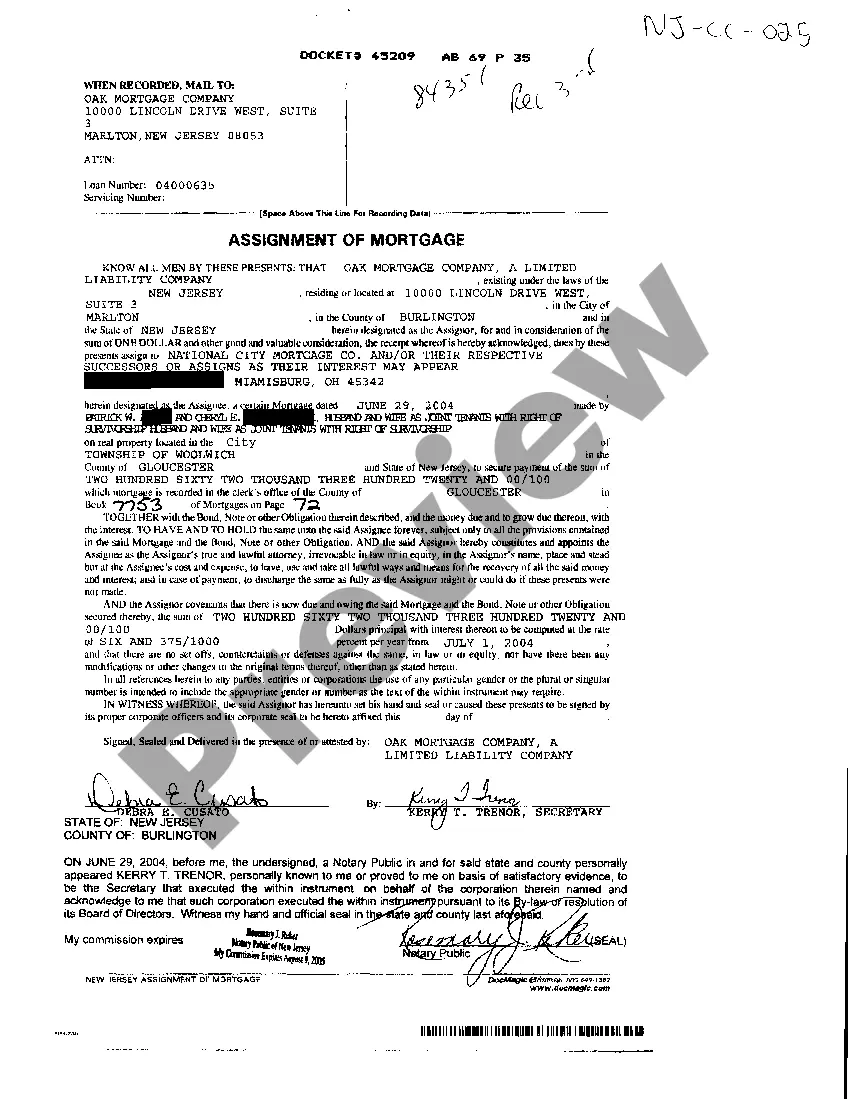

Huntsville Alabama Complaint to Collect on a Promissory Note: A Detailed Description In Huntsville, Alabama, individuals and businesses often rely on promissory notes to formalize loan agreements. These legally binding documents establish the terms and conditions under which one party promises to repay the borrowed funds to another party. However, in some cases, borrowers may default on their payment obligations, leading the lender to take legal action to collect the outstanding debt. This is where a Huntsville Alabama Complaint to Collect on a Promissory Note comes into play. A Huntsville Alabama Complaint to Collect on a Promissory Note is a legal proceeding undertaken by a lender to recover unpaid amounts owed to them according to the terms outlined in a promissory note. This process typically involves filing a lawsuit in the appropriate court, seeking a judgment against the borrower, and potentially pursuing various legal avenues to collect the outstanding debt. There are different types of Huntsville Alabama Complaints to Collect on a Promissory Note, depending on the specific circumstances and desired outcomes: 1. Simple Complaint: This type of complaint is filed when a lender seeks to recover the outstanding balance owed by the borrower according to the terms of the promissory note. It typically includes details about the loan agreement, the remaining amount due, and requests the court's intervention in forcing the borrower to fulfill their payment obligations. 2. Complaint with Collection Efforts: If the lender has already attempted to collect the outstanding debt through various means, such as reminders, negotiations, or even working with collection agencies, and has been unsuccessful, they may file a Complaint with Collection Efforts. This type of complaint highlights the lender's efforts to resolve the matter amicably before resorting to legal action. 3. Acceleration Complaint: In situations where the borrower has failed to make payments in accordance with the promissory note, lenders may choose to accelerate the debt — meaning they demand the borrower to pay the entire remaining balance upfront. An Acceleration Complaint seeks a judgment for the total outstanding debt immediately, rather than pursuing repayment according to the original payment schedule. 4. Collateralized Complaint: If the promissory note was secured by collateral, such as real estate or other assets, the lender may file a Collateralized Complaint. This type of complaint not only seeks to collect the unpaid debt but also requests the court's assistance in foreclosing or seizing the collateral to satisfy the outstanding balance. When filing a Huntsville Alabama Complaint to Collect on a Promissory Note, it is crucial to consult with an attorney experienced in debt collection and litigation. They can provide guidance on the appropriate complaint type based on your specific circumstances and effectively navigate the legal process to achieve the desired outcome. In conclusion, a Huntsville Alabama Complaint to Collect on a Promissory Note is a legal tool for lenders to pursue repayment when borrowers default on their payment obligations. By filing a complaint with the appropriate type and seeking the court's intervention, lenders in Huntsville, Alabama can initiate a legal process to collect the outstanding debt and potentially enforce collateral if available.Huntsville Alabama Complaint to Collect on a Promissory Note: A Detailed Description In Huntsville, Alabama, individuals and businesses often rely on promissory notes to formalize loan agreements. These legally binding documents establish the terms and conditions under which one party promises to repay the borrowed funds to another party. However, in some cases, borrowers may default on their payment obligations, leading the lender to take legal action to collect the outstanding debt. This is where a Huntsville Alabama Complaint to Collect on a Promissory Note comes into play. A Huntsville Alabama Complaint to Collect on a Promissory Note is a legal proceeding undertaken by a lender to recover unpaid amounts owed to them according to the terms outlined in a promissory note. This process typically involves filing a lawsuit in the appropriate court, seeking a judgment against the borrower, and potentially pursuing various legal avenues to collect the outstanding debt. There are different types of Huntsville Alabama Complaints to Collect on a Promissory Note, depending on the specific circumstances and desired outcomes: 1. Simple Complaint: This type of complaint is filed when a lender seeks to recover the outstanding balance owed by the borrower according to the terms of the promissory note. It typically includes details about the loan agreement, the remaining amount due, and requests the court's intervention in forcing the borrower to fulfill their payment obligations. 2. Complaint with Collection Efforts: If the lender has already attempted to collect the outstanding debt through various means, such as reminders, negotiations, or even working with collection agencies, and has been unsuccessful, they may file a Complaint with Collection Efforts. This type of complaint highlights the lender's efforts to resolve the matter amicably before resorting to legal action. 3. Acceleration Complaint: In situations where the borrower has failed to make payments in accordance with the promissory note, lenders may choose to accelerate the debt — meaning they demand the borrower to pay the entire remaining balance upfront. An Acceleration Complaint seeks a judgment for the total outstanding debt immediately, rather than pursuing repayment according to the original payment schedule. 4. Collateralized Complaint: If the promissory note was secured by collateral, such as real estate or other assets, the lender may file a Collateralized Complaint. This type of complaint not only seeks to collect the unpaid debt but also requests the court's assistance in foreclosing or seizing the collateral to satisfy the outstanding balance. When filing a Huntsville Alabama Complaint to Collect on a Promissory Note, it is crucial to consult with an attorney experienced in debt collection and litigation. They can provide guidance on the appropriate complaint type based on your specific circumstances and effectively navigate the legal process to achieve the desired outcome. In conclusion, a Huntsville Alabama Complaint to Collect on a Promissory Note is a legal tool for lenders to pursue repayment when borrowers default on their payment obligations. By filing a complaint with the appropriate type and seeking the court's intervention, lenders in Huntsville, Alabama can initiate a legal process to collect the outstanding debt and potentially enforce collateral if available.