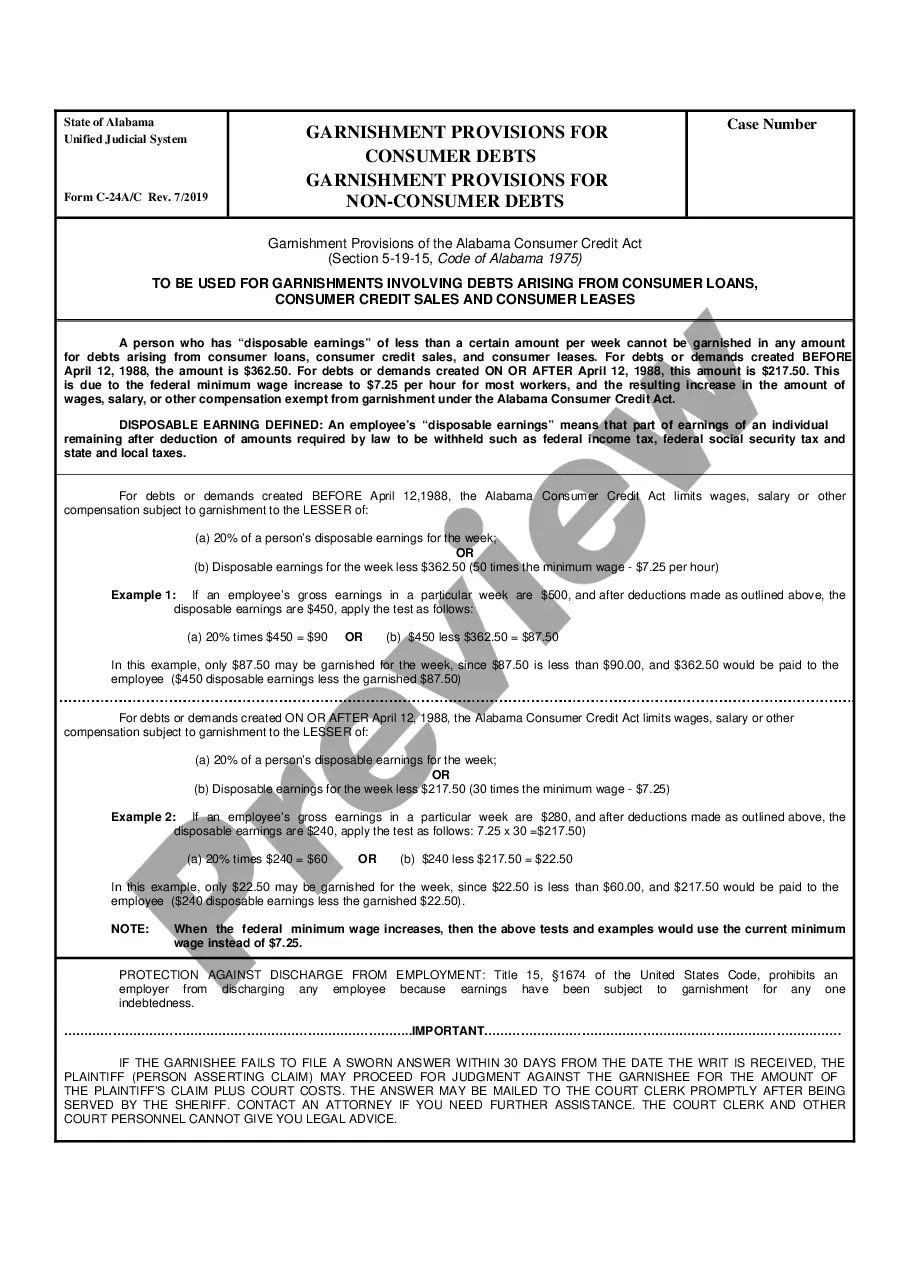

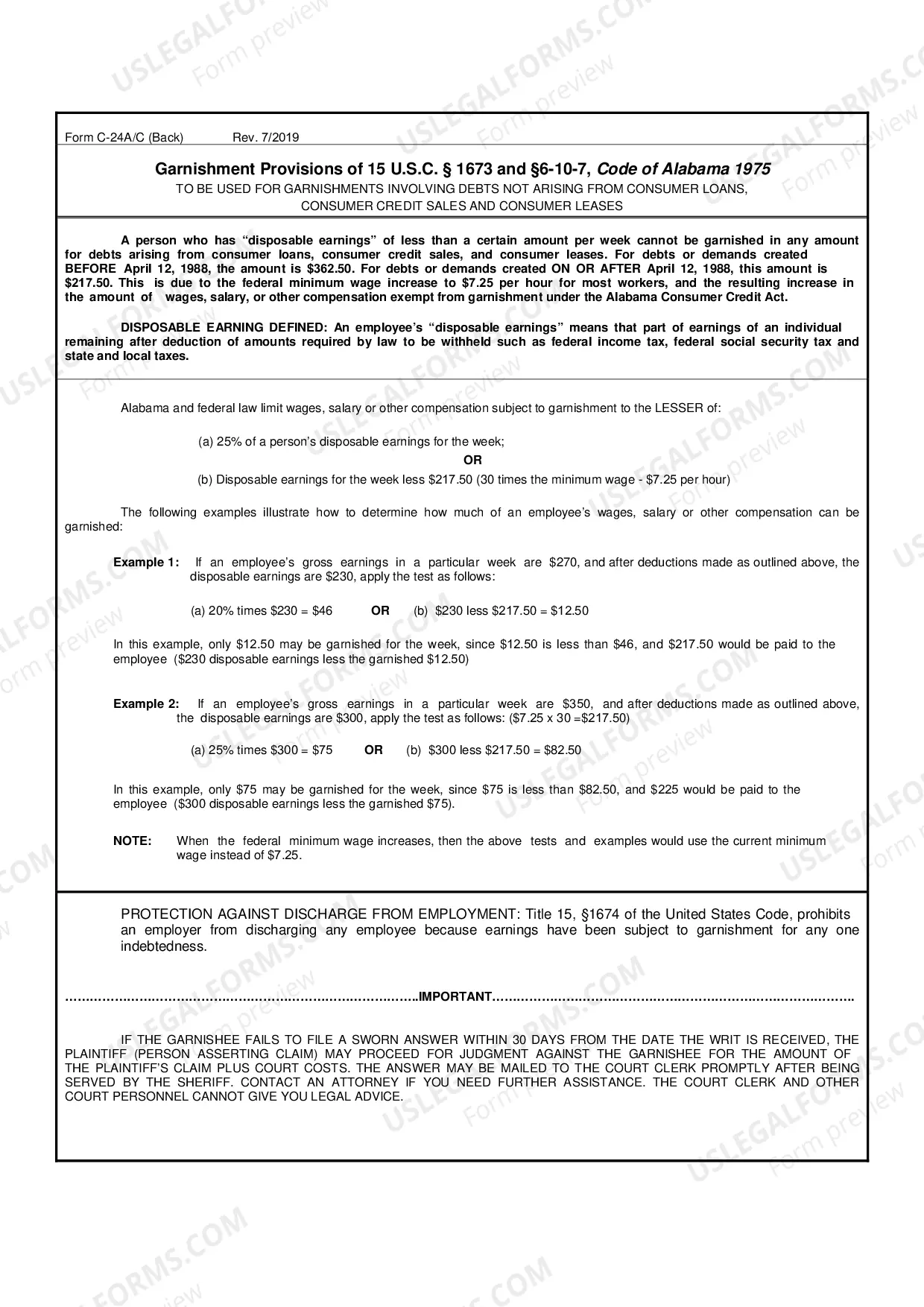

Alabama Official Form - Garnishment Provisions for Consumer Debt Pursuant to the Alabama Consumer Credit Act.

Huntsville Alabama Garnishment Provisions for Consumer Debt: Explained In Huntsville, Alabama, garnishment provisions for consumer debt play a crucial role in protecting the rights of both creditors and debtors. Garnishment is a legal process that allows a creditor to collect a portion of a debtor's wages, bank accounts, or other assets to repay the outstanding debt. Understanding the various provisions and regulations surrounding garnishment in Huntsville is essential for those involved in consumer debt cases. This article will provide a detailed description of Huntsville Alabama garnishment provisions for consumer debt, highlighting different types of garnishment. 1. Wage Garnishment: Wage garnishment is the most common type of garnishment used by creditors in Huntsville. It involves the collection of debt through a court order that allows the creditor to deduct a certain percentage from the debtor's wages until the debt is fully repaid. Huntsville follows state laws that regulate the maximum amount that can be garnished from an individual's wages, aiming to ensure the debtor can still meet their basic needs. 2. Bank Account Garnishment: If a debtor fails to pay a consumer debt, their bank account may be subject to garnishment. Creditors can obtain a court order to freeze the debtor's bank account and collect the owed amount directly from it. Huntsville Alabama garnishment provisions for bank accounts may limit the amount that can be garnished, ensuring the debtor has access to basic living expenses. 3. Property and Asset Garnishment: In certain cases, creditors may seek to collect consumer debt by garnishing the debtor's property and assets. This process involves obtaining a court order that allows the creditor to seize and sell the debtor's non-exempt property, such as vehicles or real estate, to satisfy the outstanding debt. Huntsville Alabama garnishment provisions for property and asset garnishment consider exemptions that protect the debtor's essential belongings from being sold to repay the debt. 4. Exemptions and Prohibition: Huntsville Alabama's garnishment provisions for consumer debt also include exemptions and prohibitions to ensure debtors are not left without essential resources. Certain types of income, such as Social Security benefits, welfare payments, and unemployment compensation, may be exempt from garnishment, protecting the debtor's financial welfare. Additionally, Huntsville restricts the garnishment of wages in some cases, such as child support payments, to prioritize the well-being of dependents. It is crucial for both debtors and creditors in Huntsville Alabama to understand the garnishment provisions for consumer debt to ensure fair treatment and adherence to the law. When faced with consumer debt issues, seeking legal advice from a qualified professional is highly recommended navigating through the complexities of Huntsville Alabama's garnishment provisions and protect one's rights.Huntsville Alabama Garnishment Provisions for Consumer Debt: Explained In Huntsville, Alabama, garnishment provisions for consumer debt play a crucial role in protecting the rights of both creditors and debtors. Garnishment is a legal process that allows a creditor to collect a portion of a debtor's wages, bank accounts, or other assets to repay the outstanding debt. Understanding the various provisions and regulations surrounding garnishment in Huntsville is essential for those involved in consumer debt cases. This article will provide a detailed description of Huntsville Alabama garnishment provisions for consumer debt, highlighting different types of garnishment. 1. Wage Garnishment: Wage garnishment is the most common type of garnishment used by creditors in Huntsville. It involves the collection of debt through a court order that allows the creditor to deduct a certain percentage from the debtor's wages until the debt is fully repaid. Huntsville follows state laws that regulate the maximum amount that can be garnished from an individual's wages, aiming to ensure the debtor can still meet their basic needs. 2. Bank Account Garnishment: If a debtor fails to pay a consumer debt, their bank account may be subject to garnishment. Creditors can obtain a court order to freeze the debtor's bank account and collect the owed amount directly from it. Huntsville Alabama garnishment provisions for bank accounts may limit the amount that can be garnished, ensuring the debtor has access to basic living expenses. 3. Property and Asset Garnishment: In certain cases, creditors may seek to collect consumer debt by garnishing the debtor's property and assets. This process involves obtaining a court order that allows the creditor to seize and sell the debtor's non-exempt property, such as vehicles or real estate, to satisfy the outstanding debt. Huntsville Alabama garnishment provisions for property and asset garnishment consider exemptions that protect the debtor's essential belongings from being sold to repay the debt. 4. Exemptions and Prohibition: Huntsville Alabama's garnishment provisions for consumer debt also include exemptions and prohibitions to ensure debtors are not left without essential resources. Certain types of income, such as Social Security benefits, welfare payments, and unemployment compensation, may be exempt from garnishment, protecting the debtor's financial welfare. Additionally, Huntsville restricts the garnishment of wages in some cases, such as child support payments, to prioritize the well-being of dependents. It is crucial for both debtors and creditors in Huntsville Alabama to understand the garnishment provisions for consumer debt to ensure fair treatment and adherence to the law. When faced with consumer debt issues, seeking legal advice from a qualified professional is highly recommended navigating through the complexities of Huntsville Alabama's garnishment provisions and protect one's rights.