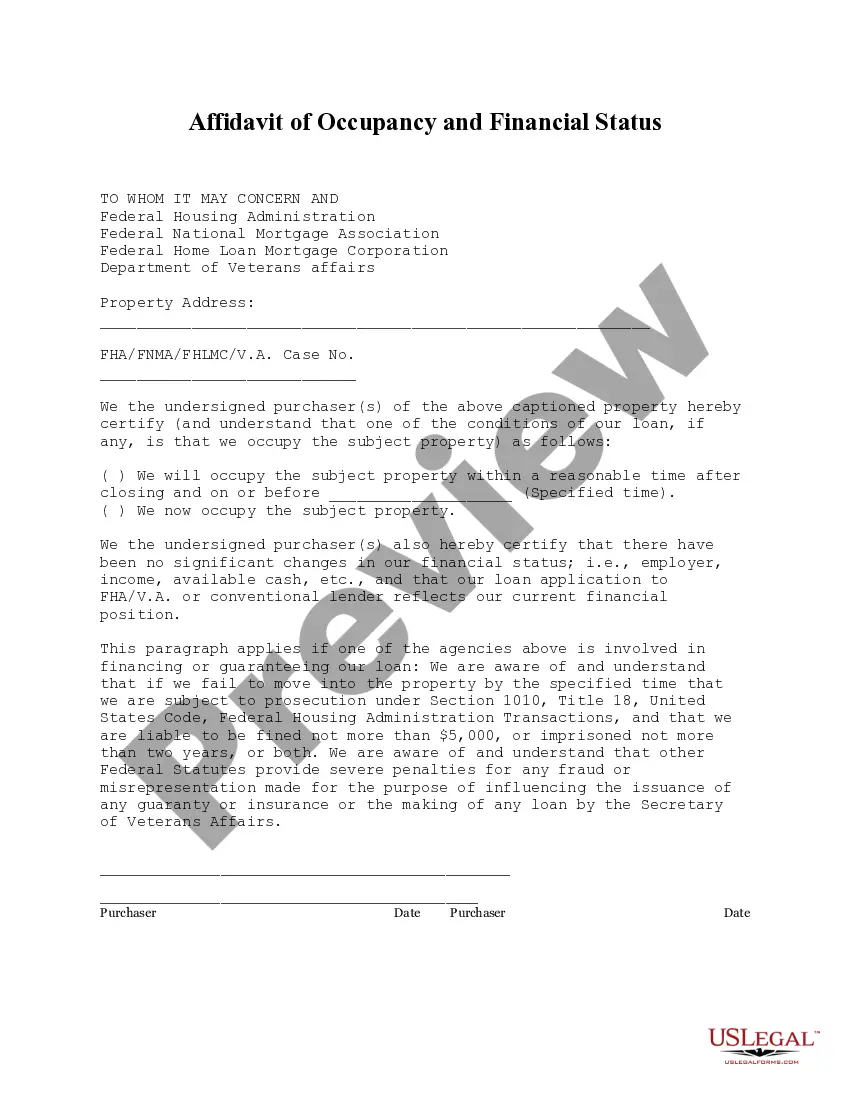

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

Title: Birmingham Alabama Affidavit of Occupancy and Financial Status: Explained in Detail Introduction: In Birmingham, Alabama, a vital legal document called the Affidavit of Occupancy and Financial Status holds significance in numerous real estate transactions. This document serves to establish a person's occupancy in a property, verify their financial standing, and ensure compliance with local regulations. Let's delve deeper into the Birmingham Alabama Affidavit of Occupancy and Financial Status, its purpose, types, and key components. Keyword: Birmingham Alabama Affidavit of Occupancy and Financial Status 1. Purpose and Importance: The Birmingham Alabama Affidavit of Occupancy and Financial Status is designed to ensure transparency and accuracy during real estate transactions. It provides a comprehensive overview of a person's financial stability and verifies their occupancy status in a property. This affidavit is crucial for mortgage applications, leasing agreements, property transfers, refinancing, or any situation requiring proof of financial capacity and association with a property. 2. Key Components: a) Personal Information: The affidavit typically includes details such as the full name, contact information, social security number, and current address of the individual filing the document. b) Occupancy Details: This section requires information about the property being occupied, including the address, type of property (residential, commercial), rental or ownership status, and lease/ownership start and end dates. c) Financial Information: Here, individuals state their income, employment details, any outstanding debts, credit score, and other financial obligations. This section ensures that the person's financial status is accurately reflected and helps assess their ability to fulfill their commitments. d) Signatures and Notarization: The affidavit must be signed by the affine in the presence of a notary public, affirming the truthfulness of the information provided. 3. Types of Birmingham Alabama Affidavits of Occupancy and Financial Status: a) Residential Property Affidavit: This affidavit specifically caters to individuals occupying residential properties such as houses, apartments, or condominiums. It captures information relevant to residential tenancies, such as lease terms, rental payments, or mortgage details. b) Commercial Property Affidavit: Geared towards individuals occupying commercial spaces, this affidavit addresses business-related properties like offices, retail spaces, or warehouses. It focuses on business financials, lease agreements, turnover information, or mortgage specifics. Keywords: Birmingham Alabama, Affidavit of Occupancy, Financial Status, real estate transactions, transparency, occupancy status, mortgage applications, leasing agreements, property transfers, refinancing, personal information, occupancy details, financial information, signatures, notarization, residential property affidavit, commercial property affidavit. Conclusion: The Birmingham Alabama Affidavit of Occupancy and Financial Status plays a crucial role in ensuring trust, credibility, and legality in real estate transactions within the Birmingham area. By accurately documenting an individual's occupancy details and financial standing, this affidavit safeguards the interests of all parties involved. Whether in residential or commercial contexts, adhering to the requirements of the appropriate affidavit type is essential for a smooth and secure real estate process.