Alabama Dissolution Package to Dissolve Limited Liability Company LLC

LIMITED LIABILITY COMPANY

VOLUNTARY DISSOLUTION

ALABAMA

STATUTORY REFERENCE

CODE OF ALABAMA, Title 10, Article 7, §§ 10-12-37 through

10-12-44 (Dissolution)

Â

NOTE:Â THIS SUMMARY ADDRESSES ONLY VOLUNTARY DISSOLUTION.

A limited liability company is dissolved and its affairs shall be wound

up upon occurrence of the first of the following events:

(1) Events specified in the articles of organization or the

operating agreement.

(2) Written consent of all members to dissolve.

(3) When there is no remaining member, unless either of the following

applies:

a. The holders of all the financial rights in the limited liability

company agree in writing, within 90 days after the cessation of membership

of the last member, to continue the legal existence and business of the

limited liability company and to appoint one or more new members.

b. The legal existence and business of the limited liability company

is continued and one or more new members are appointed in the manner stated

in the operating agreement or articles of organization.

(4) When the limited liability company is not the successor limited liability

company in the merger or consolidation with one or more limited liability

companies or other entities.

(5) Entry of a decree of judicial dissolution under §10-12-38.

Except as otherwise provided in the articles of organization or

the operating agreement, the members who have not wrongfully dissolved

a limited liability company may wind up the limited liability company's

business and affairs.

A person winding up a limited liability company's business may:

(1) Preserve the company business or property as a going concern

for a reasonable time;

(2) Prosecute and defend actions and proceedings, whether civil, criminal,

or administrative;

(3) Settle and close the limited liability company's business;

(4) Dispose of and transfer property; discharge the limited liability

company's liabilities; distribute the assets of the limited liability company

pursuant to §10-12-41; and

(5) Perform other necessary and appropriate acts.

A dissolved limited liability company continues its existence but

may not carry on any business except that necessary or appropriate to wind

up and liquidate its business and affairs.

Dissolution of a limited liability company does not:

(1) Transfer title to the limited liability company assets.

(2) Terminate or suspend a proceeding pending by or against the limited

liability company on the effective date of dissolution.

(3) Terminate the authority of the registered agent of the limited

liability company.

Upon the winding up of a limited liability company, the assets of

the limited liability company must be distributed in the following order

of priority:

(1) To creditors (including members who are creditors to the

extent allowed by law) in order of priority as provided by law, except

those liabilities to members of the limited liability company for interim

distributions or on account of their contributions.

(2) Except as otherwise provided in the articles of organization or

the operating agreement, to members of the limited liability company and

former members for interim distributions and in respect of their contributions.

(3) Except as otherwise provided in the articles of organization or

the operating agreement, to members first for the return of their contributions

and second with respect to their interests in the limited liability company,

in the proportions in which the members share in distributions.

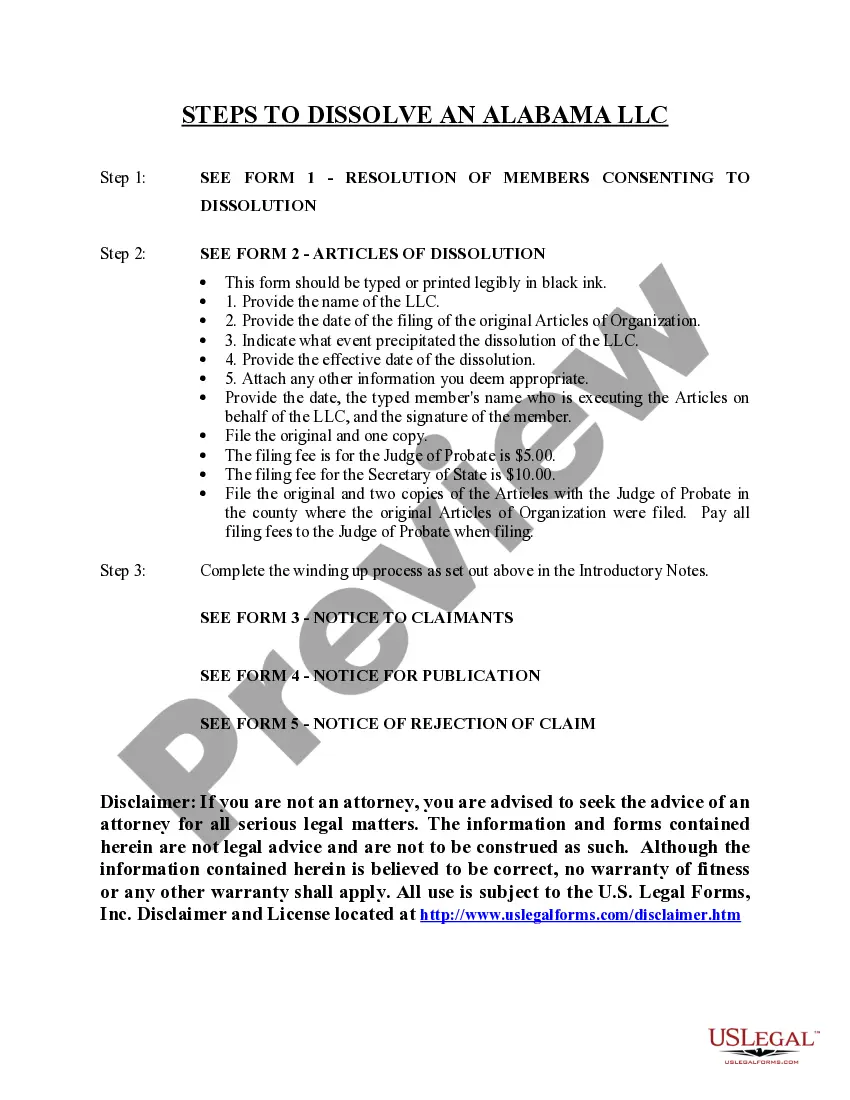

After the dissolution of the limited liability company, the limited

liability company must file articles of dissolution in the office of the

probate judge of the county in which the articles of organization were

filed. The articles of dissolution must set forth:

(1) The name of the limited liability company.

(2) The date of filing its articles of organization.

(3) The reason for filing the articles of dissolution.

(4) The effective date of the articles of dissolution (this must be

a date certain if the articles are not to be effective immediately).

(5) Any other information the members or managers filing the articles

deem appropriate.

The articles of dissolution and two copies must be filed with the

judge of probate. If the judge of probate finds that the articles of dissolution

conform to law and that all fees have been paid, the judge of probate must:

(1) Endorse on the articles of dissolution and on each copy

the word "Filed" and the hour, day, month, and year of the filing.

(2) File the articles of dissolution in the office of the judge of

probate and certify two copies.

(3) Issue a certificate of dissolution to which a certified copy of

the articles of dissolution shall be affixed, and return the certificate

of dissolution with the certified copy of the articles of dissolution affixed

to the representative of the dissolved limited liability company.

(4) Within 10 days after the issuance of a certificate of dissolution,

transmit to the Secretary of State a certified copy of the articles of

dissolution, indicating the place, date, and time of filing of the certificate.

After filing the Articles of Dissolution, a limited liability company

may dispose of the known claims against it by notifying its known claimants

in writing of the dissolution. The written notice must:

(1) Describe information that must be included in a claim.

(2) Provide a mailing address where a claim may be sent.

(3) State the deadline, which may not be less than 120 days from the

date of mailing of the written notice, by which the dissolved limited liability

company shall receive the claim.

(4) State that the claim shall be barred if not received by the deadline.

A claim against the dissolved limited liability company is barred

in either of the following circumstances:

(1) If a claimant who was given written notice does not deliver

the claim to the dissolved limited liability company by the deadline.

(2) If a claimant whose claim was rejected in writing by the dissolved

limited liability company does not commence a proceeding to enforce the

claim within 180 days from the date of the rejection notice.

A "claim" does not include a contingent liability or a claim based

on an event occurring after the effective date of dissolution.

A dissolved limited liability company may publish notice of its dissolution

which requests that persons with claims against the limited liability company

present them in accordance with the notice. The notice must:

(1) Be published one time in a newspaper of general circulation

in the county where the dissolved limited liability company's principal

office (or, if none in this state, its registered office) is or was last

located.

(2) Describe the information that shall be included in a claim and

provide a mailing address where the claim may be sent.

(3) State that articles of dissolution have been filed for the limited

liability company.

(4) State that a claim against the limited liability company shall

be barred unless a proceeding to enforce the claim is commenced within

two years after the publication of the notice.

If a dissolved limited liability company publishes a newspaper notice

in and files articles of dissolution pursuant to statutory procedures,

the claim of each of the following claimants is barred unless the claimant

commences a proceeding to enforce the claim against the dissolved limited

liability company within two years after the publication date of the newspaper

notice:

(1) A claimant who did not receive written notice.

(2) A claimant whose claim was timely sent to the dissolved limited

liability company but not acted on.

(3) A claimant whose claim is contingent or based on an event occurring

after the effective date of dissolution.

A claim may be enforced:

(1) Against the dissolved limited liability company, to the

extent of its undistributed assets.

(2) If part or all the limited liability company assets have been distributed

in liquidation, against a member of the dissolved limited liability company

to the extent of the member's pro rata share of the claim or the assets

of the limited liability company distributed to the member in liquidation,

whichever is less. If a member's total liability for all claims determined

under the preceding sentence exceeds the total amount of assets distributed

to the member in liquidation, then the member's liability on each claim

is limited to an amount determined by multiplying the assets distributed

in liquidation by a fraction, the numerator of which is the claim and the

denominator of which is the total of all the claims.

Note: All Information and Previews are subject to the Disclaimer located

on the main forms page, and also linked at the bottom of all search results.