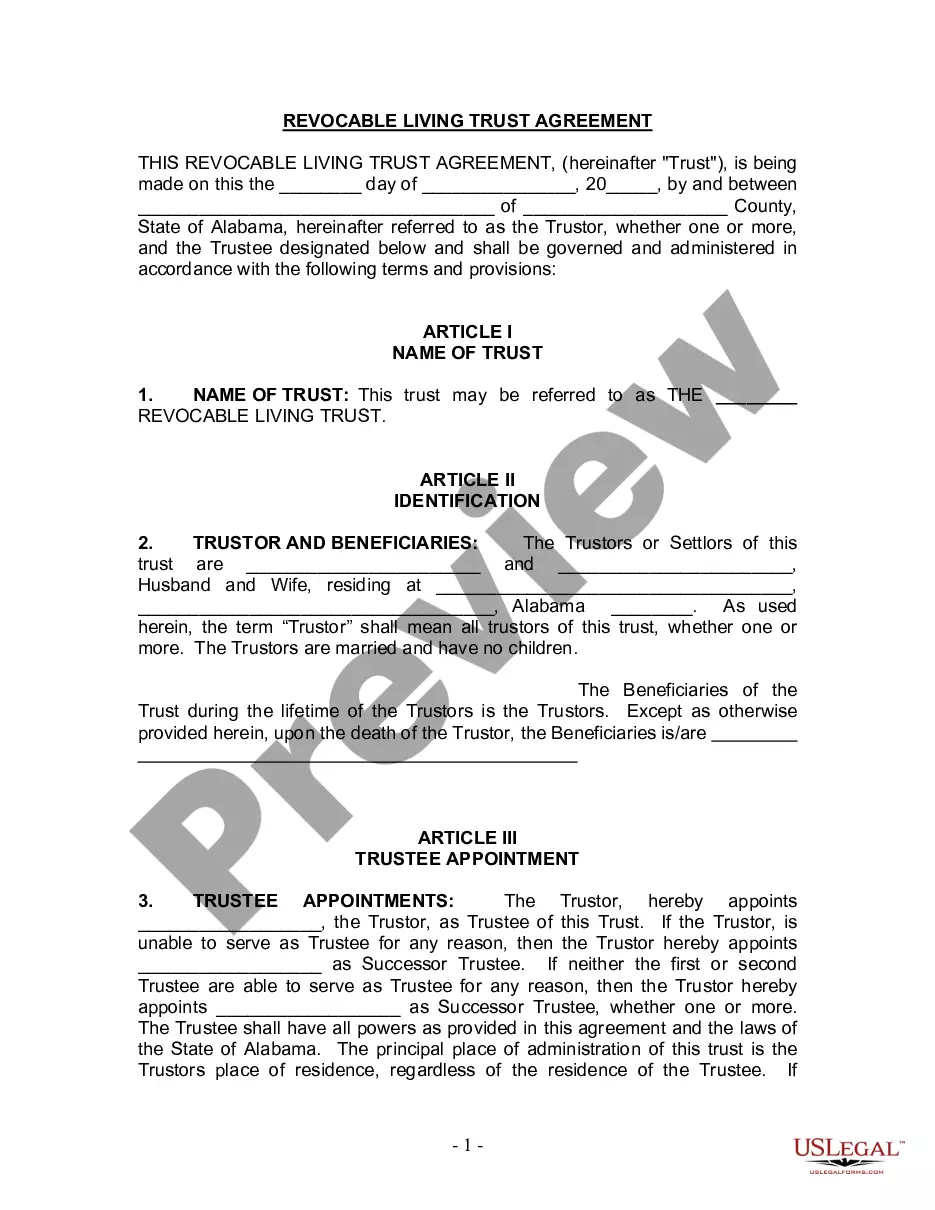

This Living Trust form is a living trust prepared for your State. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Huntsville Alabama Living Trust for Husband and Wife with No Children A living trust is a legal document that allows individuals to protect and manage their assets during their lifetime and designate how those assets will be distributed after their death. In Huntsville, Alabama, there are various types of living trusts available for couples without children. Let's explore the options: 1. Revocable Living Trust: A revocable living trust allows couples to maintain full control over their assets during their lifetime. They can amend or revoke the trust at any time, making it a flexible option. Upon the death of the first spouse, the surviving spouse becomes the sole trustee and beneficiary of the trust. After the death of both spouses, the assets within the trust are distributed according to the specified terms. 2. Irrevocable Living Trust: An irrevocable living trust, as the name suggests, cannot be amended or revoked once established. Couples often choose this type of trust when they want to protect their assets from estate taxes, creditors, or other potential liabilities. By transferring assets into an irrevocable trust, couples ensure that those assets are no longer considered part of their estate, potentially reducing the tax burden. 3. Testamentary Trust: While not strictly a living trust, a testamentary trust is established through a last will and testament. This type of trust takes effect after the death of the person creating it (the testator). Couples without children may choose this option if they want to leave their assets to specific beneficiaries, such as charities, friends, or distant relatives. A testamentary trust can also provide for the surviving spouse during their lifetime. 4. Medicaid Trust: Couples who are concerned about long-term healthcare costs may consider a Medicaid trust, also known as an Asset Protection Trust. This type of trust allows couples to transfer assets into an irrevocable trust, while ensuring their eligibility for Medicaid benefits. By placing assets into the Medicaid trust, they are protected from being counted as part of the couple's financial resources when determining Medicaid eligibility. 5. Credit Shelter Trust: Sometimes referred to as a family trust or bypass trust, a credit shelter trust aims to maximize estate tax exemptions for both spouses. This trust setup utilizes the estate tax exemption of the deceased spouse, minimizing the overall tax liability for the surviving spouse's estate. It allows the surviving spouse to retain an income from the trust while preserving the underlying assets for future generations. It's important for couples without children in Huntsville, Alabama, to consult with an experienced estate planning attorney to determine the most suitable living trust option for their needs. Each type of trust carries specific benefits and considerations, and a legal professional can provide personalized advice based on individual circumstances.Huntsville Alabama Living Trust for Husband and Wife with No Children A living trust is a legal document that allows individuals to protect and manage their assets during their lifetime and designate how those assets will be distributed after their death. In Huntsville, Alabama, there are various types of living trusts available for couples without children. Let's explore the options: 1. Revocable Living Trust: A revocable living trust allows couples to maintain full control over their assets during their lifetime. They can amend or revoke the trust at any time, making it a flexible option. Upon the death of the first spouse, the surviving spouse becomes the sole trustee and beneficiary of the trust. After the death of both spouses, the assets within the trust are distributed according to the specified terms. 2. Irrevocable Living Trust: An irrevocable living trust, as the name suggests, cannot be amended or revoked once established. Couples often choose this type of trust when they want to protect their assets from estate taxes, creditors, or other potential liabilities. By transferring assets into an irrevocable trust, couples ensure that those assets are no longer considered part of their estate, potentially reducing the tax burden. 3. Testamentary Trust: While not strictly a living trust, a testamentary trust is established through a last will and testament. This type of trust takes effect after the death of the person creating it (the testator). Couples without children may choose this option if they want to leave their assets to specific beneficiaries, such as charities, friends, or distant relatives. A testamentary trust can also provide for the surviving spouse during their lifetime. 4. Medicaid Trust: Couples who are concerned about long-term healthcare costs may consider a Medicaid trust, also known as an Asset Protection Trust. This type of trust allows couples to transfer assets into an irrevocable trust, while ensuring their eligibility for Medicaid benefits. By placing assets into the Medicaid trust, they are protected from being counted as part of the couple's financial resources when determining Medicaid eligibility. 5. Credit Shelter Trust: Sometimes referred to as a family trust or bypass trust, a credit shelter trust aims to maximize estate tax exemptions for both spouses. This trust setup utilizes the estate tax exemption of the deceased spouse, minimizing the overall tax liability for the surviving spouse's estate. It allows the surviving spouse to retain an income from the trust while preserving the underlying assets for future generations. It's important for couples without children in Huntsville, Alabama, to consult with an experienced estate planning attorney to determine the most suitable living trust option for their needs. Each type of trust carries specific benefits and considerations, and a legal professional can provide personalized advice based on individual circumstances.