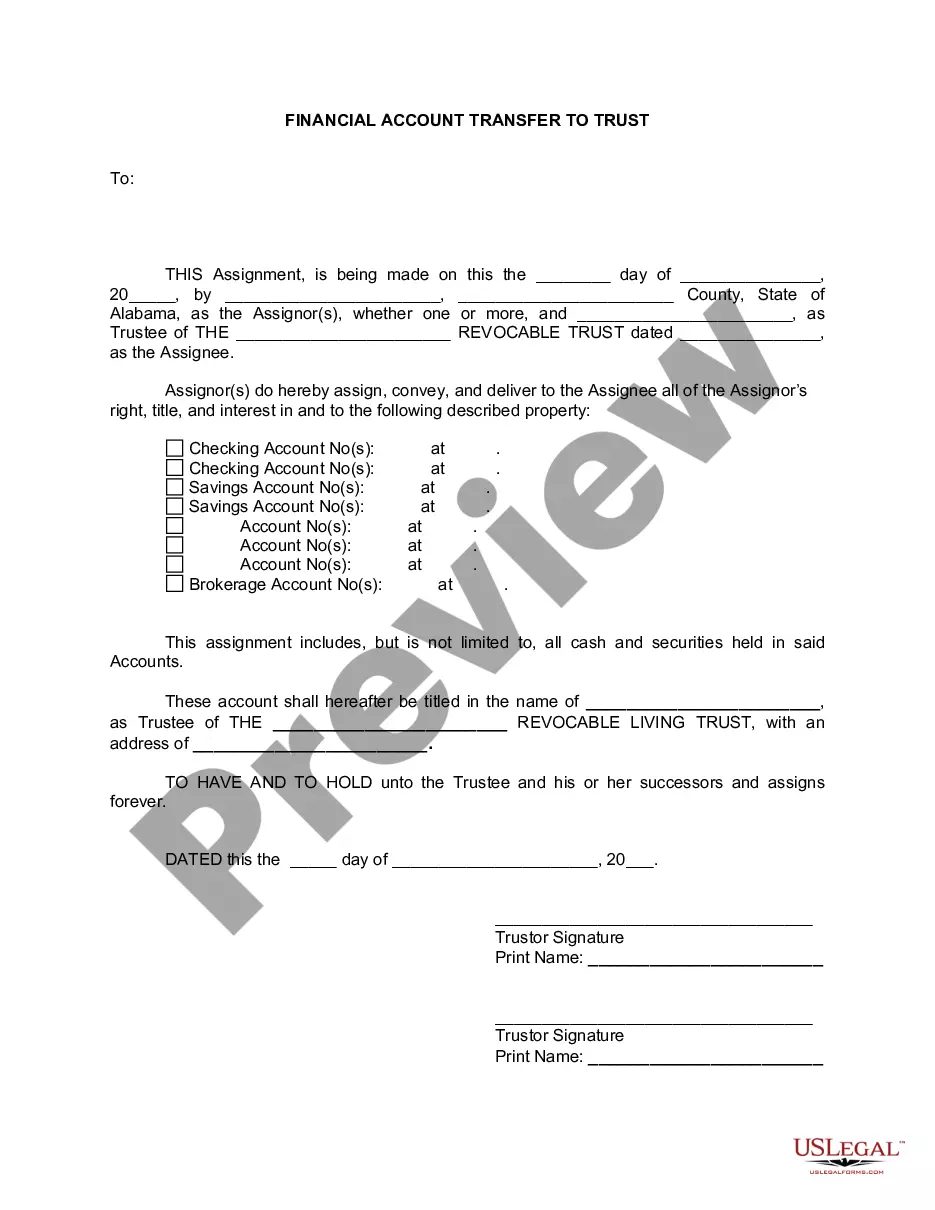

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Huntsville Alabama Financial Account Transfer to Living Trust is a legal process that involves transferring financial accounts to a living trust in Huntsville, Alabama. This important estate planning strategy ensures efficient management of assets and provides for the smooth transition of these funds after the account holder's passing, without the need for probate. A living trust allows individuals to retain control and ownership of their assets while designating a trustee to manage these accounts on their behalf. By establishing a living trust, residents of Huntsville, Alabama can minimize estate taxes, avoid probate, and preserve their privacy. There are several types of Huntsville Alabama Financial Account Transfers to Living Trust, including: 1. Bank Account Transfer: This involves transferring various bank accounts, such as savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs), into a living trust. By re-titling these accounts in the name of the trust, the assets are protected and managed according to the trust's terms. 2. Brokerage Account Transfer: Individuals can transfer their investment accounts, including stocks, bonds, mutual funds, and other securities, to their living trust in Huntsville, Alabama. This ensures that investment portfolios are properly managed and distributed according to the wishes outlined in the trust. 3. Retirement Account Transfer: Huntsville, Alabama residents can also transfer their retirement accounts, such as 401(k)s, IRAs, and pension plans, into their living trust. This allows for continued tax advantages during the account holder's lifetime and a seamless distribution of these funds upon their passing. 4. Real Estate Account Transfer: With a living trust, individuals in Huntsville, Alabama can transfer ownership of their real estate properties to the trust. This includes residential properties, commercial buildings, vacant land, and vacation homes. By doing so, the trust becomes the legal owner, ensuring proper management and eventual distribution as outlined in the trust document. 5. Business Account Transfer: For business owners in Huntsville, Alabama, it is essential to transfer business accounts, including business bank accounts, investment accounts, and ownership stakes, to a living trust. This ensures the continuity and proper management of the business assets after the owner's passing. In summary, the Huntsville Alabama Financial Account Transfer to Living Trust involves transferring various financial accounts such as bank accounts, brokerage accounts, retirement accounts, real estate properties, and business accounts into a living trust. This comprehensive estate planning strategy provides many benefits, including avoiding probate, minimizing taxes, preserving privacy, and ensuring the seamless transition of assets according to the account holder's wishes.Huntsville Alabama Financial Account Transfer to Living Trust is a legal process that involves transferring financial accounts to a living trust in Huntsville, Alabama. This important estate planning strategy ensures efficient management of assets and provides for the smooth transition of these funds after the account holder's passing, without the need for probate. A living trust allows individuals to retain control and ownership of their assets while designating a trustee to manage these accounts on their behalf. By establishing a living trust, residents of Huntsville, Alabama can minimize estate taxes, avoid probate, and preserve their privacy. There are several types of Huntsville Alabama Financial Account Transfers to Living Trust, including: 1. Bank Account Transfer: This involves transferring various bank accounts, such as savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs), into a living trust. By re-titling these accounts in the name of the trust, the assets are protected and managed according to the trust's terms. 2. Brokerage Account Transfer: Individuals can transfer their investment accounts, including stocks, bonds, mutual funds, and other securities, to their living trust in Huntsville, Alabama. This ensures that investment portfolios are properly managed and distributed according to the wishes outlined in the trust. 3. Retirement Account Transfer: Huntsville, Alabama residents can also transfer their retirement accounts, such as 401(k)s, IRAs, and pension plans, into their living trust. This allows for continued tax advantages during the account holder's lifetime and a seamless distribution of these funds upon their passing. 4. Real Estate Account Transfer: With a living trust, individuals in Huntsville, Alabama can transfer ownership of their real estate properties to the trust. This includes residential properties, commercial buildings, vacant land, and vacation homes. By doing so, the trust becomes the legal owner, ensuring proper management and eventual distribution as outlined in the trust document. 5. Business Account Transfer: For business owners in Huntsville, Alabama, it is essential to transfer business accounts, including business bank accounts, investment accounts, and ownership stakes, to a living trust. This ensures the continuity and proper management of the business assets after the owner's passing. In summary, the Huntsville Alabama Financial Account Transfer to Living Trust involves transferring various financial accounts such as bank accounts, brokerage accounts, retirement accounts, real estate properties, and business accounts into a living trust. This comprehensive estate planning strategy provides many benefits, including avoiding probate, minimizing taxes, preserving privacy, and ensuring the seamless transition of assets according to the account holder's wishes.