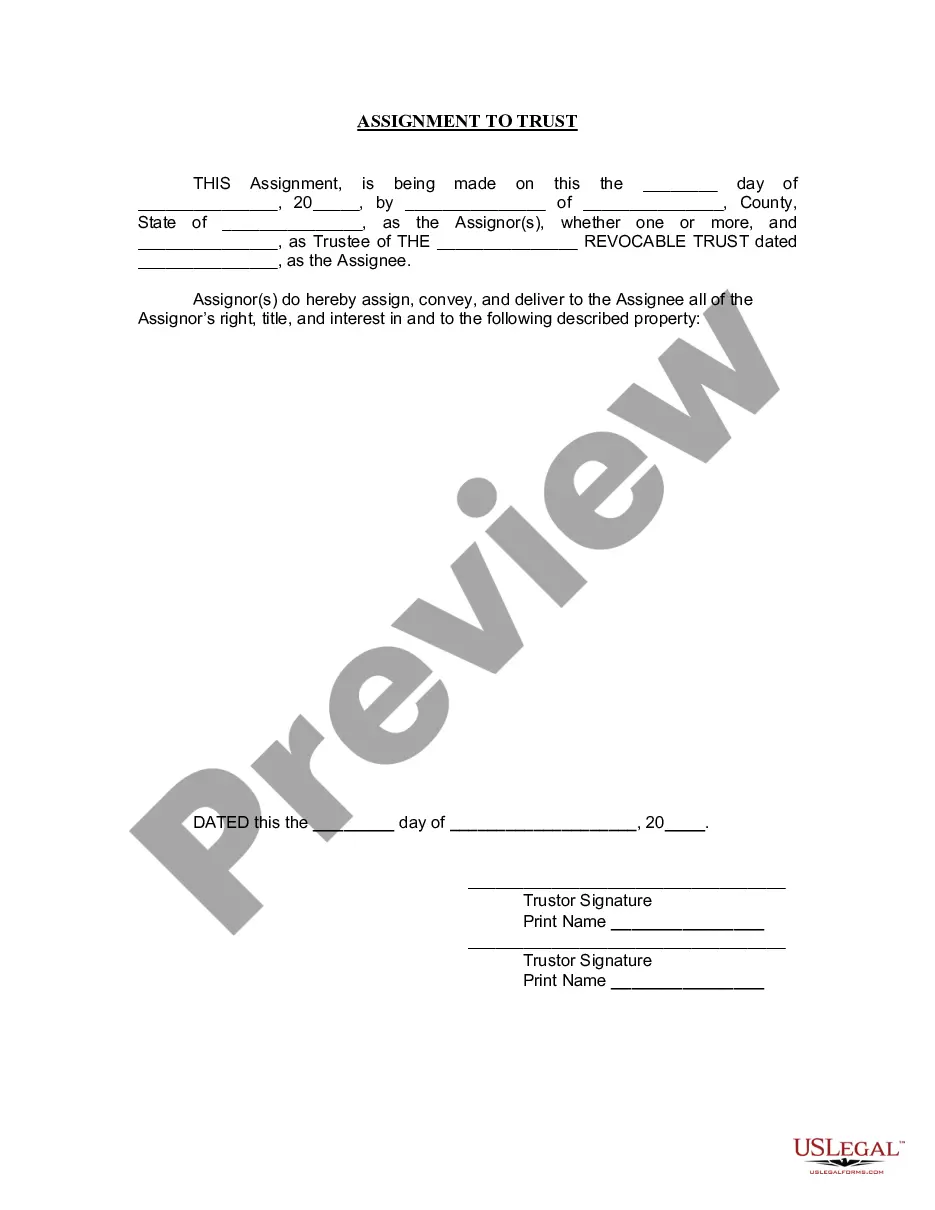

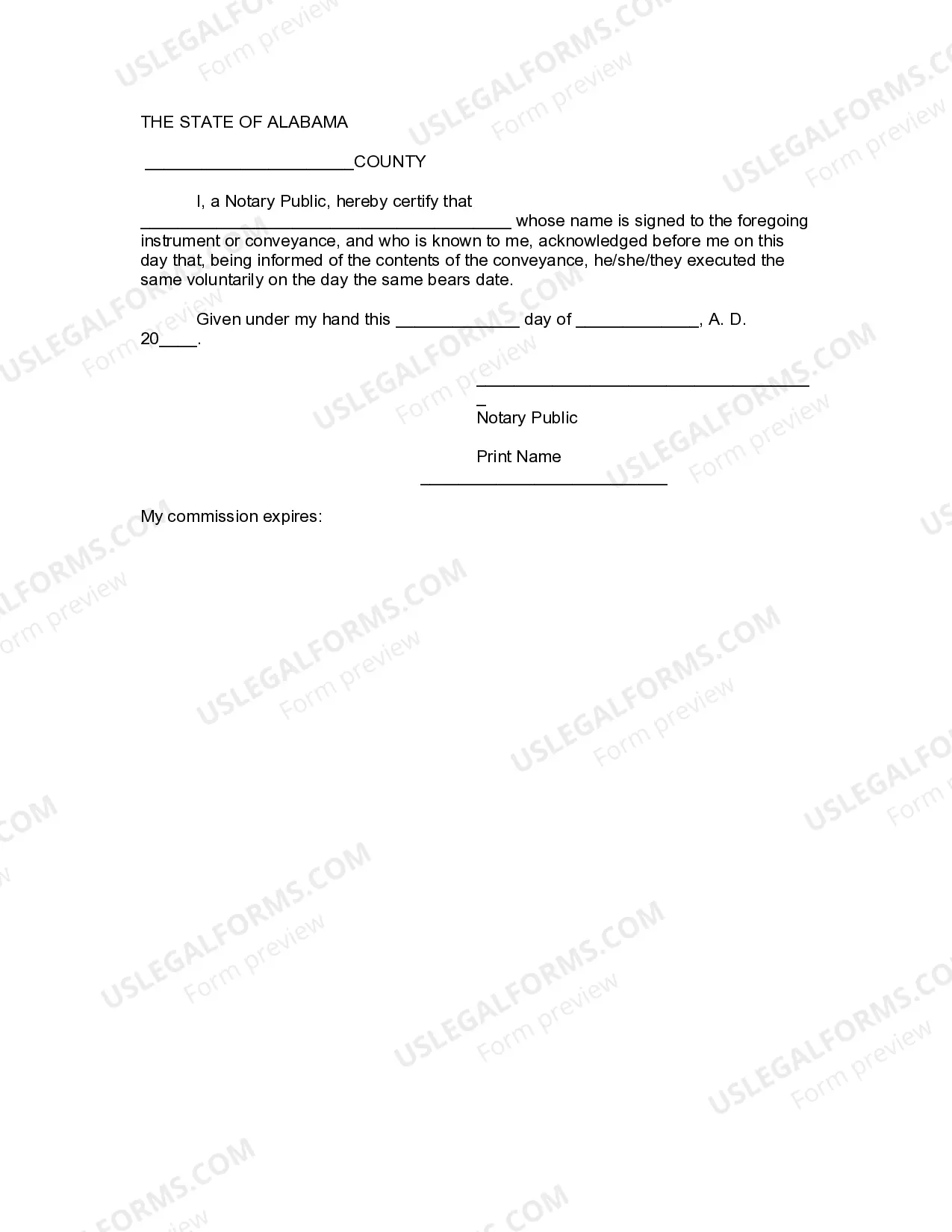

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established uring a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Huntsville Alabama Assignment to Living Trust is a legal tool that allows residents of Huntsville, Alabama, to transfer their assets and properties into a trust during their lifetime. This process involves the creation of a trust document, wherein the individual, referred to as the granter, designates a trustee to manage and distribute the trust assets according to their wishes. By creating a Huntsville Alabama Assignment to Living Trust, individuals gain several benefits. One major advantage is the ability to avoid probate, which is the court-supervised process of distributing assets after a person's death. With a living trust, the assets held within it can be distributed directly to the beneficiaries specified by the granter, bypassing the need for probate, which can be time-consuming and expensive. Furthermore, a living trust can also help facilitate the management of one's assets in the event of incapacity. By appointing a successor trustee, the granter ensures that their affairs will be handled according to their instructions without the need for court intervention or guardianship proceedings. This provides peace of mind, knowing that trusted individuals will look after their financial matters if they become unable to do so themselves. When it comes to the different types of Huntsville Alabama Assignment to Living Trust, there are primarily two types: revocable and irrevocable trusts. 1. Revocable Living Trust: This is the most common type of living trust, allowing the granter to retain control over their assets during their lifetime. As the name suggests, this trust can be revoked, modified, or amended at any time as long as the granter is mentally competent. It offers flexibility, as the granter can add or remove assets as their circumstances change and can even serve as a means of avoiding probate. 2. Irrevocable Living Trust: Unlike the revocable trust, this type of living trust cannot be easily altered or revoked once created, meaning the granter relinquishes control over the assets placed into the trust. The main advantage of an irrevocable trust is that it can provide potential tax benefits and asset protection by removing the assets from the granter's estate. This type of trust is often used for estate planning purposes, including Medicaid planning and protecting assets from creditors. It is important to consult with an experienced attorney specializing in estate planning, specifically living trusts, to understand the legal implications, options, and necessary steps for creating a Huntsville Alabama Assignment to Living Trust. This ensures that the trust is properly drafted and executed according to Alabama state laws and the granter's specific goals and wishes.Huntsville Alabama Assignment to Living Trust is a legal tool that allows residents of Huntsville, Alabama, to transfer their assets and properties into a trust during their lifetime. This process involves the creation of a trust document, wherein the individual, referred to as the granter, designates a trustee to manage and distribute the trust assets according to their wishes. By creating a Huntsville Alabama Assignment to Living Trust, individuals gain several benefits. One major advantage is the ability to avoid probate, which is the court-supervised process of distributing assets after a person's death. With a living trust, the assets held within it can be distributed directly to the beneficiaries specified by the granter, bypassing the need for probate, which can be time-consuming and expensive. Furthermore, a living trust can also help facilitate the management of one's assets in the event of incapacity. By appointing a successor trustee, the granter ensures that their affairs will be handled according to their instructions without the need for court intervention or guardianship proceedings. This provides peace of mind, knowing that trusted individuals will look after their financial matters if they become unable to do so themselves. When it comes to the different types of Huntsville Alabama Assignment to Living Trust, there are primarily two types: revocable and irrevocable trusts. 1. Revocable Living Trust: This is the most common type of living trust, allowing the granter to retain control over their assets during their lifetime. As the name suggests, this trust can be revoked, modified, or amended at any time as long as the granter is mentally competent. It offers flexibility, as the granter can add or remove assets as their circumstances change and can even serve as a means of avoiding probate. 2. Irrevocable Living Trust: Unlike the revocable trust, this type of living trust cannot be easily altered or revoked once created, meaning the granter relinquishes control over the assets placed into the trust. The main advantage of an irrevocable trust is that it can provide potential tax benefits and asset protection by removing the assets from the granter's estate. This type of trust is often used for estate planning purposes, including Medicaid planning and protecting assets from creditors. It is important to consult with an experienced attorney specializing in estate planning, specifically living trusts, to understand the legal implications, options, and necessary steps for creating a Huntsville Alabama Assignment to Living Trust. This ensures that the trust is properly drafted and executed according to Alabama state laws and the granter's specific goals and wishes.